Let’s examine the insights shared by our Technical Analyst at UseTheBitcoin as he walks us through his personal trading approach and observations on the crypto market.

Loopring (LRC) Market Update

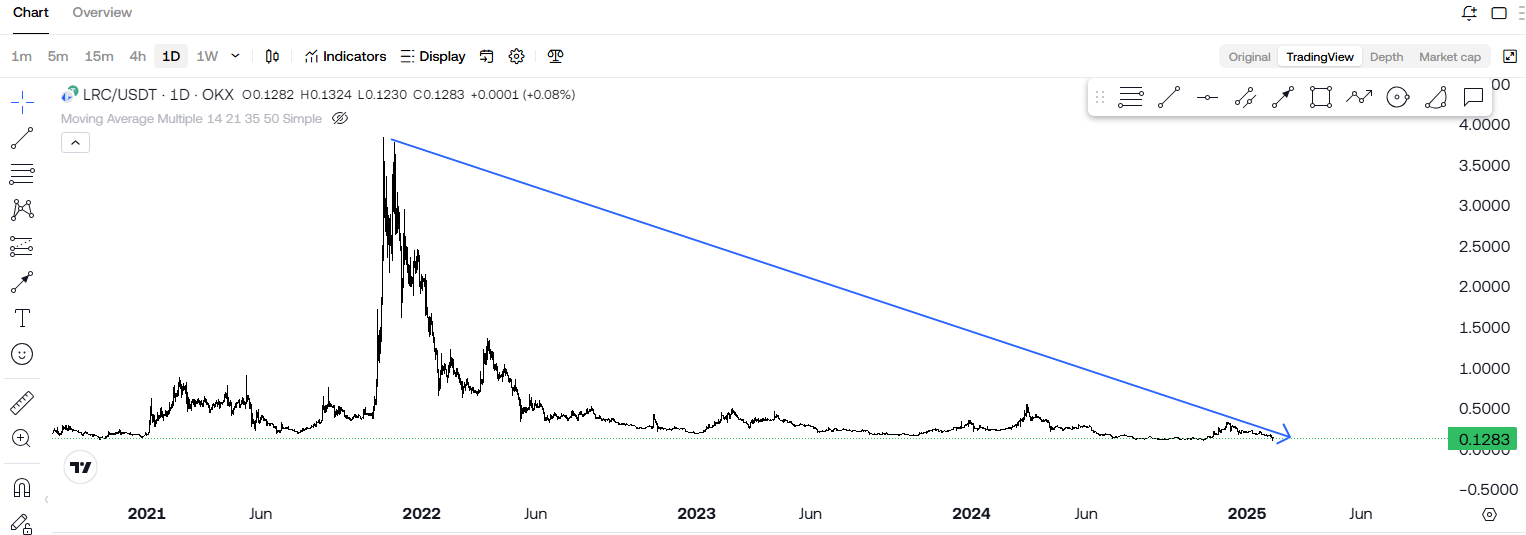

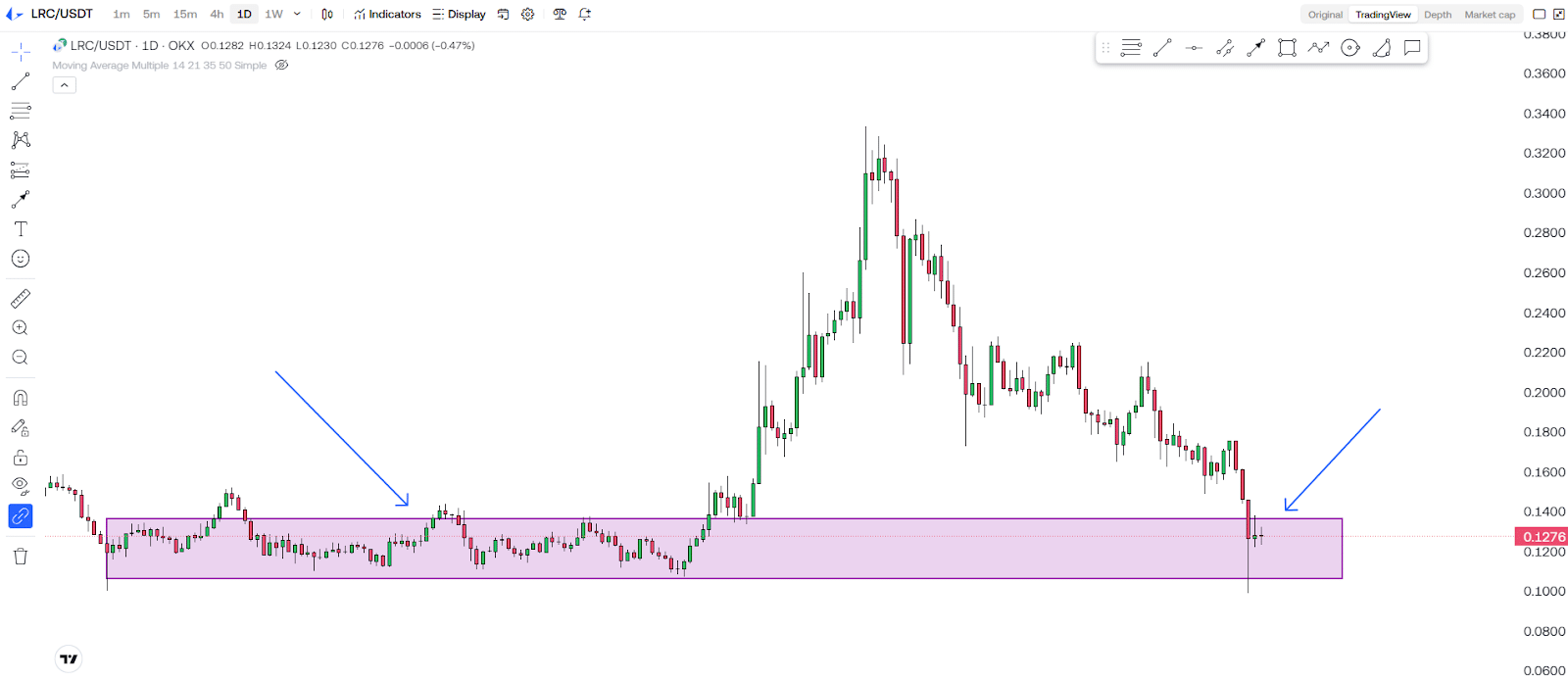

Looking at the chart, it is evident that LRC (Loopring) is still in a downward trend. From its all-time high of around $3, it has now plunged to just $0.12. This massive decline raises the question: is there still a chance for LRC to recover?

