Let’s examine the insights shared by our Technical Analyst at UseTheBitcoin as he walks us through his personal trading approach and observations on the crypto market:

Solana (SOL) Market Update

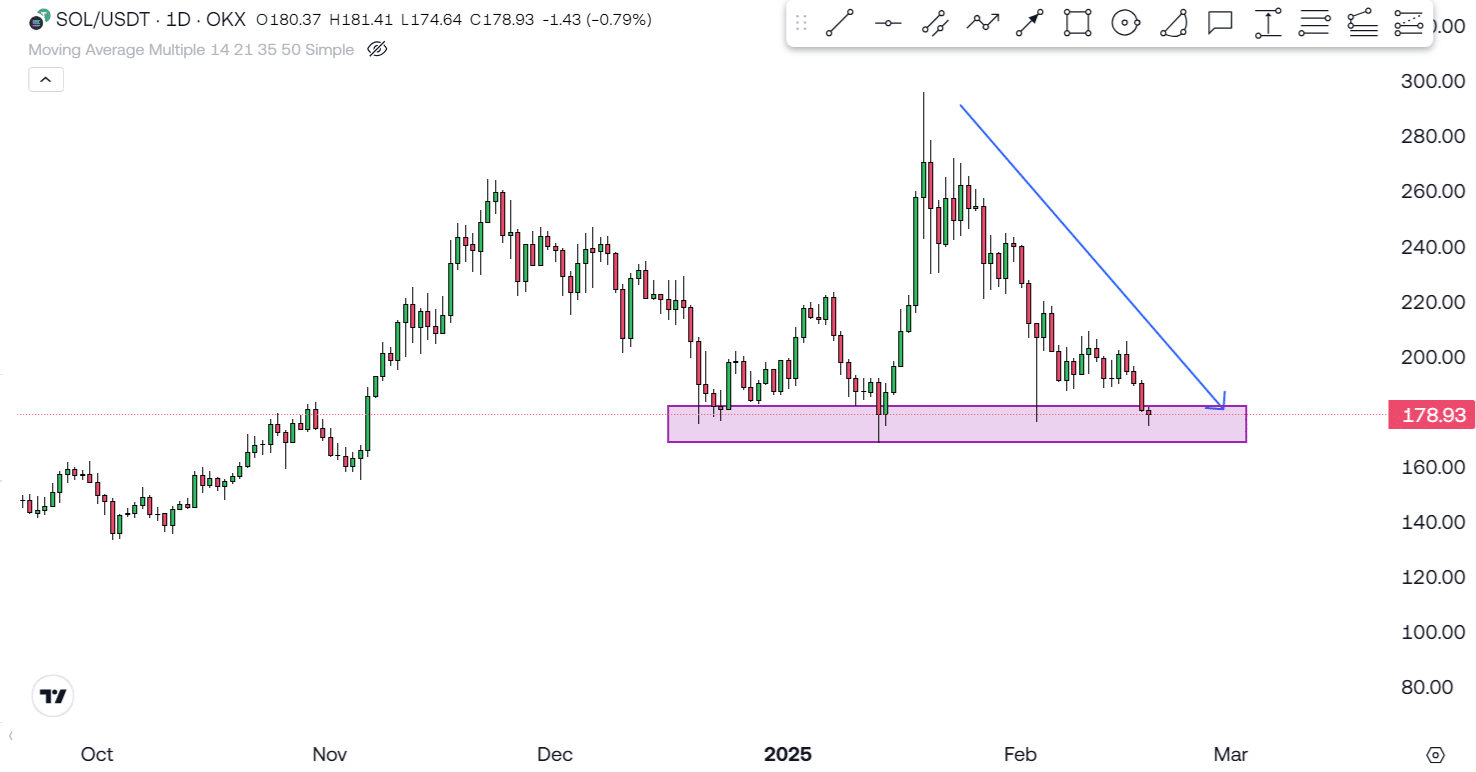

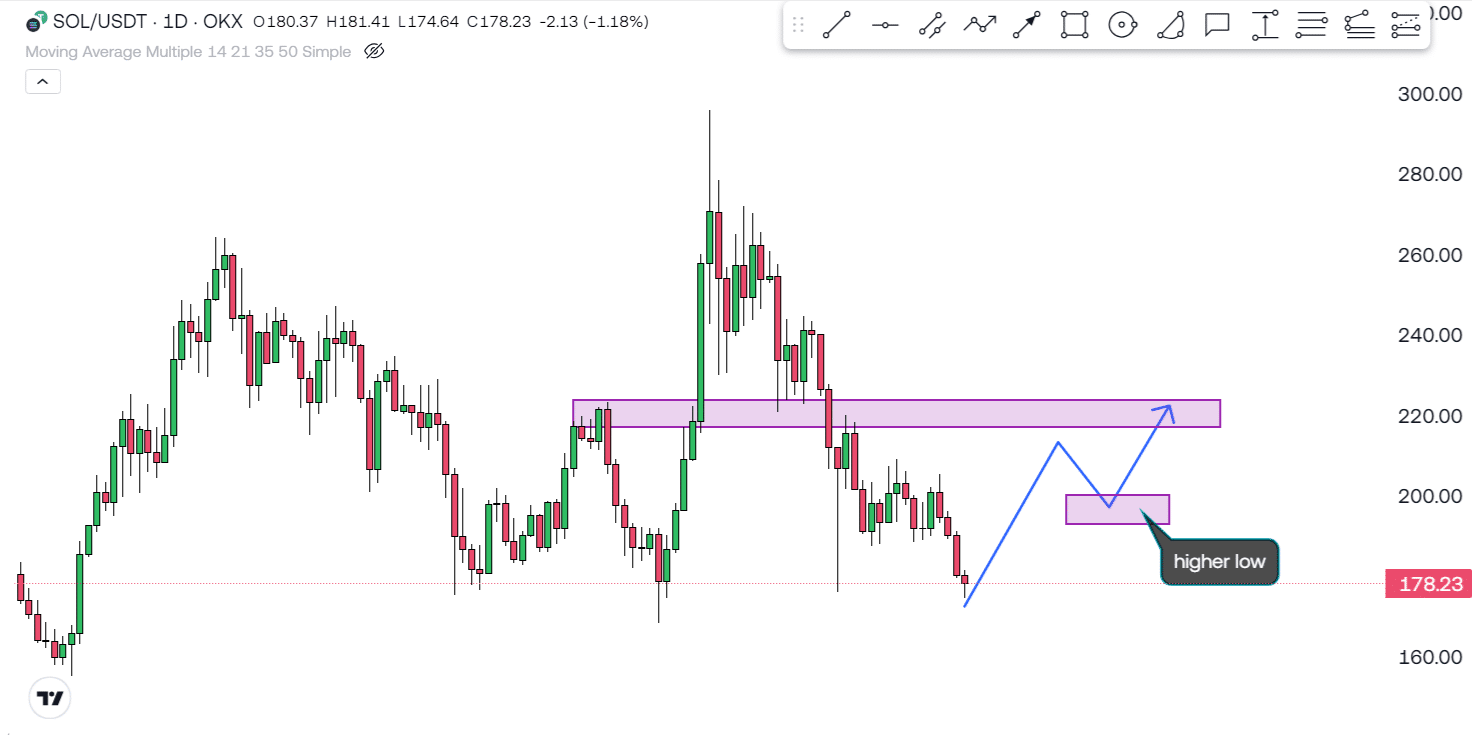

Solana is currently at a very crucial stage in its price action, trading around $177, as shown in the latest daily chart. The price has been declining consistently, respecting a clear downtrend, and is now hovering around a key support zone marked by the rectangular box.

