Stay in the loop with our weekly crypto digest as we get you up to speed on the hottest trends and events in the crypto space.

Here’s what happened in crypto this week:

NYDIG Executive: The mNAV Metric For Crypto Treasuries “Needs To Be Removed”

NYDIG’s Global Research Director, Greg Cipolaro, released a report indicating that the mNAV metric (market Net Asset Value) frequently used by Bitcoin treasury companies may be misleading, as mNAV does not take into account the operational businesses or other assets that the relevant companies may own.

Additionally, this metric often uses “assumed shares outstanding,” which frequently includes convertible bonds that have not yet met conversion conditions, so the data may be inaccurate.

It is reported that mNAV is the ratio of market capitalization to net asset value. If mNAV is greater than 1, Bitcoin treasury companies can issue additional financing within a premium range and use the proceeds to purchase BTC, thereby increasing the per-share BTC holdings and enhancing the book value; if it converges to 1 or falls below 1, with the price of BTC declining and weak secondary market support, the flywheel mechanism will shift from “enhancement” to “dilution,” creating negative feedback.

China Launches Digital Yuan International Hub To Spur Cross-Border Use

China has officially launched an international operations center for its digital yuan in Shanghai, a move aimed at solidifying the e-CNY’s role in global transactions.

The center, which began operations on September 24, introduced three business platforms focused on cross-border digital payments, blockchain services, and digital assets.

Lu Lei, a deputy governor of the People’s Bank of China (PBOC), stated that the central bank is committed to providing open and innovative solutions to enhance global cross-border payments. He noted that a preliminary framework for the digital yuan’s cross-border financial infrastructure has been built.

The launch marks a significant step in China’s strategy to promote the global use of its currency. By building out its own infrastructure for cross-border finance and digital assets, Beijing aims to increase the efficiency of international trade and investment settlement while creating new channels for the yuan’s adoption.

