Let’s examine the insights shared by our Technical Analyst at UseTheBitcoin as he walks us through his personal trading approach and observations on the crypto market.

Gala (GALA) Market Update

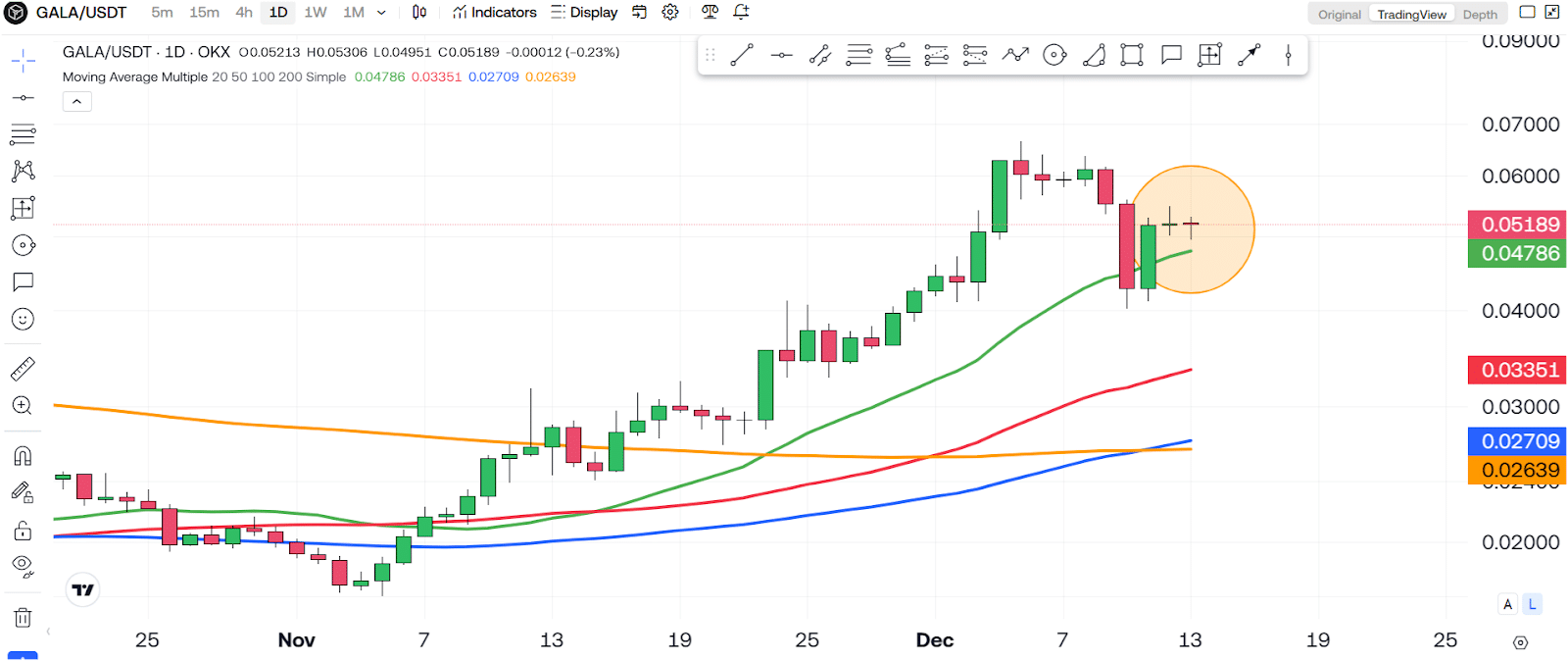

Currently, Gala (GALA) is consolidating near the 20-day moving average (20MA), which is an important level to watch. Consolidation in this area often suggests that the market is taking a pause after recent price movements. This phase could indicate indecision among traders as they await the next potential trend.