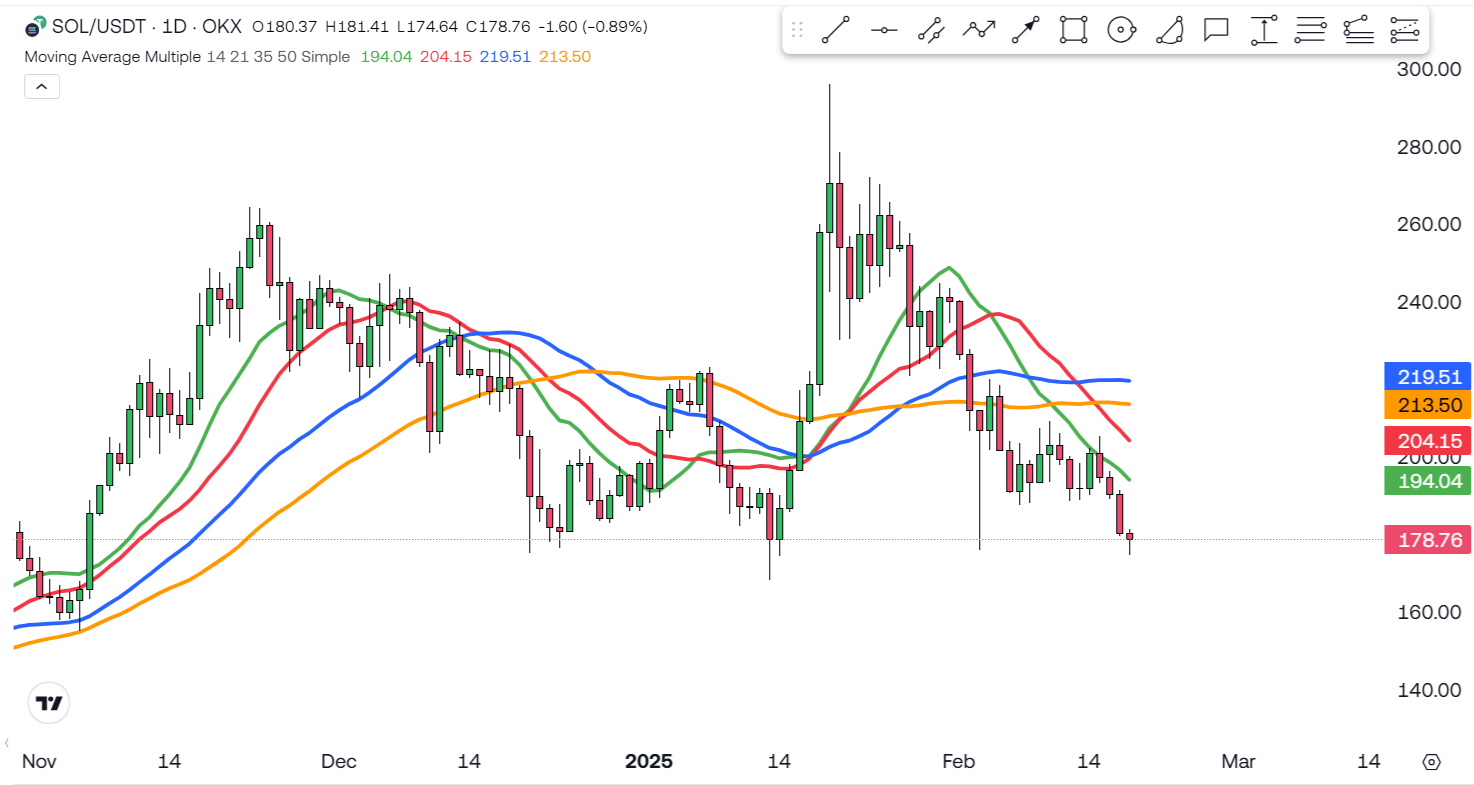

One of the most striking observations from the chart is that Solana is trading below all major moving averages (20, 50, 100, and 200 SMAs). Since Solana is trading well below all of these levels, it clearly signals that the market remains in a strong bearish trend. The 200-day moving average at $219 has acted as a long-term resistance, preventing any sustained bullish breakout. With the price failing to reclaim even the shorter-term moving averages (20 & 50 SMAs), the bearish sentiment remains strong, and there is no clear sign of a reversal yet.