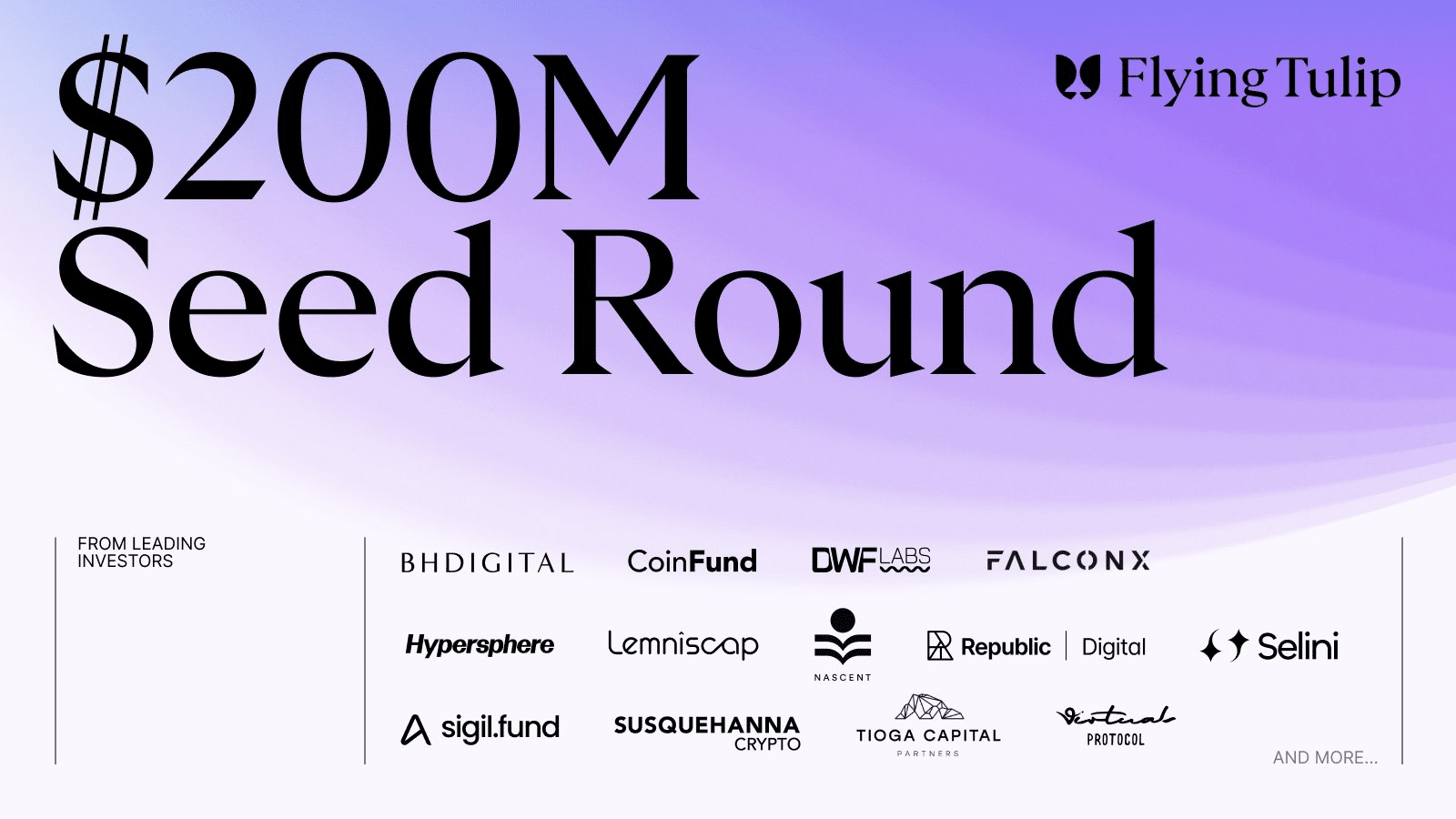

Andre Cronje’s Flying Tulip Raises $200 Million At $1 Billion Token Valuation

Andre Cronje’s Flying Tulip, a new on-chain trading platform, has secured $200 million in funding at a $1 billion token valuation.

Flying Tulip is built on the Sonic blockchain and is pushing boundaries with high-leverage trading and adaptive liquidity models. This capital raise marks a significant step toward challenging centralized exchanges with a fully on-chain solution.

The focus on US institutional funds indicates a strategic shift to tap into substantial capital. With plans for a platform token (FT), the project aims to redefine yield-backed liquidity in DeFi.

