Key Takeaways

- Bitcoin continues to suffer a price decline as macroeconomic news affects its price, which has fallen to a low of $80,000.

- BTC’s monthly bearish close could signal bearish dominance for price, with a potential price drop to $70,000.

- BTC price crash towards $70,000 could see a carnage price drop for altcoins as bears could take advantage of the price.

The price of Bitcoin (BTC) continues to struggle with macroeconomic news, which has affected its price in recent times. Following BTC rallying to a high of $88,500, renewed speculation of a potential breakout above $95,000 has emerged, but the price has failed to meet such expectations.

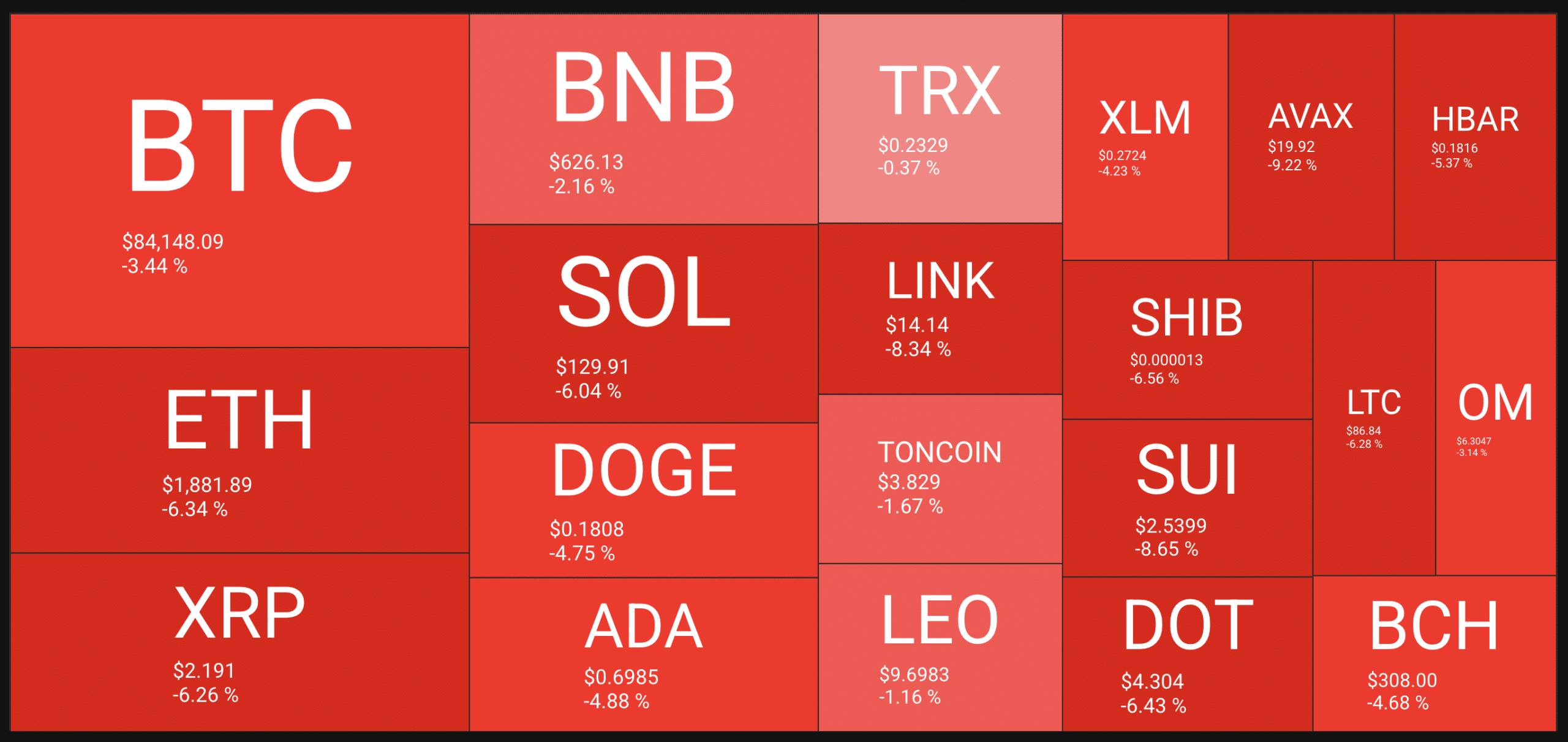

Altcoins continue to suffer more price decline as most altcoins are headed once more to their key support zone, with the price of BTC trading lower than $80,000, forcing altcoins to break these support zones they have protected in the past few weeks.

While the monthly candle looks imminent for a close, there are strong hopes that the market will resume its bullish price once more as a close below $75,000 for Bitcoin ahead of the new month and second quarter of 2025 could lead to much crash for altcoins.

Crypto Market Update And Sentiment

Source – Crypto Market Update From CryptoQuantify

The crypto market looks weak following the recent BTC price crash, from a high of $88,500 to a region of $83,000. BTC’s fear-to-greed index continues to indicate extreme fear in the crypto market despite the recent market bounce for BTC and altcoins.

