Let’s examine the insights shared by our Technical Analyst at UseTheBitcoin as he walks us through his personal trading approach and observations on the crypto market.

Worldcoin (WLD) Trading Recap

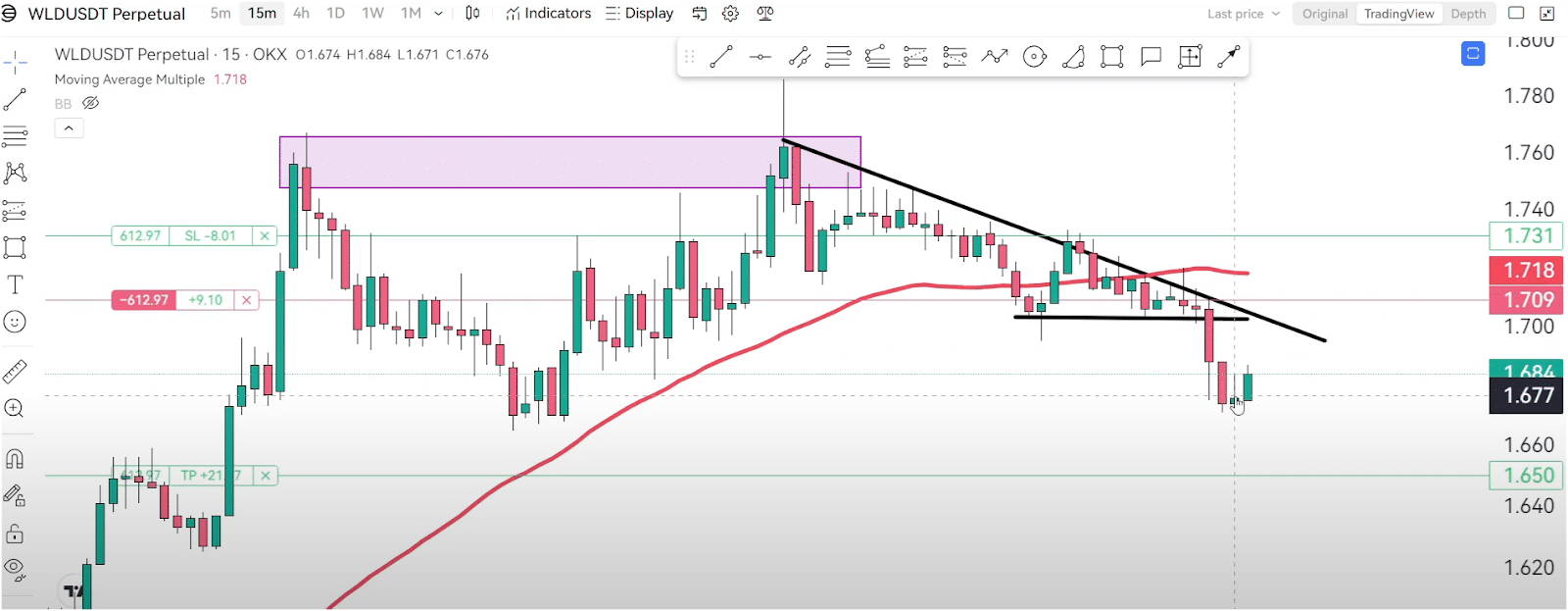

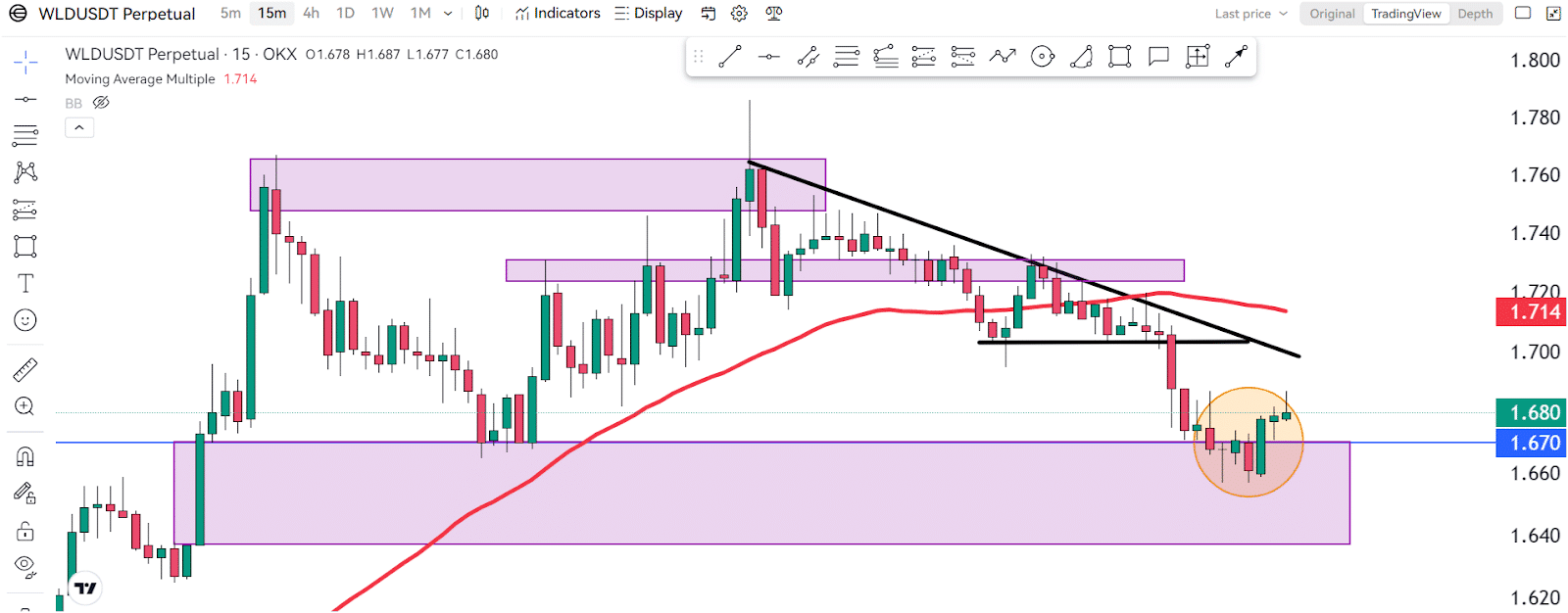

I decided to short Worldcoin (WLD) after noticing that it reached a significant resistance level. By plotting a trendline, I observed the price was trending downward, supporting my decision to go short. Another key factor was that the price dropped below the 50MA on the 15-minute chart, signaling the potential for further downside movement. Additionally, forming a descending triangle reinforced my belief that Worldcoin could experience short-term declines.

Setting A Stop-Loss Order

Managing risk is very important, so my next step was to identify an appropriate stop-loss level after entering the trade. I placed my stop-loss in an area with multiple resistance levels, ensuring my capital is protected if the trade does not go as planned.