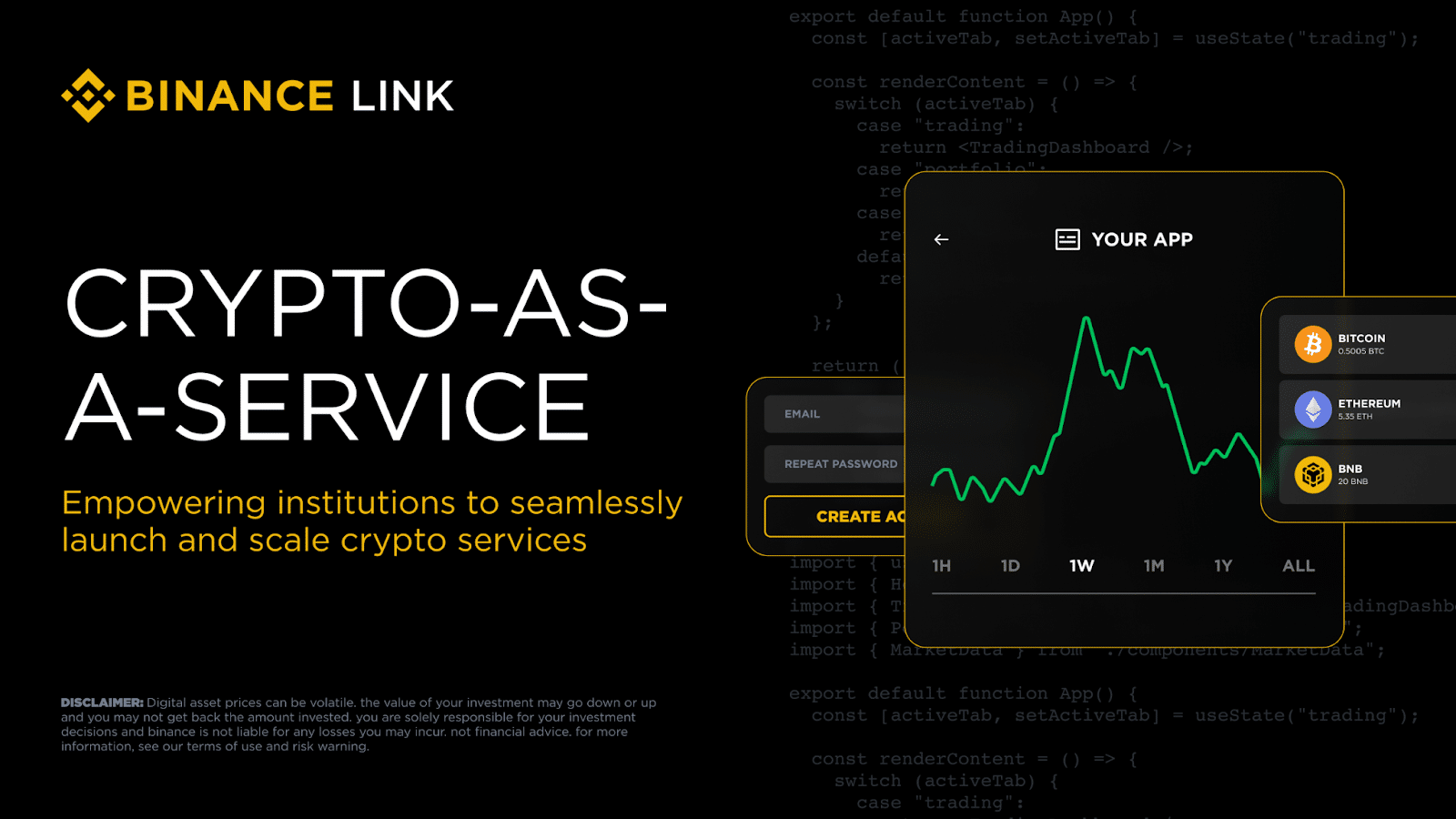

Binance Introduces Crypto-as-a-Service For Financial Institutions

Binance has announced Crypto-as-a-Service (CaaS), a white-label platform for licensed banks, brokerages, and exchanges that want to offer cryptocurrency trading but lack the necessary infrastructure to do so themselves.

Instead of building complex systems from scratch, institutions can plug into Binance’s back-end stack, which includes trading, liquidity, custody, settlement, and compliance, while maintaining complete control over their own brand and client relationships.

CaaS is packaged with oversight tools tailored for large financial players. A management dashboard and API integration give partners visibility into volumes, asset flows, and onboarding activity, simplifying reporting and operational control. On the security side, institutions can create segregated client wallets with unique deposit addresses, while compliance modules cover KYC and transaction monitoring across jurisdictions.

