Let’s examine the insights shared by our Technical Analyst at UseTheBitcoin as he walks us through his personal trading approach and observations on the crypto market.

Bitcoin Retraces To As Low As $91,000: What’s Next?

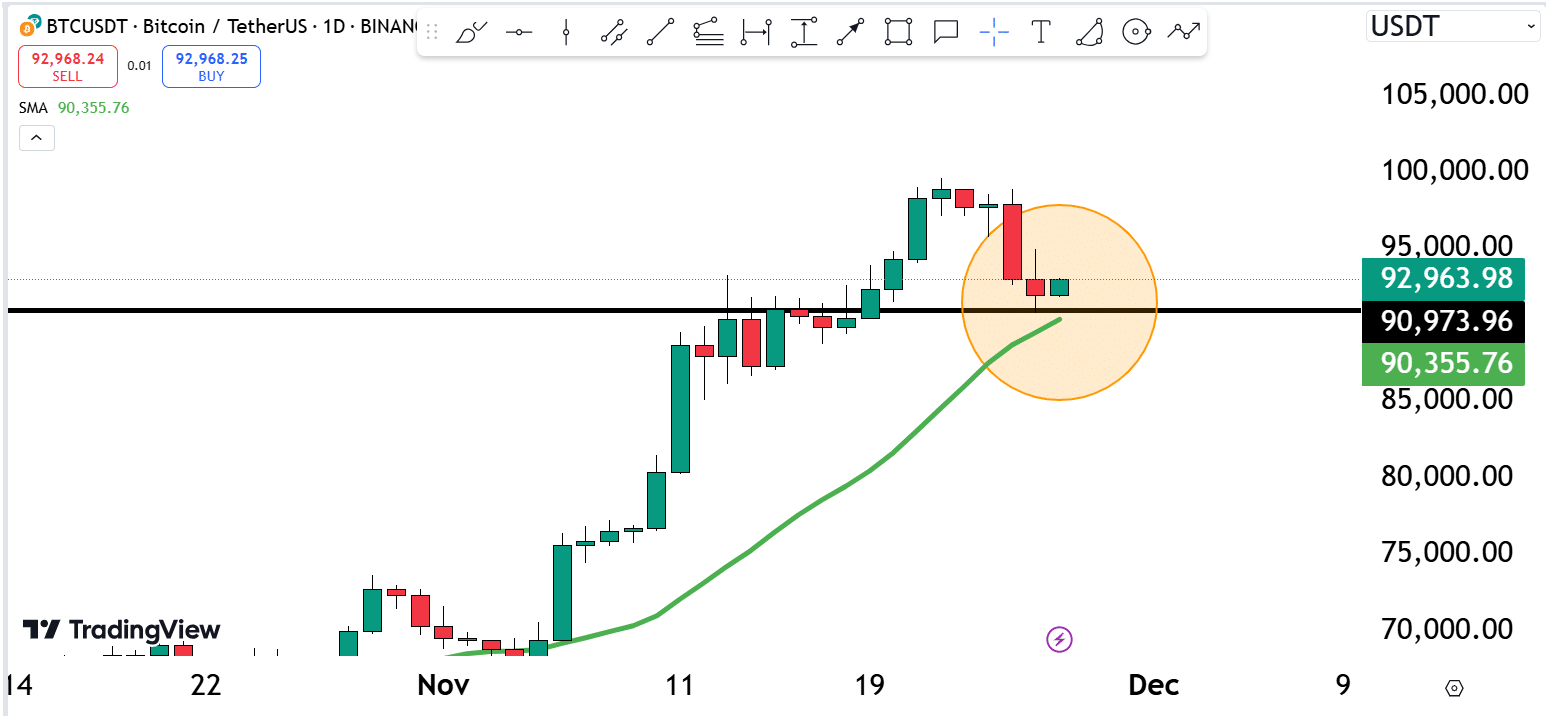

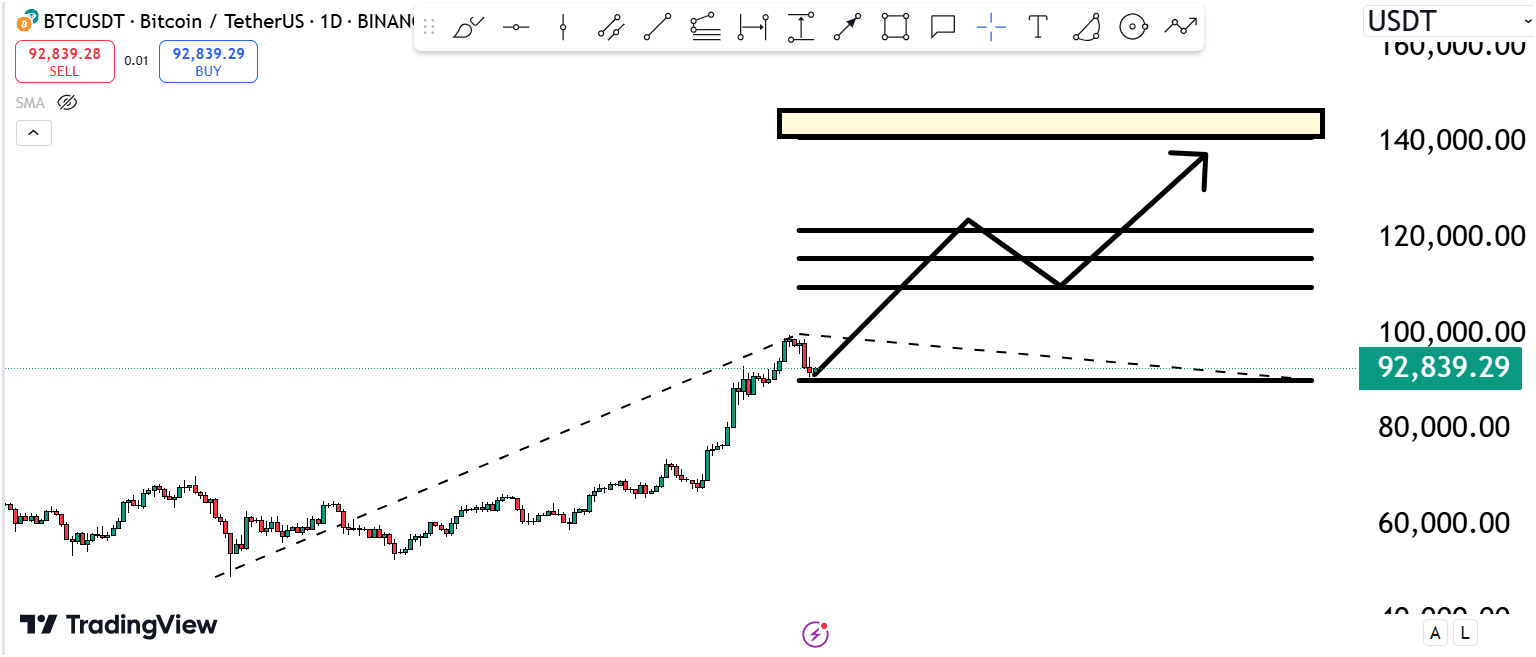

After a significant surge over the past few days, Bitcoin has retraced to as low as $91,000. This pullback comes as panic selling begins to subside, bringing us closer to the 20-day moving average. Historically, these moving averages have acted as reliable support zones, providing a potential launchpad for Bitcoin’s next move.

