Let’s examine the insights shared by our Technical Analyst at UseTheBitcoin as he walks us through his personal trading approach and observations on the crypto market.

Stellar (XLM) Market Update

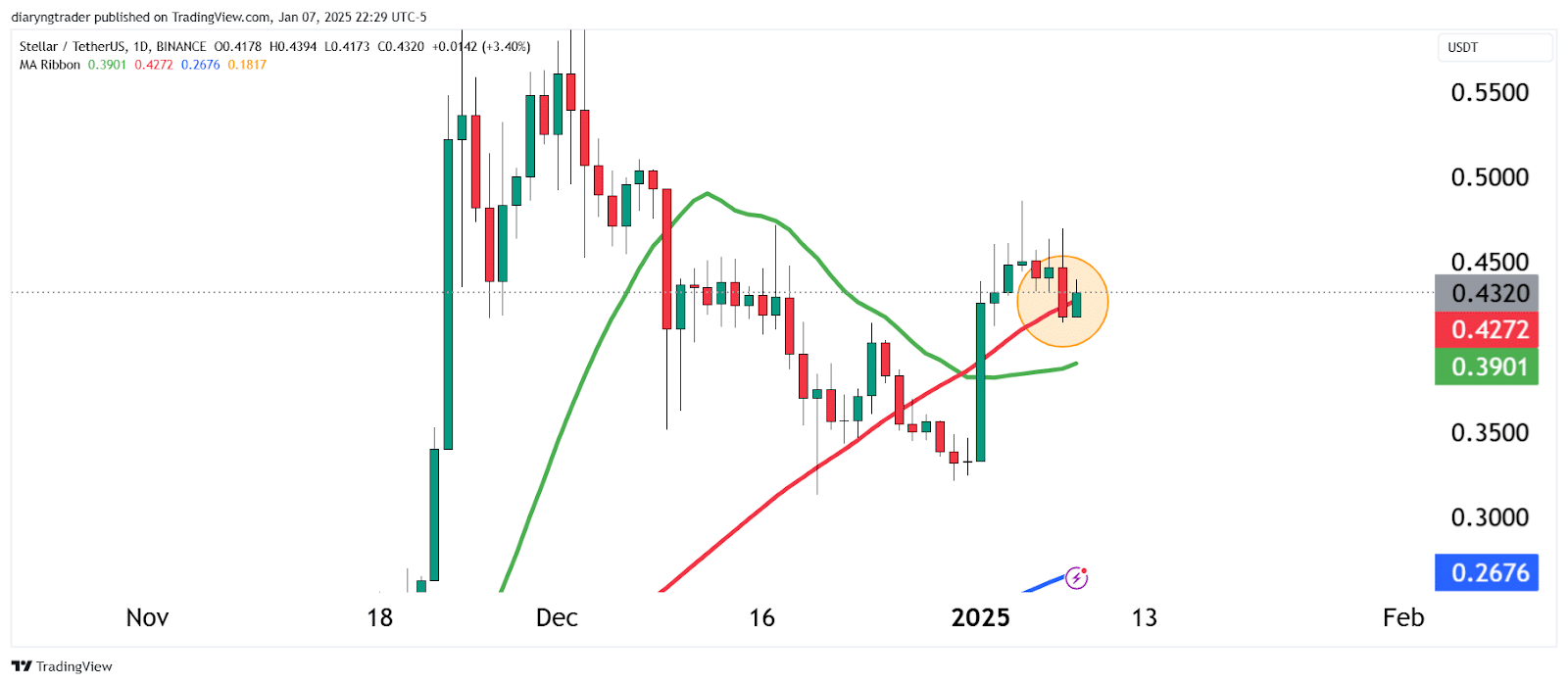

XLM is currently trading above the 50-day moving average. For many traders, this is often a good time to consider entering a position, as prices near support levels are typically favorable for trading. Support levels like this can act as a safety net, offering a strong base for prices to bounce back up.