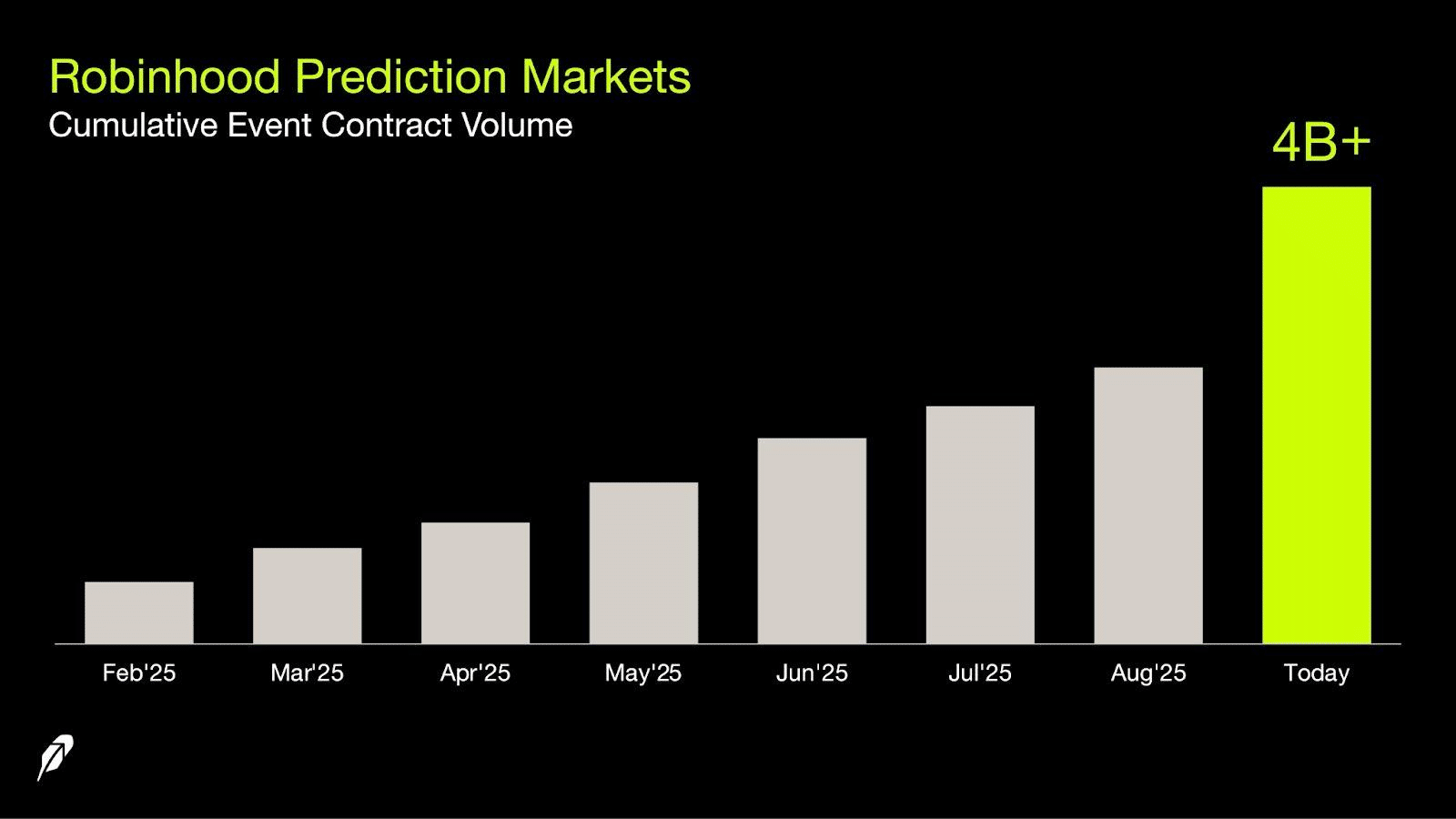

Robinhood Explores Launching Prediction Markets Outside The US

Robinhood is reportedly exploring the launch of an offshore prediction market outside the US, tapping into new user bases for event-based contracts.

The push aims to replicate their US success in prediction markets—where users wager on events like elections or sports—beyond domestic borders, leveraging their existing hub launched earlier this year.

$HOOD also surged 9% after CEO Vladimir Tenev revealed on social media that more than four billion event contracts have been traded on the platform since its launch.

1inch Rebrands To Reflect Broader Mission Uniting DeFi And Global Finance

1inch rebrands as a DeFi-TradFi bridge, unveiling new branding at TOKEN2049 to emphasize infrastructure maturity and cross-chain integration.

The rebrand follows the expansion of 1inch’s Software-as-a-Service (SaaS) model, which has been adopted by major industry players such as Binance, Coinbase, Ledger, MetaMask, and Trust Wallet.

By providing non-custodial infrastructure for decentralized exchanges (DEX) aggregation, cross-chain swaps, and intent-based trading, 1inch now serves over 25 million users and processes more than $500 million in daily trades.

