Recently, I have decided to sell my Toncoin (TON) holdings. This decision was influenced by several key technical indicators, all of which pointed towards a downtrend.

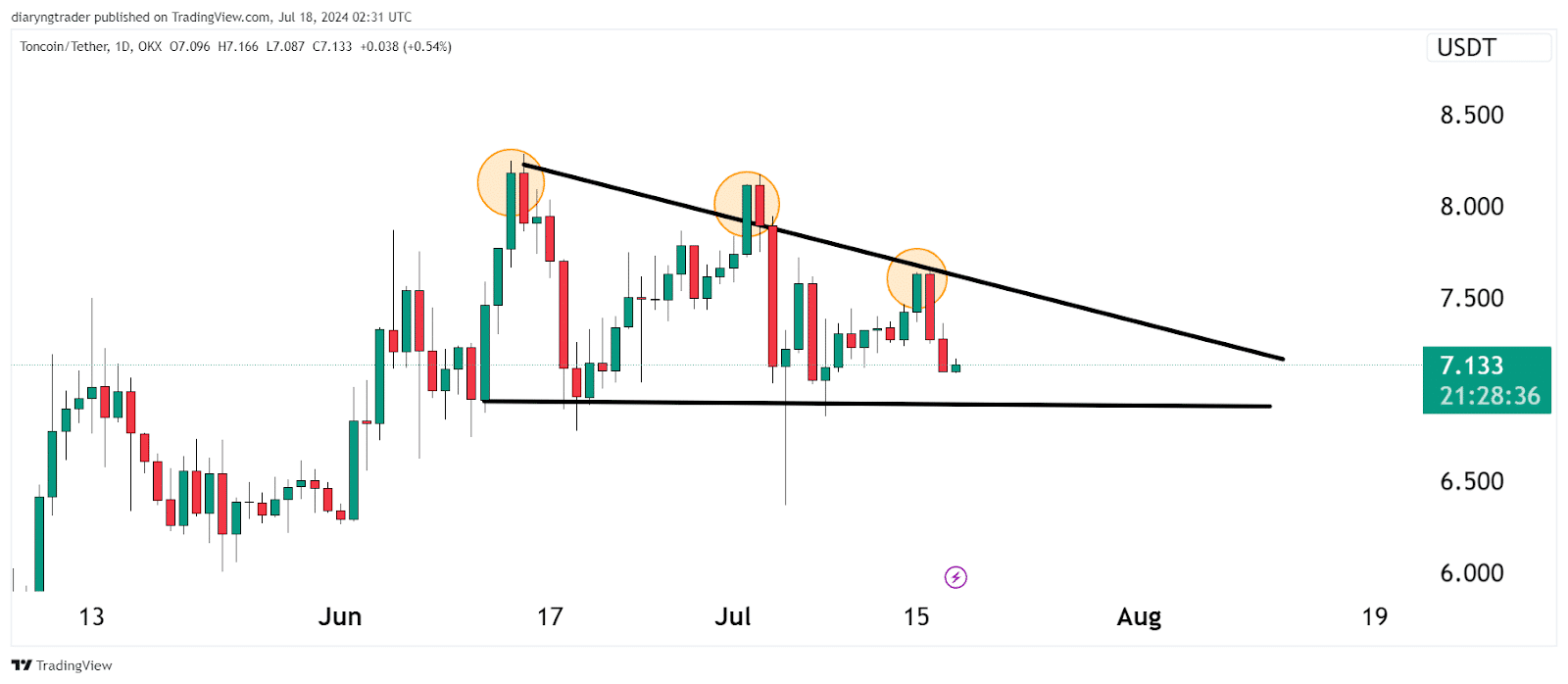

Lower Highs And Support Levels

Toncoin has been forming a series of lower highs, a classic sign of a downtrend. Despite maintaining its support level at $6.90, the overall pattern forms a descending triangle. This formation is typically a bearish indicator, suggesting further downward movement.

