Key Takeaways

- Gold hits new all-time highs of $3,940 as Bitcoin trails its price action with potential new all-time highs imminent.

- BTC’s price action above $125,500 would see price rally towards $130,000 as spot ETF and economic uncertainties drive volume.

- Crypto experts suggest a price of $200,000 or above for BTC if the price reverts to the bullish trend seen in the last few months.

Bitcoin and Gold continue to rally to new all-time highs despite growing fiscal concerns as the world’s largest economies suffer setbacks, leaving traders and investors to hedge against these assets as they continue to surge to new highs.

With growing debt piles hitting the likes of the US, Europe, and Japan, this has forced many to turn to alternative currencies and cryptocurrencies rather than fiat currencies in the FX market. Gold, seeing a new all-time high of $3,940, and Bitcoin struggling to trade above $124,000 on Monday, has sparked a reaction of potential price catching up with Gold.

Since its low of $3,300 for Gold, the price has rallied by over 17% in the last few weeks, reaching a high of $3,940. If the price of Bitcoin were to experience a 20% price rally, we could see the price trade towards a key region of $130,000 and above before the end of October, as historically, this month has been a favorable one for the crypto market.

According to traders and investors, there is high conviction that the price of BTC will trade towards new all-time highs following a brief market rally to a high of $125,800 on Sunday, as the price traced back into its zone of $123,000.

Bitcoin Sustains Bullish Price

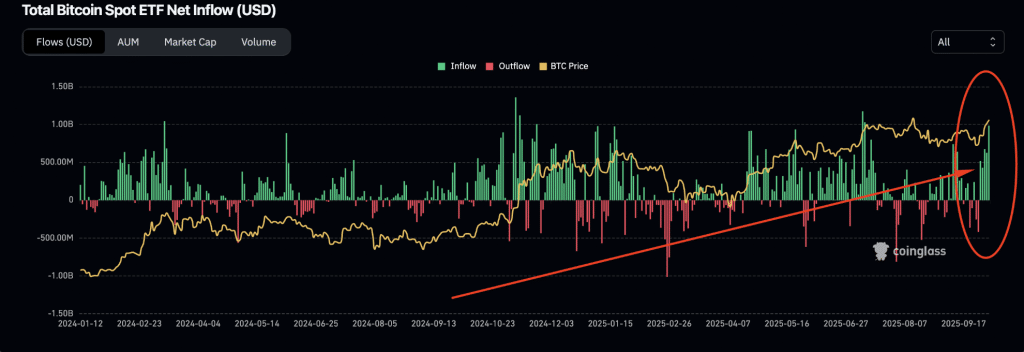

Source – Bitcoin ETF Inflow from CoinMarketCap

Despite macroeconomic shifts in the last few days, with the US announcing a shutdown leading to market uncertainties and the weakening of Japanese pairs, many traders and investors have turned to digital currencies such as Bitcoin as the price of the crypto asset continues to build strong market price action and gain strong demand from spot ETF inflows in the last few days.

A breakout for the BTC price above the $125,500 region could trigger a strong market push to the upside, as price discovery for this crypto asset may aim towards a range of $130,000 to $150,000.

However, a break towards a low of $120,000 could activate huge market liquidation to the downside.

Crypto Market Insight to Debt Pile

Following the recent price action of Gold and BTC, Ansem, the crypto expert, suggested that a close of the BTC price below the weekly low of $120k would have invalidated the current price action. However, with the price showing strength, he has suggested that many expose themselves to stocks and Bitcoin.

His suggestions were based on current macroeconomic events resulting from the debt pile across the US, Japan, and Europe. With exposure to BTC and Gold, traders would be able to hedge against struggling economies.

Overall, Bitcoin remains bullish as the price aims for a breakout above $125,500, seeking to catch up with the current Gold rally.

FAQs

Does Bitcoin go up when Gold goes up?

Debate and data suggest that BTC and Gold are correlated by a few percentage points, as the price of BTC on several occasions has tried to catch up with Gold.

Is it better to buy Gold or Bitcoin?

Buying BTC or Gold depends on preferences; investors and traders have used both as a hedge against economic uncertainties and devaluation.

Is holding Gold better than cash?

Gold remains a haven against economic uncertainties and devaluations; thus, many traders and investors prefer to hold Gold.

Related Read