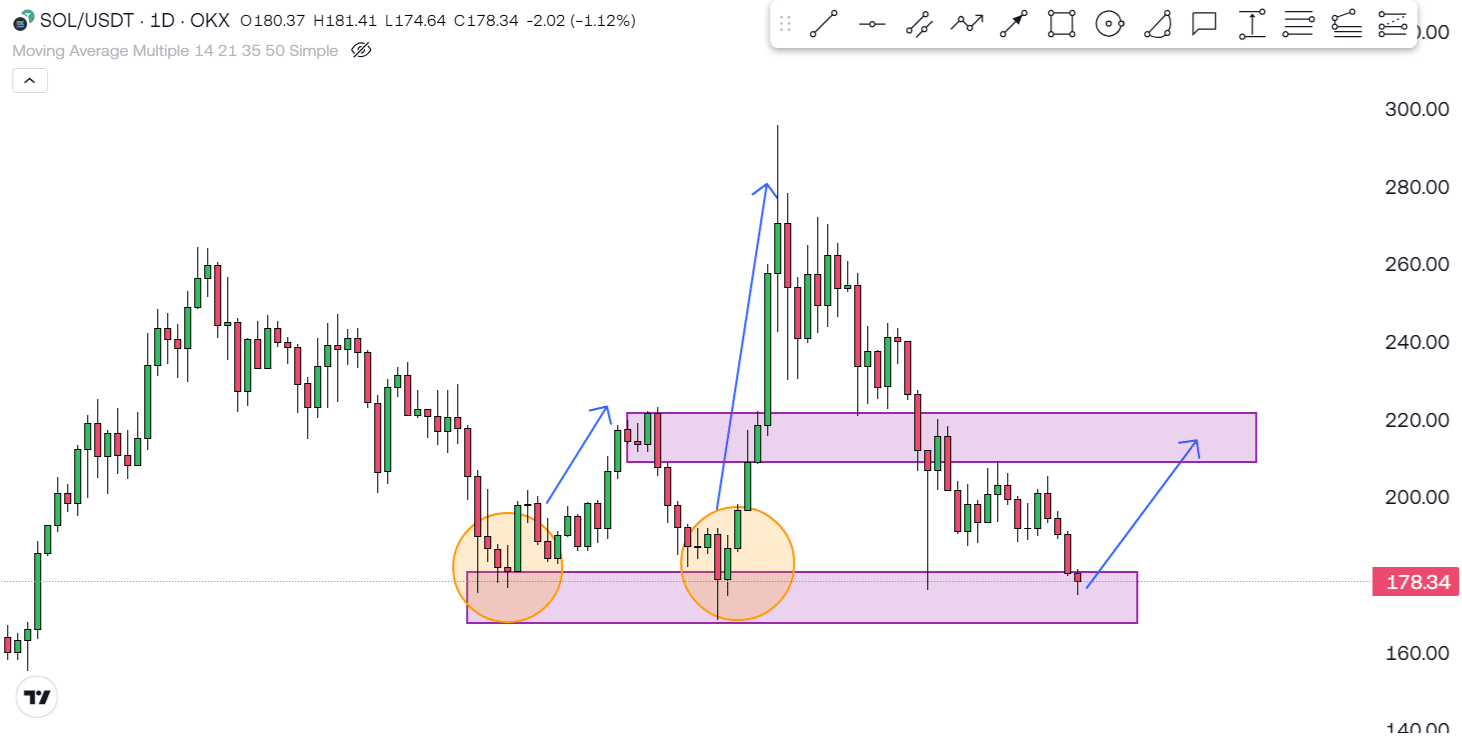

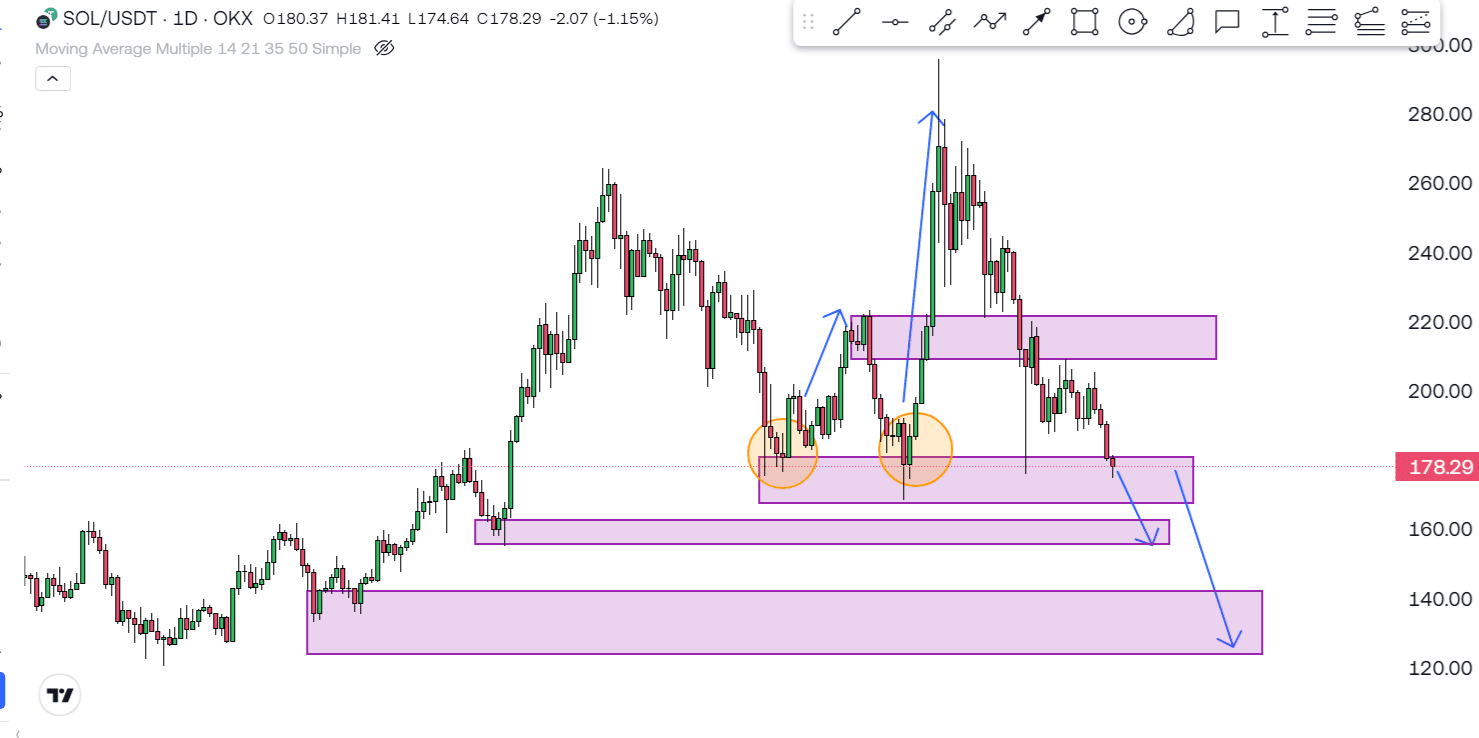

The purple rectangular box on the chart highlights the key support level around the $170-$180 range. This level has acted as support multiple times in the past, meaning that buyers have previously defended it aggressively. If Solana can hold this support and bounce from here, we could see a potential relief rally toward the 50-day or 100-day moving averages.

However, if the price breaks below this critical support, it could trigger a much deeper retracement, with the next potential downside targets being $150, which is a psychological support level, and $120, a historical bottom in the last major pullback. A break below the support zone could also accelerate selling pressure, leading to more liquidations and potentially pushing SOL into an extended downtrend.

