Key Takeaways

- Bitcoin price has reached new highs of $123,000, as investor interest has increased over the past few days.

- Crypto experts speculate that the potential for the Bitcoin price to hit $200,000 looks more realistic.

- On-chain data from different sources indicates that Bitcoin bulls could push the price towards $150,000.

Bitcoin’s price is back in the headlines once more, following its bullish price rally over the last few days, which has broken the $111,500 high.

Still, this time, BTC is out creating new highs daily, with a recent high hitting $123,000 and liquidating over $1.2 billion in short positions as the price continues to trend higher.

Speculations and crypto experts are beginning to anticipate a strong bullish price rally in the coming weeks to months, with speculations hinting at a price rally towards $150,000. This could result in substantial price gains for altcoins in the cryptocurrency market.

Related Read – Bitcoin Price Blast $115,000 as Bulls Aim for $135,000

The recent Bitcoin bullish price rally has seen the crypto market reach a high of over $3.88 trillion in market capitalization, with Bitcoin’s price surpassing $2.4 trillion in market capitalization, occupying the largest share of the market.

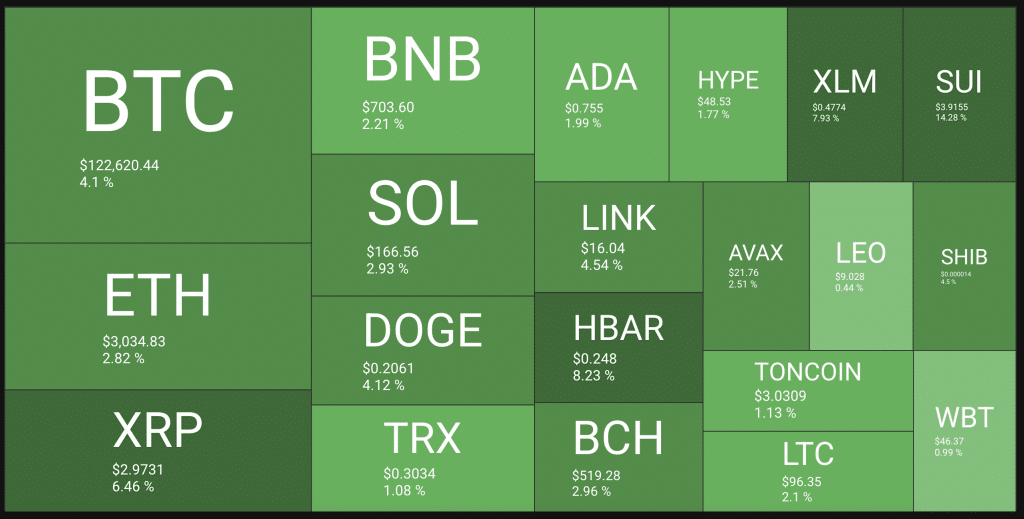

Crypto Market Sentiment as Bitcoin Price Hits New Highs

Crypto Market Heatmap – Source Quantifycrypto

According to data from Quantifycrypto, the cryptocurrency market is in a bullish state, with the prices of Bitcoin and altcoins rallying to create double-digit gains over the last couple of days. Bitcoin’s price, which has been rallying from its range of around $109,000 for weeks to new highs, has created significant bullish price action for the crypto market in general.

However, there has been a stark difference in the inflow of money into the cryptocurrency space, as pointed out by Ali Martinez from Glassnode, based on on-chain data.

According to the crypto expert and on-chain analyst, during the Bitcoin price rally to $100,000 in December 2024, the market saw over $130 billion flow into it. Still, while the price of Bitcoin has reached new historical highs of over $123,000, it has seen just around $50 billion in inflow of capital.

Despite such stark differences, the price of Bitcoin interest across exchanges has seen a significant rally in the past year, hitting new highs as speculation of a new all-time high continues for BTC, with gains gaining more momentum.

Bitcoin Price Analysis Ahead of $150,000 Target

BTC M2 Data – Source BGeometrics

Bitcoin’s latest rally to $123,000 is not a coincidence or just hype; it’s a clear, macro-driven increase in money supply, according to data, as the price rallies by over 12% with trillions of fiat entering the crypto market space.

Many individuals and institutions are waking up to the inevitability of a Bitcoin price rally, as speculation continues to suggest that the price of Bitcoin will reach a high of $200,000 before the end of the year.

However, Bitcoin market analysis suggests otherwise, following a strong market breakout to the highs of $123, which created new historical highs and trading above weekly downtrend resistance.

Bitcoin 1W Price Breakout – Source TradingView

Bitcoin’s price has broken its long-standing weekly resistance since 2018, as speculation suggests the price of Bitcoin will continue its rally towards a potential $135,000 to $150,000 in the coming weeks, with the price action remaining bullish.

Market sentiment in the crypto space, particularly around the Bitcoin price and altcoins, remains bullish as traders and investors seek to establish buy positions.