Key Takeaways

- ETH faces key resistance of $4,800, similar to the 2021 bull market, which has prevented the price from reaching a new ATH.

- The price must break above $5,000 with increased volume to the upside, which will give the crypto asset greater conviction to rally further.

- Spot ETF buys and a key demand zone could help the price of the second-largest crypto asset reach new highs.

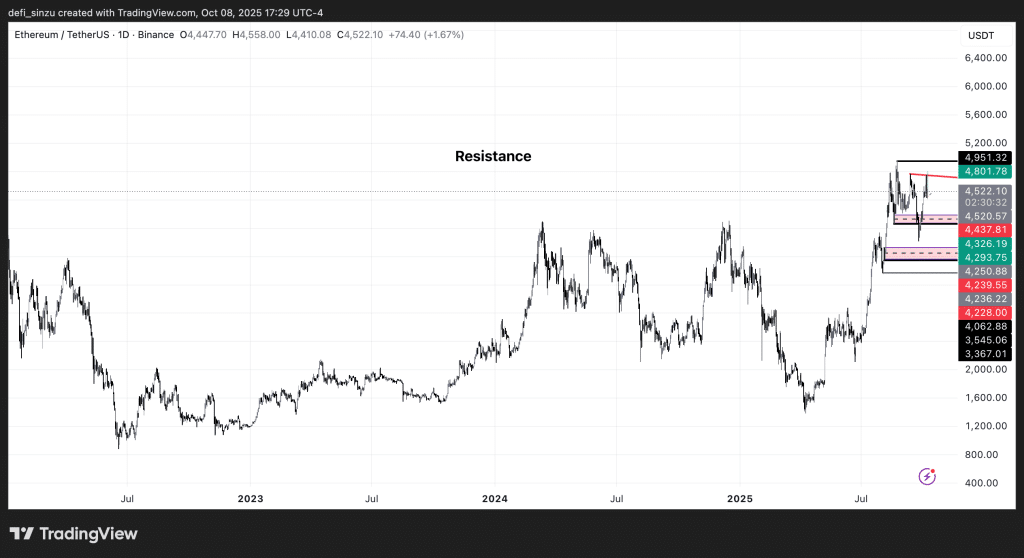

The price of Ethereum, following a rebound around its key zone of $2,200, rallied to a new all-time high of $4,950, which was seen as a significant rally for the number two crypto asset by market capitalization.

This rally towards historical all-time highs, which had lasted over three years, was halted following a market rejection at $4,700, as the price has continued to face struggles and build bullish price action. Speculations suggested that the region of $4,800 was a key rejection zone for the price.

Despite the price of BTC rallying to a new all-time high of $126,500, the price of Ethereum has remained below $4,800, as the crypto asset faced another rejection in its attempt to break higher.

Ethereum’s Struggle to New Highs

The price of ETH, following a build of its key support around $3,750, rallied to new all-time highs but was quickly faced with rejection above $4,950, preventing the price of ETH from entering a price discovery phase, which would have favored many altcoins to the upside.

This rejection, around $4,800 to $4,950, is similar to the 2021 bull market resistance zone, as the price of the crypto asset is rejected several times around this zone, leading to a significant correction.

According to crypto expert and on-chain analyst Ali Martinez, this zone coincides with the 2021 price zone, acting as resistance for the price. Multiple attempts around this zone led to corrections to the downside.

If the price of ETH is to break this zone convincingly, it needs to rally with strong volume to the upside, flipping this area into support. This could help sustain its price action at or above the highs of $5,000.

However, the price appears bullish, with indicators and spot ETF purchases indicating bullish sentiment across the market, despite the market having recently declined towards a region of $4,500.

ETH Price Analysis to ATH

Source – Ethereum Price Analysis from TradingView

The price of the second-largest crypto asset by market cap looks bullish despite a brief market decline, as the price needs to reclaim its level above $4,800, acting as key resistance before it can build its rally to the upside.

If price breaks above this zone, we could see a potential ATH to a region of $5,500 to $6,000. However, if the price fails to trade above its key resistance, it could be forced to trade back into its key low of $3,500, where liquidity zones are waiting to be filled for ETH.

FAQs

How much is ETH right now?

At the time of writing, the price of ETH trades around $4,500, and it could break above the $4,800 region to reach new all-time highs.

How much will 1 ETH be worth in 2030?

Predictions for its price suggest it could trade above $10,000 by 2030.

Can Ethereum reach $30,000?

While price exhibits significant volatility, it is unlikely that we will see prices trade around $30,000 in the current bull market.

Related Read

Gold and Silver Hit New Highs as BTC Struggles – Is the Top In?