However, there is a chance that GALA might dip slightly lower to touch the 20MA, which could provide a more stable support level. This is common in technical setups, where price movements often test support zones to confirm their strength. For now, it’s crucial to monitor how the price reacts in this area. If the 20MA holds, it could become a solid base for the next potential upward move. Remember that patience is key, as consolidation phases often signal that an upward or downward breakout might be imminent.

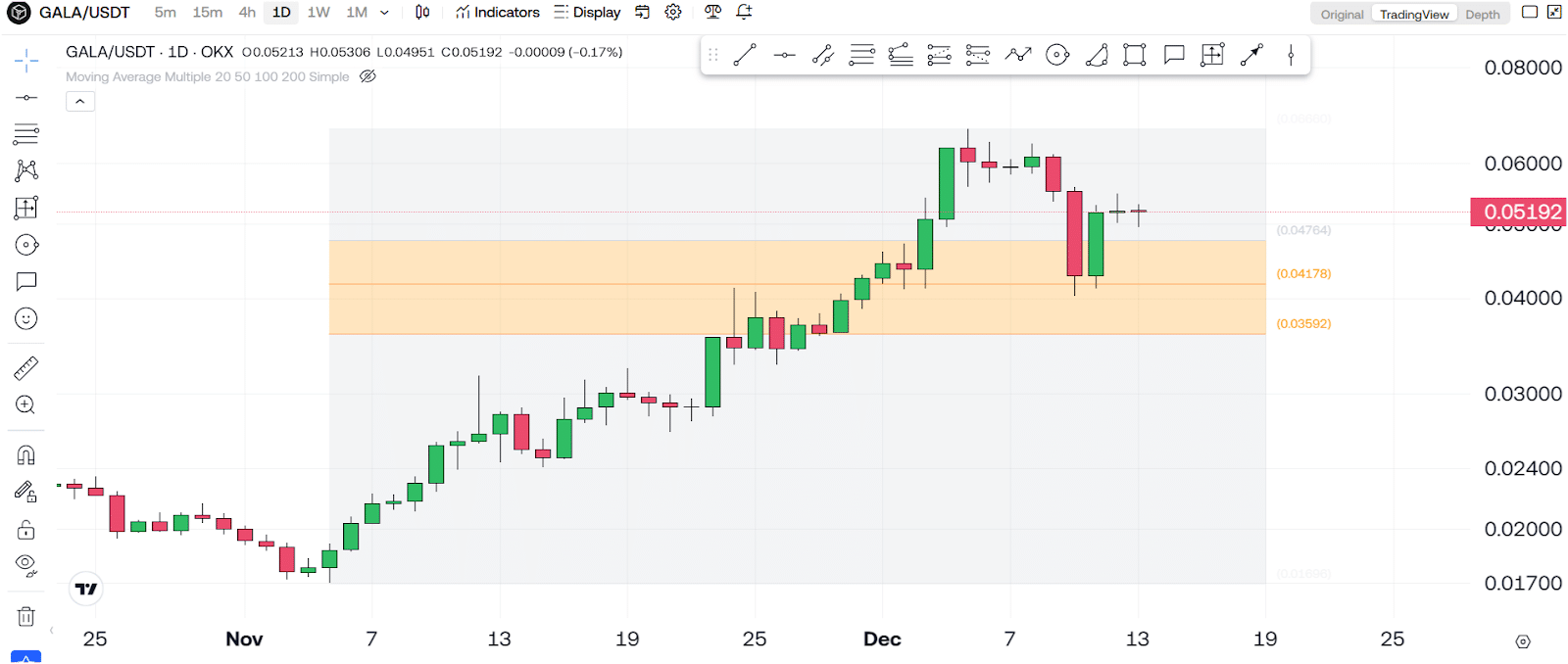

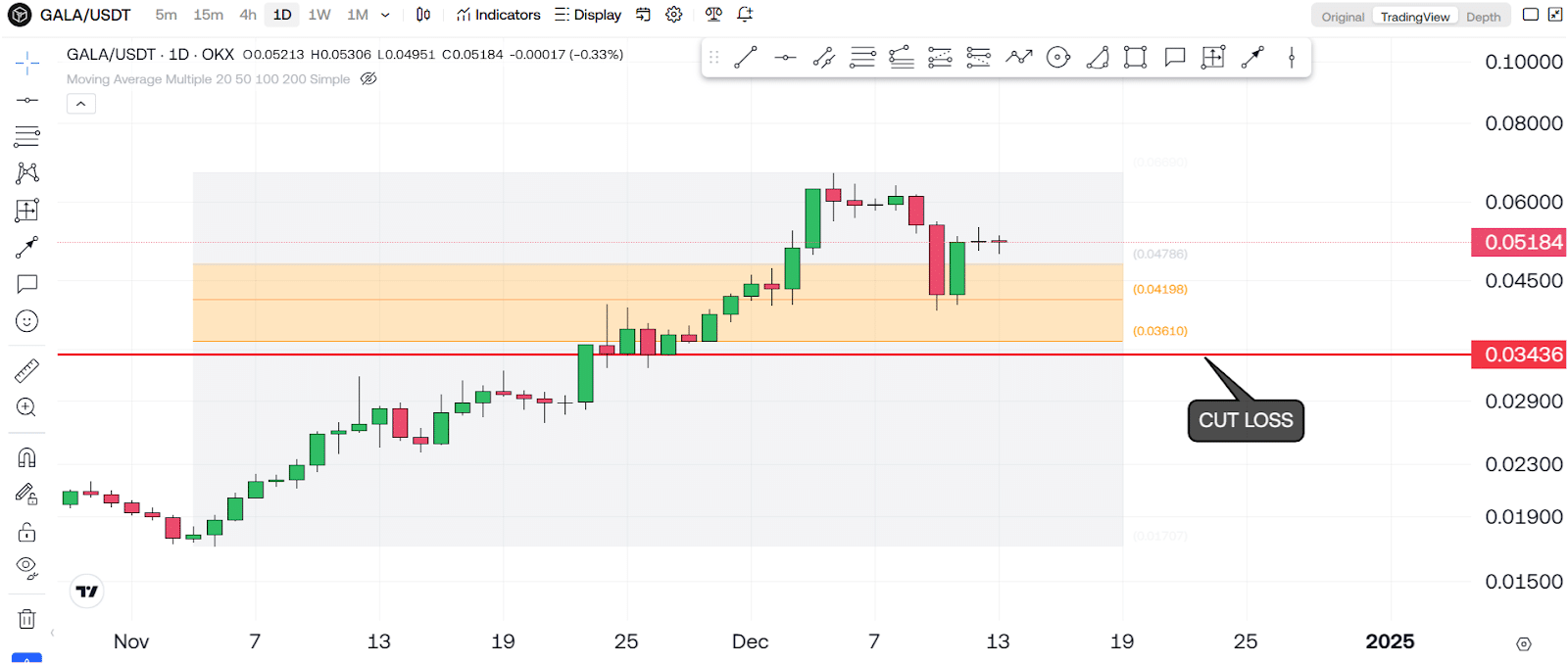

When we zoom out and apply the Fibonacci retracement tool, we notice that GALA has already entered the buying zones. Fibonacci levels are highly regarded in technical analysis because they help identify key support and resistance areas.

These levels often represent price points where traders tend to enter or exit positions, making them critical areas of interest. If you’re considering entering a trade at these levels, it’s essential to place your stop-loss orders just below the Fibonacci zones. This strategy protects your capital in case the market moves against you. It’s worth noting that trading cryptocurrencies carry significant risks, and no matter how promising a setup appears, market conditions can change unpredictably. Always prioritize risk management over potential rewards.