Identifying Take-Profit Levels

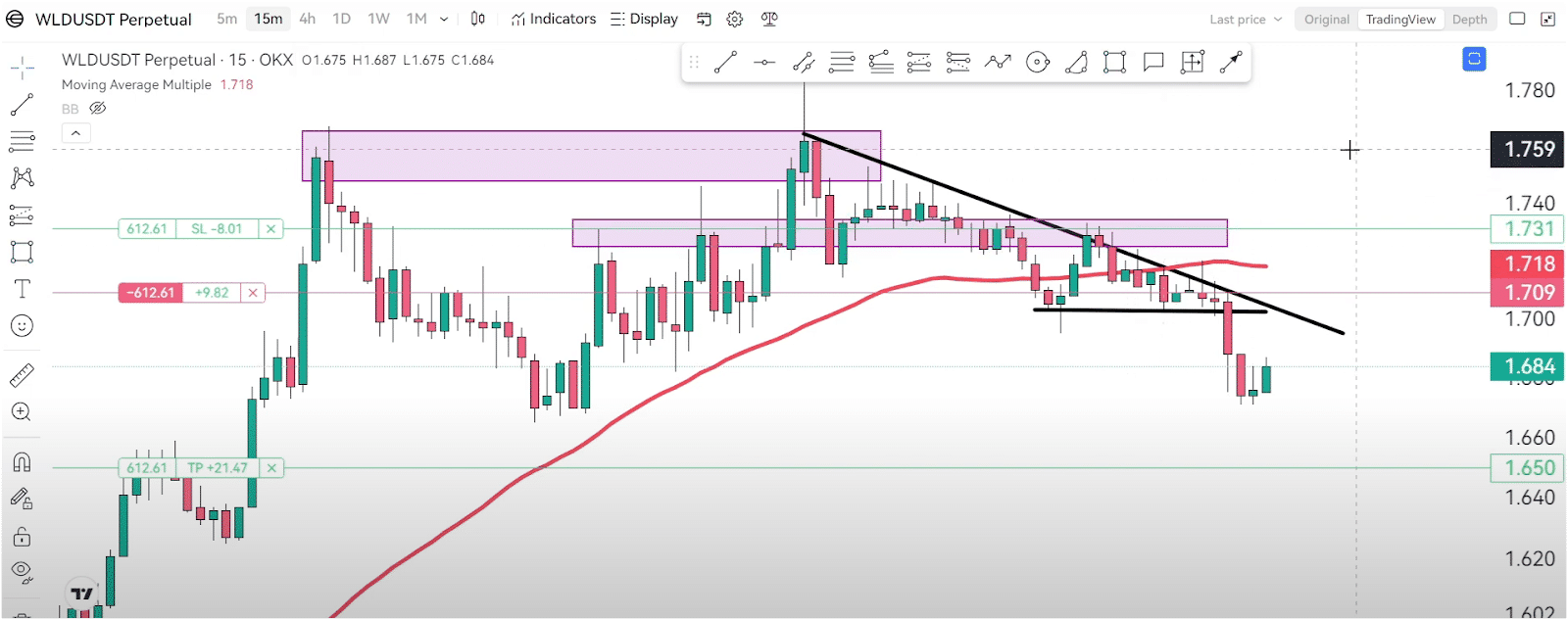

I look for fair value gaps (FVG) to set take-profit targets. A fair value gap is a large gap between three consecutive candles, where the price typically retraces to fill imbalanced orders. I placed my take-profit levels within this gap, expecting the price to return and fill it.

