Key Takeaways

- BTC’s price needs to close the year above $88,000 to avoid bears from taking advantage of weak prices.

- Factors such as favorable regulatory policy in 2025 and BTC dominance retracement could lead to altcoin season.

- Bitcoin will remain on track to $120,000 and beyond if bulls close its price above the key support zone.

The cryptocurrency market has had quite a run in 2024, with Bitcoin (BTC) rallying from a region of $30,000 to a high of $108,000, creating new highs despite facing many uncertainties and a bearish cycle that hampered its price for over two years.

Exchange-traded funds and the post-U.S. election with the announcement of Donald Trump were the major factors driving the price of Bitcoin in 2024, with major investors and institutions coming into the cryptocurrency space.

Despite the price of Bitcoin facing a price decline towards the end of the year due to its low volume and lack of trading activity, the overall performance of Bitcoin for 2024 has been incredible beyond imagination, as 2025 could be far more explosive.

Crypto Altcoins Market Sentiment Ahead Of 2025?

One of the major concerns for the cryptocurrency market recently was regulatory policy favoring the market. Trump and his pro-crypto administration favor the crypto space and the desire to make the U.S. a hub for the Bitcoin powerhouse and its strategic reserve, so we could see the crypto market enjoying a more friendly policy and altcoins rallying higher.

Although altcoins have struggled, Bitcoin outperformed them due to rising BTC dominance, hitting a new high of 65. With BTC dominance looking bearish for the long term, we could see better performance from altcoins in 2025.

Best performing altcoins for 2024 were memecoins, real-world assets, DeFi, and recently AI agents. Although it is a new narrative, AI agents could gain much traffic in 2025.

Bitcoin Price Prediction For Today, Tomorrow, Daily, 2025, 2030

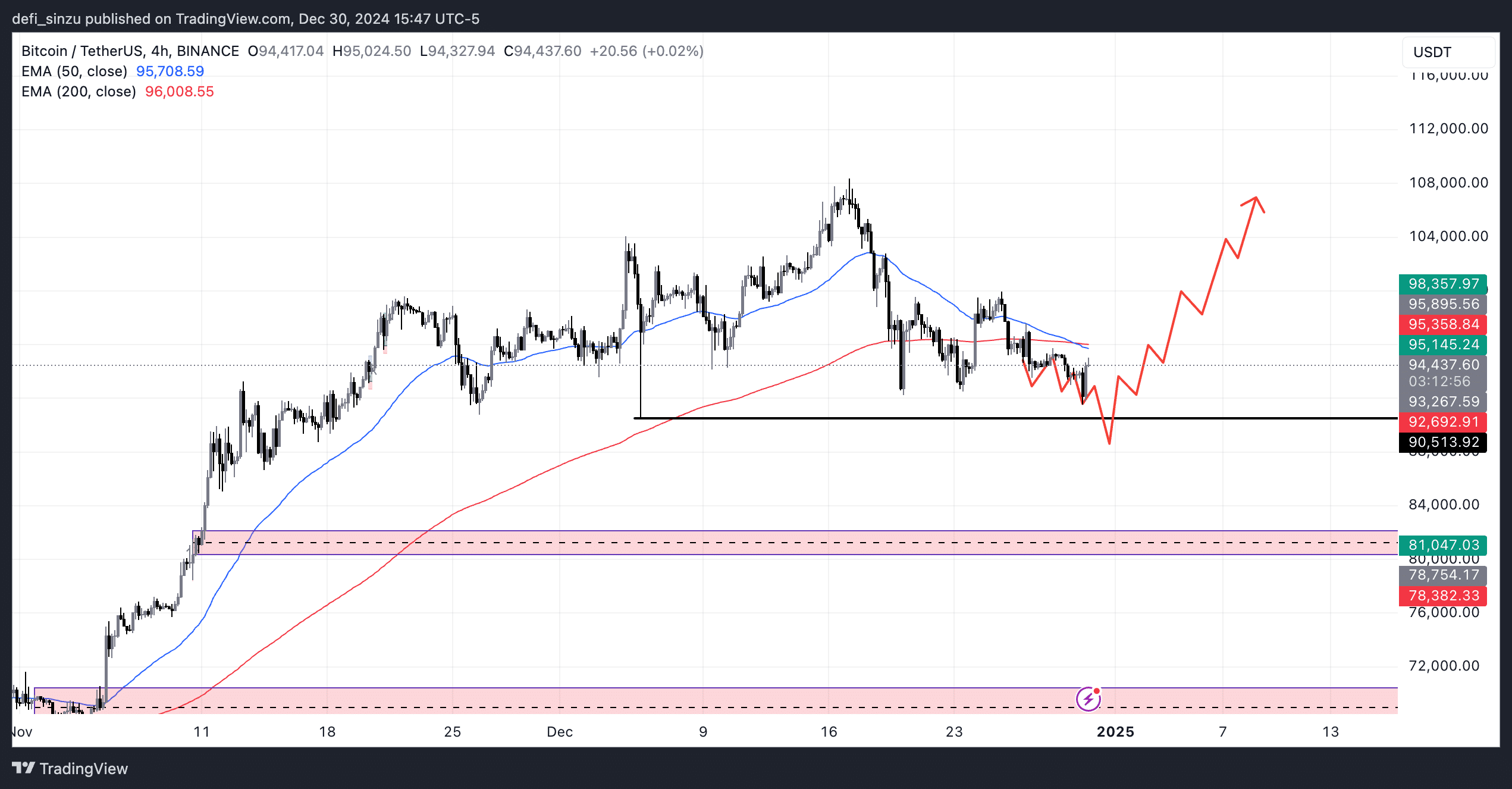

Source – BTC Price Chart From TradingView

The price of Bitcoin at $92,000 is currently trading below its 50-day and 200-day EMAs, an indicator of bears trying to overpower bulls in the 4-hour timeframe. In contrast, the daily and weekly timeframes still maintain their bullish structure.

As long as Bitcoin trades above $88,000 heading into 2025, the overall trend remains bullish, closing its year candle pretty well, and we could see volume stepping in to push the price of Bitcoin to a high of $120,000 in the coming weeks or months.

In the next few days, BTC could trade towards its $90,000 to $88,500 region to grab more buy volume as there is a lot of liquidity and orders waiting to be filled.

If the price of BTC breaks below $88,500, we could see the price go lower towards $81,000 and possibly $77,000. BTC bulls need to defend themselves from lower prices in these regions.

Key Support Zone – $90,000 and $88,000

Key Resistance Zone – $$101,000