Let’s examine the insights shared by our Technical Analyst at UseTheBitcoin as he walks us through his personal trading approach and observations on the crypto market.

Bitcoin (BTC) Market Update

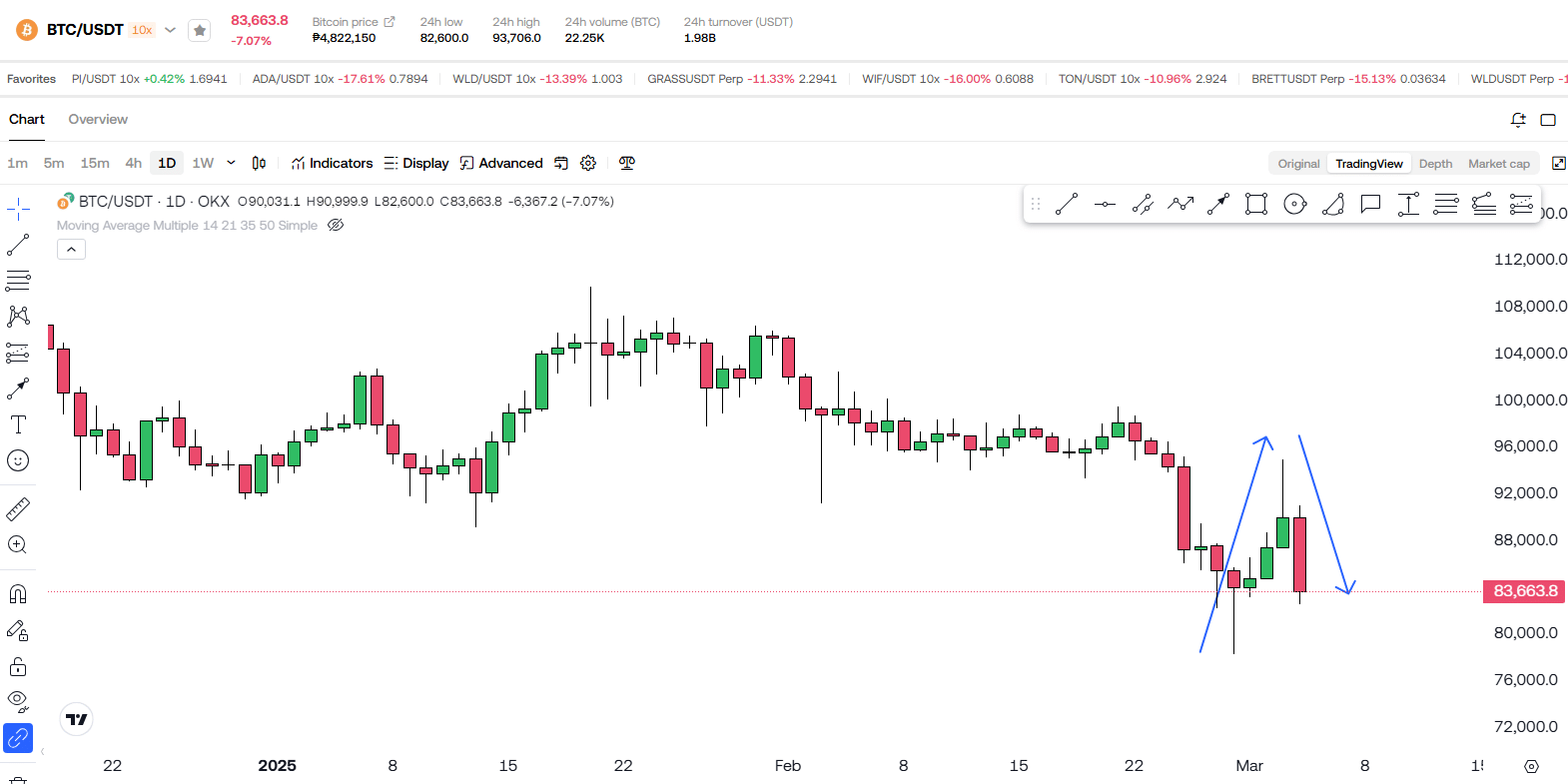

Recently, Donald Trump posted a tweet that caused a sudden surge in cryptocurrency prices. The market reacted almost instantly, pushing Bitcoin’s price up significantly. However, just a few hours after that spike, Bitcoin retraced back to around $85,000 to $86,000. Now, the big question is: Was this a clear rejection that signals the start of a bear market, or was it just another case of market manipulation?