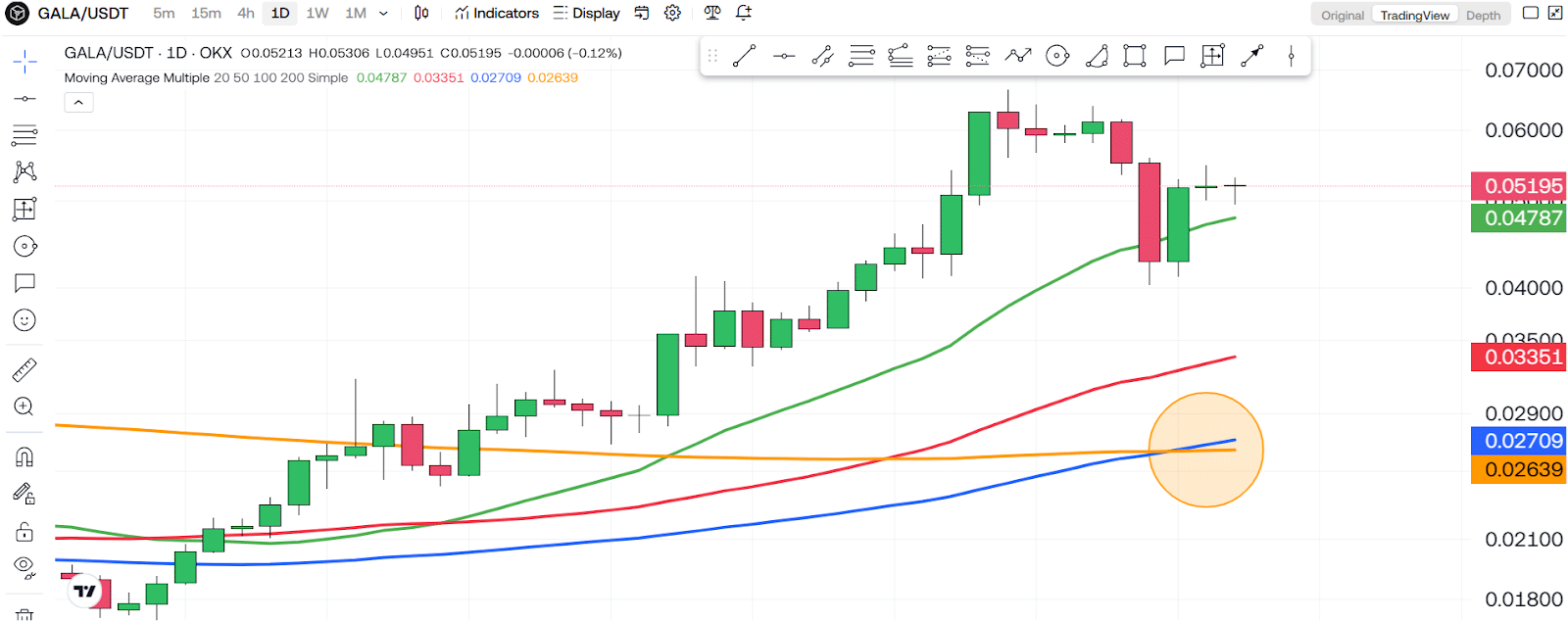

Another positive signal is coming from the moving averages. Currently, we’re seeing a golden crossover between the 100-day moving average (100MA) and the 200-day moving average (200MA). The 100MA, represented by the blue line, has crossed above the 200MA, represented by the orange line. This crossover is often viewed as a bullish indicator, suggesting that the market momentum is gradually shifting towards an uptrend.

While this doesn’t guarantee an immediate price surge, it is a strong sign that the overall trend may favor buyers in the medium to long term. As always, it’s important to combine this signal with other indicators to confirm the trend.

