Let’s examine the insights shared by our Technical Analyst at UseTheBitcoin as he walks us through his personal trading approach and observations on the crypto market.

Starknet (STRK) Market Update

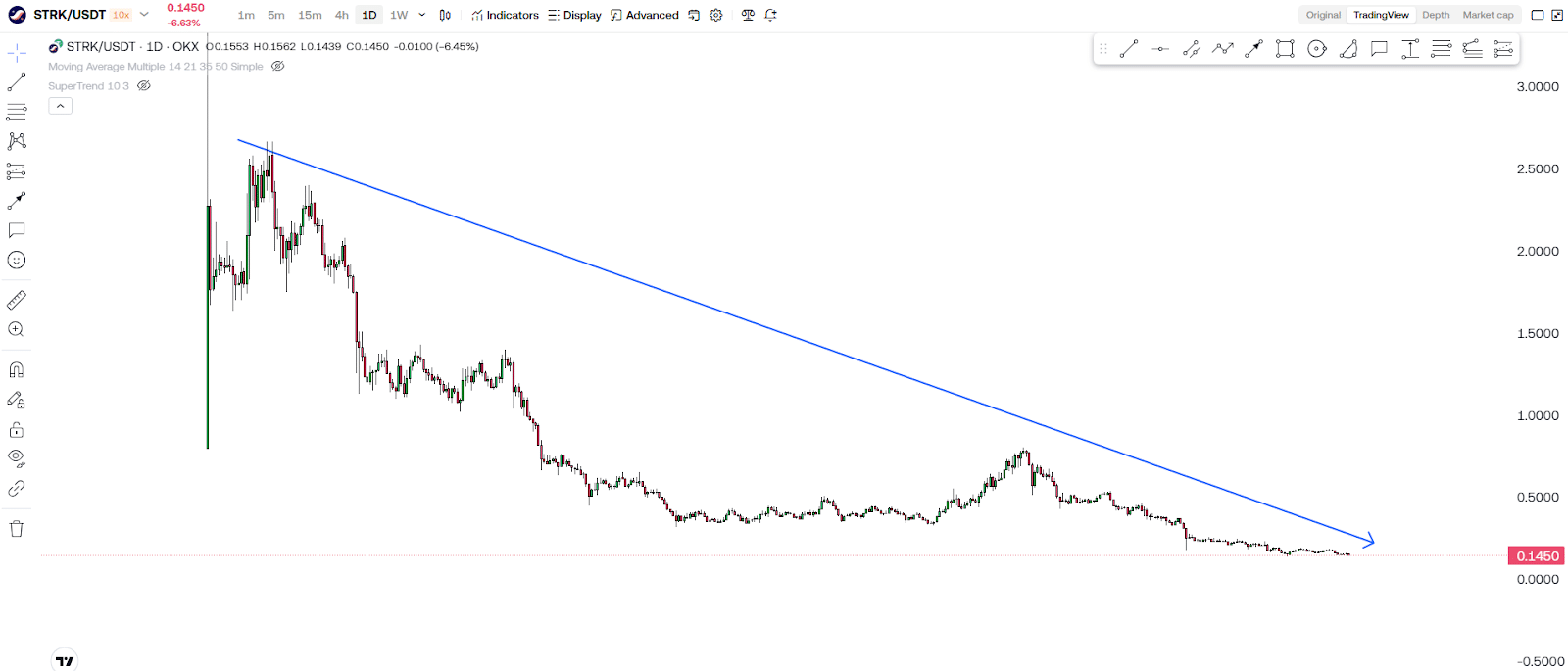

For the longest time, Starknet (STRK) has been in a downward trend. There hasn’t been any major news or catalyst that could trigger a potential uptrend, making many investors wonder if the project is fading away.

