Stay in the loop with our weekly crypto digest as we get you up to speed on the hottest trends and events in the crypto space.

Here’s what happened in crypto this week:

Utah Senate Passes Bitcoin Bill Without Reserve Clause

Utah’s Bitcoin bill, known as the HB230 “Blockchain and Digital Innovation Amendments,” has successfully passed the state Senate, but not in the way many had hoped.

The original proposal included a groundbreaking provision that would have made Utah the first US state to hold a BTC reserve, but it was removed before the final vote.

The original reserve clause would have permitted Utah’s treasurer to invest up to 5% of digital assets with a market cap exceeding $500 billion in five state accounts, with Bitcoin being the sole digital asset meeting this criterion. Although the clause passed the second reading, it was removed during the third and final reading.

Even without the Bitcoin reserve, the bill still offers key protections for Utah residents. Citizens can mine Bitcoin, run nodes, and participate in staking without interference. The bill also strengthens custody protections, giving people more control over digital assets.

Spanish Bank BBVA Unlocks Bitcoin And Ethereum Trading In Spain With Regulatory Green Light

Leading Spanish bank Banco Bilbao Vizcaya Argentaria (BBVA) has just received the go-ahead from regulators to offer Bitcoin and Ethereum trading services to its clientele.

Upon approval, the bank is set to launch a new service, accessible to all its customers, enabling them to securely buy, sell, and manage Bitcoin and Ethereum transactions through its app.

Customers in Spain will be able to manage their cryptoasset trading orders directly within the app, alongside their accounts, investments, and regular banking activities.

Initially, the service will be rolled out to a small group of users and gradually extended to all private customers in Spain over the coming months. The initiative builds on the bank’s experience in Switzerland and Turkey, where similar services have been offered since 2021 and 2023, respectively.

Singapore Exchange (SGX) To Introduce Bitcoin Perpetual Futures By 2025 For Institutional Investors

Singapore Exchange Ltd. (SGX) plans to launch Bitcoin perpetual futures by the latter half of 2025. The company intends to focus exclusively on institutional clients and professional investors, thus restricting retail customers from engaging in these trades.

With existing products awaiting the nod from the Monetary Authority of Singapore (MAS), SGX aims to solidify its role as a connector between regulated financial markets and the burgeoning realm of crypto trading. The initiative is anticipated to “significantly expand institutional market access,” according to a company spokesperson.

Perpetual futures, which allow traders to speculate on asset prices without holding the physical asset, are common among offshore crypto exchange platforms.

Thai SEC Adds USDC And USDT Stablecoins To Approved Crypto List

The Thai Securities and Exchange Commission (SEC) has announced the addition of USD Coin (USDC) and Tether (USDT) stablecoins to its approved list of cryptocurrencies.

This revision allows these stablecoins to be used for investments in digital tokens through Initial Coin Offerings (ICOs), transactions conducted via ICO portals, and as base trading pairs on digital asset exchanges.

These amended regulations will take effect on March 16th, 2025.

Previously, the SEC’s approved list included Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Stellar (XLM), and cryptocurrencies used in the Bank of Thailand’s Programmable Payment Sandbox.

Coinbase Plans India Comeback After Securing Regulatory Registration With FIU

Coinbase has secured registration with India’s Financial Intelligence Unit (FIU), allowing it to return to the Indian market.

The exchange plans to resume retail services in India this year and is exploring additional products and investments.

Coinbase had previously exited the Indian market due to regulatory challenges but is now committed to operating in compliance with local regulations.

The company views India as a significant market opportunity and aims to deepen its investment in the region.

Cayman Islands Now Requires Licensing For Crypto Custody And Trading Companies

The Cayman Islands now requires crypto firms providing custody and trading services to obtain a license due to its regulatory framework.

Custodians must disclose the types and amounts of crypto they will hold and ensure secure storage, while trading platforms must provide insights into revenue expectations and asset safety measures.

The initial rules for virtual asset service providers (VASPs) were implemented in 2021 to attract new entities to the region.

Several notable crypto firms, including Coinbase and Binance, have obtained licenses or established headquarters in the Cayman Islands.

US SEC Signals Shift In Crypto Regulation, Reassesses Firm Registration

The US Securities and Exchange Commission (SEC) is reconsidering a 2022 proposal requiring crypto firms to register as alternative trading systems.

Acting Chairman Mark Uyeda directed the staff to explore dropping the mandate, citing public criticism.

“In my view, it was a mistake for the Commission to link together regulation of the Treasury markets with a heavy-handed attempt to tamp down the crypto market,” Uyeda said.

Uyeda acknowledged past regulatory missteps, signaling a more tailored approach to crypto oversight. This move reflects broader efforts to refine digital asset regulations.