A Bold Prediction: $140,000 Bitcoin Peak

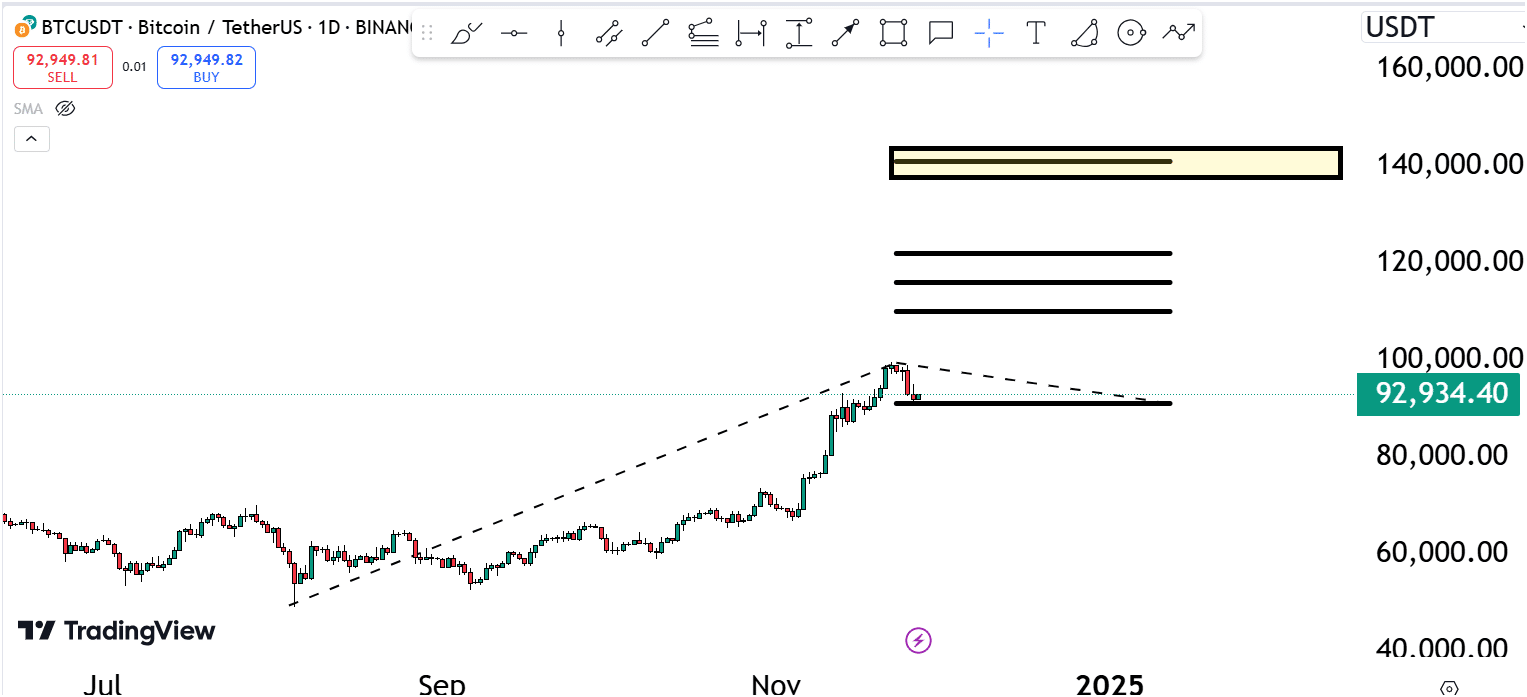

Here’s my wild prediction for Bitcoin’s current bull run: the peak could reach $140k. Let me explain why.

I’m using the Fibonacci extension tool, a popular technical analysis method to estimate this. By measuring from the swing low of the current rally to its swing high, then plotting back to the most recent low, the Fibonacci levels point toward $140k as a potential target. This pattern isn’t random—it’s based on historical price action, which often mirrors past trends.

Let’s break it down further with examples of Bitcoin’s previous bull runs to see how the Fibonacci extension has consistently marked peaks.