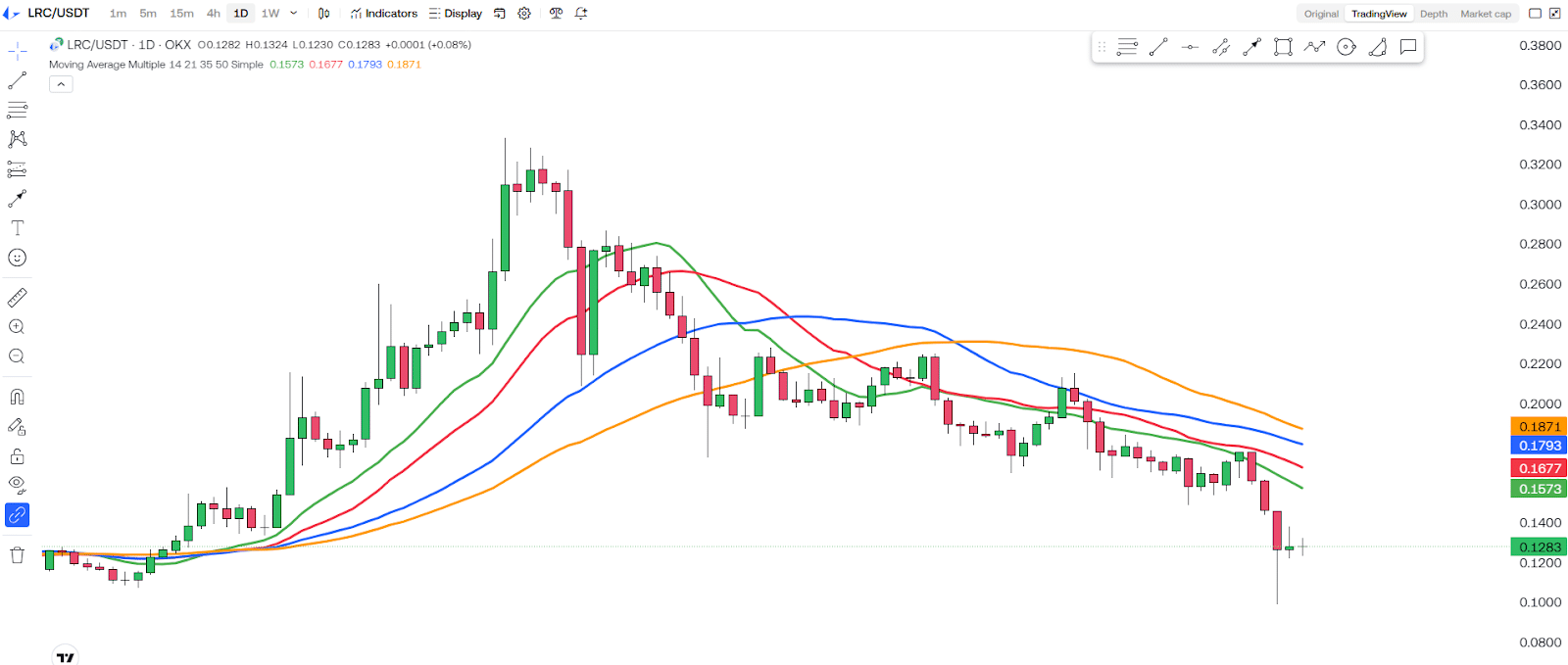

To answer this, let’s analyze its indicators and technical setups. Unfortunately, the overall market structure does not look favorable. The momentum indicators suggest that the downtrend remains intact, and there are no strong signs of reversal. Moving averages are still not in a bullish formation, with short-term averages positioned below the long-term ones, indicating continued bearish pressure. Trend lines do not yet show a clear breakout pattern, which further confirms the weakness in price action.

