Let’s examine the insights shared by our Technical Analyst at UseTheBitcoin as he walks us through his personal trading approach and observations on the crypto market.

Raydium (RAY) Market Update

Raydium has been gaining significant attention lately, thanks to the growing popularity of memecoins. However, for those considering entering the market now, it’s crucial to analyze the current price action carefully. Based on technical indicators, there seem to be more risks of losing money than making profits at this stage. Here’s why:

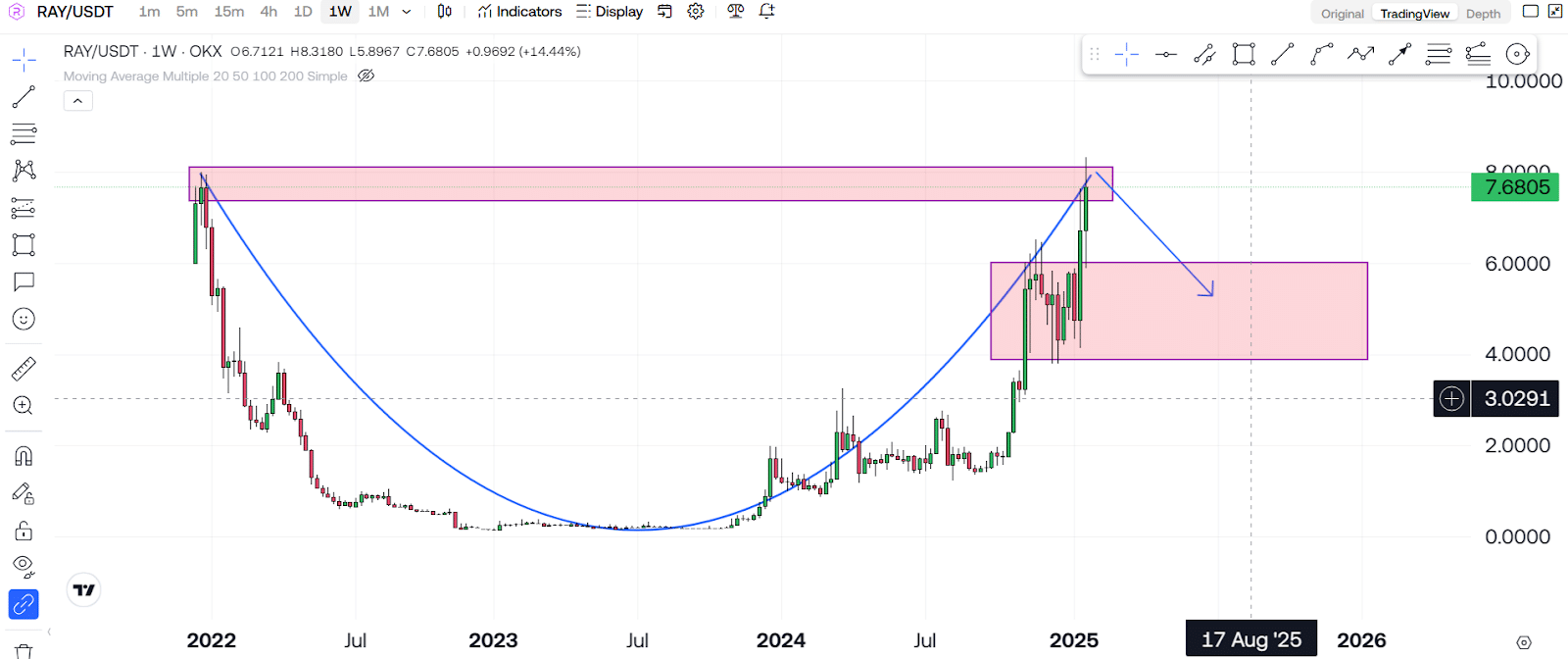

Weekly Timeframe Analysis

Looking at Raydium’s weekly timeframe, we can observe a cup pattern forming. This pattern is generally considered a very bullish signal, often indicating that prices may rise after a consolidation phase. However, upon closer inspection of the historical price movements, we notice a resistance area forming. This resistance could act as a barrier, preventing prices from rising further and possibly pushing them lower.

