Stay in the loop with our weekly crypto digest as we get you up to speed on the hottest trends and events in the crypto space.

Here’s what happened in crypto this week:

FBI Arrests Man Behind SEC Twitter Hack Who Posted The Fake Spot Bitcoin ETF Approval

The Federal Bureau of Investigation (FBI) announced the arrest of a man linked to an unauthorized January 2024 takeover of the US SEC’s X account. The hack led to a false announcement about spot Bitcoin ETFs, causing significant market disruption. Bitcoin’s price surged by $1,000 at the time, only to fall by over $2,000 after the SEC corrected the misinformation.

Eric Council Jr., a 25-year-old Alabama resident, was arrested and will face charges of conspiracy to commit aggravated identity theft and access device fraud.

DBS Bank Launches Token Services To Enable Blockchain-Based Banking

Singapore’s DBS Bank has launched a new service called “DBS Token Services,” which combines tokenization and smart contract capabilities with its existing banking services.

According to the statement, the DBS Token Services integrates the bank’s permissioned blockchain, which is compatible with the Ethereum Virtual Machine (EVM), its core payment engine, and multiple industry payment infrastructures.

Additionally, smart contracts enable institutions to manage the use of funds programmatically. The new services include Treasury Tokens, Conditional Payments, and Programmable Rewards.

Lyn Shun Chong, Head of Global Transaction Services at DBS Bank, stated that the DBS Token Services allow corporate and public sector entities to “optimize liquidity management, streamline operational workflows, enhance business resilience, and open up new opportunities for end customers or end users.”

Vladimir Putin Says BRICS Plans To Use Digital Currencies For Investment Development

At the recent BRICS Business Forum in Moscow, Russian President Vladimir Putin announced that the bloc will continue discussing the use of digital currencies in investment developments.

This highlights the group’s broader strategy to reduce reliance on the US dollar and assert greater economic independence. Putin noted that digital currencies could benefit both BRICS members and developing economies.

Putin mentioned that Russia and other BRICS members have already been working on a SWIFT-like financial messaging system and the use of national digital currencies in financing high-growth investment projects.

BlackRock In Talks With Global Crypto Exchanges To Use BUIDL Token As Future Collateral

BlackRock is making moves to expand the use of its digital money-market coin, BUIDL, as collateral for cryptocurrency derivatives trades. According to Bloomberg, BlackRock and its brokerage partner, Securitize, are engaged in early discussions with some of the largest global crypto exchanges. These talks are a part of making BUIDL accepted as collateral on platforms such as Binance, OKX, and Deribit.

BUIDL is the largest tokenized offering on the market, with over $550 million of assets. Its price is fixed at $1 and offers money market yield to investors without leaving blockchain rails. It’s offered to institutional investors and other protocols to invest or use it as a reserve asset, with a minimum investment limit of $5 million.

Notably, tokenized money market funds as collateral allow traders to keep earning a yield while using them as a margin for trading instead of posting stablecoins as collateral.

SEC Approves NYSE Options Trading On Spot Bitcoin ETFs

The US securities regulator has granted “accelerated approval” to 11 exchange-traded funds (ETFs) to list and trade options tied to spot Bitcoin prices on the New York Stock Exchange (NYSE), according to a regulatory filing.

The index options—listed derivatives offering a quick and inexpensive way to amplify exposure to Bitcoin—on a Bitcoin index would give institutional investors and traders an alternative way to hedge their exposure to the world’s largest cryptocurrency.

Options are listed derivatives that give the holder the right to buy or sell an asset, such as a stock or exchange-traded product, at a predetermined price by a set date.

Last month, the SEC approved listing and trading of options for asset manager BlackRock’s ETF on the Nasdaq.

Fed’s Kashkari: Very Few Transactions Are Actually Happening On Crypto

Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, hammered crypto again, claiming that legitimate transactions are rare.

According to him, the only reason most people touch crypto is for illegal purposes like drugs.

“People are buying and selling crypto,” he said, but they aren’t using it to pay for things legally.

He claimed that crypto barely sees any action unless it’s drugs or illegal stuff.

Ripple Co-Founder Chris Larsen Donates Another $10 Million In XRP To Kamala Harris

Ripple co-founder Chris Larsen has pledged another $10 million in XRP to support Kamala Harris’s campaign.

Larsen shared his decision on X, emphasizing the need for Democrats to adopt a fresh perspective on technological innovation, particularly in crypto. Ripple’s CEO, Brad Garlinghouse, expressed his backing for Larsen’s move, highlighting the urgent necessity for the US to shift away from what he termed the “misguided war on crypto” under the current administration.

Cryptocurrency Donations For The 2024 US Election Surpass $190 Million

According to a recent report by CNBC, political donations made by the US crypto industry have surged to record highs after surpassing $190 million as the final stretch of the election cycle approaches.

This represents a significant increase from previous election cycles, marking nearly a 13-fold jump from the $15 million spent in 2020.

The industry’s growing influence is evident as large sums pour into critical congressional and Senate races, intending to shape future US regulatory policies.

Avalanche (AVAX) Releases Visa Card For Crypto Payments

Avalanche has just launched the Avalanche Visa Card, making it easier for users to spend their crypto assets. With this new card, you can use your wAVAX, USDC, and sAVAX at any Visa-accepting location.

