Stay in the loop with our weekly crypto digest as we get you up to speed on the hottest trends and events in the crypto space.

Here’s what happened in crypto this week:

Coinbase Says Hackers Bribed Staff To Steal Customer Data, Demanding $20 Million Ransom

Crypto exchange Coinbase reported that cybercriminals bribed overseas support agents to steal customer data to use in social engineering attacks.

In a blog post, Coinbase said the criminals had gained access to “less than 1%” of its customer data, which they then used to impersonate the firm and trick people into handing over their crypto.

The group then demanded $20m from Coinbase to keep it quiet, but it refused to pay the bribe and instead promised to pay back every person who got scammed.

Additionally, Coinbase disclosed that a data breach in December 2024 affected 69,461 users, revealing KYC details but not passwords or funds.

Critics, including investor Michael Arrington, condemned #Coinbase’s delayed response and the potential human cost of the breach, estimating remediation costs between $180 million and $400 million.

Arrington also criticized KYC laws as ineffective, urging for better protection of user data by both regulators and corporations.

Judge Analisa Torres Denies Ripple–SEC Motion Over XRP

Judge Analisa Torres of the US District Court for the Southern District of New York has rejected a joint motion by the US Securities and Exchange Commission (SEC) and Ripple Labs in the case over XRP.

In a May 15 decision, she denied the request to lift an injunction and reduce a $125 million civil penalty, ruling that the proposed agreement did not meet the legal standards for modifying a final judgment.

The SEC and Ripple had sought court approval to vacate an injunction prohibiting Ripple from violating securities laws and to cut the penalty to $50 million as part of a negotiated settlement while their appeals are pending. Judge Torres found the motion procedurally improper, stating it should have been made under Rule 60, which applies to requests for relief from a final judgment and demands a demonstration of “exceptional circumstances.”

Notably, the case can only conclude if Judge Torres first signals she will dissolve the injunction and approve distributing $50 million to the SEC and the remainder to Ripple. If so, both parties will seek a limited remand from the Second Circuit. Once granted, they will formally request the relief. After the injunction is lifted and funds are distributed, both sides will move to dismiss their appeals, ending the case.

Vitalik Buterin Suggests Implementing ‘Partially Stateless Nodes’ To Help Scale Ethereum

Vitalik Buterin proposed the concept of “partially stateless nodes” to improve Ethereum’s scalability while maintaining the ability to run full nodes.

The proposal includes implementing EIP-4444 to limit node storage to 36 days of historical data, significantly reducing the storage burden for full nodes.

Buterin’s roadmap aims to enhance node efficiency through medium-term changes like stateless verification, potentially reducing storage needs by 50%. These advancements could increase Ethereum’s Layer-1 gas limit by 10 to 100 times, allowing nodes to verify blocks without needing to store all blockchain data.

Metaplanet Buys 1,004 Bitcoin For $104 Million, Pushing Total Holdings To 7,800 BTC

Metaplanet purchased 1,004 Bitcoin for approximately $104.3 million, raising its total holdings to 7,800 BTC, valued at around $806 million.

The Japanese investment firm aims to reach 10,000 BTC by the end of 2025 and has been funding its purchases through bond issuances, including a recent $15 million offering.

Metaplanet is currently Asia’s largest publicly listed corporate Bitcoin holder and ranks 11th globally.

Strategy Faces Class Action Lawsuit Over Bitcoin Strategy

Strategy (formerly MicroStrategy), along with its CEO Michael Saylor, CFO Phong Le, and executive Andrew Kang, is facing a class action lawsuit filed in the US District Court for the Eastern District of Virginia. The lawsuit, initiated by plaintiff Anas Hamza on behalf of investors from April 30th, 2024, to April 4th, 2025, accuses the company of violating securities laws.

The allegations claim that MicroStrategy made false or misleading statements regarding its Bitcoin investment strategy and the expected profitability of its financial operations. The lawsuit asserts that the company failed to disclose relevant information about the risks associated with Bitcoin volatility and the potential losses that could be recognized under new accounting standards.