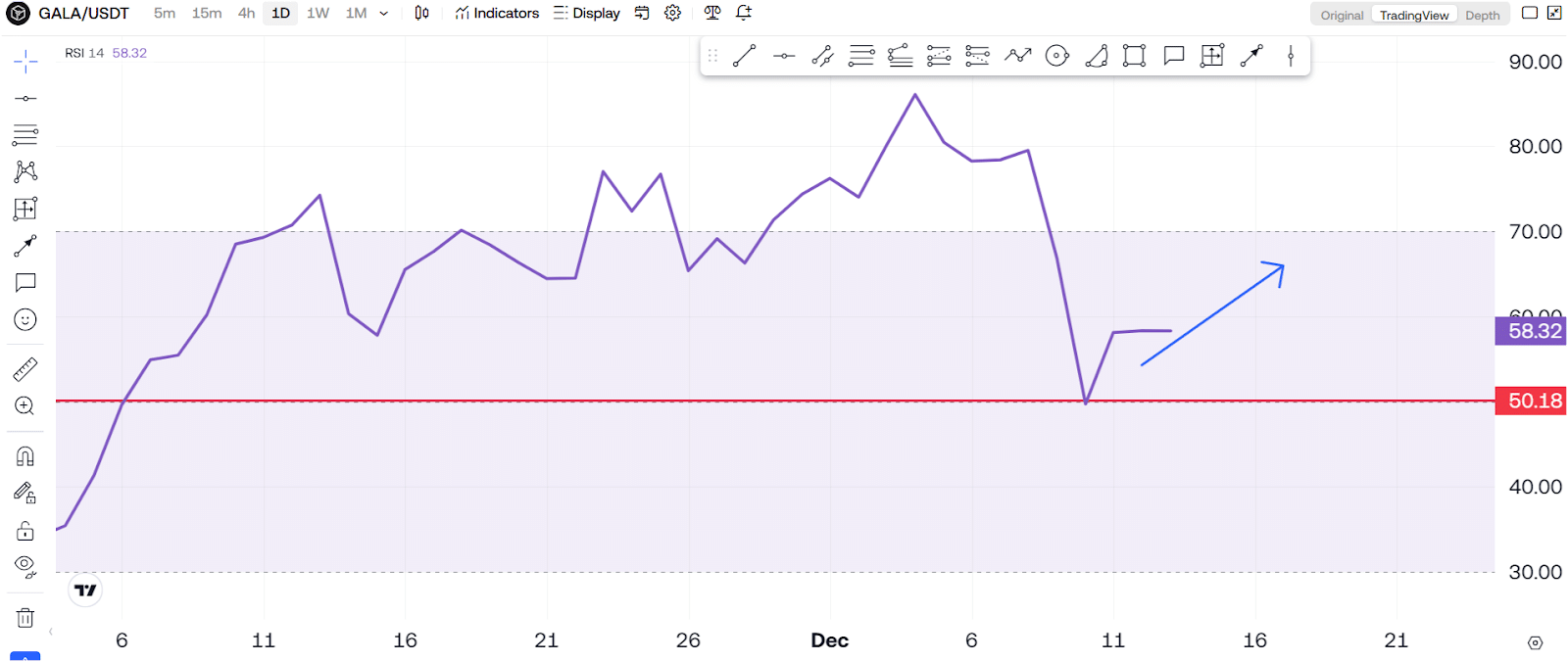

In addition, the Relative Strength Index (RSI) provides more insight into the market’s momentum. Despite experiencing a significant 30% drop recently, the RSI has remained above the median line (50). This is a strong indication that bullish momentum is still present.

In technical analysis, an RSI above 50 generally signals that buyers are in control, even during temporary dips. As long as the RSI stays above this median line, there is potential for a bounce or a recovery. However, if the RSI drops below 50, it may signal further downside risk, so it’s important to keep a close eye on this indicator.

For beginners, understanding the importance of risk management is essential when trading cryptocurrencies. The market is highly volatile, and prices can change drastically within minutes. To protect your capital, always set manageable position sizes and establish clear stop-loss levels. Even when technical indicators look promising, no trade setup is guaranteed to succeed. The market operates independently of individual traders and can behave unexpectedly.

Final Thoughts

To summarize, Gala is at a critical point near the 20MA and Fibonacci buying zones, with support from a golden crossover on the moving averages and strong RSI momentum. While these indicators suggest a potential bullish movement, a disciplined and cautious trading approach is vital. Stick to your plan, manage your risk, and never trade more than you are willing to lose.

For more in-depth technical analysis like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!