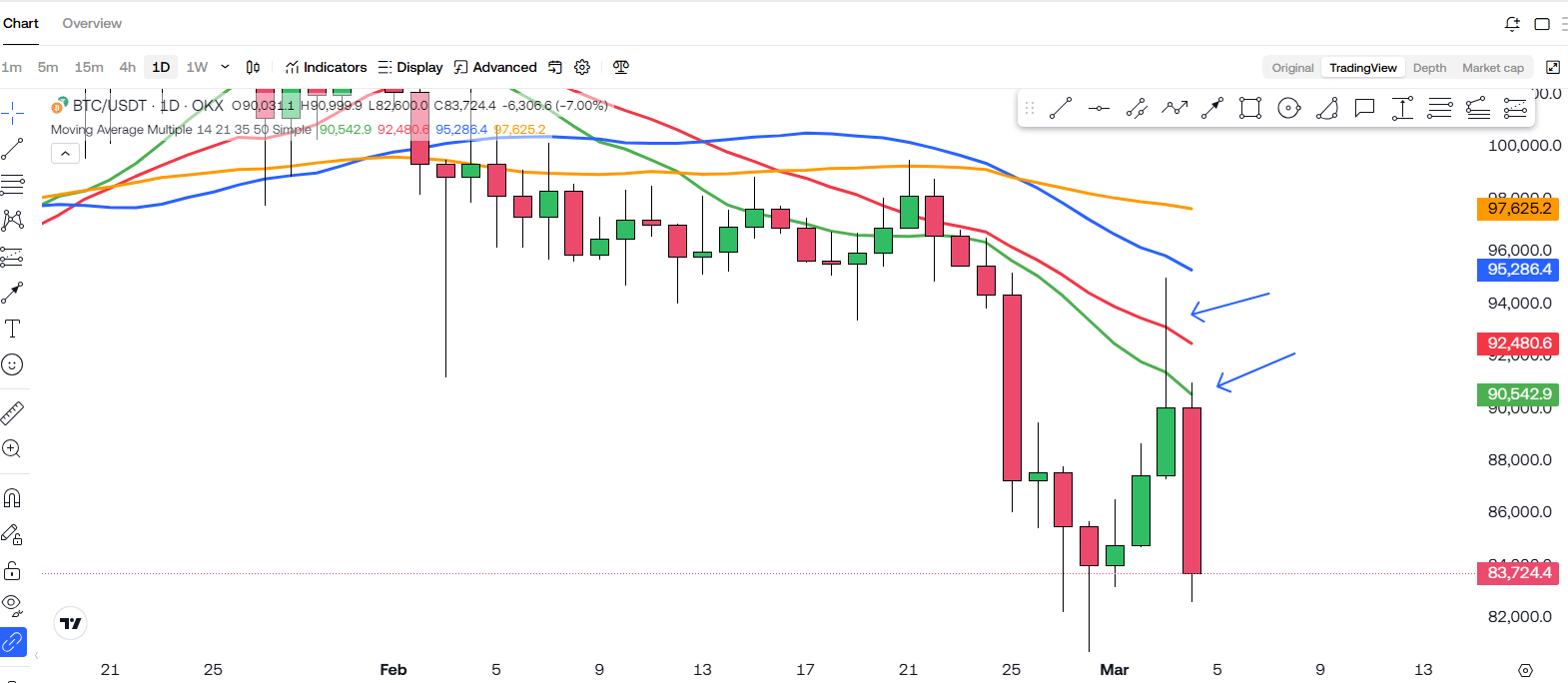

To answer that, let’s take a closer look at Bitcoin’s price action and key technical indicators. If we analyze the charts, we can see that Bitcoin managed to break above the 50-day moving average (50MA) during the sudden pump, which is usually a bullish sign. But the problem is, it couldn’t hold that level for long. Shortly after, the price dropped back below the 20-day moving average (20MA), erasing most of its gains. This kind of movement suggests that Bitcoin is still in a clear downtrend, and the breakout was more of a temporary reaction rather than the start of a strong uptrend.