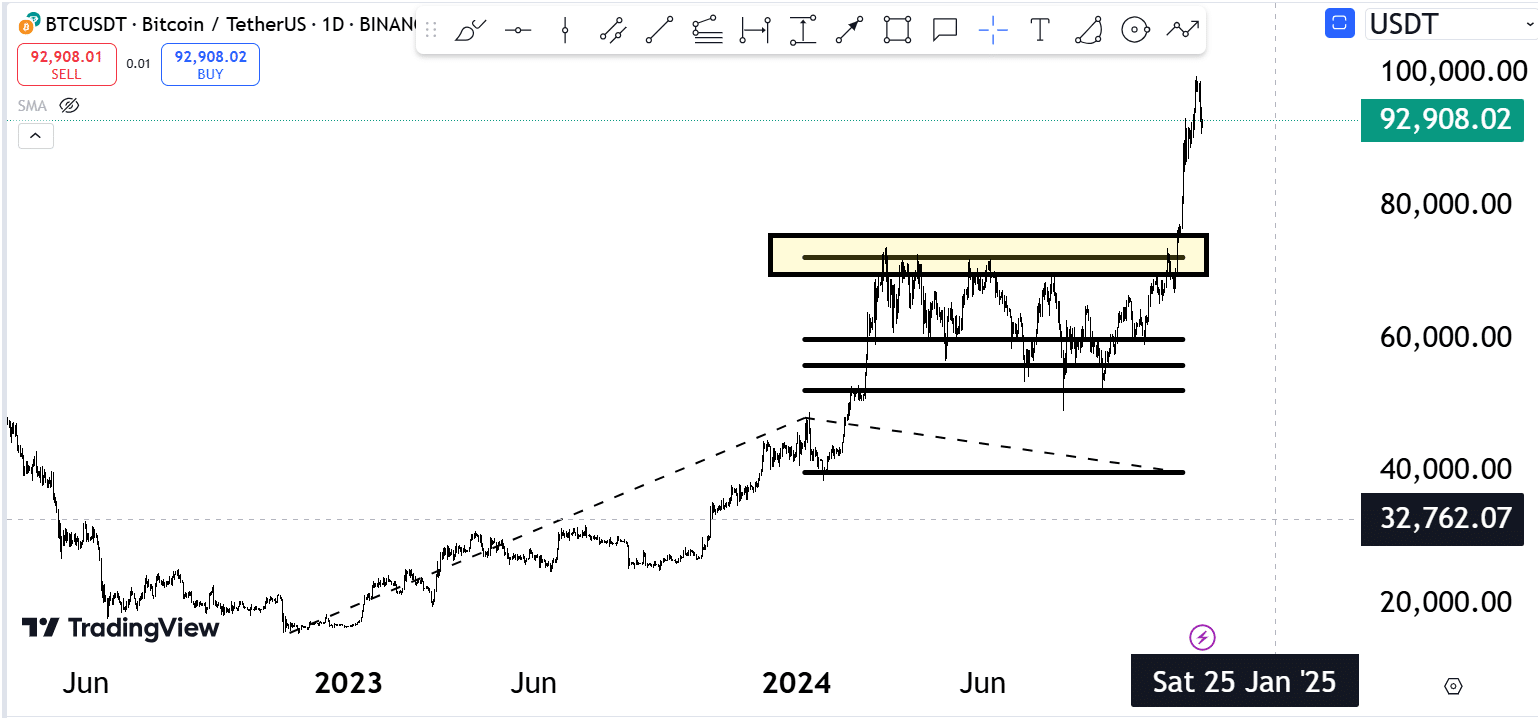

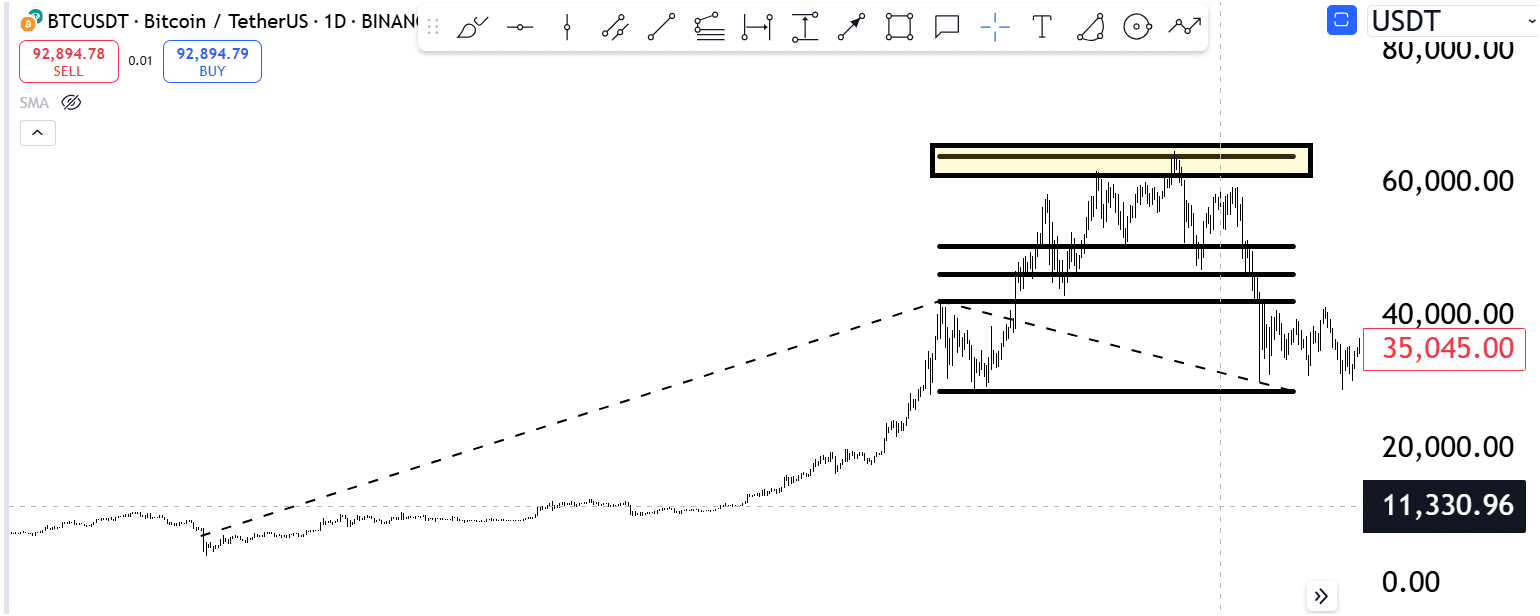

Example 1: The Previous Bull Trend

In a prior bull trend, we measured from the swing low to the swing high and then back to the previous low. The Fibonacci extension aligned almost perfectly with the bull market’s peak, reinforcing its reliability as a predictive tool.

