Key Takeaways

- Arthur Hayes claims the four-year Bitcoin cycle is dead as the market has evolved past that phase.

- Chinese policymakers have always had an impact on the crypto market, but the market has grown to survive without them.

- The crypto market would still experience bull cycles; however, historical data from the past four years would have little effect on the market based on adoption.

The four-year crypto bull cycle has always attracted an adrenaline rush from traders, investors, and crypto experts who have witnessed Bitcoin (BTC) perform extremely well over the last few years, with speculation of its bull cycle making waves in the crypto space.

However, BitMex co-founder Arthur Hayes believes the current market is different and could signal the end of BTC’s four-year cycle, which has seen prices rally to new all-time highs. He claims the market has grown beyond historical data and patterns that could indicate a bull market or market top.

His arguments are based on three references to past historical data and how the current shift in microeconomic and institutional inflow of money suggests the current cycle would be different from the past.

Genesis Cycle and the Global Financial Crisis

In 2008, the world faced the global financial crisis, which impacted financial institutions globally. Governments worked tirelessly to abate the situation, exploring various policies.

However, China played a key role in alleviating the situation by using credit to fuel infrastructural spending and a bid to save the economy. At that time, money flowed into real estate, Bitcoin, and Gold, leading to the BTC crash.

The world survived these tough times as the crypto market started seeing some growth, leading up to the Initial coin offering (ICO) bubble.

ICO Cycle

This period was marked by the growth of ICOs in the crypto space, with Ethereum going live and smart contracts fueling this growth. This led to the rally of Bitcoin once more from the ashes as the Yuan currency was devalued against the USD. BTC saw its price hit new highs due to excessive Yuan in the economy, leading to one of the biggest bull cycles ever witnessed, but later saw its price crash around late 2017.

The crypto market experienced fewer activities until COVID-19, when the market crashed to a lower price point before experiencing another rally from 2017 to 2021.

COVID-19 Bitcoin Price Action and Beyond

COVID-19 was a scare for many, taking millions of lives and leading to endless policies by the government to find a solution. The US government offered palliatives to citizens, and the injection of money into the economy led to a boom in the crypto market at the time, with every crypto asset, including memecoin, being “UP ONLY”.

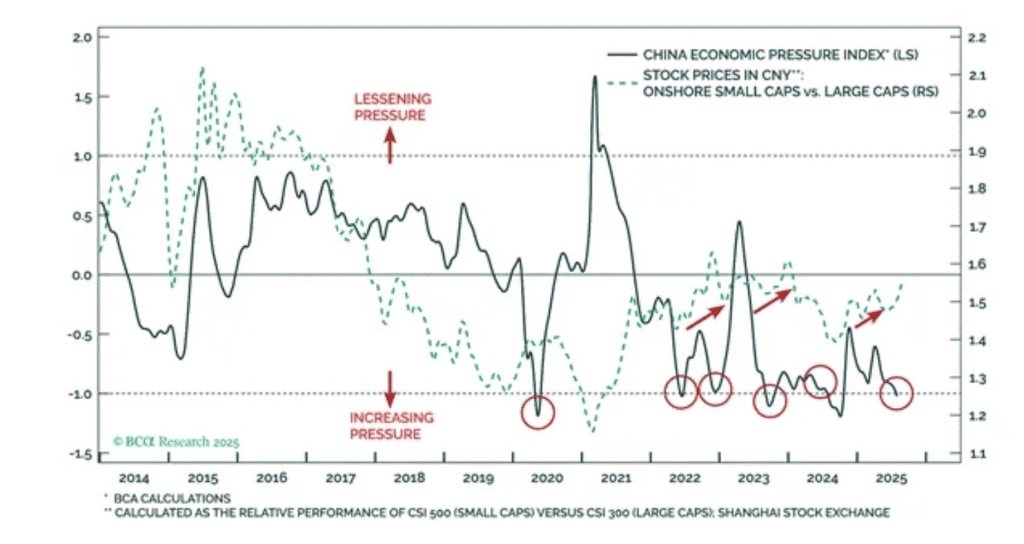

Source – Chinese Policymakers Print Money to Ease Market Tension

At this time, the Chinese government was focused on tackling COVID-19 through policies that had little impact on the crypto space. However, these economic events have significantly impacted the crypto market over the years as the US government, through Trump’s administration, has become increasingly interested in it.

The emergence of institutional players, Exchange-traded funds (ETFs), and favorable policies could redefine the next crypto cycles.

According to Hayes, crypto bull cycles will still be present in the market, but he strongly believes the market has evolved beyond the Bitcoin 4-year bull cycles, as policies, governments, and financial institutions now influence market events.

FAQs

What is the 4-year cycle in crypto?

The four-year crypto cycle has been marked by key events that have shaped the general market, including Bitcoin.

Does crypto go up every 4 years?

Following BTC’s four-year halving, the market is expected to rally to new all-time highs with altcoins performing extremely well.

What happens every 4 years with Bitcoin?

BTC experiences halving every four years, including its block mining, which has been a regular occurrence for years now.

Related Read

Gold and Silver Hit New Highs as BTC Struggles – Is the Top In?