Let’s examine the insights shared by our Technical Analyst at UseTheBitcoin as he walks us through his personal trading approach and observations on the crypto market.

Don’t Buy Bitcoin Just Yet!

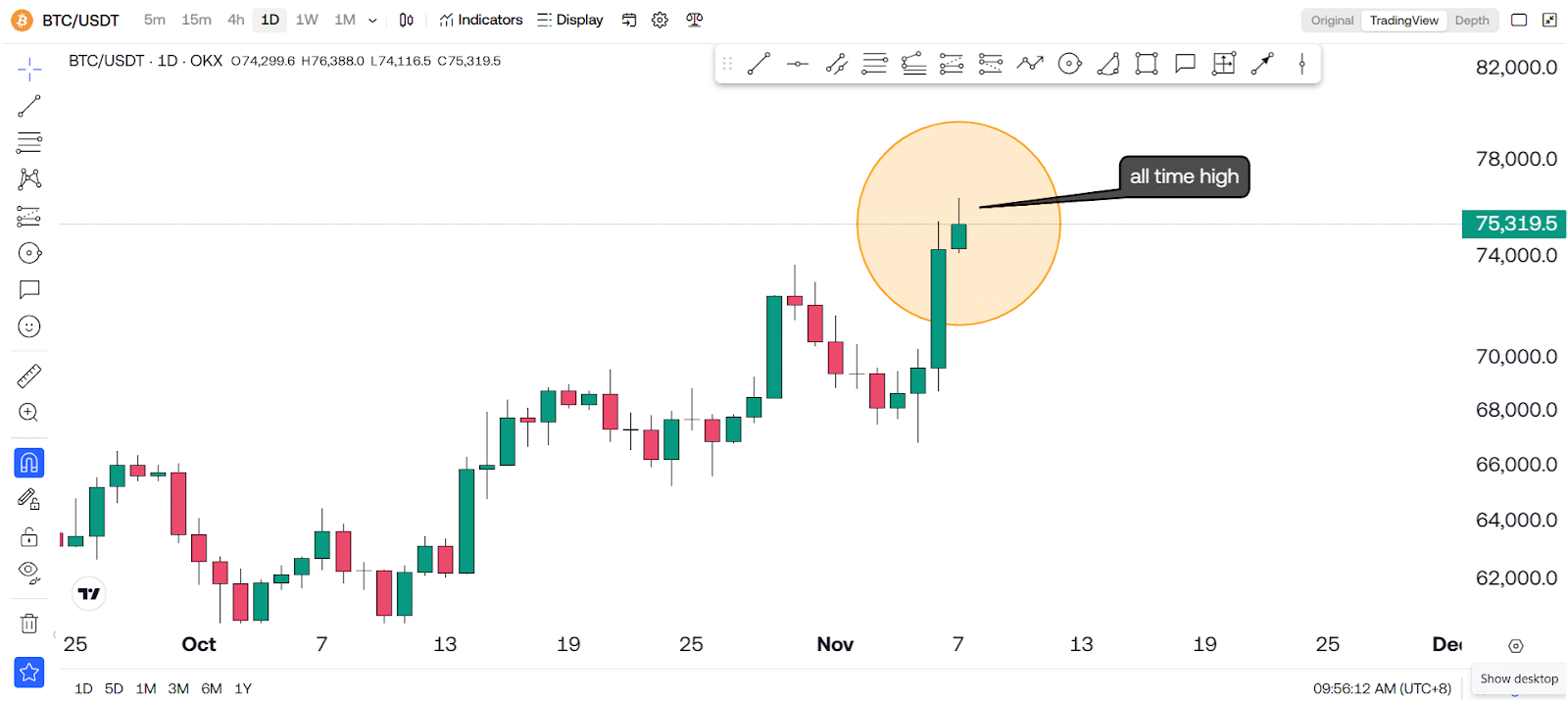

If you’re considering buying Bitcoin right now, take a step back—this might not be the ideal time to jump in. When an asset like Bitcoin reaches an all-time high, it often faces a natural pullback as early investors start locking in their profits. This means the price could suddenly drop, and if you buy in at the peak, you risk falling into what’s known as a “bull trap.”

A bull trap happens when the price initially spikes, drawing in new buyers, only to reverse direction as those who bought at lower prices begin selling to secure their gains. This scenario can be risky, as you might buy high and watch the value fall right after.

