Key Takeaways

- Metaplanet, a Japanese company, increases its Bitcoin holdings to 8,888 after a new purchase of $117 million worth of BTC.

- MicroStrategy makes a new Bitcoin purchase following Michael Saylor’s tweet, bringing its BTC holding to 580,955 BTC.

- The Bitcoin price struggles around $103,000 following its price retracement after reaching new all-time highs.

MicroStrategy continues to expand its Bitcoin holdings with a fresh multimillion-dollar acquisition, following a new pending purchase announced by MicroStrategy’s CEO, Michael Saylor, on Twitter. Saylor has stated that he is a fan of the “Orange” color purchase, indicating a heatmap of its previous purchases.

On June 2, 2025, MicroStrategy added around $70 million worth of Bitcoin, bringing its total Bitcoin holdings to a region of 580,955 Bitcoin. This new purchase not only boosts MicroStrategy’s Bitcoin holding but also reaffirms the company’s commitment to accumulating Bitcoin for the future, as it sees the potential for Bitcoin to become an elite digital asset for the wealthy.

MicroStrategy remains the largest publicly traded Bitcoin holder by a wide margin. It has also attracted many other corporate companies in the last five years, accumulating Bitcoin to build their stockpile of Bitcoin reserves.

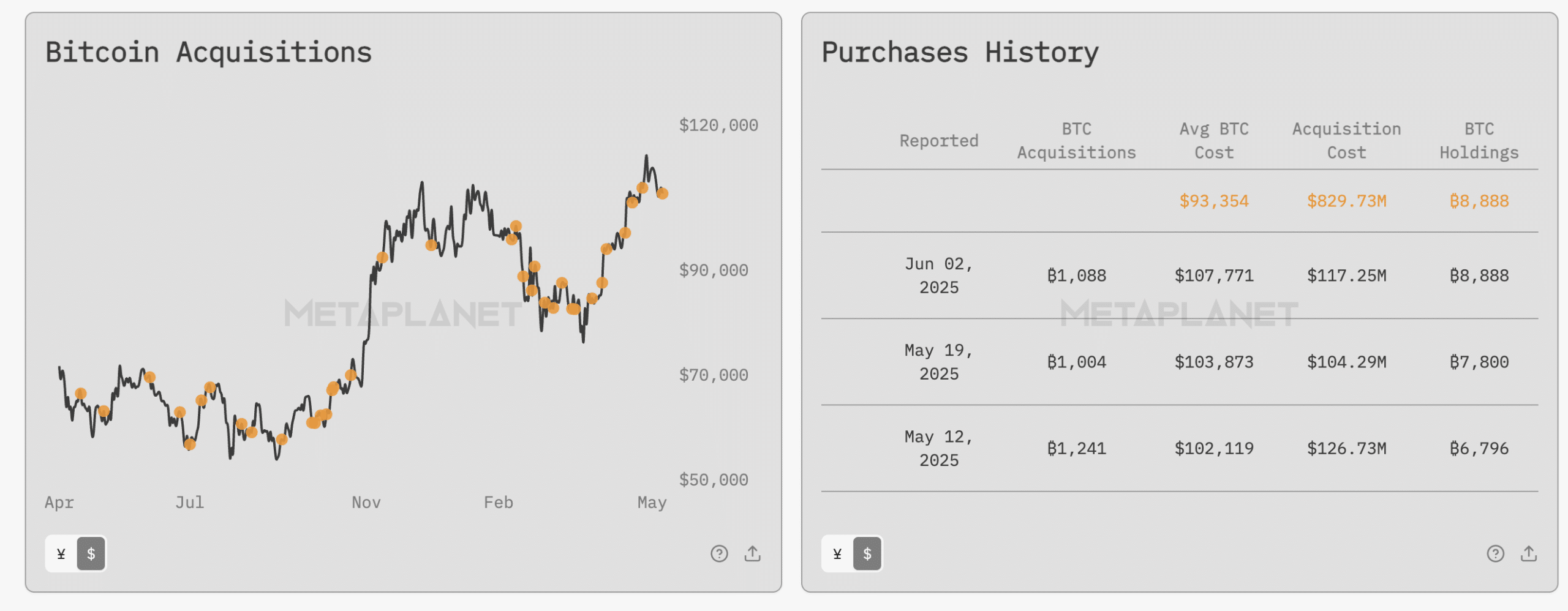

The likes of Metaplanet have continued to emulate MicroStrategy in accumulating Bitcoin for the long term, with recent news indicating that Metaplanet has made a new Bitcoin Purchase.

Japanese Metaplanet Buys Bitcoin

Source – Metaplanet Bitcoin Holdings

In recent news, Metaplanet acquired an additional 1,088 Bitcoins, valued at $117.25 million, bringing its Bitcoin holdings to a total of 8,888 Bitcoins in reserve. This acquisition follows a strategic accumulation strategy similar to that of MicroStrategy despite the market decline in Bitcoin prices.