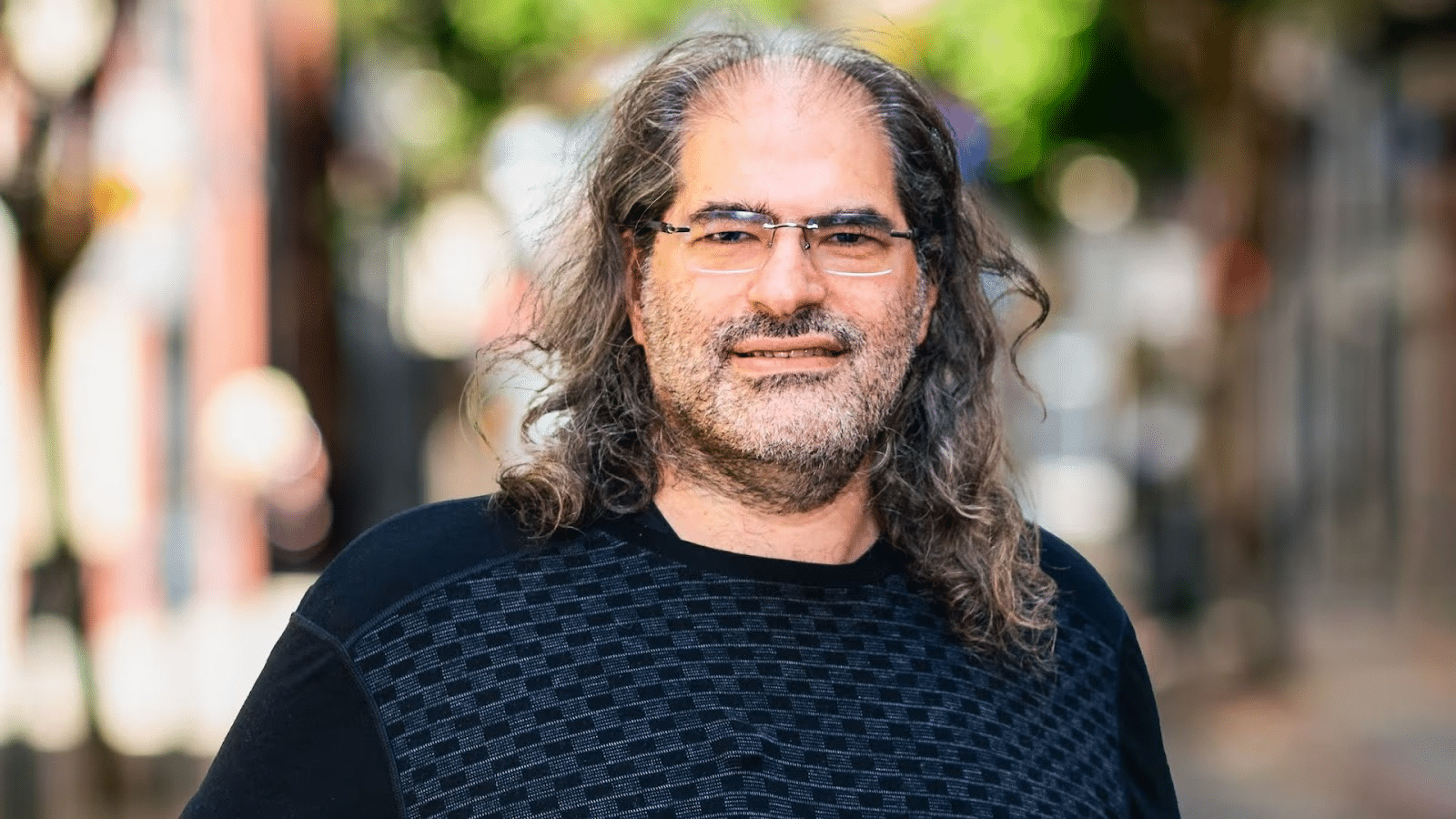

Ripple’s David Schwartz Announces Departure From CTO Role By Year-End

Ripple’s Chief Technology Officer, David Schwartz, has announced he will step down from his role by the end of 2025 after over 13 years with the company.