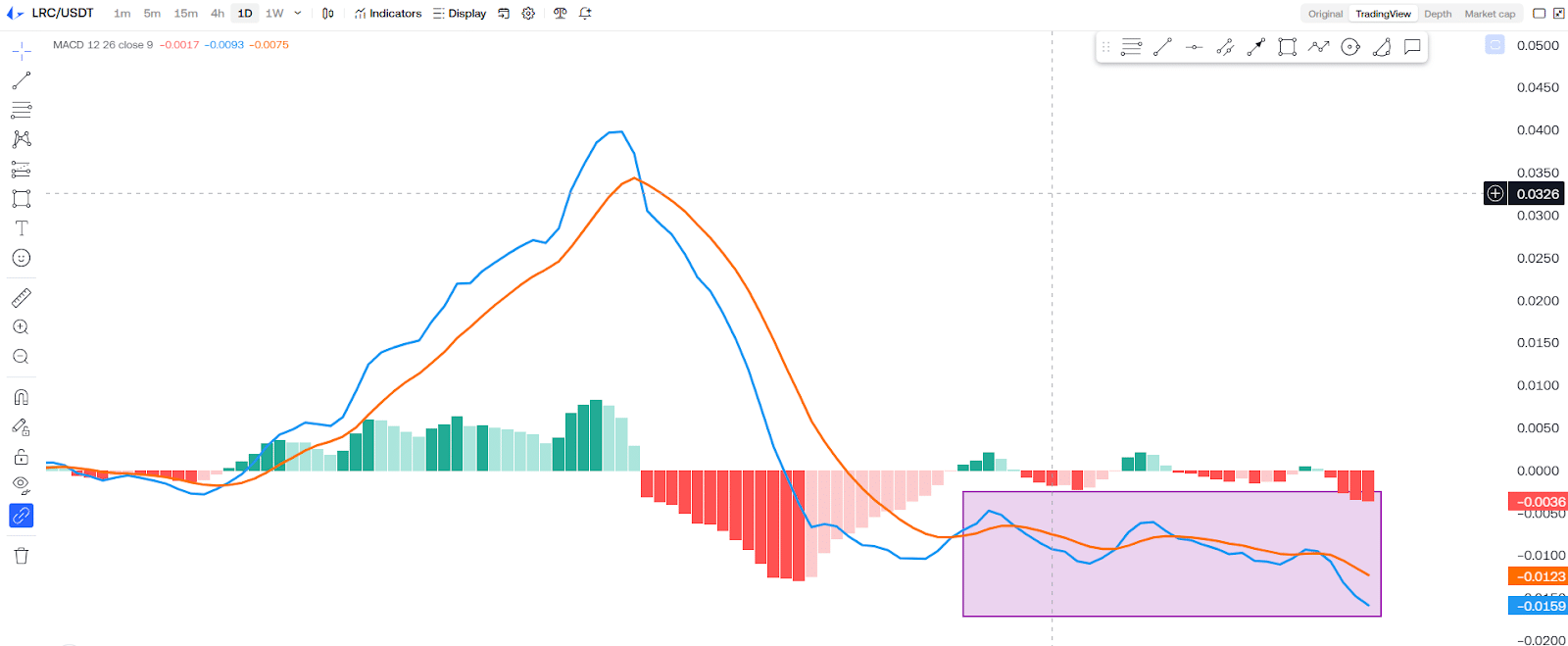

One of the most crucial indicators, the MACD (Moving Average Convergence Divergence), is still moving in negative territory. This means that the bearish momentum continues to dominate, and buyers have yet to step in with significant volume. The histogram bars remain below the zero line, further reinforcing the fact that bears are in control of LRC’s price movement.