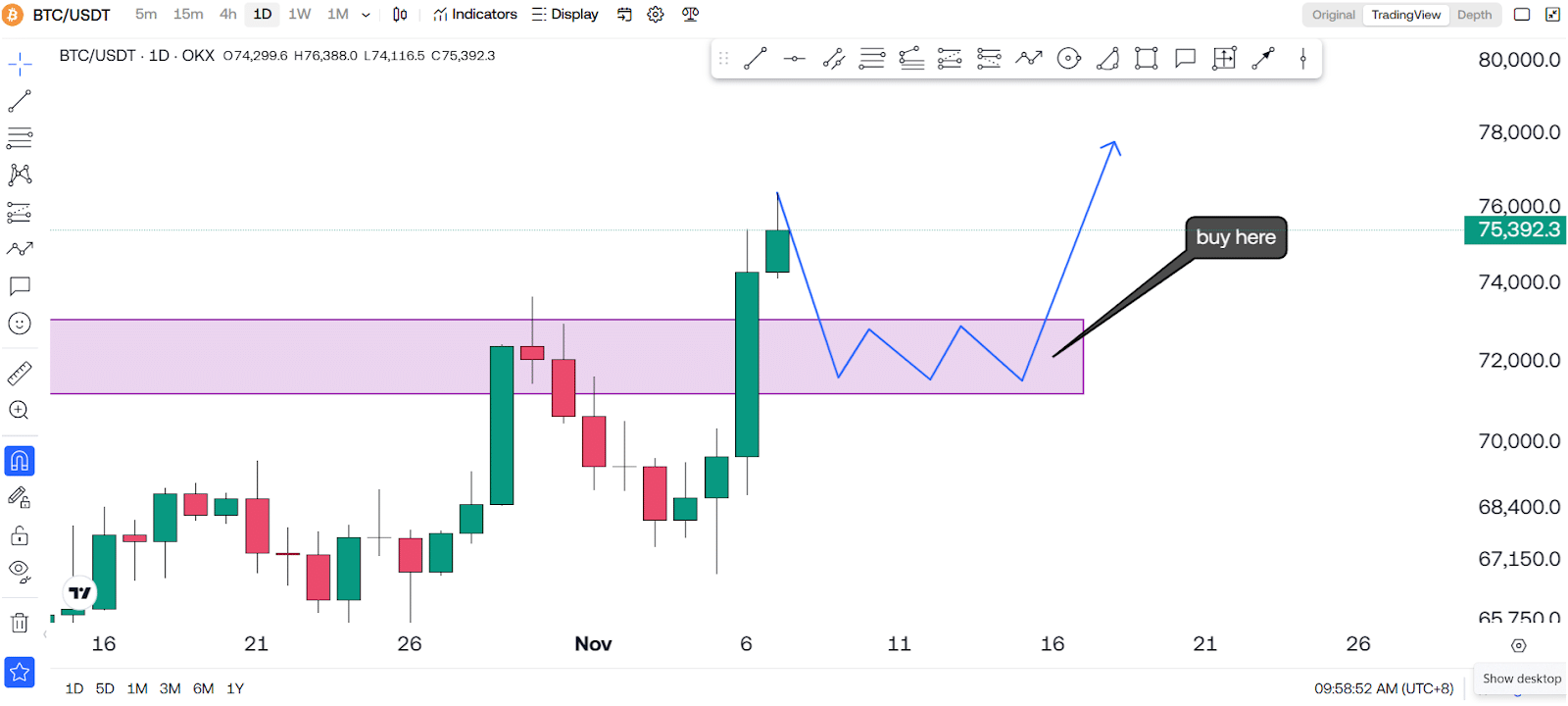

A more strategic approach is to wait for what traders call a “retracement”—a temporary price pullback to a more stable support level. This type of pullback often follows a significant surge in price and can present a more favorable entry point.