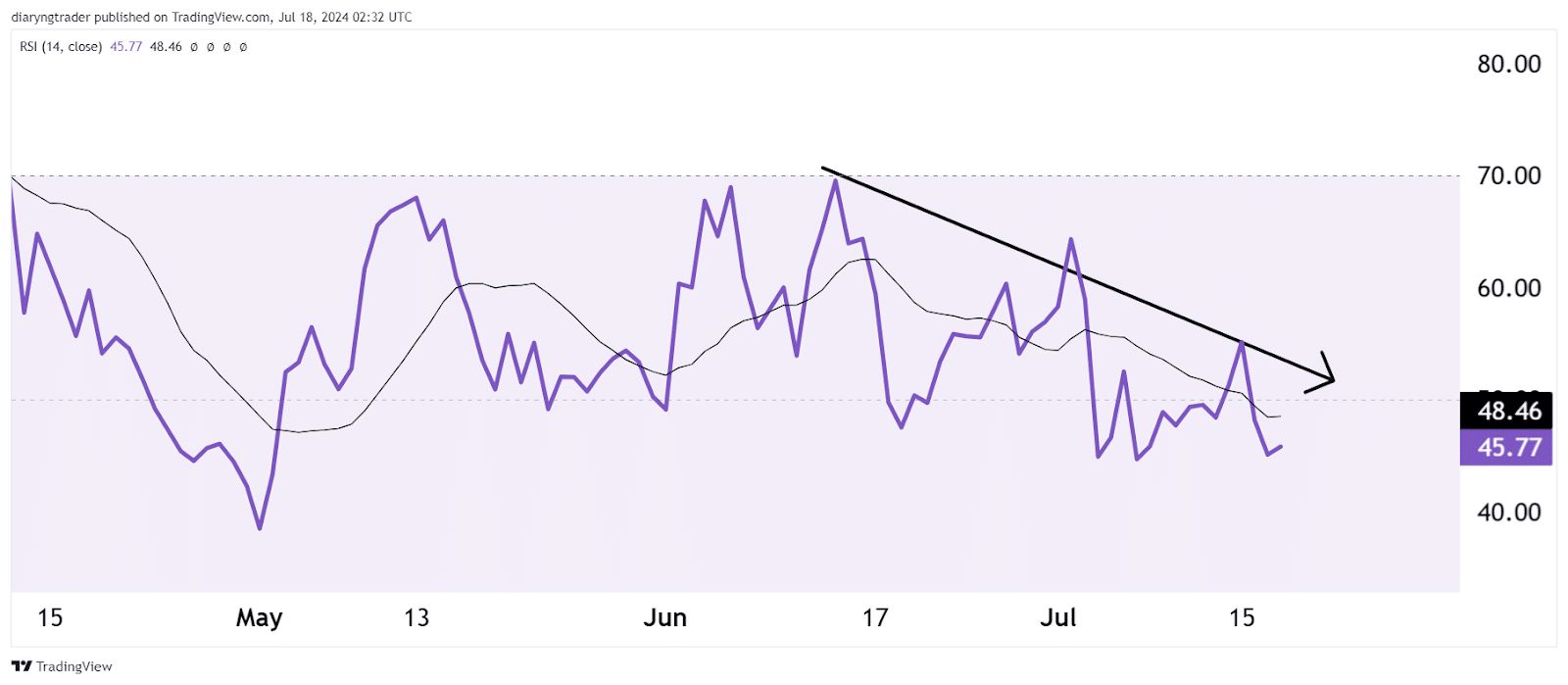

Relative Strength Index (RSI)

When examining the RSI on the daily timeframe, it is evident that the index is declining. This downward movement in the RSI indicates that the price of Toncoin could decrease in the short term.