If the price does drop, it could lead to the formation of the handle pattern, a natural progression in the cup-and-handle structure. This handle is often characterized by a short-term price decline before resuming its upward trend.

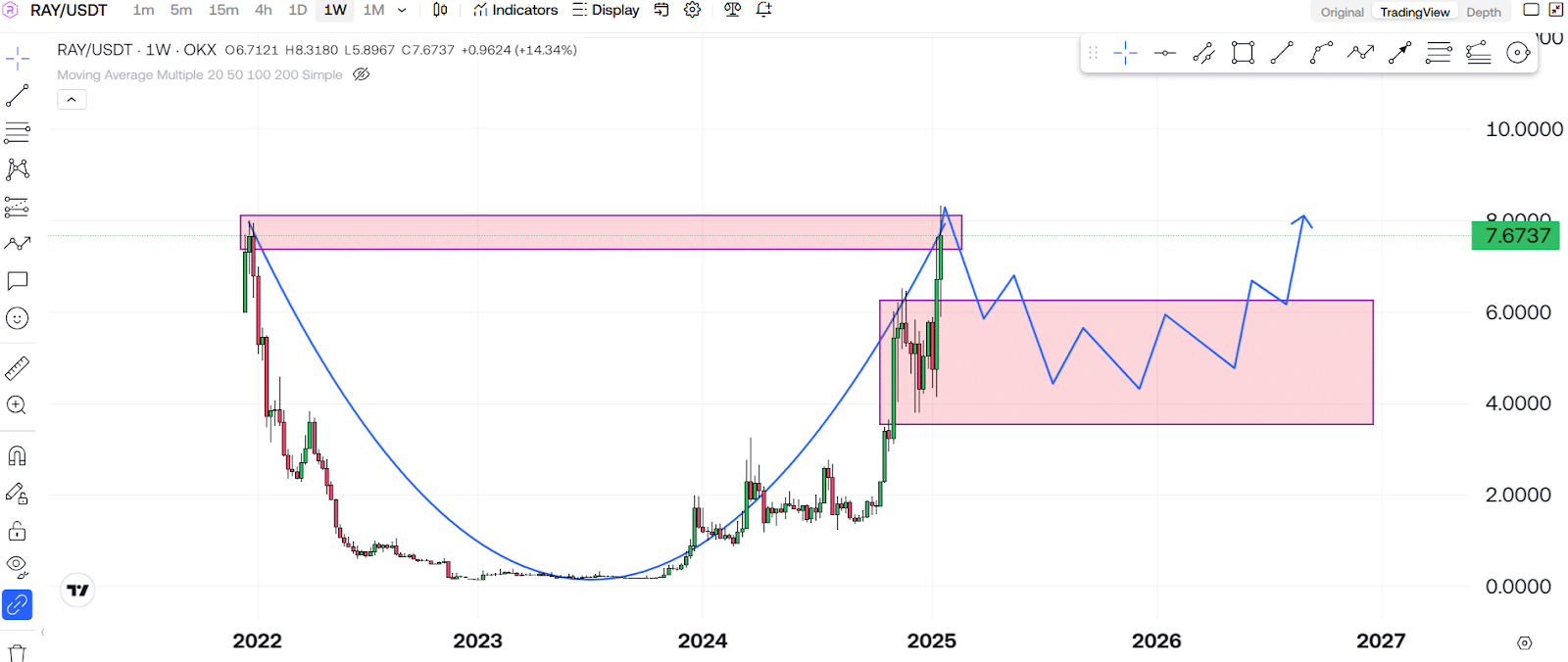

Potential Handle Pattern Formation

The handle pattern could potentially pull prices down to the $4–$6 range. This estimate is based on the visible price buildup in this area, where Raydium has shown previous support levels. These levels are crucial because they often act as a base where buyers step in to prevent further price declines. For traders, this range could represent an opportunity to position themselves at a more favorable entry point.