Schwartz, who played a crucial role in developing the XRP ledger, will shift his focus to spending more time with his family and pursuing personal hobbies.

Despite his departure from the CTO position, Schwartz confirmed that he would remain involved with Ripple through its board of directors.

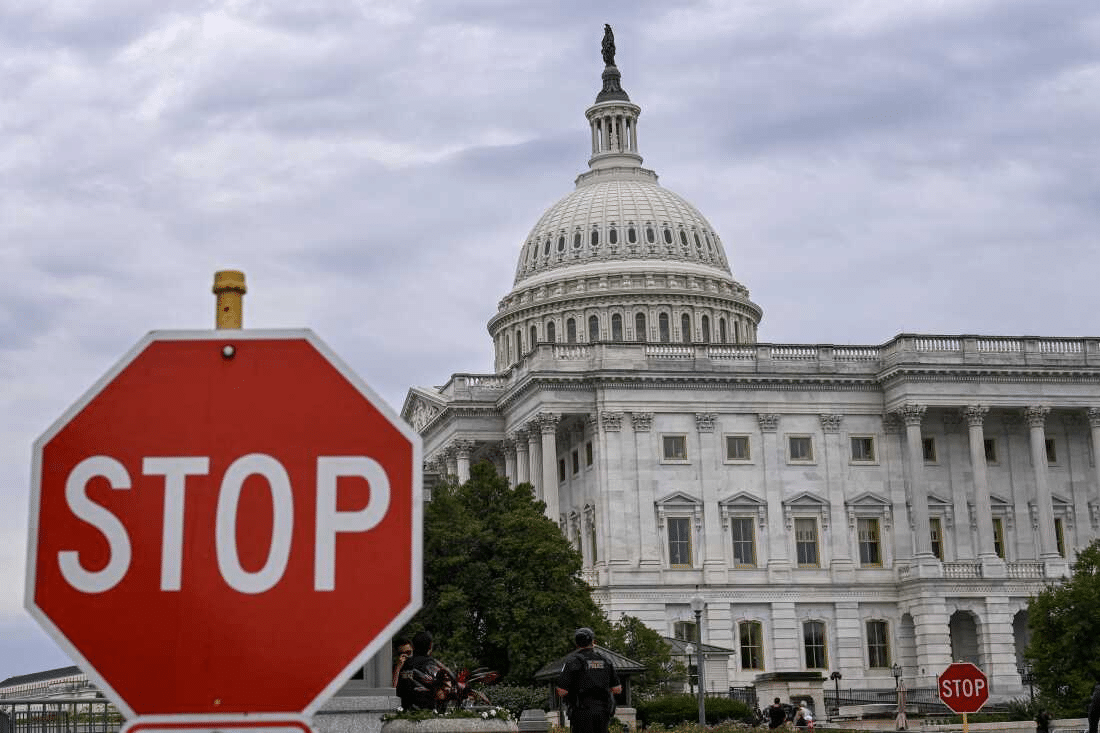

US Stock Market And Crypto Rises As Investors Seek A Global Safe Haven Amid Shutdown

Bitcoin and the US stock market rose on Wednesday after US lawmakers failed to reach a government funding agreement, resulting in a shutdown.

Bitcoin traded around 3% higher on the day, and the Dow Jones Industrial Average jumped 43 points, or 0.09%, while the S&P 500 climbed 0.34%. The tech-heavy Nasdaq increased 0.42%. The Dow and S&P 500 each closed at record highs on Wednesday.

The US government shut down at midnight after a Senate bill to keep the government funded did not garner enough votes to pass.

Final Thoughts

So that’s it for this week!

To stay ahead of the game with the freshest crypto news and insights delivered straight to your inbox, consider subscribing to UseTheBitcoin’s newsletter today.

Have a fantastic week ahead!