Key Takeaways

- The XRP price is retesting the key support zone of $2, as a further bearish decline could occur if the price fails to hold this zone.

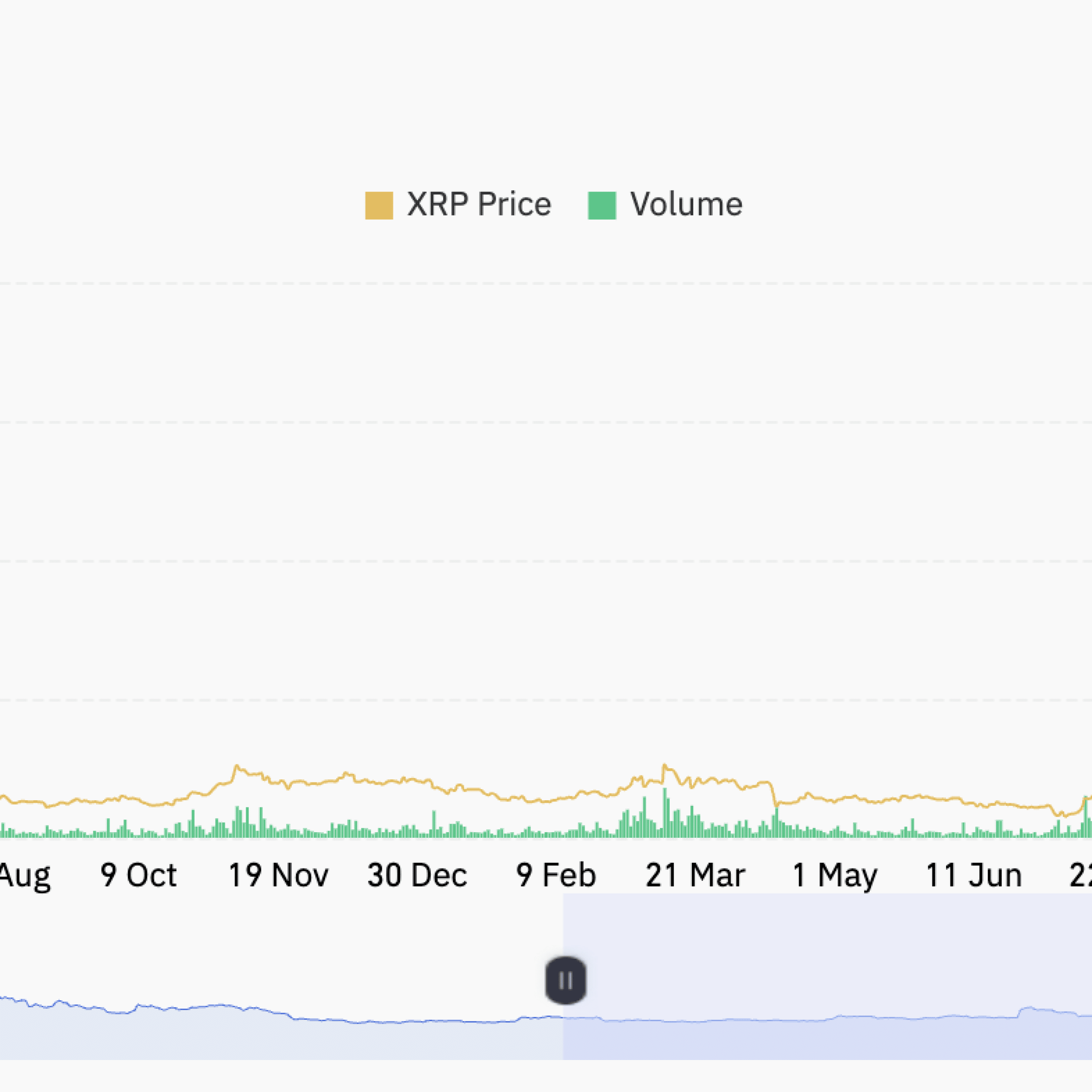

- XRP’s volume has declined significantly since the October to December 2024 rally, as the price trades within a range.

- XRP’s strong breakout above $3 could signal a shift in current market sentiment to bullish.