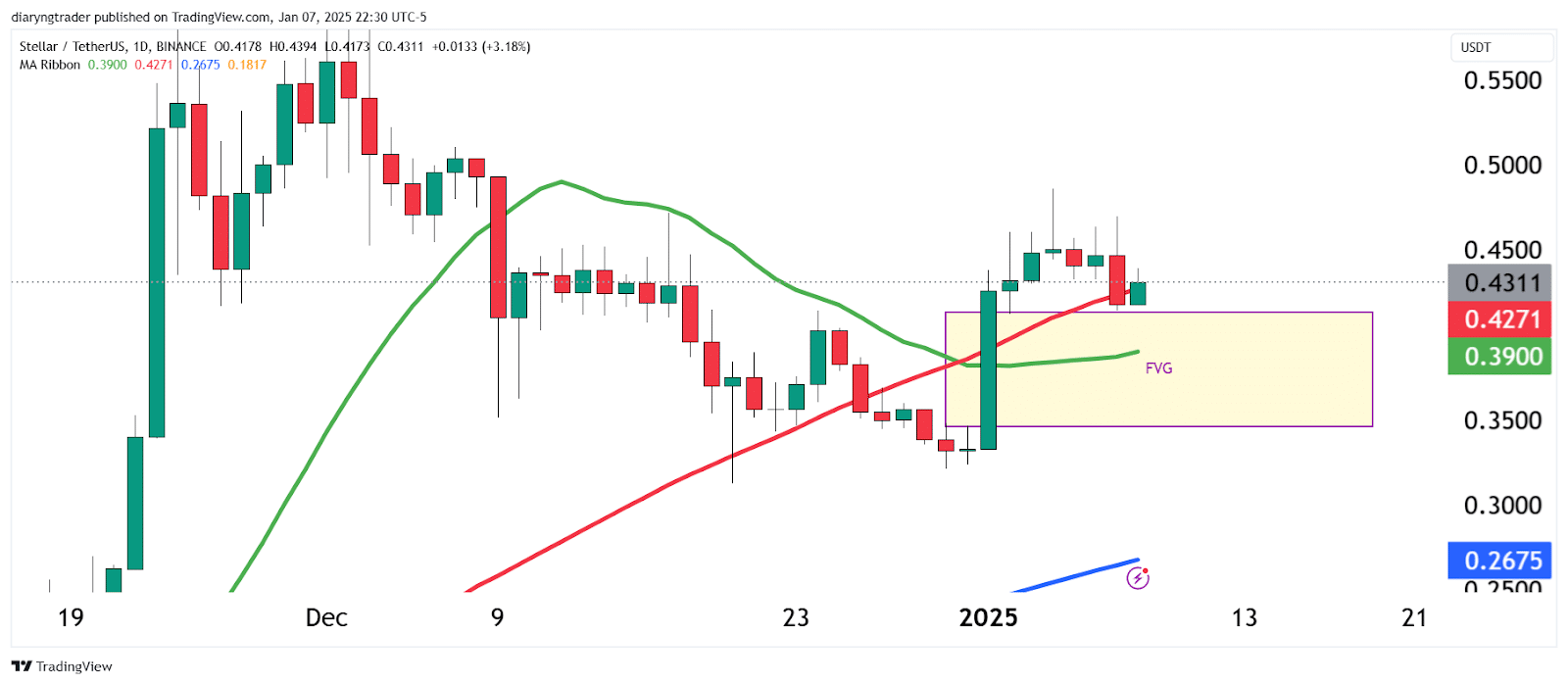

However, if we take a closer look at the chart, there’s an important detail worth considering: a fair value gap (FVG) between the $0.42 and $0.41 range. These gaps are critical to technical analysis, as they often act like magnets, pulling prices toward them. Traders frequently revisit these areas to capitalize on better entry opportunities or to fill these price imbalances.

Another key factor here is the relationship between the fair value gap and moving averages. Upon closer inspection, the 20-day moving average is sitting right within this fair value gap. This alignment strengthens the possibility of prices gravitating toward the $0.42 to $0.41 range before establishing a stronger support level.