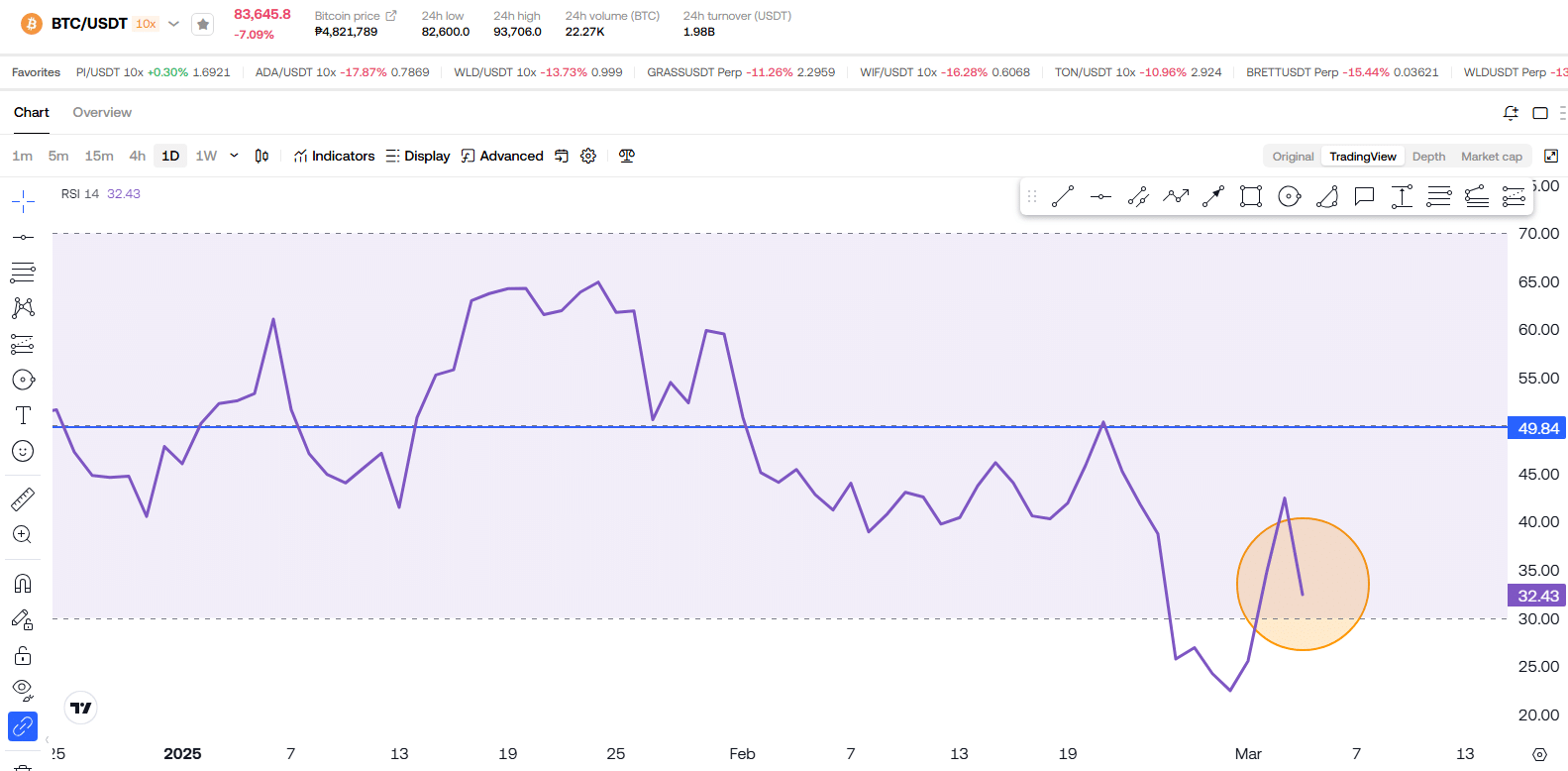

The Relative Strength Index (RSI) also supports this bearish outlook. Right now, RSI remains below the median line (50 level), which indicates weak buying pressure. If RSI had moved above 50 and stayed there, it could have been a sign of increasing momentum from the bulls. But since it failed to do so, this suggests that despite the quick pump, there wasn’t enough strength from buyers to push Bitcoin into a sustainable uptrend. Sellers are still in control, keeping the price in a vulnerable position.