MicroStrategy has stated its intention to vigorously defend against the lawsuit but has acknowledged that it is currently unable to predict the outcome or estimate potential losses.

Senate Votes To Move Forward On Landmark GENIUS Stablecoin Legislation

The US Senate voted to advance the Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act), a significant step toward regulating stablecoins.

Some Democrats initially opposed the bill due to concerns about foreign issuers and anti-money laundering standards, but later negotiations led to support from several party members.

The bill mandates that stablecoins be fully backed by US dollars or liquid assets, requires annual audits for large issuers, and introduces regulations on foreign issuance.

Lawmakers are considering combining the stablecoin bill with broader legislation to regulate the digital asset market, reflecting Washington’s priority on this issue.

Circle In “Informal Talks” To Sell Itself To Coinbase Or Ripple

Circle Internet Financial, the issuer of the USDC stablecoin, is reportedly in informal talks to sell itself to either Coinbase or Ripple, according to Fortune. The discussions come just weeks after Circle filed publicly for its long-anticipated initial public offering (IPO) in early April.

Sources from the banking and private equity sector say Circle is seeking at least $5 billion, the same valuation it is targeting for the IPO. The company is still committed to going public, but the talks with Coinbase and Ripple suggest it is exploring multiple paths.

Ripple has already made a bid between $4 billion and $5 billion, but that offer was turned down as too low.

Coinbase, meanwhile, is seen as a more natural acquirer. The two companies share a long history through their joint venture, Centre Consortium, which launched USDC in 2018. Though the consortium dissolved in 2023, Coinbase retains an equity stake in Circle and continues to share in the USDC revenue.

Cardano’s Charles Hoskinson Addresses Claims Of ADA Theft Linked To IOHK

Cardano founder Charles Hoskinson has resisted mounting allegations that IOHK engaged in theft involving unredeemed ADA tokens. For context, Charles Hoskinson is accused of rewriting the network ledger to manipulate token flows and seize control of $619M worth of ADA tokens.

In a recent YouTube AMA, Hoskinson addressed what he described as a “coordinated campaign of defamation,” while offering new details and context about the complex redemption process that followed Cardano’s early token distribution.

He confirmed that an audit report is underway and urged the public to await its release before concluding.

Javier Milei Shuts Down Argentina Unit Investigating Crypto Scandal

President Javier Milei has dissolved the special investigative unit he established to probe alleged wrongdoing in his controversial promotion of the $LIBRA cryptocurrency.

The special unit, formed just three months ago, was tasked with examining fraud and misconduct allegations linked to the memecoin’s rapid rise and crash, which left retail investors with an estimated $250 million in losses.

Milei, who promoted the coin on X, now claims the unit completed its objectives. However, critics argue the move appears premature and politically motivated, as no public findings have been released.

NYC Mayor Eric Adams Launches Crypto Advisory Council

Mayor Eric Adams announced at a recent fintech summit held at Gracie Mansion that New York City is stepping up its commitment to digital innovation with the launch of a Digital Assets Advisory Council.

The initiative aims to attract more fintech jobs to the city and strengthen NYC’s position as a global hub for blockchain and digital assets.

“We want to use the technology of tomorrow to better serve New Yorkers today,” said Adams. The council will include industry leaders, with a chairperson to be named soon, and will guide the city’s strategy on integrating blockchain solutions into public services.

Mayor Adams’ administration has consistently supported Web3, cryptocurrency, and fintech innovation, viewing these sectors as essential for future economic growth. The Digital Assets Advisory Council is the latest move to align New York City with evolving global trends and attract top-tier talent.

Solana Mobile Unveils SKR Token Plans, Confirms Seeker Shipping Date

Solana Mobile has announced plans to launch its SKR token and its decentralized architecture, TEEPIN, while confirming that its second crypto smartphone, “Seeker,” will ship on August 4th, 2025.

TEEPIN aims to provide a three-layer architecture for secure mobile access, allowing developers, users, and manufacturers to operate in a decentralized ecosystem without reliance on a central authority.

The SKR token is intended to facilitate economics, incentives, and ownership within the Solana Mobile ecosystem, promoting active participation from users, developers, and hardware manufacturers.