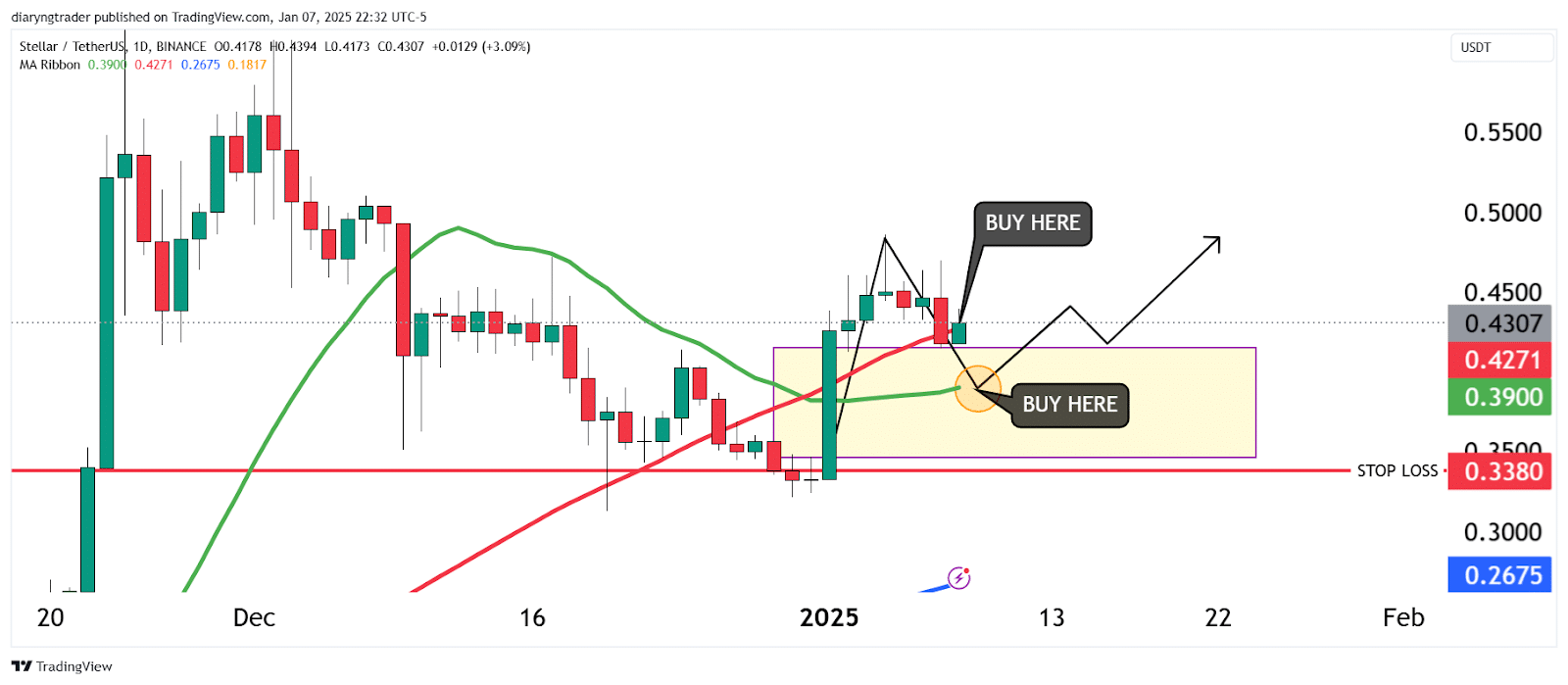

So, while XLM is currently trading at a favorable level, it’s essential to consider this potential pullback to the fair value gap. The prudent approach here would be to allocate your trade wisely. Buying a small position at the current price makes sense, as it allows you to take advantage of the ongoing momentum. But at the same time, reserving funds to add more at the FVG levels could help you create a better overall position. This strategy not only maximizes potential gains but also reduces risk by lowering your average entry price if the pullback occurs.