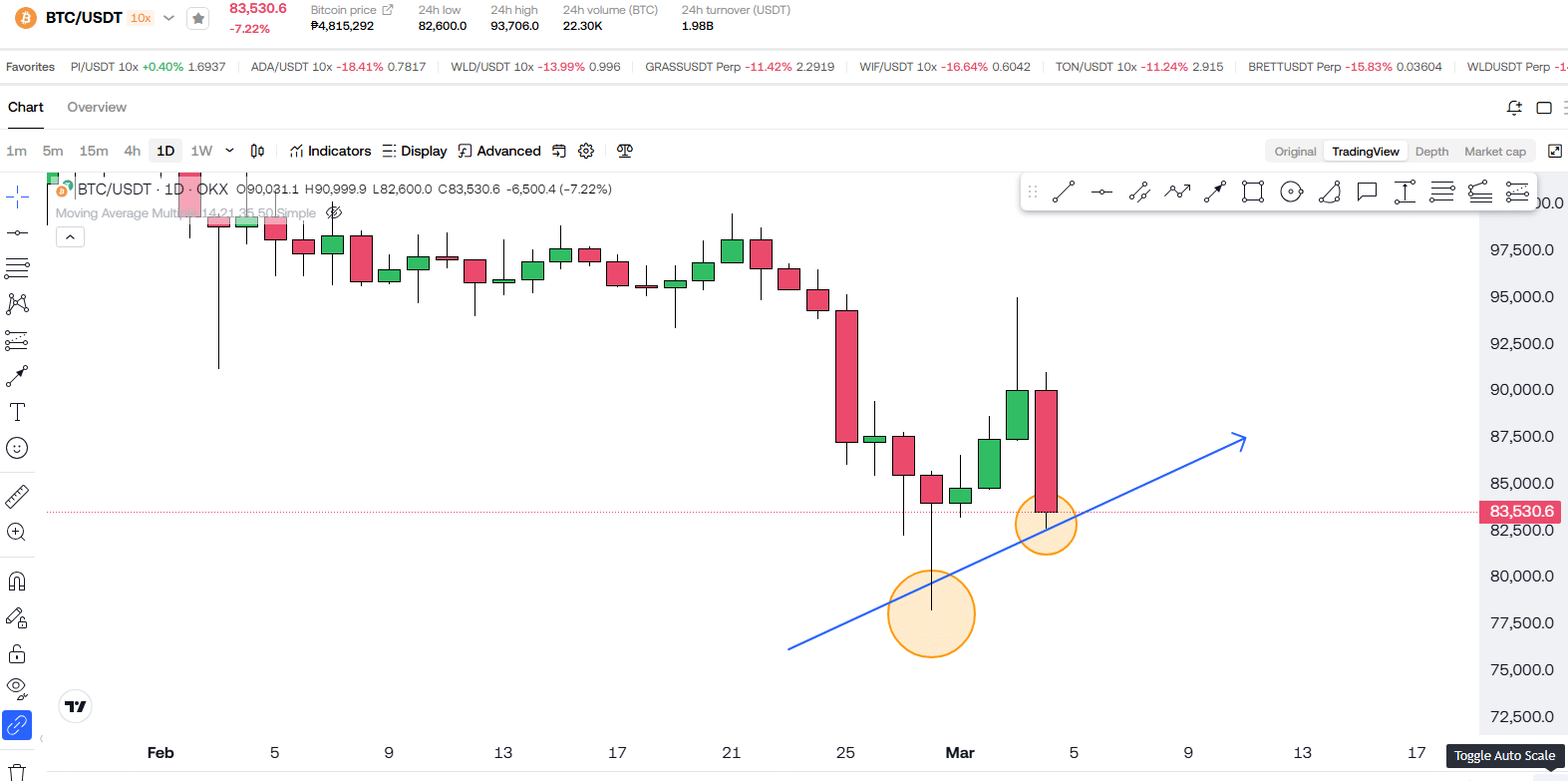

However, there’s another interesting factor to consider—Bitcoin seems to be forming a higher low. In simple terms, a higher low happens when the price dips but doesn’t drop as low as it did before, which can sometimes signal a potential trend reversal. If this pattern continues, it could be a sign that Bitcoin is trying to shift from a downtrend to an uptrend. But at this stage, it’s still too early to say for sure. We need more confirmation, such as Bitcoin making a higher high, before we can conclude that a trend reversal is happening.

