Key Takeaways:

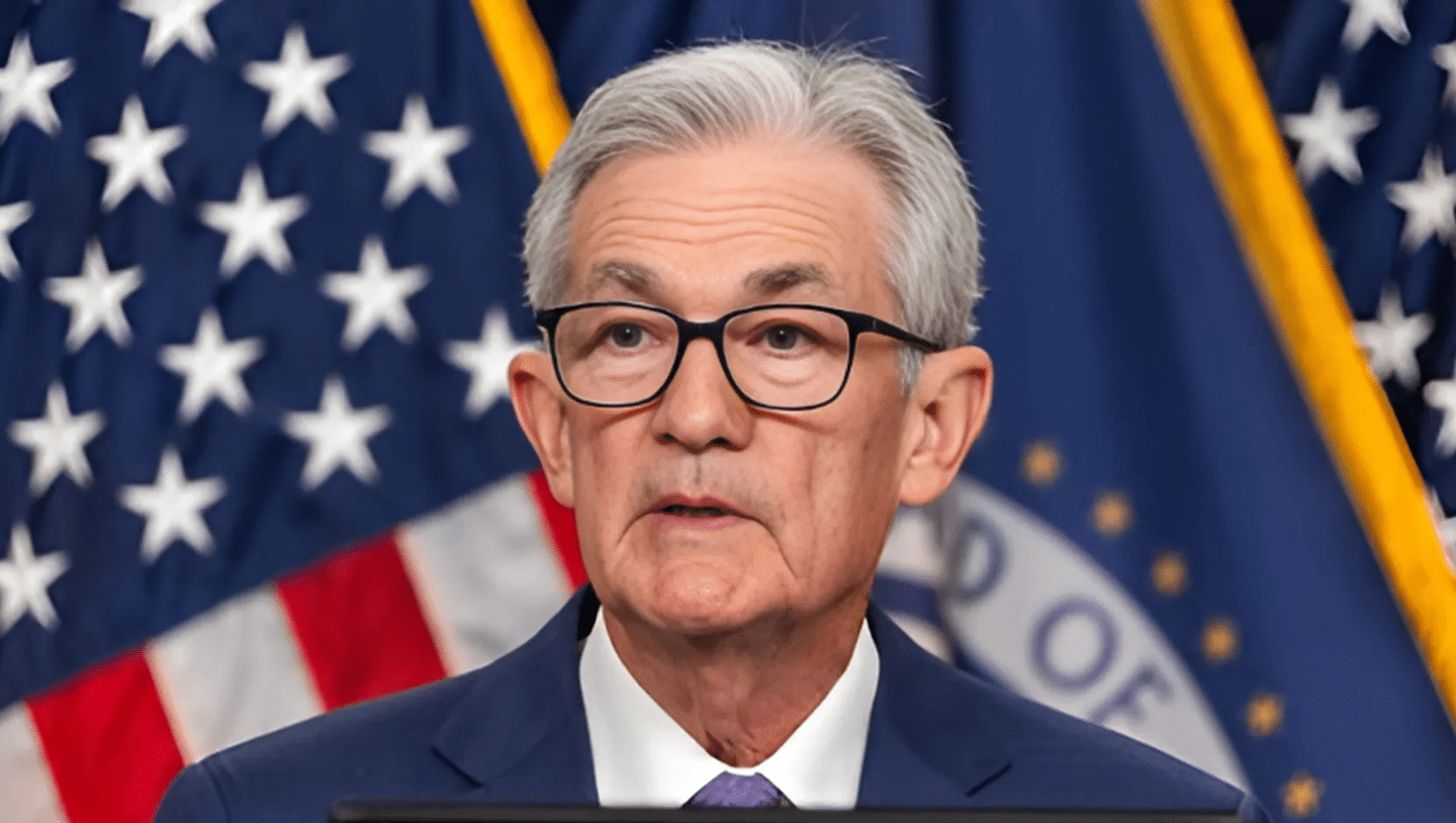

- Federal Reserve’s Stance: Jerome Powell confirmed the Fed cannot and will not hold Bitcoin, emphasising no plans to change current laws.