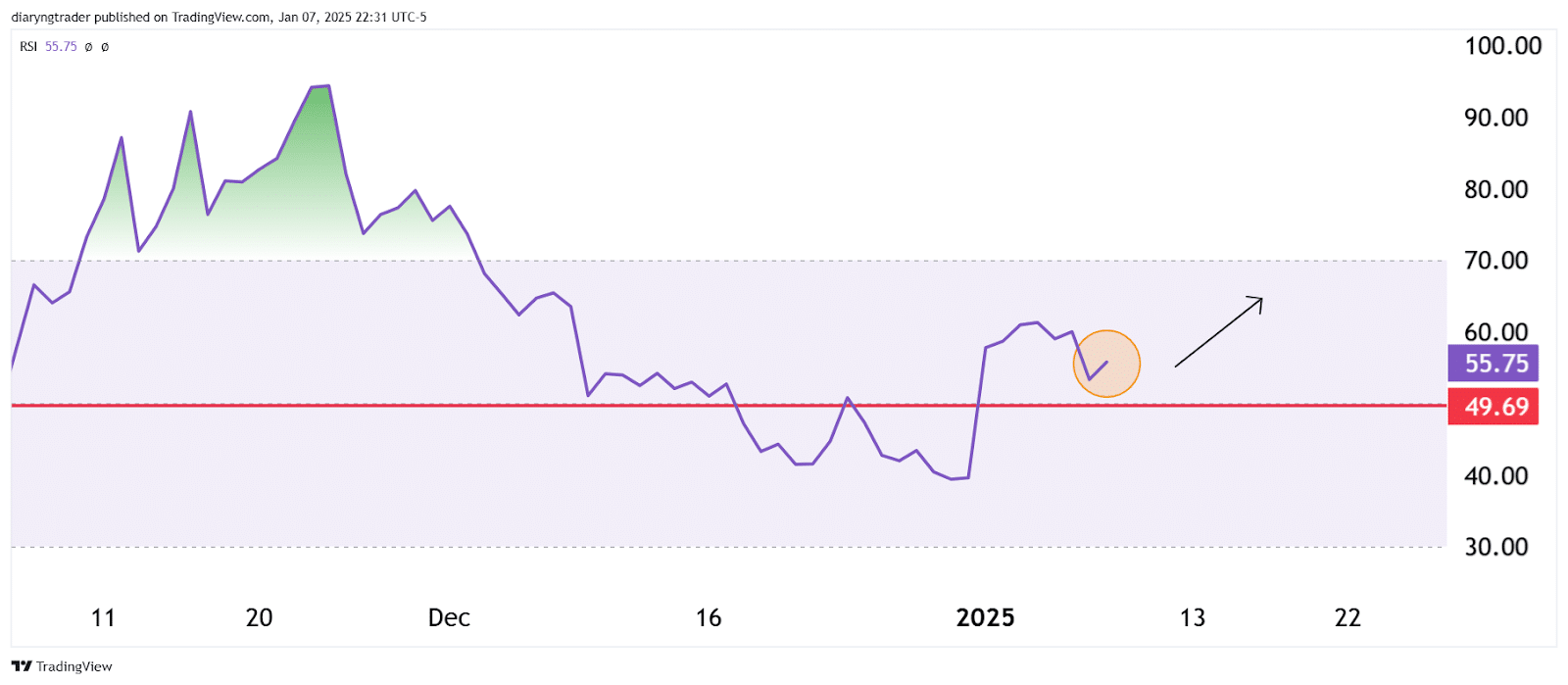

Looking at another indicator, the Relative Strength Index (RSI), we can see that XLM is trading above its median line. This signals a continuation of its uptrend, further supporting the idea that XLM might still have room to climb higher. However, as always, caution and a well-structured plan are essential when navigating volatile markets like crypto.

To summarize, XLM is in an interesting position right now. While it’s trading above the 50-day moving average and shows signs of bullish momentum on the RSI, the fair value gap in the $0.42 to $0.41 range should not be ignored. A potential pullback to this area, where the 20-day moving average resides, could provide an even better support level for those looking to enter or add to their positions.

For traders, the smart move would be to adopt a layered approach: start with a small position at the current price and then strategically add more if prices revisit the fair value gap. This way, you are prepared for both scenarios—whether the uptrend continues or the price pulls back to the FVG.

Final Thoughts

For more in-depth technical analysis like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!

Additionally, join our Telegram community to discuss the latest market trends, share insights, and get real-time updates from experienced traders. Don’t miss the chance to be part of the conversation!