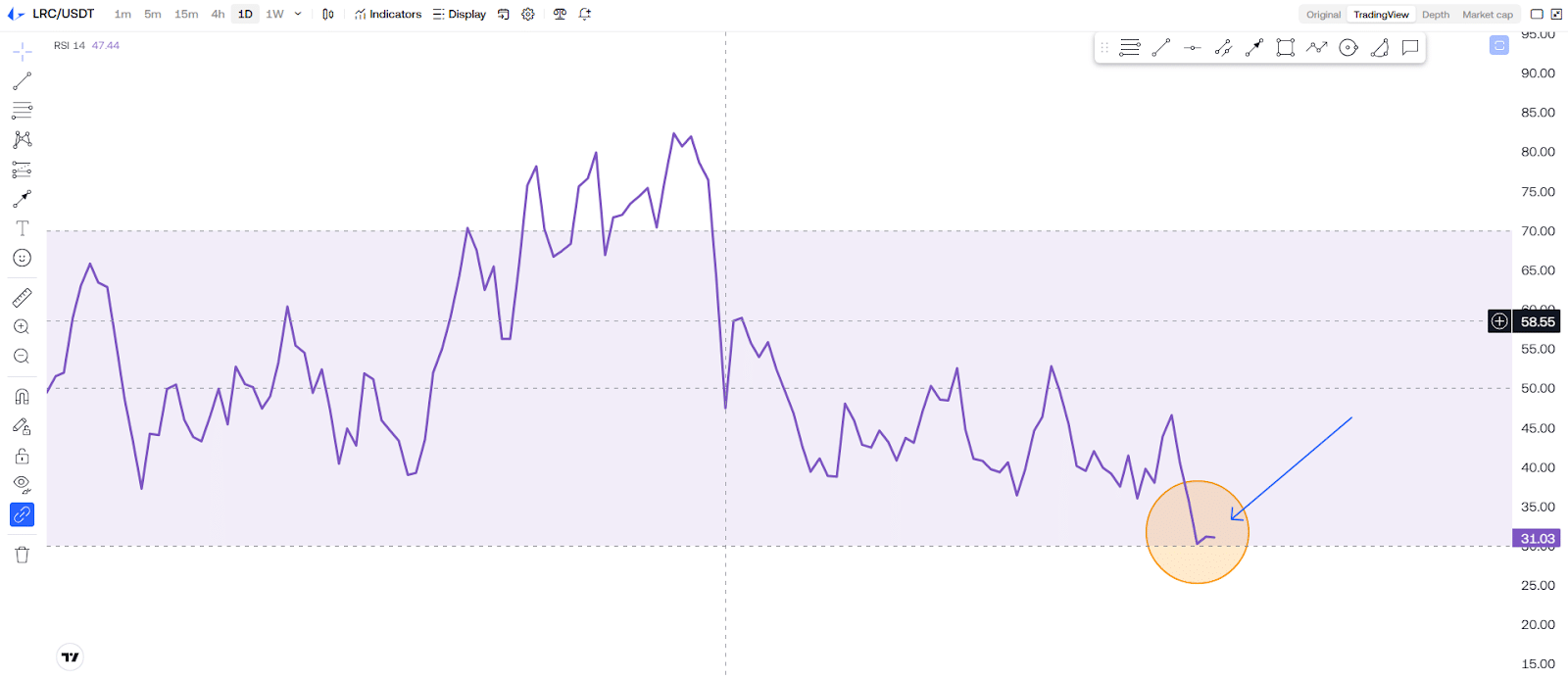

Next, let’s take a look at the RSI (Relative Strength Index). Currently, LRC is approaching the oversold region, which is typically a sign that selling pressure might be exhausting. However, being in oversold territory does not automatically mean a reversal is imminent. A stock or crypto asset can remain oversold for a long period before any meaningful recovery occurs. While this could be the first indication of a potential bounce, it alone is not enough to push prices significantly higher.

Examining the overall chart pattern, LRC is now trading near its previous support levels. This is a critical zone where price has historically found some buying interest. However, merely testing a support level does not guarantee a strong bounce. Without additional bullish catalysts, such as positive news, increased trading volume, or overall market recovery, the price might struggle to gain any real momentum. There is a possibility of a short-term bounce from this level, but there may not be enough demand to drive the price significantly higher.

For investors and traders looking for promising setups, LRC’s current state suggests that caution is warranted. While no one can predict the market with absolute certainty, the current technical indicators advise staying away from this coin unless clear bullish confirmations appear. Instead, looking at other crypto projects with better fundamentals and stronger chart patterns may be the wiser choice.

Of course, prices in the cryptocurrency market can be influenced by various factors, including market sentiment, news developments, and macroeconomic conditions. If a sudden positive catalyst emerges, such as an ecosystem expansion, major partnership, or broader bullish sentiment in the crypto space, LRC could potentially see a reversal. However, as of now, the data available does not support a bullish case.

Final Thoughts

In conclusion, LRC is still in a strong downtrend with no convincing signs of recovery. The technical indicators suggest continued weakness, and the price structure does not indicate a strong reversal pattern. While an oversold RSI could hint at a potential short-term bounce, it is not enough to drive significant gains. For now, it might be best to stay on the sidelines and look for other crypto assets with better technical structures and stronger fundamental backing.

For more in-depth technical analysis like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!

Additionally, join our Telegram community to discuss the latest market trends, share insights, and get real-time updates from experienced traders. Don’t miss the chance to be part of the conversation!