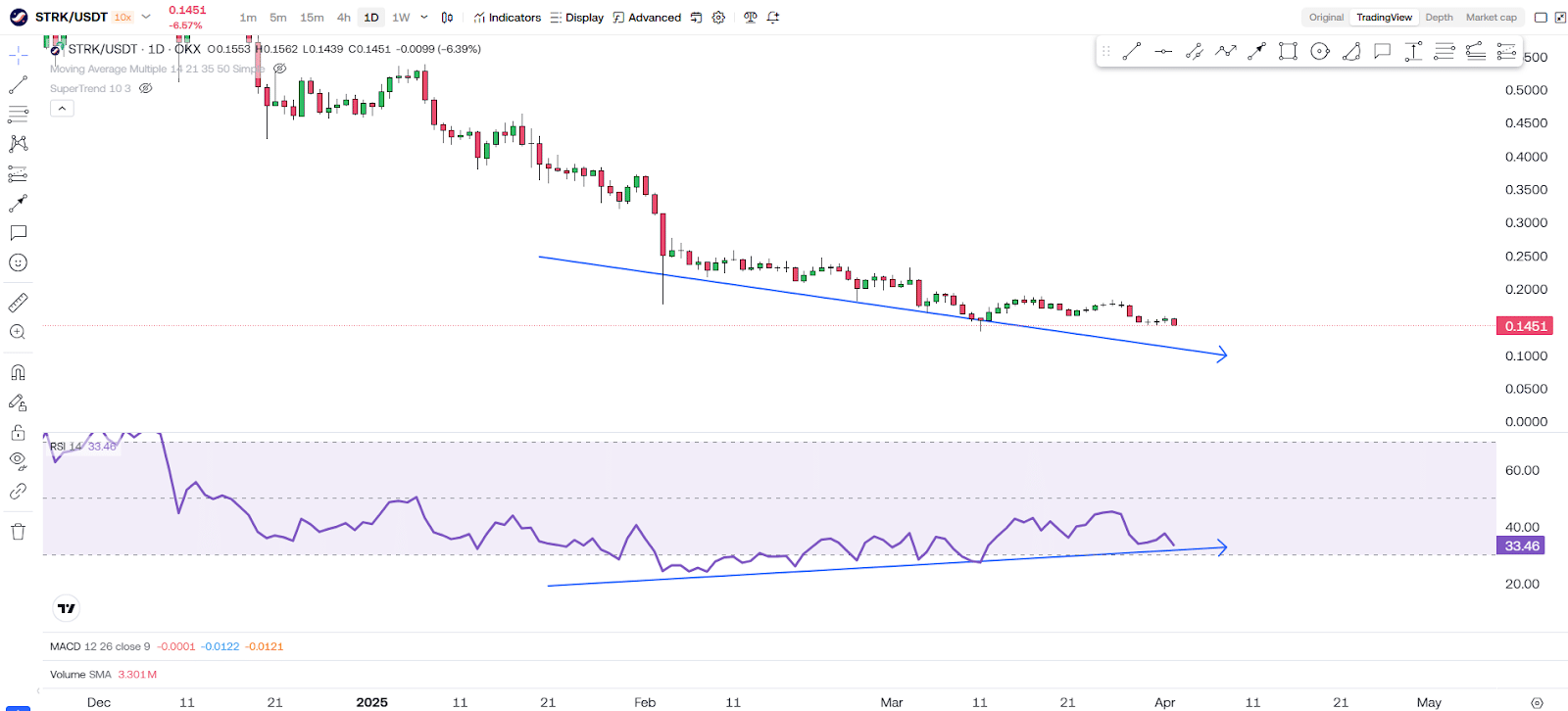

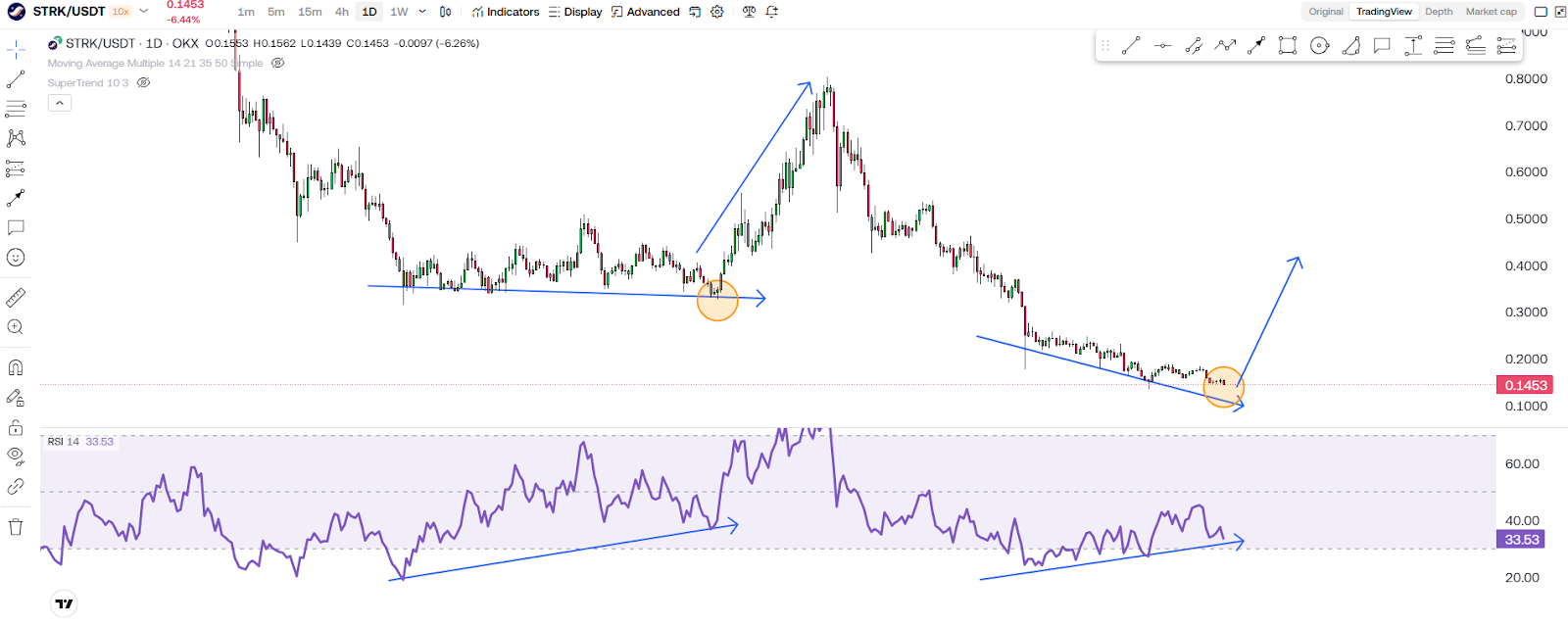

However, when analyzing its technical indicators, we see a different story. By using the Relative Strength Index (RSI), we can observe that it is slowly climbing. Meanwhile, the price continues to move downward. This pattern is known as bullish divergence.

A bullish divergence occurs when the RSI moves upwards while the price either trends downward or remains sideways. This signals that a new trend may be forming. If we examine Starknet’s past price action, we can see a similar divergence—prices were declining or moving sideways, yet the RSI was climbing. What happened next? Prices surged higher. And now, we are seeing this pattern again. The big question is: Will Starknet gain bullish momentum again?

One important thing to consider when analyzing bullish divergence is that it does not guarantee an immediate price reversal. In many cases, it can take weeks or even months for the price to reflect what the RSI is indicating. Looking at past trends, we have seen similar patterns play out, leading to strong upward movements. However, there have also been instances where the divergence did not result in a sustained breakout.

It is also crucial to consider broader market sentiment. If the overall cryptocurrency market remains weak, Starknet may struggle to gain traction, even if technical indicators are pointing towards a potential uptrend. That being said, if Bitcoin and other major cryptocurrencies begin to rally, Starknet could follow suit and experience a stronger move to the upside.