With traders and investors reluctant to trade major pairs in the crypto market to remain cautious, BTC’s minor price recovery will need substantial volume to initiate a strong bullish trend to the upside that would break past the $95,000 resistance.

Bitcoin’s Price Analysis Ahead Of Monthly Close

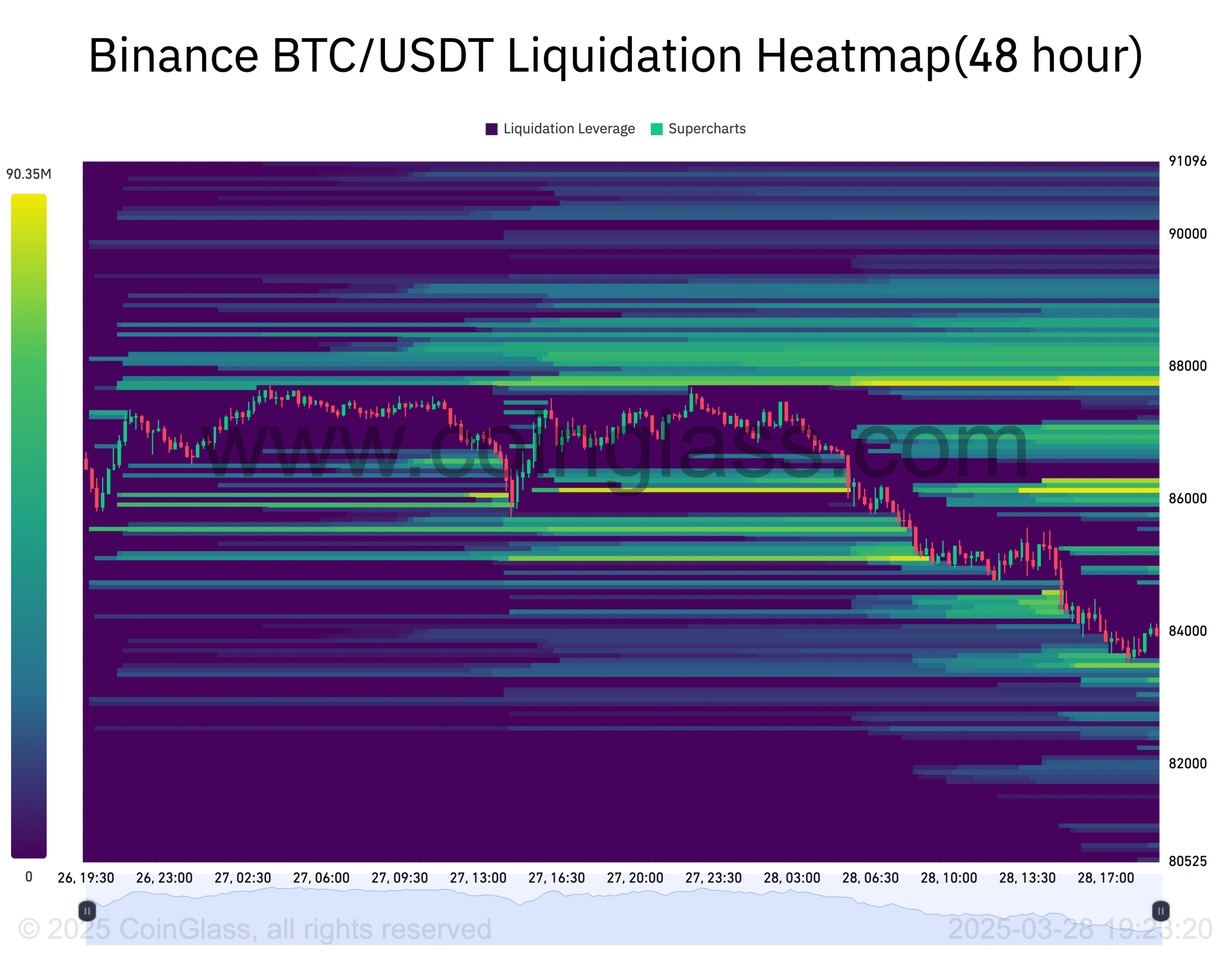

Source – BTC Short Liquidation Zones From Coinglass

The current price retracement of BTC towards a low of $83,000 has led to short positions opened with a huge liquidation zone set around $86,000 and $88,000. These regions represent strong liquidity zones and the possibility of new resistances for BTC, as the price of Bitcoin could aim to retest the lower region.

Bitcoin’s struggle for bullish price action for weeks indicates that BTC bulls are struggling to dominate the price. Bears will be looking to take advantage of the price towards the lower region in the coming weeks if the price of BTC fails to close the monthly candle above $90,000.

With the monthly candle closing bearish, there are high indications that the price of BTC could attempt to retest a region of $70,000, sweeping liquidity around those zones before a bullish price rally to the upside and a potential new all-time high in sight.