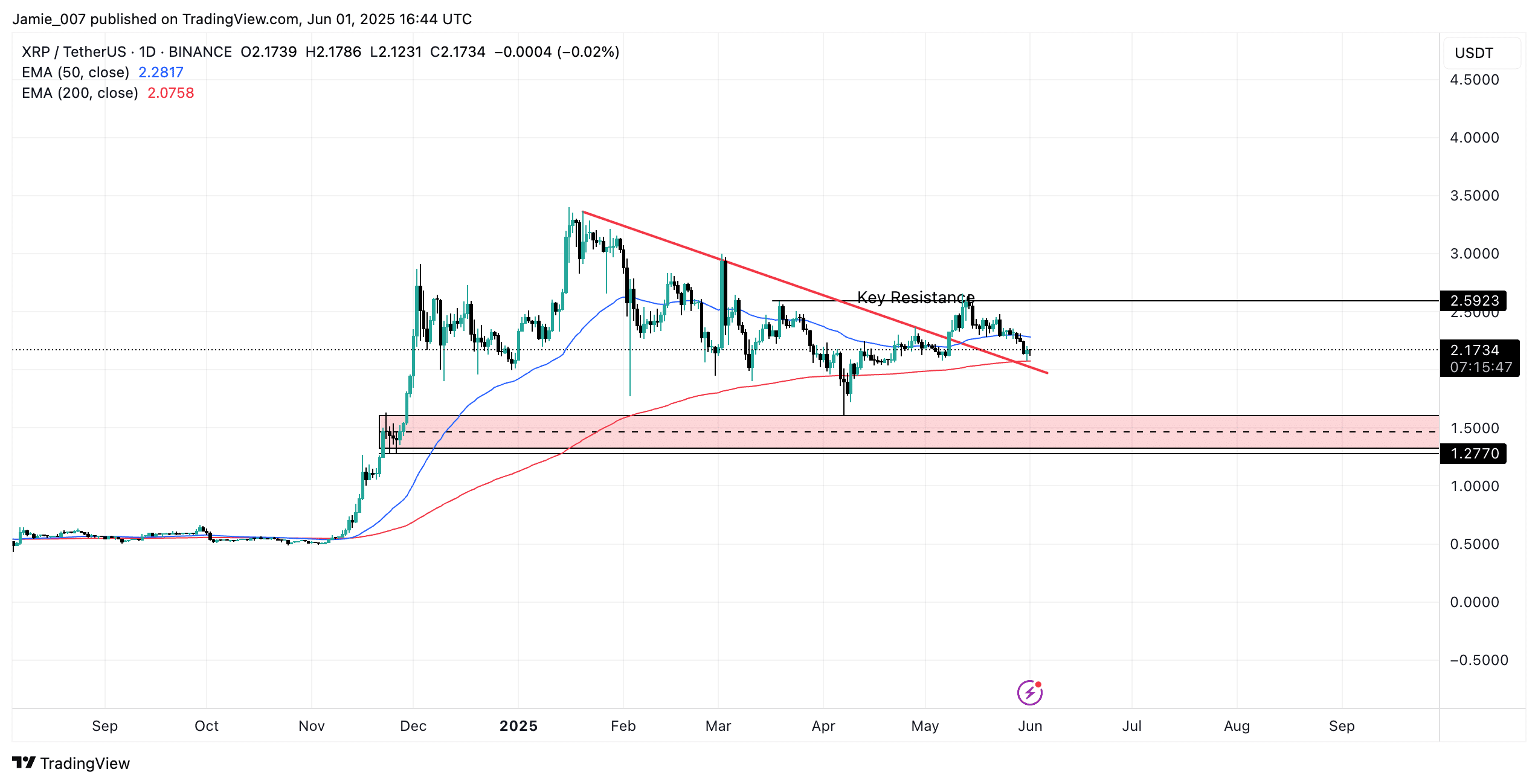

Ripple’s (XRP) price action in May failed to meet the expectations of market analysts and investors despite the market seeing a renewed price action with Bitcoin (BTC) hitting new all-time highs and altcoins enjoying considerable gains from its price rally. XRP has struggled to break its key resistance of $2.6 as the price closed below $2.3 in May.

The potential for XRP’s price to protect its $2 support, acting as a key demand zone for traders and investors, resurfaces in the picture once more. XRP’s failure to trade above $3 comes as a big setback for many investors and experts due to XRP’s strong fundamentals acting as a catalyst for bullish price expectations.

Will on-chain technical indicators, such as volume, market sentiment, and active addresses, serve as a strong price catalyst in June for XRP to ignite a rally above $3, providing a strong price opportunity to the upside for traders and investors?

XRP Volume And Market Sentiment

Source – XRP On-chain Volume From Coinglass

Following XRP’s strong volume from October to December 2024, the price of XRP has struggled for most of 2025, accompanied by a decline in volume, as shown by on-chain data on the Coinglass website. Despite many financial institutions filing for XRP to be approved for a spot XRP ETF and other fundamental factors that would have boosted price and volume, XRP continues to struggle.

Top crypto expert Ali Martinez, on his X account, has speculated that the price of XRP faces strong price resistance around the $2.6 region, preventing its price from rallying higher to a potential new all-time high following a recent market uptrend.

Will XRP break the odds to initiate a strong price rally to the upside in June, as the historical price chart suggests that June is not usually a strong month for the crypto market uptrend?

XRP Price Analysis

Source – XRP Daily Price Chart From TradingView

Following the price breakout to the upside from its bearish downtrend, the price of XRP encountered resistance on two occasions, failing to break above the $ 2.60 resistance zone on the daily timeframe. Breaking above this zone could lead to a strong rally to the upside.

The price of XRP traded within a range throughout May, as it retested the $2 region, acting as a strong demand zone and a key retest of its downtrend line following a recent breakout from the downtrend.

If the price of XRP holds above this zone, with the price breaking towards a high of $3, we could see the price initiate a new trend to the upside, potentially reaching $4 and above. The key zones for the XRP price remain at $2 support and $2.6 resistance for bullish price continuations.