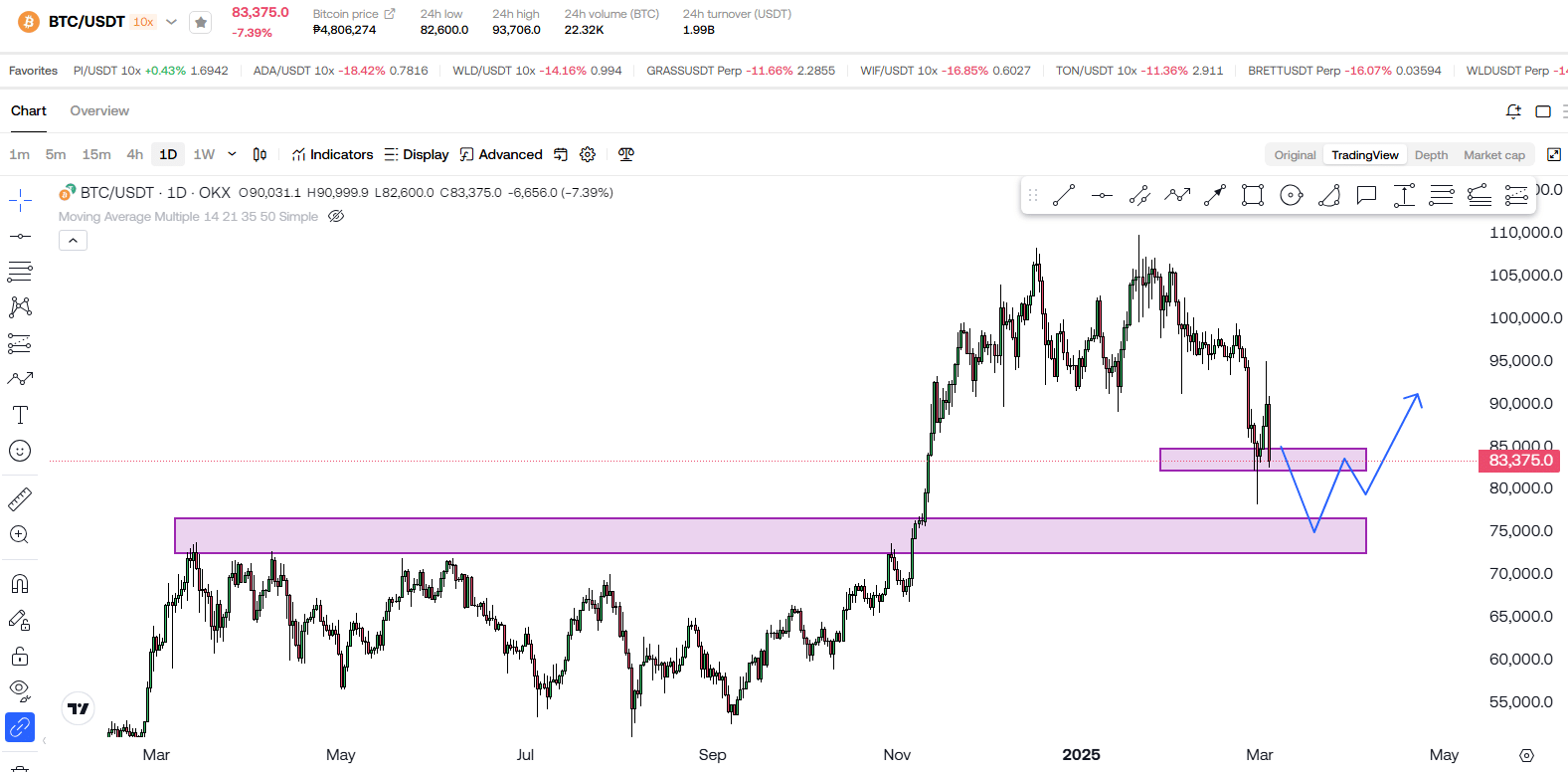

Now, let’s talk about the key support and resistance levels to watch. Right now, Bitcoin’s most important support zone is between $84,000 and $85,000. This level is critical because if Bitcoin holds above it, we might see a new attempt to push higher. But if Bitcoin breaks below this support, things could get ugly fast. A breakdown from this level could send the price plunging toward $79,000 or even as low as $72,000, which would indicate a deeper correction.

On the other hand, for Bitcoin to regain bullish momentum, it needs to break above the recent highs and hold above the 50MA. Right now, there’s strong resistance around $90,000, and unless Bitcoin manages to stay above this level, the risk of another rejection remains high. A clean break above $90,000, followed by strong volume, would be a clear sign that bulls are taking control.

Final Thoughts

At this point, the market is still in a highly uncertain phase. Bitcoin is showing some signs of strength, particularly with the possibility of forming a higher low, but at the same time, the rejection at the 50MA and weak RSI indicate that bearish pressure is still dominant. It is important to keep an eye on the $84,000 support level because if that fails, we might see a much bigger drop.

For more in-depth technical analysis like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!

Additionally, join our Telegram community to discuss the latest market trends, share insights, and get real-time updates from experienced traders. Don’t miss the chance to be part of the conversation!