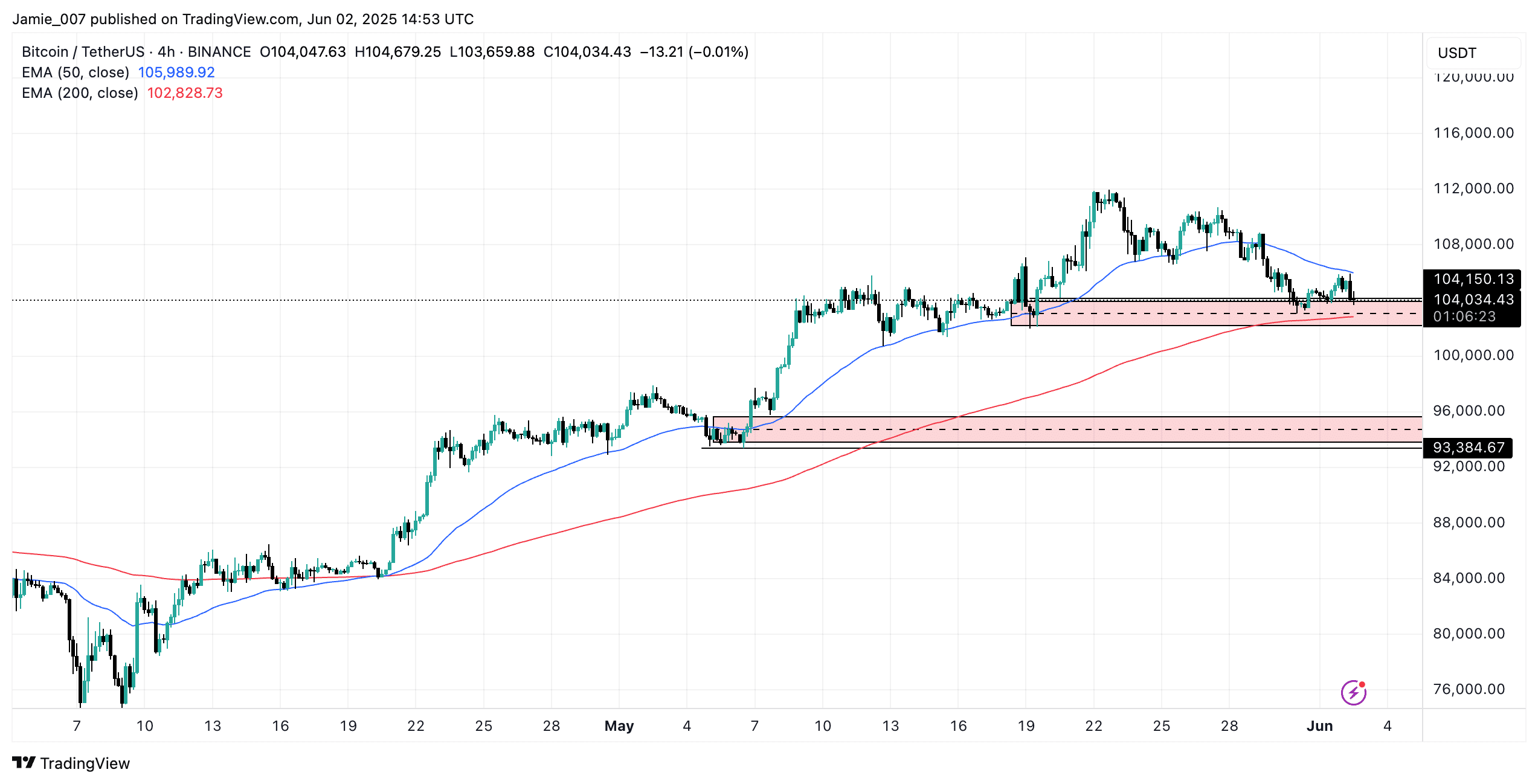

Bitcoin Price Analysis Despite MicroStrategy Purchase

Source – Bitcoin 4HR Price Analysis From TradingView

The price of Bitcoin has struggled in the last few days, dropping from it’s all-time high of $111,700 towards a region of $103,800, where price has found strong support for the time being following the recent price range as the price of BTC was unable to continue its rally to a potential region of $120,000 based on market speculation.

Although the price of BTC trades around the key demand zone of $103,000, the price of Bitcoin needs to hold above this zone to prevent a sharp decline in price towards the $96,500 low, acting as another key demand zone for the price.

A price rally above its previous all-time highs for the BTC price could see a potential price gain to a region of $120,000, as crypto experts and investors remain bullish, speculating that the price of Bitcoin could reach $200,000 before the end of 2025.