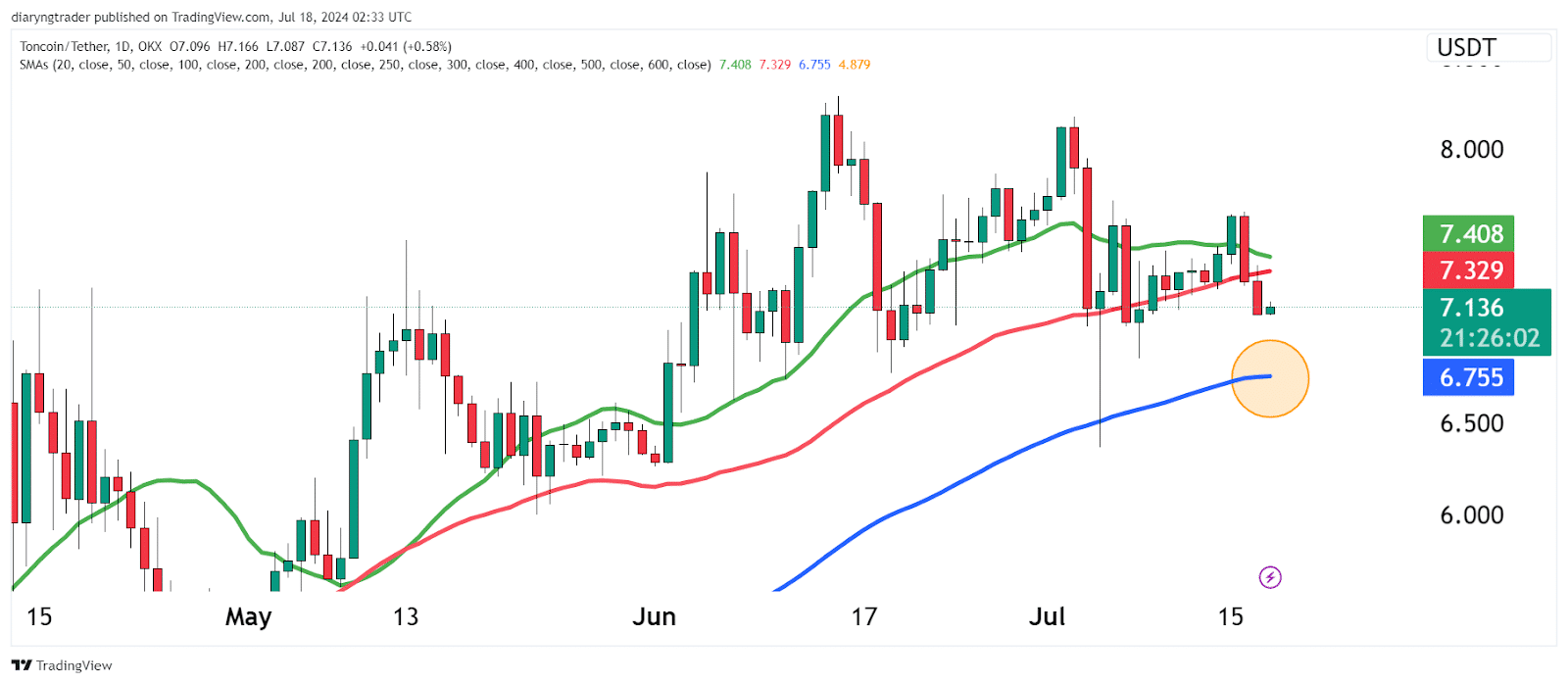

Moving Averages

Another critical factor in my decision was the position of the moving averages. The price of Toncoin is below both the 20-day and 50-day moving averages, which is a strong bearish signal. The following support level to watch is at around $6.76, corresponding to the 100-day moving average.

