Stay in the loop with our weekly crypto digest as we get you up to speed on the hottest trends and events in the crypto space.

Here’s what happened in crypto this week:

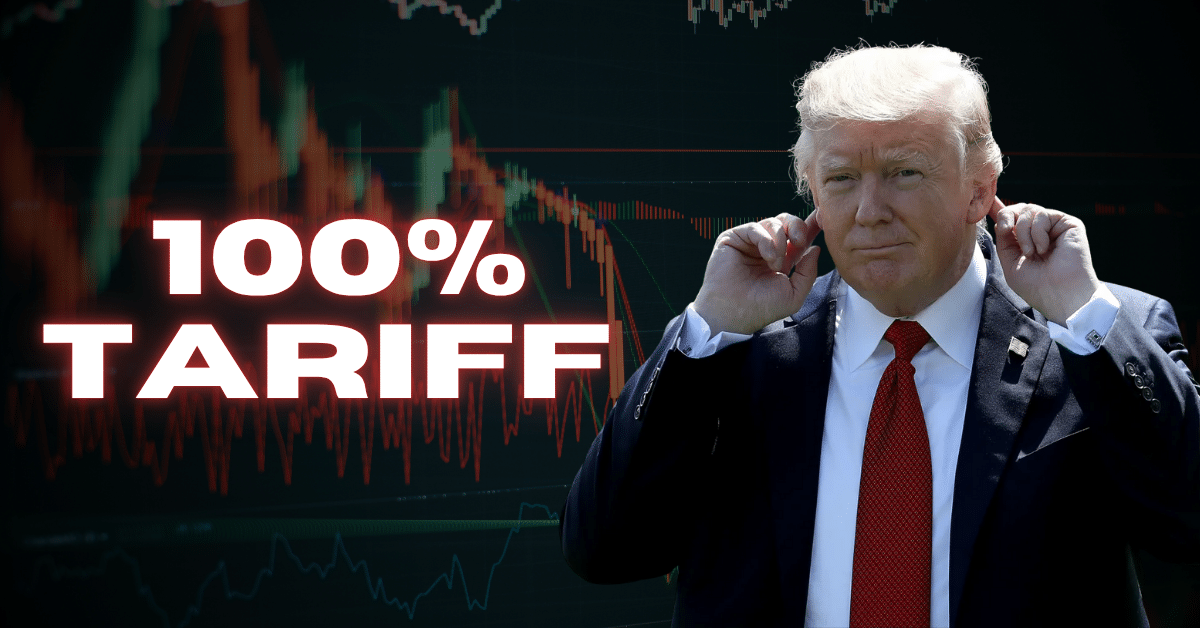

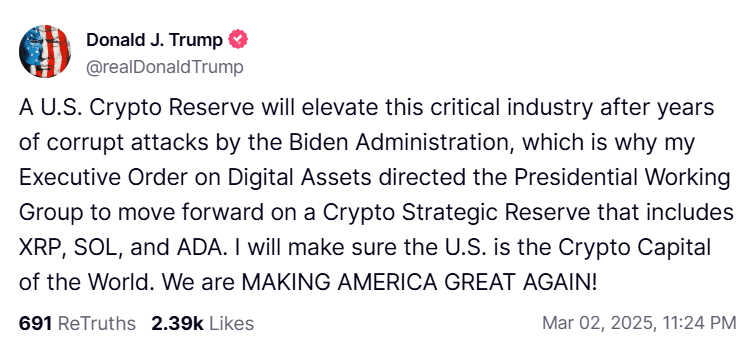

President Trump To Establish US Crypto Reserve, Which Will Include XRP, ADA, And SOL

US President Donald Trump announced the inclusion of XRP, Solana (SOL), and Cardano (ADA) in a proposed strategic crypto reserve.

The announcement was made on Trump’s social media platform, Truth Social, emphasizing the desire to elevate the crypto industry amid perceived attacks from the Biden Administration.

Trump’s executive order in January directed a working group to evaluate the creation of a crypto reserve, which aligned with his campaign goals for the 2024 presidential election.