Adjusting The Stop-Loss To Secure Profits

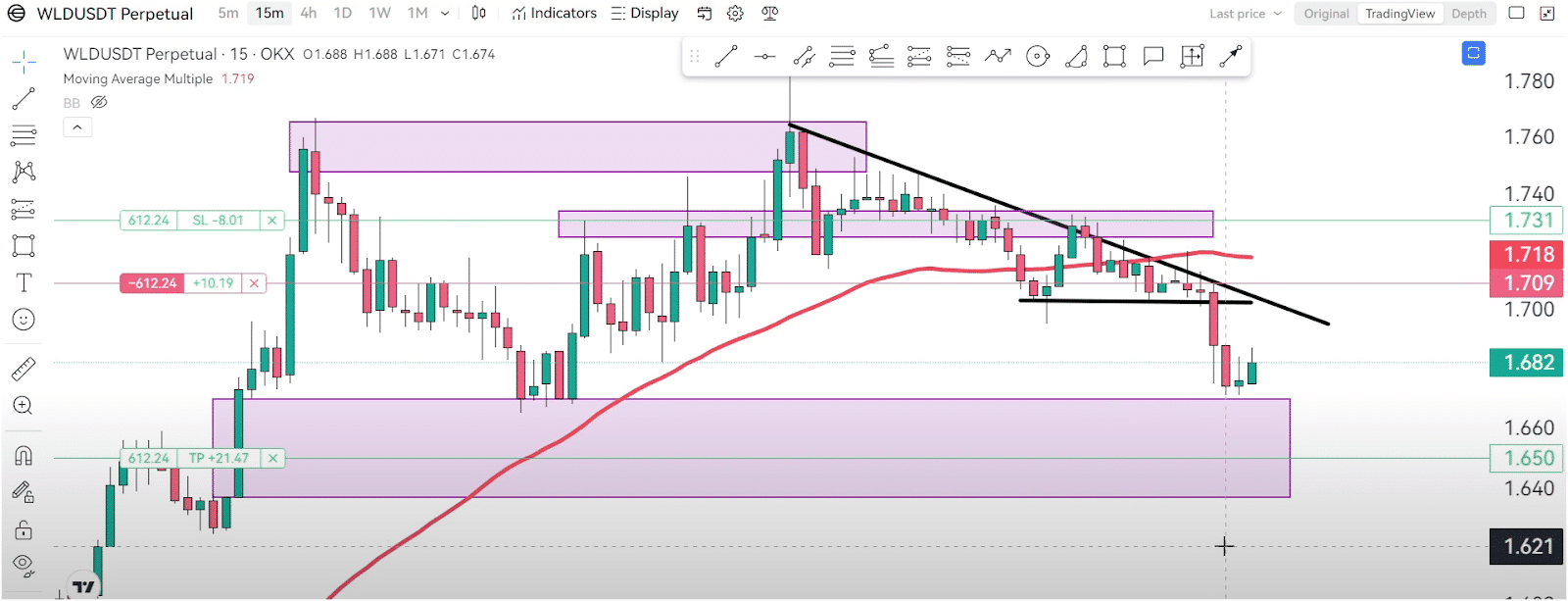

As the trade progressed, I moved my stop-loss to lock in profits. This allows me to secure gains even if the price retraces. If the market continues in my favor, I’ll profit more, but if it reverses, I’ll still earn a small amount. This strategy protects capital while maximizing potential returns.

Exiting The Trade

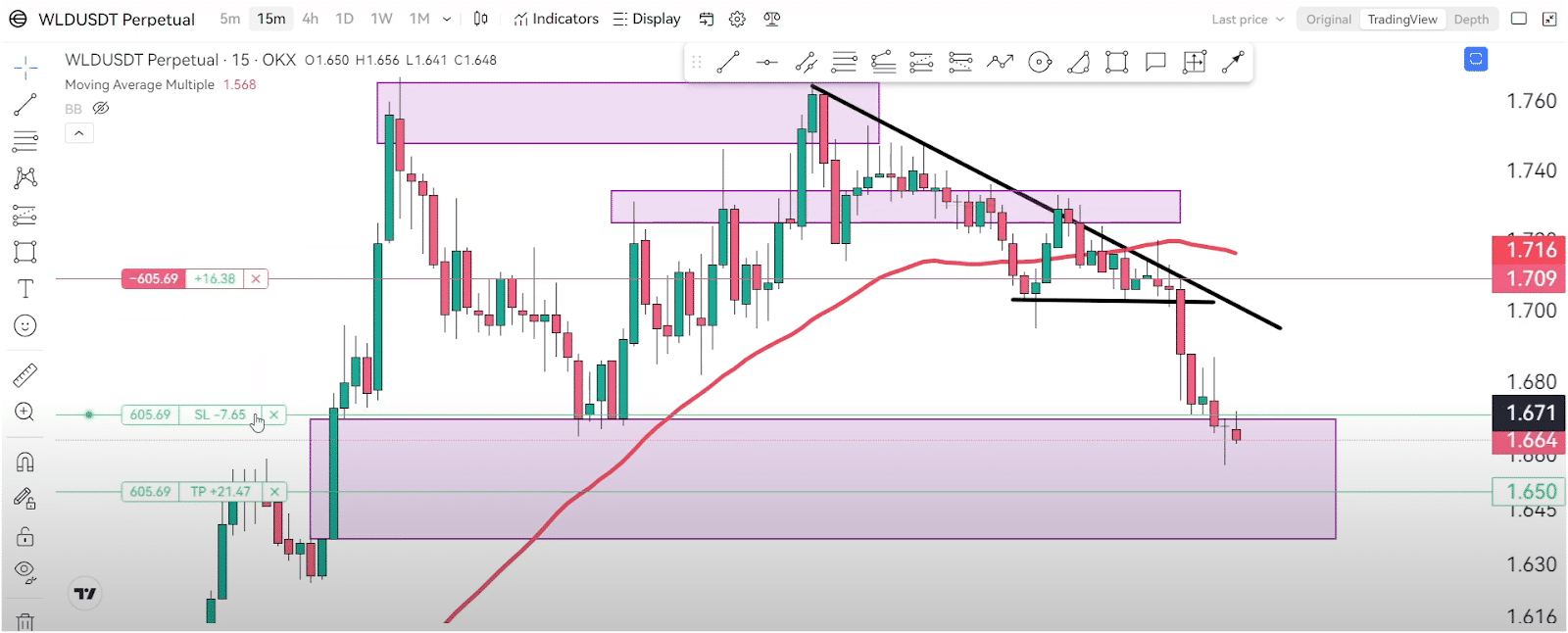

Eventually, the price returned and triggered my stop-loss, taking me out of the trade with a decent profit. Even with a small amount of capital, proper risk management and technical analysis helped me secure gains.

Final Thoughts

In summary, my trading process is simple: I look for patterns and fair value gaps and use price action to guide my decisions.

For more in-depth technical analysis like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!