The Seeker smartphone has surpassed 150,000 presales across 57 countries at an introductory price of $500 and features enhancements like a hardware Seed Vault and an upgraded Solana dApp Store.

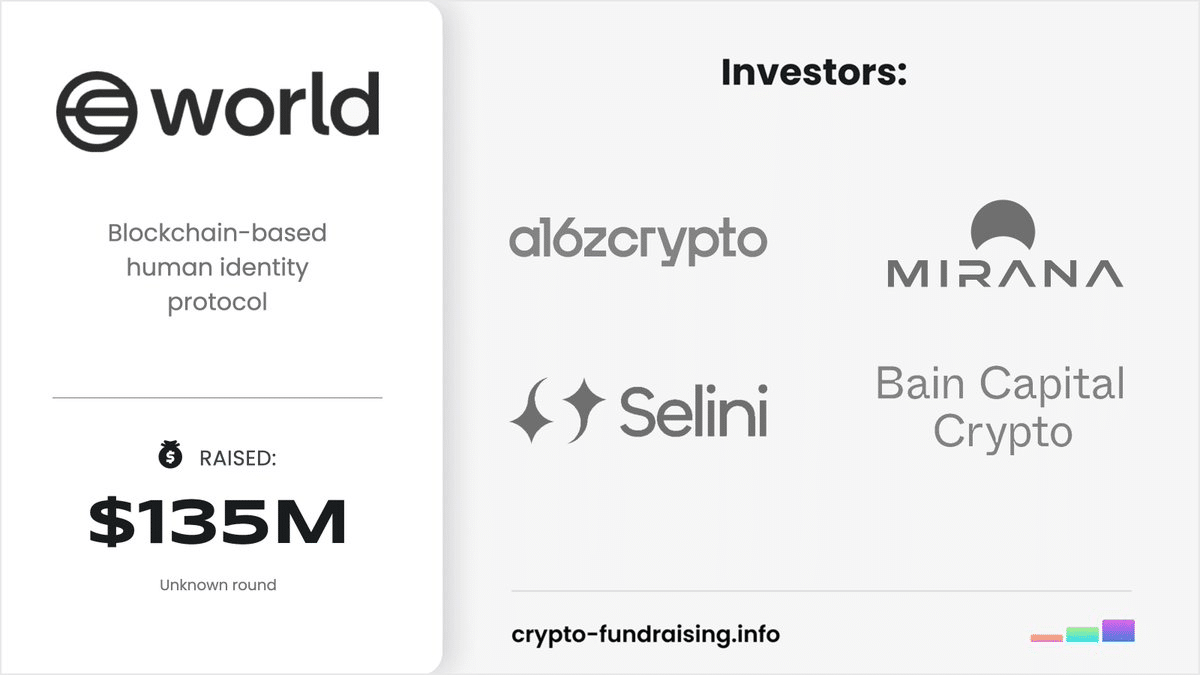

World Raises $135M From Andreessen Horowitz And Bain Capital Crypto To Fund Network Expansion

Worldcoin, the controversial digital identity venture co-founded by OpenAI CEO Sam Altman, has secured $135 million in fresh funding from heavyweight backers including Andreessen Horowitz and Bain Capital Crypto, the company announced.

The funding will fuel World’s rollout of its iris-scanning orbs and backend infrastructure across more US cities, following its April pledge to launch in six cities and expand its footprint globally.

So far, over 12.5 million people across more than 160 jurisdictions have received a World ID, a digital credential tied to their biometric data. The idea is to offer a “proof of personhood” in an increasingly AI-saturated internet.

The project has come under fire from regulators and privacy watchdogs around the world, with critics raising alarms over the ethics of swapping cryptocurrency for sensitive biometric data. They argue that users are being nudged into giving up their iris scans without fully grasping the implications, a challenge to the concept of informed consent.

Final Thoughts

So that’s it for this week!

To stay ahead of the game with the freshest crypto news and insights delivered straight to your inbox, consider subscribing to UseTheBitcoin’s newsletter today.

Have a fantastic week ahead!