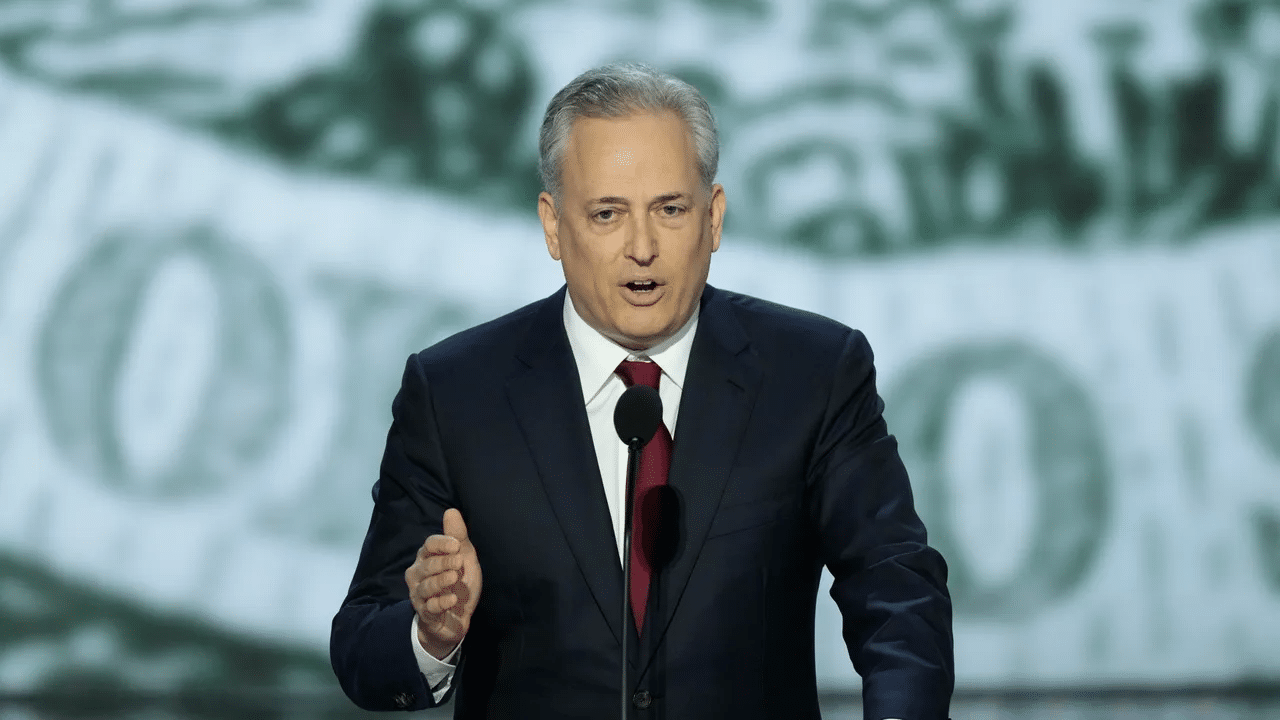

AI And Crypto Czar David Sacks Confirms He Sold All His Crypto Before The Administration Began

AI and Crypto Czar for the White House, David Sacks, confirmed on X that he sold his cryptocurrency holdings prior to the start of the Trump administration.

“Correct. I sold all my cryptocurrency (including BTC, ETH, and SOL) before the start of the administration,” Sacks wrote on X on Sunday, reposting a screenshot of a Financial Times report.

Sacks’ comment came in response to concerns emerging online over potential conflicts of interest regarding Sacks’ ties to Bitwise.

Binance To Remove Non-Compliant Stablecoins On March 31st, 2025

Following the latest guidance from EU authorities in relation to stablecoins, Binance is set to remove stablecoins that are not compliant with Markets in Crypto-Assets (MiCA) regulation in the European Economic Area (EEA) on March 31st, 2025.

Impacted assets are USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG.

MiCA-compliant stablecoin pairs, such as USDC and EURI, and fiat pairs remain available and unchanged.

Binance encourages EEA clients to convert any remaining MiCA non-compliant stablecoin holdings at their earliest convenience.