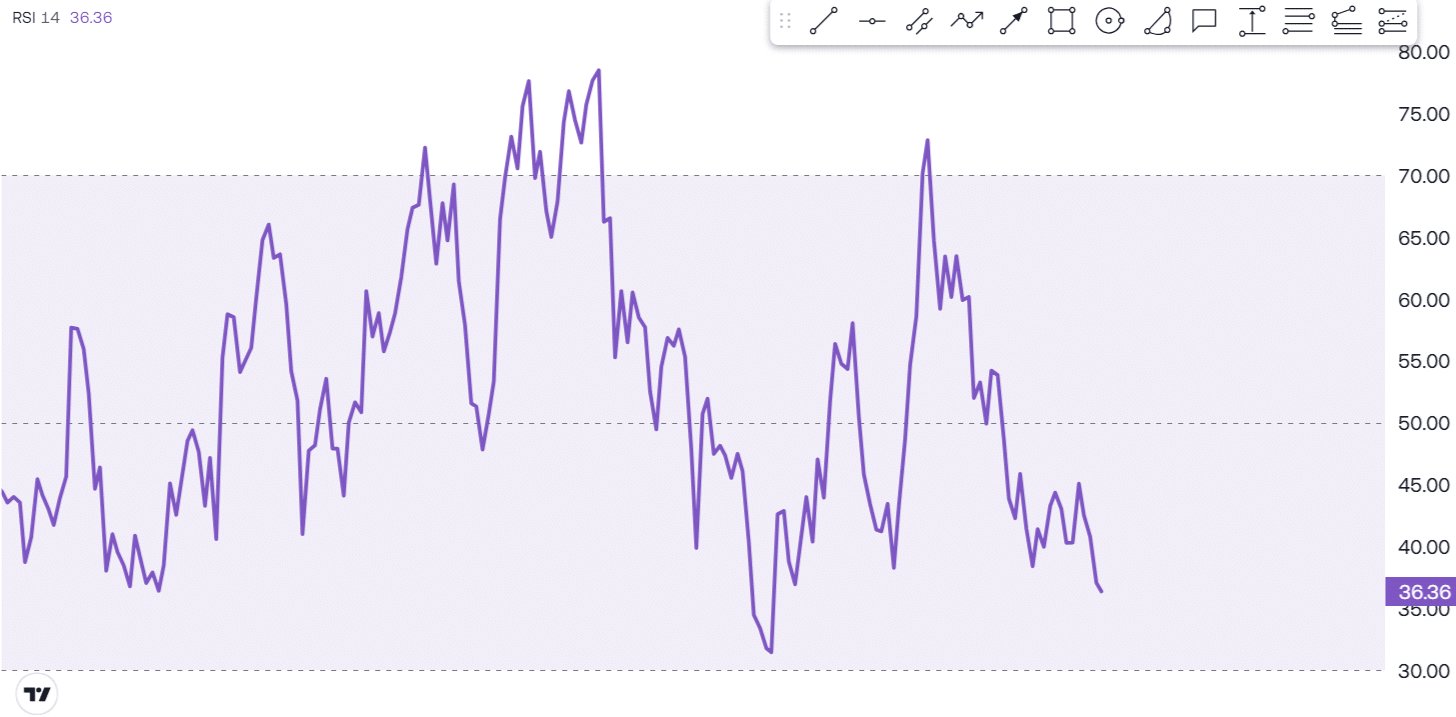

The Relative Strength Index is currently at 36 which is close to the oversold threshold of 30 but still pointing downward. This suggests that although selling pressure is high, there might be room for further downside movement before a strong bounce occurs. A move below 30 on the RSI would indicate extreme oversold conditions, which could bring in buyers looking for a potential reversal. However, until we see a bullish divergence or an uptick in RSI, the bearish bias remains intact.