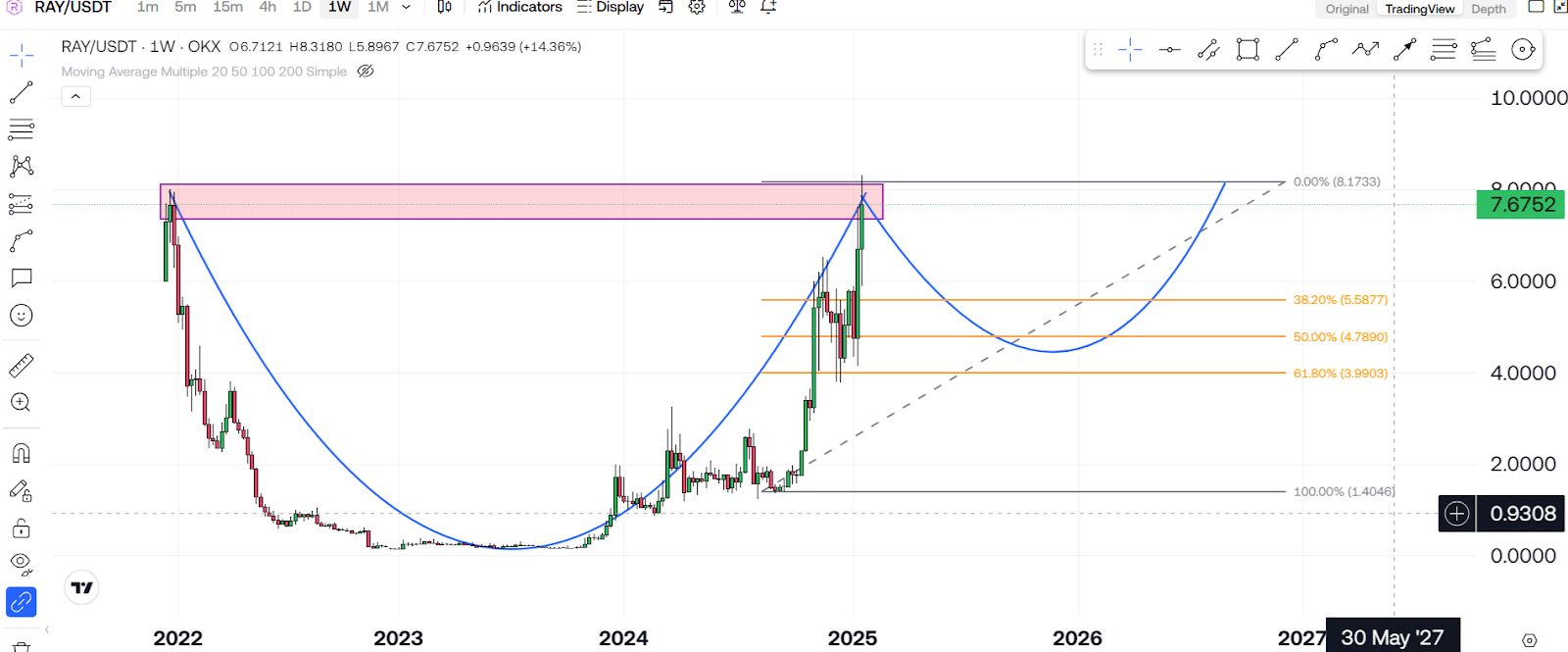

Fibonacci Retracement Insights

Adding to this analysis, the Fibonacci retracement tool provides further confirmation of this price action. When plotting the Fibonacci levels, we can see that the price consolidation aligns closely with the golden ratio—an essential level in technical analysis that often serves as a strong support or resistance zone. This alignment strengthens the case for a potential pullback to the $4–$6 range, solidifying this area as a key level for traders to watch.

The golden ratio is significant because it reflects natural market movements where prices tend to bounce or reverse. With the current price action consolidating near this level, traders have additional confidence in identifying strong support zones.