Tether Appoints New CFO To Drive Full Audit, Reinforcing Transparency Focus

Tether has appointed Simon McWilliams as its new Chief Financial Officer. With over 20 years of experience, McWilliams will spearhead Tether’s commitment to transparency by leading a full financial audit, a crucial step in raising industry standards and ensuring regulatory compliance.

Giancarlo Devasini, Tether’s co-founder and former CFO, will transition to the role of Chairman of the Group. As Chairman, he will focus on macroeconomic strategy and advancing digital asset adoption.

Coinbase CEO Believes US Crypto Reserve Should Focus Only On Bitcoin

Coinbase CEO Brian Armstrong suggested that Bitcoin might be the best option for a US cryptocurrency reserve, following President Donald Trump’s proposal for a “Crypto Strategic Reserve.”

His comments counter Trump’s multi-crypto approach, which includes ETH, SOL, XRP, and ADA.

Alternatively, Armstrong proposed that to maintain variety, a market capitalization-weighted mix of crypto assets could be used to keep the reserve “unbiased.”

US SEC Drops Kraken Lawsuit

Kraken announced that the US Securities and Exchange Commission (SEC) had agreed to dismiss its lawsuit against the crypto exchange with prejudice—meaning the case is permanently closed, with no penalties, no required business changes, and no admission of wrongdoing by the company.

Kraken expressed approval of “new leadership both at the White House and the Commission” and their role in the dismissal. The exchange also said it would continue working with policymakers and regulators to establish protective guidelines while fostering technological advancement.

SEC Drops Yuga Labs Investigation Into BAYC NFTs And ApeCoin

The Securities and Exchange Commission (SEC) has concluded its investigation into Yuga Labs, the developer of the prominent non-fungible token (NFT) Bored Ape Yacht Club (BAYC).

Yuga Labs announced via X that “the SEC has concluded its investigation into Yuga Labs, which had been ongoing for three years,” adding that “this is a win for NFTs and all creators in the ecosystem. NFTs are not securities.”

The SEC has recently been withdrawing investigations against numerous cryptocurrency companies. Previously, the SEC withdrew investigations into Robinhood Crypto, Gemini, Uniswap Labs, Consensys, and OpenSea and also ended lawsuits against cryptocurrency exchanges such as Coinbase and Kraken.

US SEC Offers Eligible Staff $50,000 To Resign

The US Securities and Exchange Commission (SEC) recently announced the availability of a voluntary separation incentive program valued at $50,000 for eligible employees who resign or retire by April 2025.

By March 21st, 2025, eligible employees must submit their applications and must have been on the agency’s payroll before January 24th, 2025. SEC’s Chief Operating Officer, Ken Johnson, emailed the announcement to all staff.

The program follows a broader trend across federal agencies, aiming to save the government up to $100 billion potentially, which is led by the Department Of Government Efficiency (DOGE).

David Sacks: White House Will Support CRA To Repeal “DeFi Broker Rule”

White House AI and Crypto Czar David Sacks announced on X that according to the “Executive Policy Statement” released by the Office of Management and Budget (OMB), the US government supports S.J. Res. 3, a bill initiated by Senator Ted Cruz and others, aimed at overturning the IRS’s rule on “reporting total revenue for digital asset sales brokers.”

It is reported that this rule was initially proposed by the Biden administration at the end of 2024, expanding the definition of “broker” to include software related to DeFi protocols and requiring certain DeFi users to report total revenue from crypto transactions and taxpayer information.

The White House believes this regulation improperly increases the compliance burden on US DeFi businesses, hinders innovation, and raises privacy concerns.