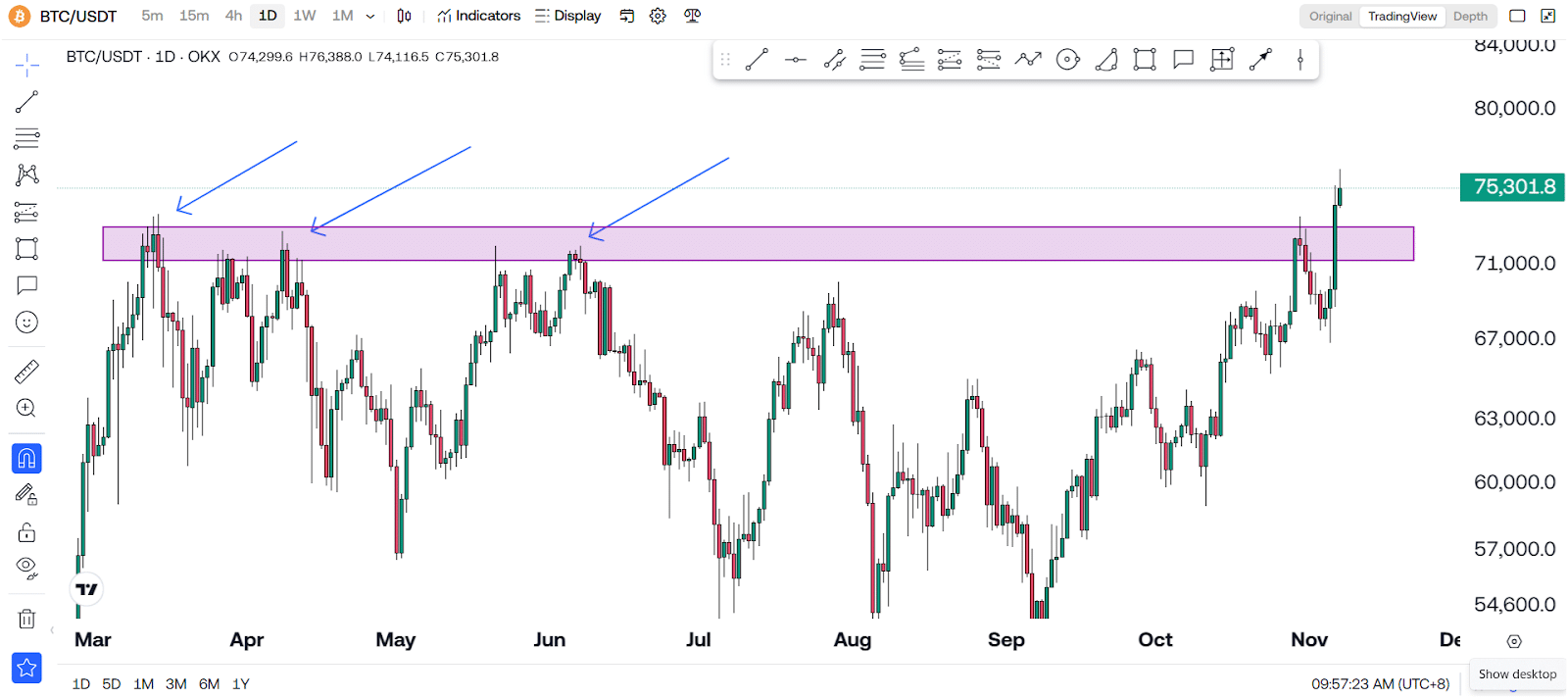

Looking at Bitcoin’s previous price movements, we can see a buildup of selling orders between the $72,000 to $73,000 range. This indicates that Bitcoin’s price might eventually pull back to this level, which could offer a better opportunity to buy. Once a resistance level where investors previously sold, this range could soon transform into a support level where new buyers start stepping in. By waiting for the price to retrace to this support level, you reduce the risk of buying high and allow your investment a better chance to grow over time.

If you’re serious about buying Bitcoin, it’s wise to wait until it retraces to around the $72,000 to $73,000 range. We can’t predict exactly when this will happen, but looking at historical trends, it’s a likely scenario. Bitcoin, like most financial assets, tends to move in waves. After a strong upward movement, it’s common to see a period of retracement and consolidation, where the price stabilizes before potentially rising again. By waiting for this retracement, you avoid the risk of getting in at the peak and benefit from entering at a more balanced point.

Another reason buying Bitcoin at this all-time high is risky is due to some upcoming fundamental news that could impact the market in the short term. Major economic events, highlighted in red on financial calendars, often increase market volatility. High-impact news can influence not only traditional stock markets but also the cryptocurrency market, including Bitcoin. If the news is negative, it could cause the price of Bitcoin to dip as investors turn cautious. However, if the news is positive and supports economic growth, it could strengthen investor confidence, stabilizing or even boosting Bitcoin’s price. Either way, this news adds a layer of uncertainty, so it might be wise to wait and see how the market responds before making buying decisions.

Final Thoughts

In summary, patience and strategy are your best allies when investing in Bitcoin. Rather than rushing in at an all-time high, consider waiting for a retracement to around $72,000 to $73,000. Monitor the market news and be mindful of potential price movements due to economic factors. Setting up a stop-loss for your investments and only investing what you’re comfortable losing will protect you and rationalize your trading decisions. With a thoughtful approach, you can maximize your investment when the timing is right.

For more in-depth technical analysis like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!