When you sign up for the card, you will receive a brand-new self-custody wallet and a unique address for each asset. The Avalanche Card is initially available to residents of countries in Latin America and the Caribbean.

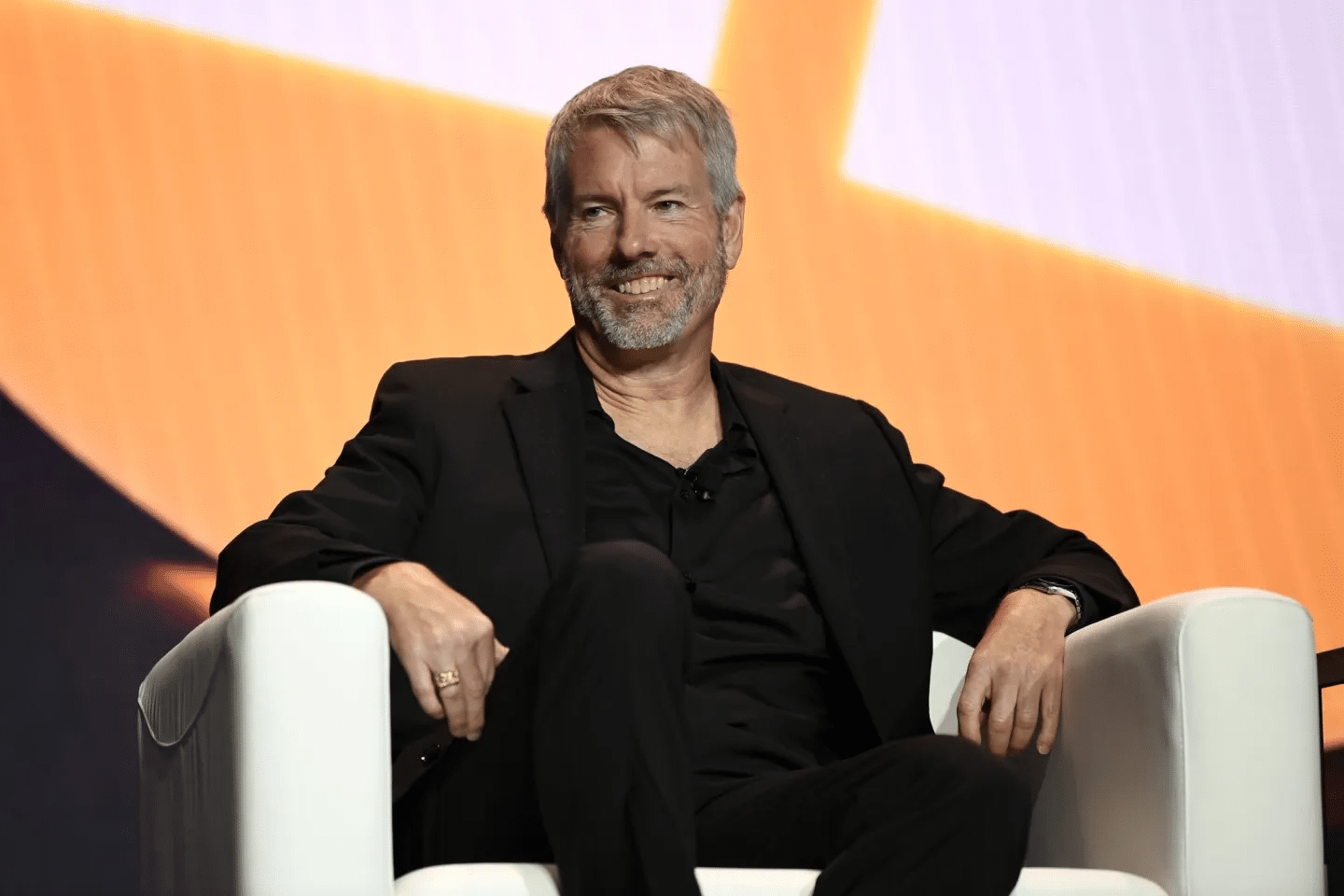

Michael Saylor Faces Criticism From Bitcoiners For Relying On Banks

Michael Saylor, the executive chairman of MicroStrategy, has recently faced strong backlash from the Bitcoin community for supporting banking giants’ attempts to gain control of Bitcoin custody. This move was a pivot from his previous stance of supporting self-custody.

During his recent interview, Saylor controversially argued that Bitcoin holders “have nothing to lose” by transferring their assets to institutions. When asked about the possibility of the US government stripping Bitcoin holders of self-custody rights, similar to how private gold ownership was made illegal in 1933, Saylor dismissed the concern, labeling those who fear state-sanctioned seizure as “paranoid crypto-anarchists.”

Kraken To Launch Its Own Blockchain In 2025

Cryptocurrency exchange Kraken has announced it is launching its own blockchain early next year. Called Ink, the blockchain will host decentralized applications that enable trading, borrowing, and lending of tokens independently and without intermediaries involved.

Ink will launch a testnet later this year, giving developers an opportunity to start building applications on the chain. According to Andrew Koller, Ink’s founder, the network is expected to open for retail and institutional users in the first quarter of next year.

Final Thoughts

So that’s it for this week!

To stay ahead of the game with the freshest crypto news and insights delivered straight to your inbox, consider subscribing to UseTheBitcoin’s newsletter today.

Have a fantastic week ahead!