- Bitcoin’s Market Impact: Powell’s comments disrupted Bitcoin’s rally past $100K, highlighting the cryptocurrency’s sensitivity to regulatory updates.

- Investor Outlook: The Fed’s restrictive policies and crypto skepticism challenge Bitcoin’s adoption in traditional financial systems.

Jerome Powell clarified that the Federal Reserve is not permitted to hold Bitcoin under current laws and has no plans to seek legislative changes to allow such holdings. This statement comes amidst growing conversations about the government’s potential involvement in cryptocurrency, such as creating a U.S. Bitcoin Strategic Reserve. Powell emphasized that any change to allow the Federal Reserve to hold Bitcoin would require approval from Congress and is not something the Fed is pursuing.

It is clear from Powell’s position that the Fed is cautious about cryptocurrencies. Bitcoin and other digital assets are seen as too volatile and speculative to fit into the traditional financial system managed by the Federal Reserve.

Bitcoin Prices Take a Hit

Powell’s comments had an immediate impact on Bitcoin’s price. The cryptocurrency, which recently surpassed $100,000, saw a sharp drop. Investors had been optimistic about President-elect Donald Trump’s administration supporting crypto-friendly policies. However, Powell’s statement reminded investors of the regulatory hurdles that still exist.

Bitcoin’s drop reflects how the cryptocurrency market remains heavily influenced by government policies and central bank announcements. While Bitcoin’s price has been rising recently, this incident shows how quickly sentiment can shift.

Federal Reserve’s Broader Monetary Policy

Powell also talked about the Federal Reserve’s plans for the economy. He said that interest rates will stay high in 2024 to keep inflation under control. This means it will remain expensive for businesses and people to borrow money, which could slow down economic growth. However, Powell said this approach is necessary to stabilize prices and the economy.

Powell also signaled fewer interest rate cuts than expected next year, reinforcing the Fed’s cautious approach. This hawkish stance has already affected financial markets, and cryptocurrencies, seen as risky investments, are particularly vulnerable to such pressures.

What Is the U.S. Bitcoin Strategic Reserve?

The idea of a U.S. Bitcoin Strategic Reserve has been circulating in some policy circles. Proponents argue that holding Bitcoin as a national reserve could hedge against inflation and diversify financial assets. Powell, however, makes clear that the Federal Reserve does not support this idea.

Traditional financial institutions still shy away from cryptocurrencies. Many central banks, including the Fed, consider them excessively volatile. Critics of the idea argue that Bitcoin’s decentralized nature and unpredictable value make it unsuitable for such purposes.

How This Affects Investors

While Bitcoin and other digital assets continue to gain popularity, they remain outside the scope of central bank policies, making their value subject to significant fluctuations based on government decisions.

The Federal Reserve’s decision to keep interest rates high could also weigh on the cryptocurrency market. Higher rates often lead investors to prioritize safer, interest-bearing options over speculative assets like Bitcoin.

What’s Next for Bitcoin?

Bitcoin’s long-term prospects remain strong for supporters. However, the lack of support from the Federal Reserve and regulatory uncertainties remain obstacles to widespread adoption.

Meanwhile, governments and central banks worldwide are exploring Central Bank Digital Currencies (CBDCs), which might complement or compete with cryptocurrencies.

Conclusion

Jerome Powell’s comments show how difficult it is for cryptocurrencies like Bitcoin to gain a foothold in traditional finance. Bitcoin’s potential as a store of value and investment vehicle continues to grow, but regulatory and policy hurdles remain significant.

The Fed’s firm stance on not holding Bitcoin and its commitment to restrictive monetary policy highlights the cautious approach regulators are likely to maintain. For investors and policymakers alike, the road ahead will involve balancing innovation in digital finance with the stability of established economic systems.