Let’s examine the insights shared by our Technical Analyst at UseTheBitcoin as he walks us through his personal trading approach and observations on the crypto market.

Fed Chair Jerome Powell Hints At A Potential Rate Cut

When Federal Reserve Chair Jerome Powell hints at a potential rate cut, it suggests the central bank might lower interest rates soon. This decision can significantly impact the crypto market in several ways:

- Lower Borrowing Costs – Reduced interest rates make borrowing money cheaper, encouraging more investments and spending. This stimulation of economic growth can lead to increased liquidity in the market, including cryptocurrencies, as investors have more capital to allocate.

- Increased Risk Appetite – Lower interest rates make traditional savings and bonds less attractive due to lower yields. Investors seeking higher returns may turn to riskier assets like cryptocurrencies. This shift can drive up demand and prices for digital assets as investors look for better investment opportunities.

- Weaker Dollar – A rate cut can weaken the U.S. dollar by reducing returns on dollar-denominated investments. A weaker dollar often makes cryptocurrencies more appealing as alternative assets, as they can hedge against currency depreciation. This increased attractiveness can lead to higher crypto prices and trading volumes.

Powell’s hint at a rate cut could boost investor interest in cryptocurrencies, potentially leading to increased prices and trading volumes.

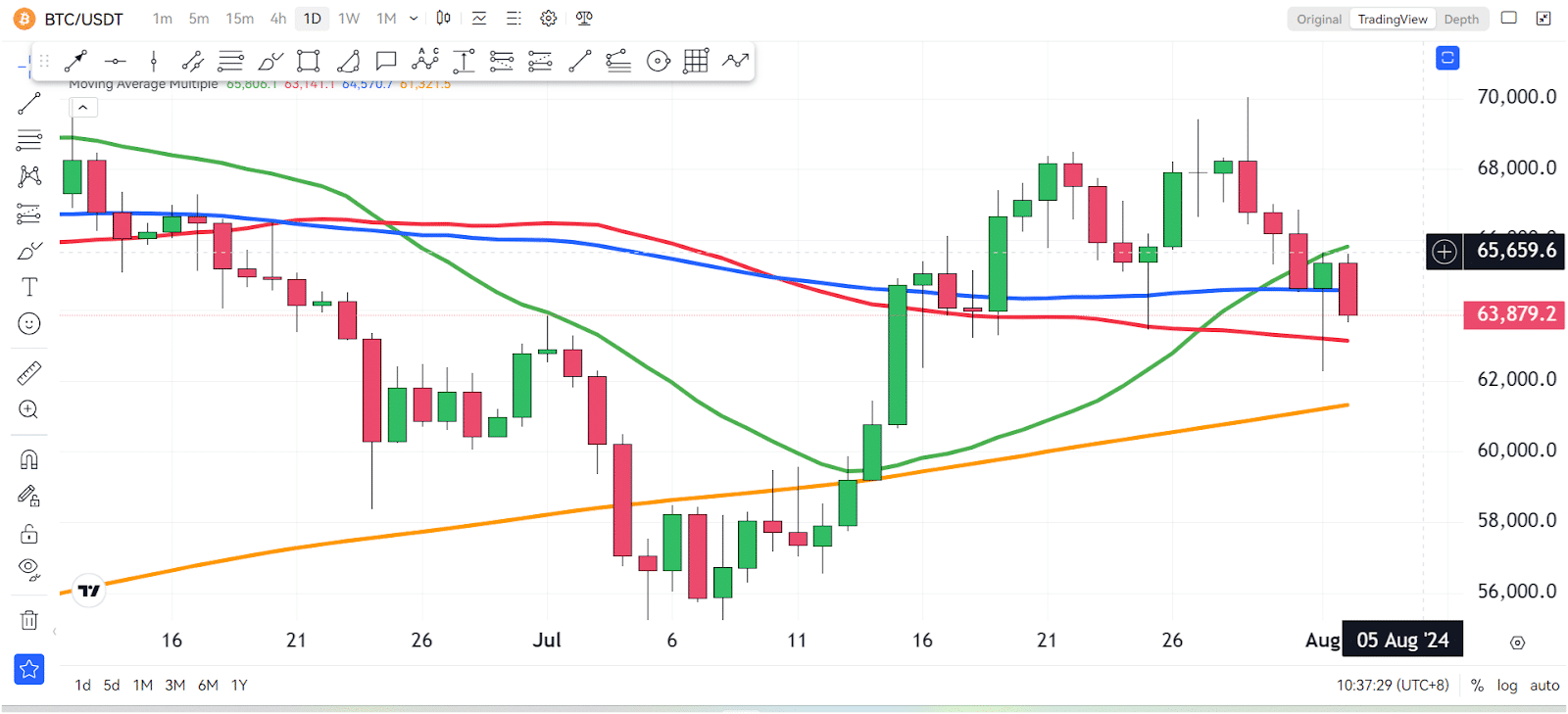

Bitcoin (BTC) Update

Recently, Bitcoin dipped to the $62,000 level but managed to close above the 100-day Moving Average (MA), which could now serve as a strong support level. Maintaining a close above the 100 MA is crucial for Bitcoin to sustain its upward momentum. If Bitcoin breaks below the 100 MA, the next support level is at $63,000, with the possibility of reaching $60,000.

It’s important to observe the market closely and continue managing risk properly during volatility.

Final Thoughts

For more in-depth technical analysis like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!