Example 2: Repeating The Process

Looking at another historical cycle, we again plotted the swing low, swing high, and the preceding low. Once again, the Fibonacci extension levels matched the peak of that bull run.

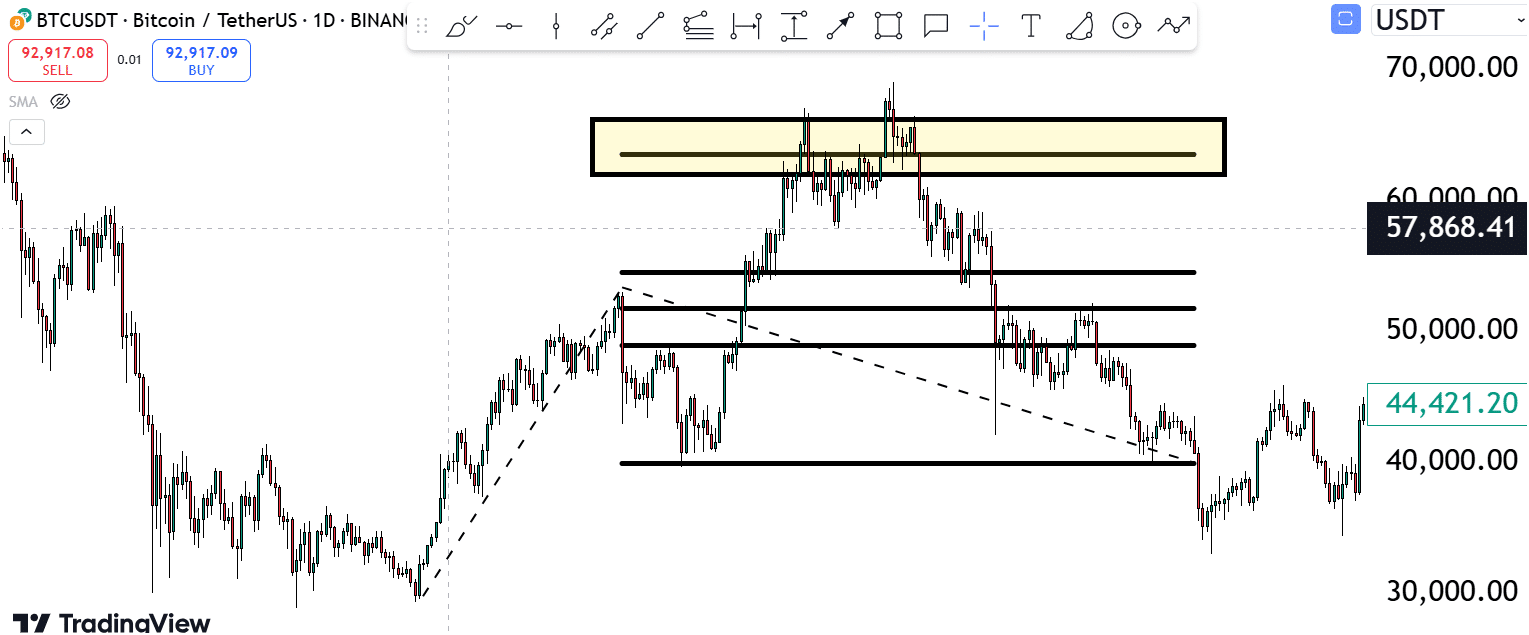

Example 3: A Consistent Pattern

Using the same methodology in yet another bull market, we observed that the Fibonacci extension accurately identified the market top.

These examples show a pattern: Bitcoin’s bull markets often follow similar structures, with Fibonacci extension levels serving as reliable indicators of potential peaks. Now, applying the same process to the current market cycle, we see $140k as a plausible target.

Will Bitcoin Really Hit $140,000?

The question remains: Will Bitcoin actually reach $140k in this bull cycle? Based on historical patterns, the possibility is there. However, as with any market prediction, nothing is guaranteed. Market conditions, external factors, and unforeseen events can unexpectedly influence price movements.

That said, having a potential target like $140,000 gives traders a reference point for planning their strategies. It’s essential to remain adaptable and stay informed about market developments, as no one can predict the future with absolute certainty.

Final Thoughts

While this analysis is based on historical data and technical tools, it’s important to remember that trading involves risk. My trading bias could be wrong, and markets are inherently unpredictable. Always do your own research, and trade only what you can afford to lose.

In conclusion, Bitcoin’s current pullback to the 20-day moving average could pave the way for its next move, potentially leading to new highs. The Fibonacci extension tool suggests $140k as a possible peak, but as always, trade cautiously and stay informed.

For more in-depth technical analysis like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!