Key Takeaways

- Standard Chartered, a global banking institution, suggests that Bitcoin’s price could reach a high of $135,000 by Q3.

- Institutional players’ role in spot Bitcoin ETF purchases has driven the price above $110,000 for the first time in months.

- Bitcoin’s price breaking above previous all-time highs would see the price rally towards $120,000 or more.

Bitcoin’s price in the last few days has gained much attention following a strong market close above $105,000 marking a solid close to its monthly close of June that saw the price of BTC trade in range for weeks following market uncertainties such as Israeli-Iranian war and the U.S. tariff new affecting price to lower price points.

The price of Bitcoin in July has started strong, showing increasing signs of a potential price rally to new all-time highs, as crypto experts and institutional investors are suggesting a strong price rally for Bitcoin.

A notable institutional finance player, Standard Chartered, has hinted at a strong price possibility for BTC, suggesting a key milestone of $135,000 in Q3 2025, which has generated strong market sentiment.

Bitcoin (BTC) Strong Institutional Outlook

Global bank Standard Chartered has dropped a bold, bullish price prediction for Bitcoin for Q3, as the financial institution expects the price of BTC to hit a high of $135,000 and break its expected all-time yearly highs of over $200,000, based on market speculation.

An excerpt from the speculation above is based on the strong demand for BTC spot ETFs (Exchange-traded funds) in the last few months, which has contributed significantly to such a rally and prevented a huge price collapse after its post-halving period.

Standard Chartered analysis also suggests that strong institutional demand has held the price of Bitcoin afloat from repeating an 18-month price crash seen in the aftermath of the 2017 and 2021 bull markets.

To further highlight the strong bullish price action for Bitcoin, on-chain data from Glassnode has identified that strong holders and institutional investors have been accumulating Bitcoin over the last 155 days, with no immediate plans to sell their Bitcoin holdings, as the price is expected to continue rallying to the upside in the coming days.

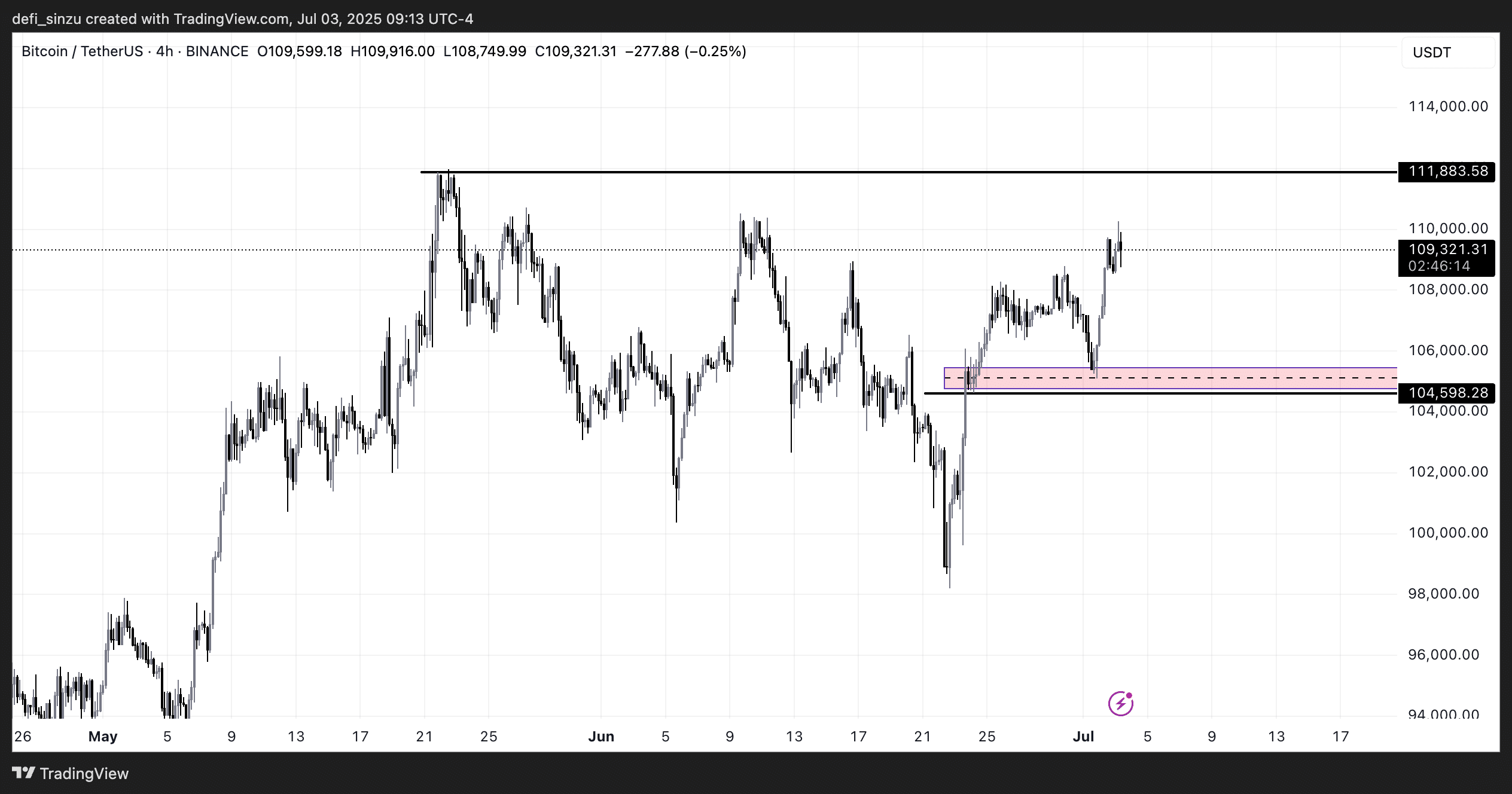

Market expectation would be placed on previous all-time highs of around $111,800 as a breakout above this zone could see the price of Bitcoin rally to new highs following a recent price reclaim of $110,000.

Related Read – Bitcoin Price Prediction for July – Is $120,000 Incoming?

Why Is Bitcoin Pumping Today?

Source – Bitcoin Price Chart From TradingView

The key drivers for Bitcoin’s recent surge past $110,000 have been attributed to institutional players making a strong statement in the last few days with huge purchases of spot Bitcoin ETFs, leading to the price of Bitcoin trading higher and breaking its price consolidation.

If the price of Bitcoin maintains this price momentum and breaks out to the high of $115,000, there is strong price speculation that BTC will hit $120,000 or more in the coming weeks, as the current price looks bullish.