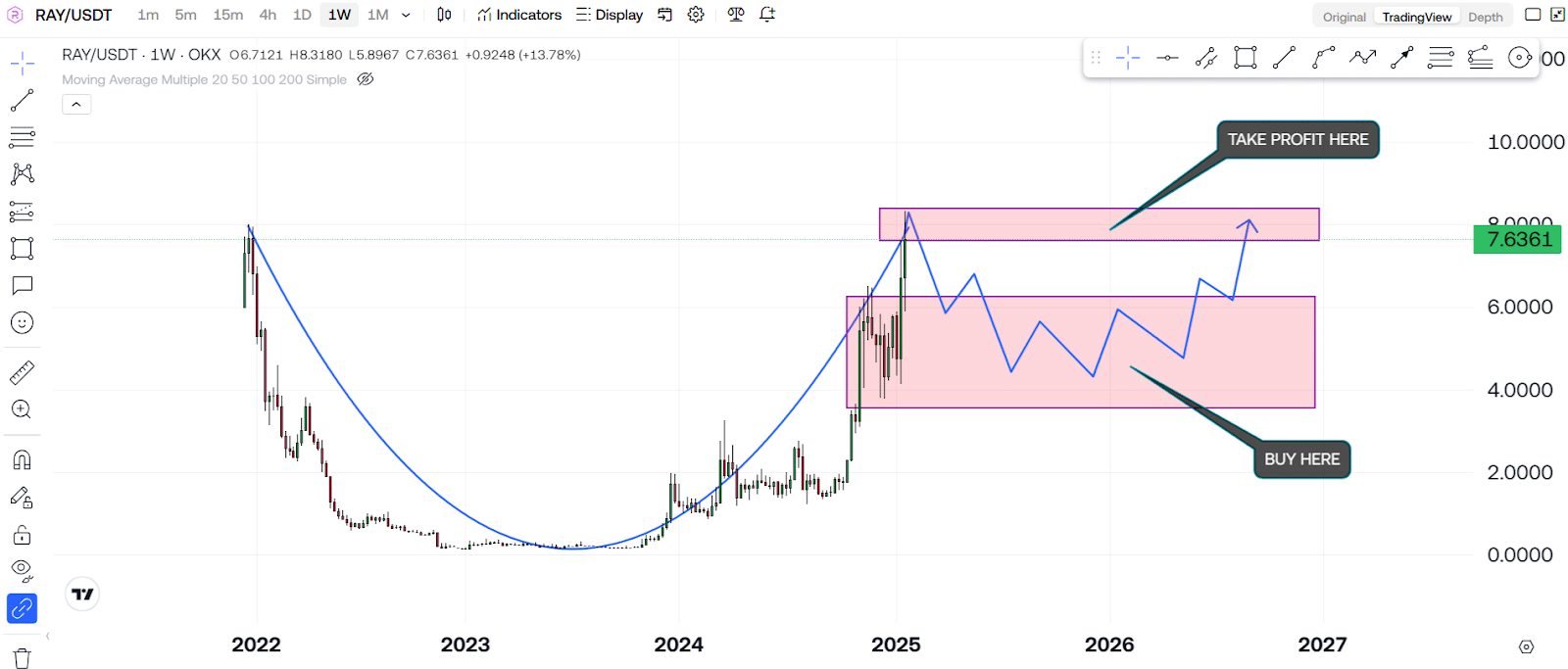

Trading Strategy

Given this analysis, the best course of action for those interested in Raydium would be to exercise patience. Instead of entering the market at its current price, waiting for the handle pattern to form and for prices to consolidate around the $4–$6 range is a more strategic move.

Once prices reach this support level and begin to show signs of consolidation or reversal, traders can position themselves for a potential upward move. The next resistance levels to watch are between $7 and $8. Taking profits at these levels would align with the resistance area identified in the weekly timeframe.

Key Takeaways

- Current Market Conditions: Raydium shows bullish signs with a cup pattern forming, but resistance is visible, increasing the chances of a pullback.

- Support Levels: The handle pattern could bring prices down to the $4–$6 range, a key support zone based on historical price action.

- Fibonacci Confirmation: The golden ratio further supports this analysis, confirming the possibility of lower-level price consolidation.

- Trading Plan: The ideal strategy is to wait for the $4–$6 consolidation zone, then aim to take profits when prices approach $7–$8.

Final Thoughts

While Raydium is garnering attention due to the memecoin hype, it is essential to remain cautious and rely on technical indicators to guide your decisions. Rushing into the market at current levels carries more risk than reward. By waiting for better entry points and following a disciplined trading strategy, you can maximize your chances of success.

For more in-depth technical analysis like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!

Additionally, join our Telegram community to discuss the latest market trends, share insights, and get real-time updates from experienced traders. Don’t miss the chance to be part of the conversation!