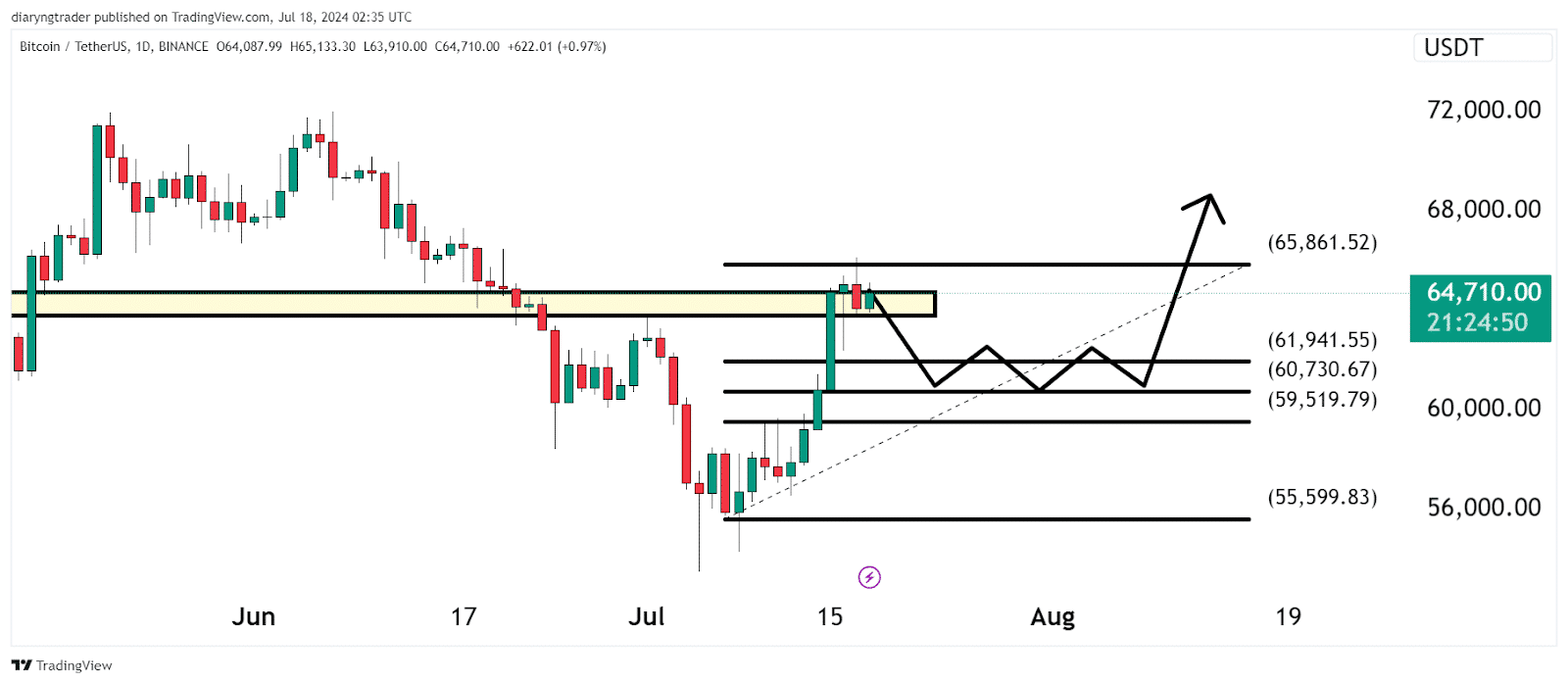

Outlook On Bitcoin

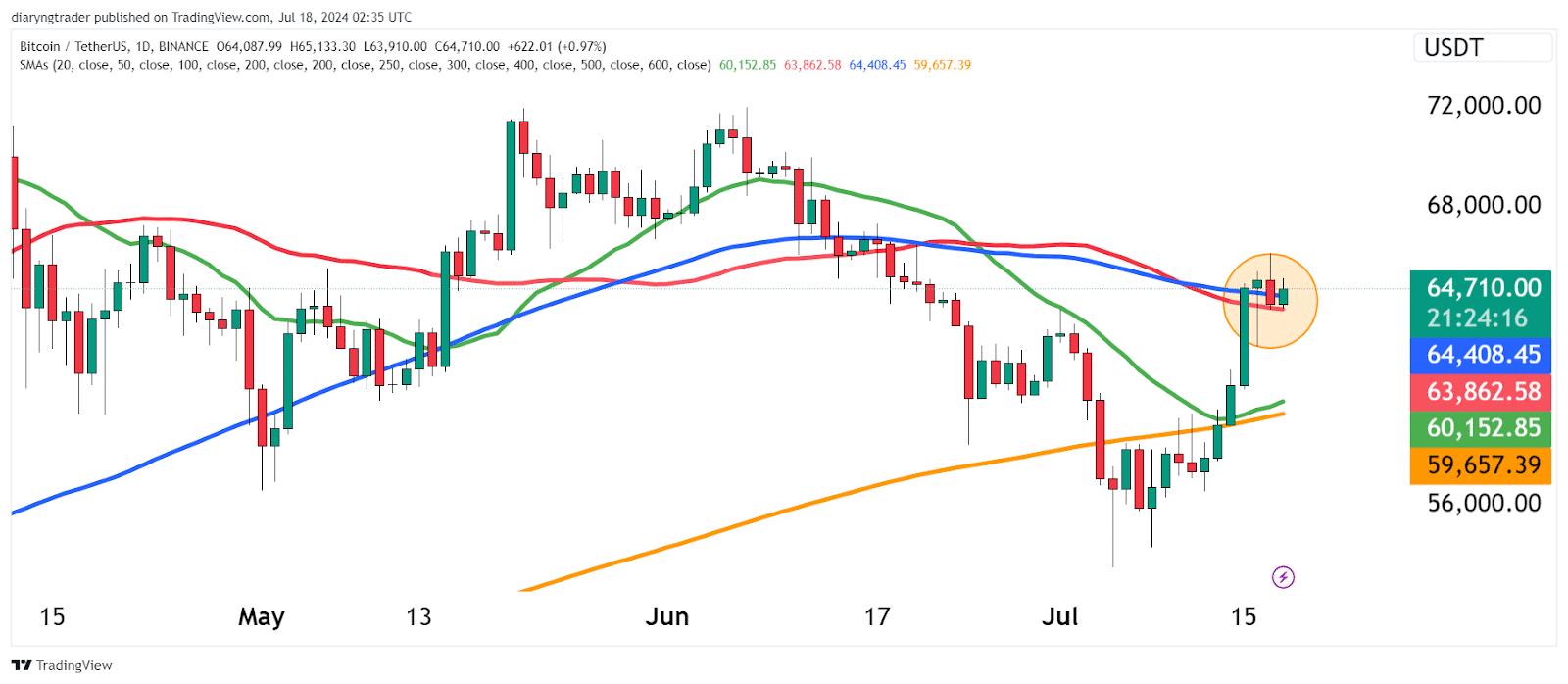

Bitcoin presents a different picture. Despite some signs of short-term resistance and a downward trend, this is a healthy pullback rather than a significant cause for concern.

According to the Fibonacci retracement levels, the optimal range for buying Bitcoin is between $60,700 and $61,940. Purchasing within this range offers a higher chance of a bounce.

Furthermore, Bitcoin’s current price is below the 100-day moving average, suggesting it may decline further to the Fibonacci golden levels before rebounding.

Final Thoughts

In conclusion, my decision to sell Toncoin was based on a confluence of bearish indicators across multiple timeframes, signaling a potential decline in price. Conversely, while Bitcoin shows short-term bearish signs, these are likely temporary. A strategic buy at the Fibonacci support levels could present an excellent opportunity for a rebound. Therefore, while I have exited my position in Toncoin, I remain cautiously optimistic about Bitcoin’s potential for recovery.

For more in-depth technical analysis like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!