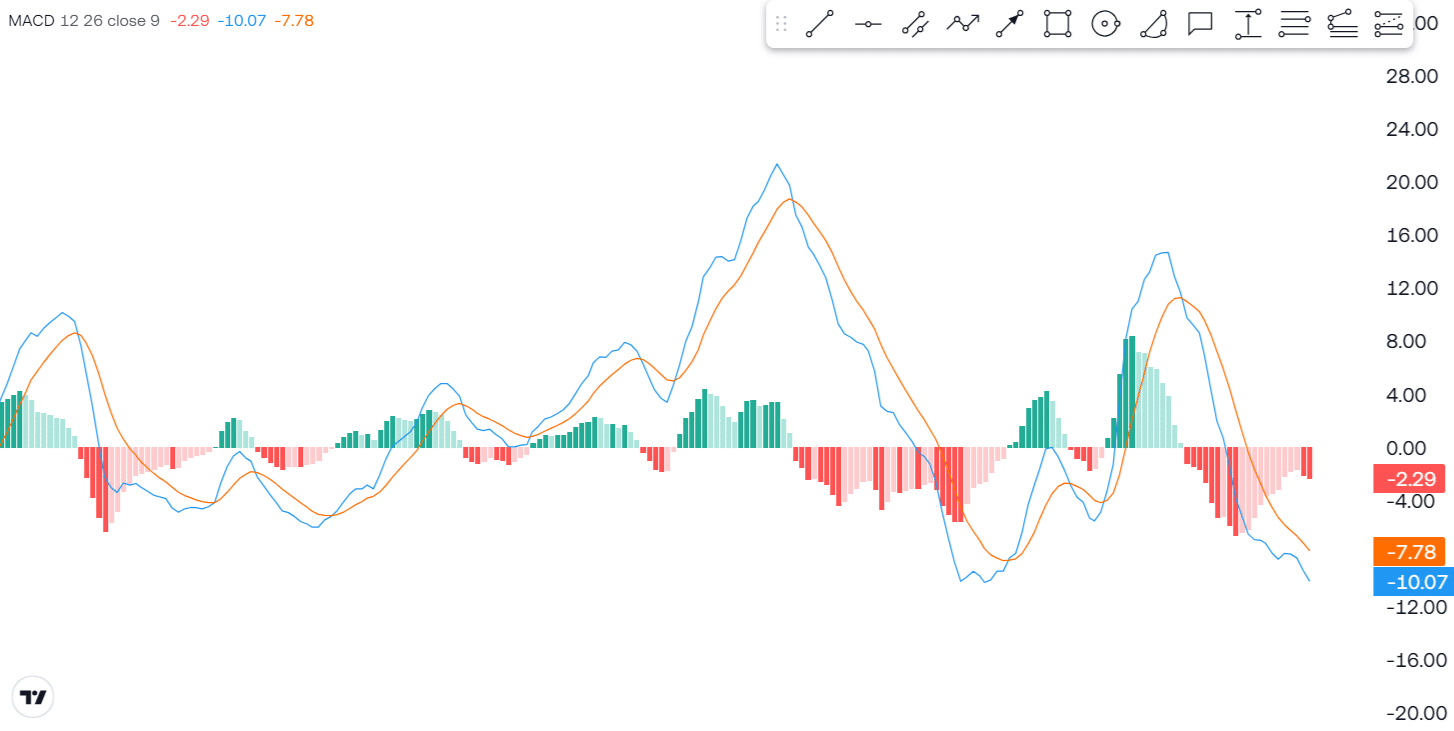

The MACD also remains bearish, with the histogram showing negative values and the MACD line trading below the signal line. The following values indicate that the downward momentum is still strong. As long as the MACD line remains below the signal line and the histogram stays in negative territory, it confirms that the bears are still in control, and there is no immediate sign of a bullish reversal.

For Solana to shift towards a more bullish structure, it must hold the key support zone and establish a higher low. A break above the $193-$204 resistance zone (20 & 50 SMAs) would indicate that buyers are regaining strength. If momentum builds, Solana could aim for the $213-$220 range, where the 100 and 200 SMAs align.

If Solana fails to hold the $170-$180 support range, then expect further downside movement. The next critical support levels to watch would be $150 and $120, where buyers may step in again. A confirmed breakdown below this level could lead to another strong wave of selling pressure.

Final Thoughts

Solana is at a make-or-break moment as it tests a major support level. With price trading below all major moving averages and both RSI and MACD still pointing down, the current trend remains bearish. If the support holds, a relief rally could be expected. However, if it breaks below, a much deeper retracement is likely. Traders should closely monitor price action around this critical support zone to determine the next big move.

For more in-depth technical analysis like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!

Additionally, join our Telegram community to discuss the latest market trends, share insights, and get real-time updates from experienced traders. Don’t miss the chance to be part of the conversation!