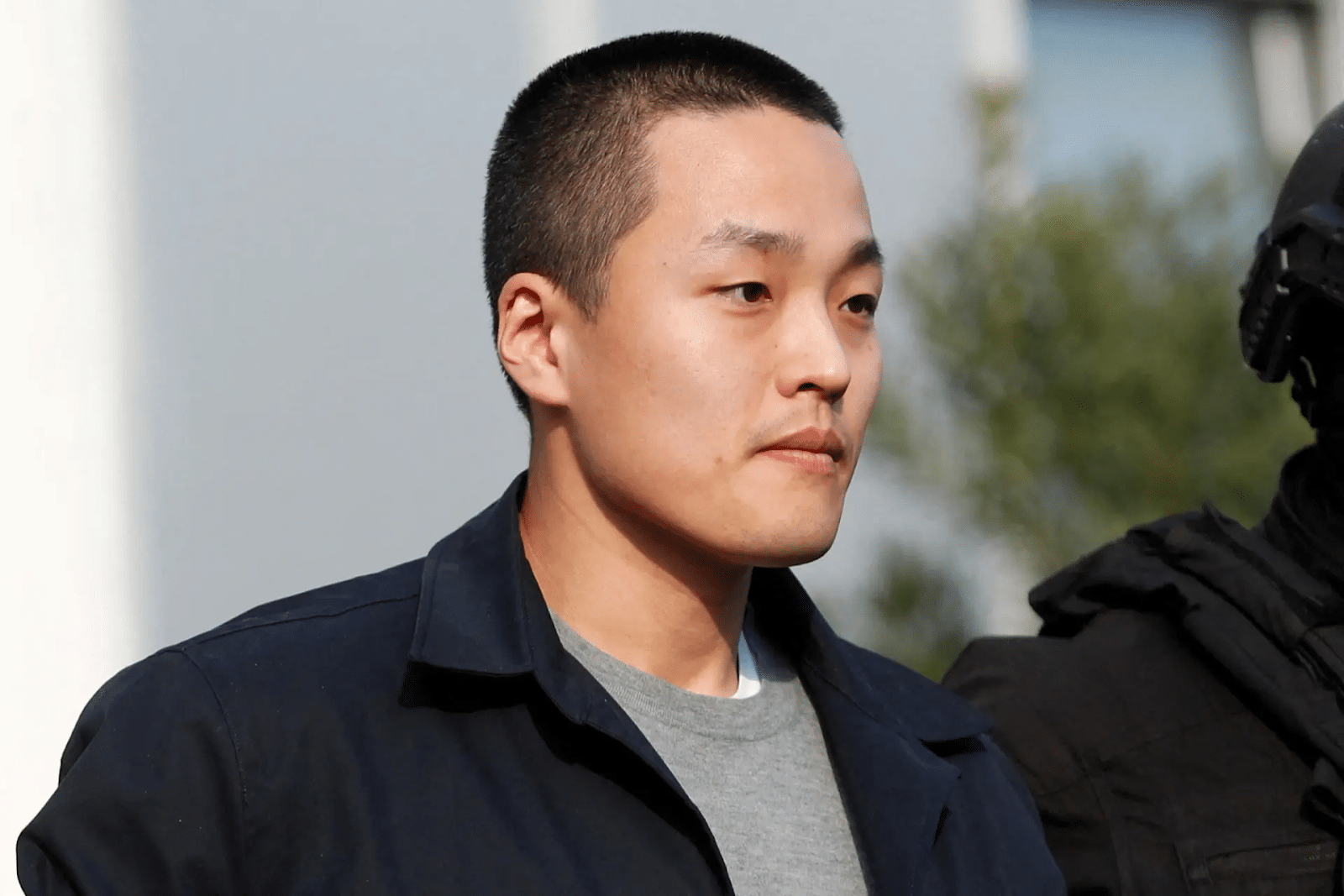

Do Kwon’s Court Hearing Postponed To April 10th, 2025

The US government’s case against Terraform Labs co-founder Do Kwon has been postponed until April 10th, 2025, after prosecutors uncovered an additional four terabytes of evidence.

The new court evidence comes from multiple electronic communications and accounts, which helps explain Kwon’s activity during the Terra Luna ecosystem collapse. Prosecutors have already handed over approximately 600 gigabytes of data, including information from four cellphones previously owned by Do Kwon.

Additionally, the case files contain statements by Do Kwon to the US Securities and Exchange Commission (SEC) and records of his cryptocurrency trading activity.

Kwon’s defense team requires this time extension to establish a strong defensive platform against expanding charges from his accusers.

Final Thoughts

So that’s it for this week!

To stay ahead of the game with the freshest crypto news and insights delivered straight to your inbox, consider subscribing to UseTheBitcoin’s newsletter today.

Have a fantastic week ahead!