Key Takeaways

- Bitcoin price action creates mixed feelings as crypto experts speculate that the price could mimic the 2017 bear market.

- CryptoQuant CEO Ki Young Ju hints at the emerging bear signs for BTC based on on-chain analytics from the CryptoQuant dashboard.

- BTC’s price could resume bullish price action if the price breaks above the key resistance of $95,000.

The crypto market and Bitcoin (BTC) have experienced quite a substantial correction in the last three months, leading to wide uncertainties regarding the next price direction of Bitcoin (BTC) and other crypto assets.

While BTC and altcoins continue to struggle to find strong bullish price action remaining in consolidation, Gold has created a new historical price high of over $3,000 per ounce as the price of Gold continues to outshine Bitcoin in the past few weeks with no sign of weakness or price slowing down.

Although the market sentiment around BTC remains bullish following its price decline in the past few weeks, many crypto experts are divided on whether the price of Bitcoin could follow the upward price rally of Gold or remain in consolidation. Other top crypto personalities think BTC is on the brink of a bearish run.

Why Is Bitcoin Crashing? Crypto Market Sentiment

The price of Gold continues to show bullish strength, rallying to new highs despite political tension and macroeconomic uncertainties, and investors turn to Gold as a safe haven. While Gold has gained much attention in the past few weeks due to its strong bullish price rally, Bitcoin continues to make runs due to its price crash in the past weeks.

Following the price crash of BTC from its high of $109,000, the price of BTC has crashed by over 40% towards a low of $78,000, leading to wild speculation that the market is at the start of a bearish run. CryptoQuant CEO speculates that this could be a bear market with characteristics similar to the evolution of the 2017 bear market.

According to Ki Young Ju in his X post, he expects 6 months to 12 months of price consolidation from BTC following its price crash from $109,000 as the price has struggled to show any sign of bullishness in the past few weeks.

Ali Martinez has also shared on-chain data from Glassnode on his x post, suggesting a 180-day momentum shift for BTC MVRV, which signals a turning point for the number one digital asset in the crypto space.

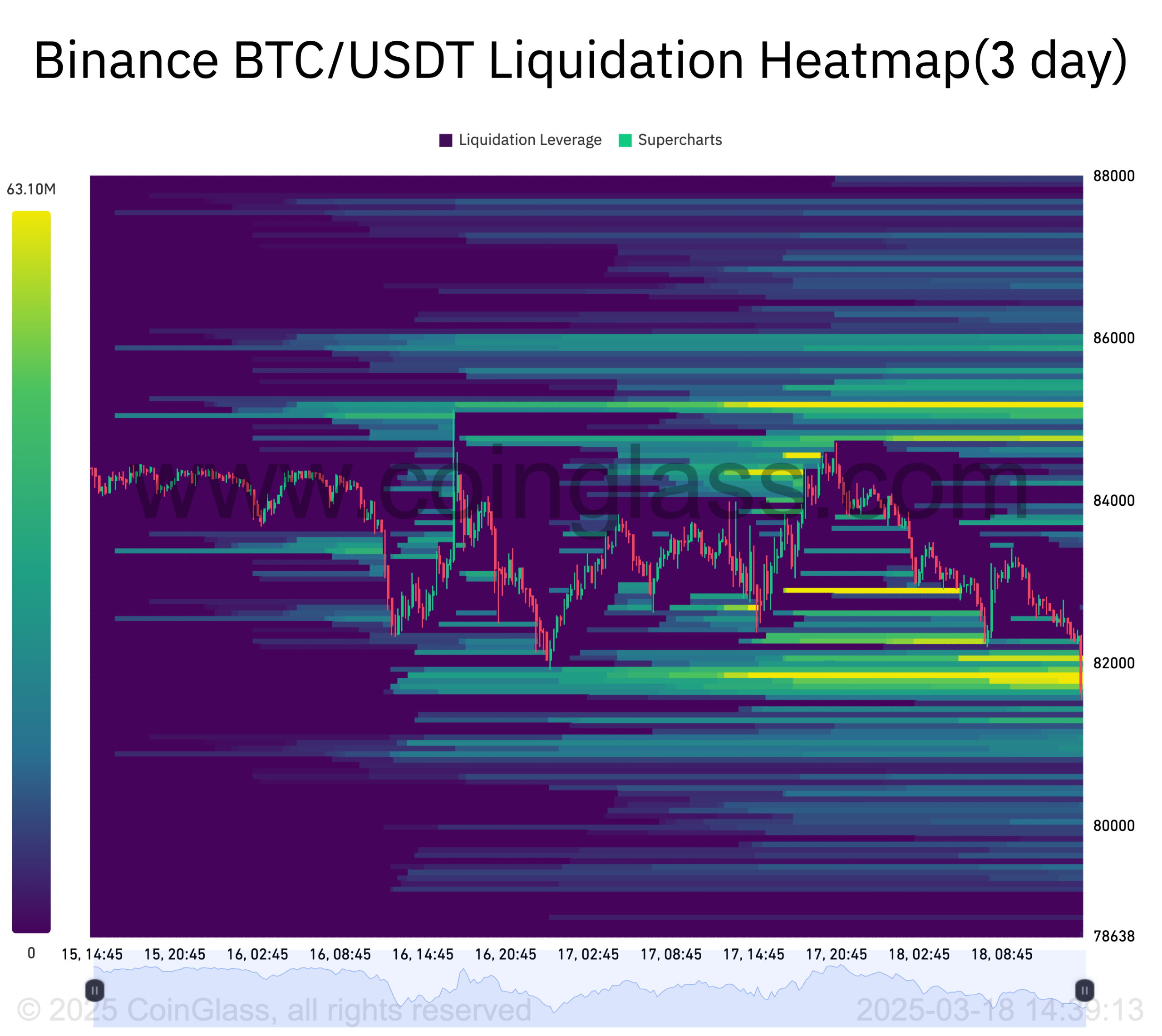

BTC Price Analysis – Cascading Long Liquidations Continues

Source – New BTC Long Liquidations Activated From Coinglass

Bitcoin’s price continues to consolidate between $78,000 and $85,000. Despite showing some great signs of price recovery, it has failed to break above its resistance of $85,000. The price of BTC was rejected around $85,000, crashing towards its low of $81,500, activating long liquidations.

The current on-chain data from Coinglass regarding BTC price movement suggests short liquidation prices are around $82,900, acting as resistance for the price. If the price shows strong signs of reversal, BTC is expected to break above its new swing highs of $83,000.

Bitcoin (BTC) Key Support Zone – $75,000 and $70,000

Bitcoin (BTC) Key Resistance Zone – $84,000 and $95,000

Bitcoin (BTC) Short Liquidation Zone – $75,000 and $70,000