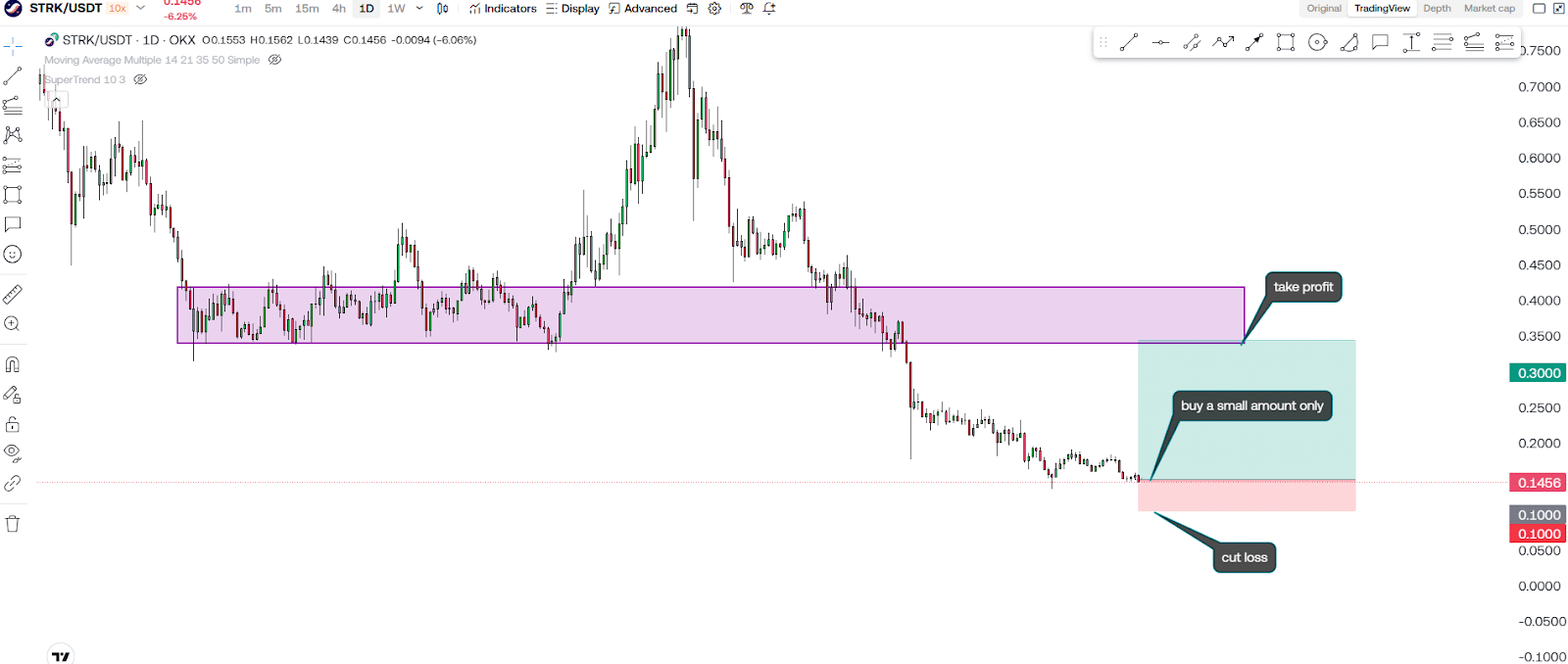

If you are considering entering into Starknet, one strategy is to buy a small position now to position yourself early in case a price pump materializes. However, it’s crucial to only invest an amount you are willing to lose, as there’s always a risk that our trading bias may not play out as expected.

For traders looking to manage risk effectively, setting stop-loss orders and scaling into positions gradually may be a smart approach. Instead of going all in at once, consider dollar-cost averaging (DCA) to spread your investment over time and reduce the impact of short-term volatility.

Final Thoughts

While Starknet’s price action has been disappointing for a long time, the presence of bullish divergence suggests that a potential trend reversal could be on the horizon. However, this does not mean that prices will immediately skyrocket. It is important to remain patient and manage risk appropriately.

For more in-depth technical analyses like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!

Additionally, join our Telegram community to discuss the latest market trends, share insights, and get real-time updates from experienced traders. Don’t miss the chance to be part of the conversation!