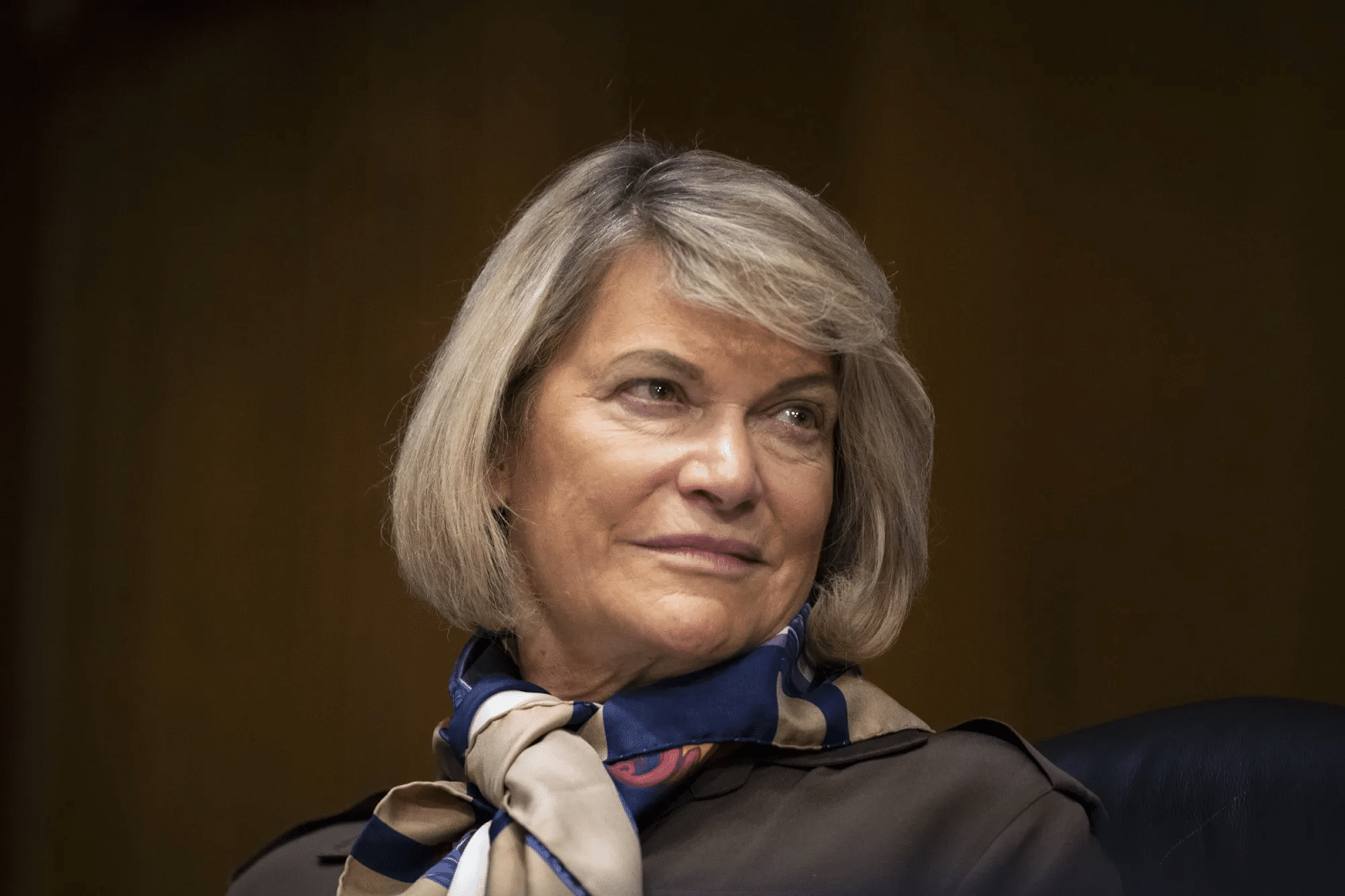

Senator Cynthia Lummis Reintroduces “BITCOIN Act” For US Strategic Reserve

Wyoming Senator Cynthia Lummis reintroduced the “Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide” (BITCOIN) Bill to Congress. If the bill passes, it would establish a Strategic Bitcoin Reserve.

The bill would add two key features:

👉 It would codify the reserve, meaning a new president cannot just kill it with an executive order.

👉 It would force the government to buy 1 million coins over the next five years.

Flashback: Lummis introduced the bill in Congress last year but didn’t pass.

US CPI Inflation Falls 2.8% In February, Lower Than Expectations

Data: 2.8% YoY, 0.2% MoM

Forecasted: 2.9% YoY, 0.3% MoM

Last Month: 3.0% YoY, 0.5% MoM

US inflation eased more than expected in February, with the headline Consumer Price Index (CPI) rising 2.8% year-on-year, below the estimated 2.9%, according to the Bureau of Labor Statistics. On a month-on-month basis, inflation rose 0.2%, also softer than the expected 0.3%.

Core CPI, which excludes food and energy prices, climbed 3.1% YoY, in line with estimates, while the MoM increase was 0.2%, slightly below the 0.3% forecast. The cooler-than-expected inflation figures could reinforce expectations of Federal Reserve rate cuts later this year.

However, analysts and economists have warned that US President Donald Trump’s proposed tariffs could fuel inflation, adding uncertainty to the outlook. The CPI data will be a key test for these forecasts, shaping expectations for the Federal Reserve’s next policy move.

Final Thoughts

So that’s it for this week!

To stay ahead of the game with the freshest crypto news and insights delivered straight to your inbox, consider subscribing to UseTheBitcoin’s newsletter today.

Have a fantastic week ahead!