Let’s examine the insights shared by our Technical Analyst at UseTheBitcoin as he walks us through his personal trading approach and observations on the crypto market.

Solana (SOL) Market Update

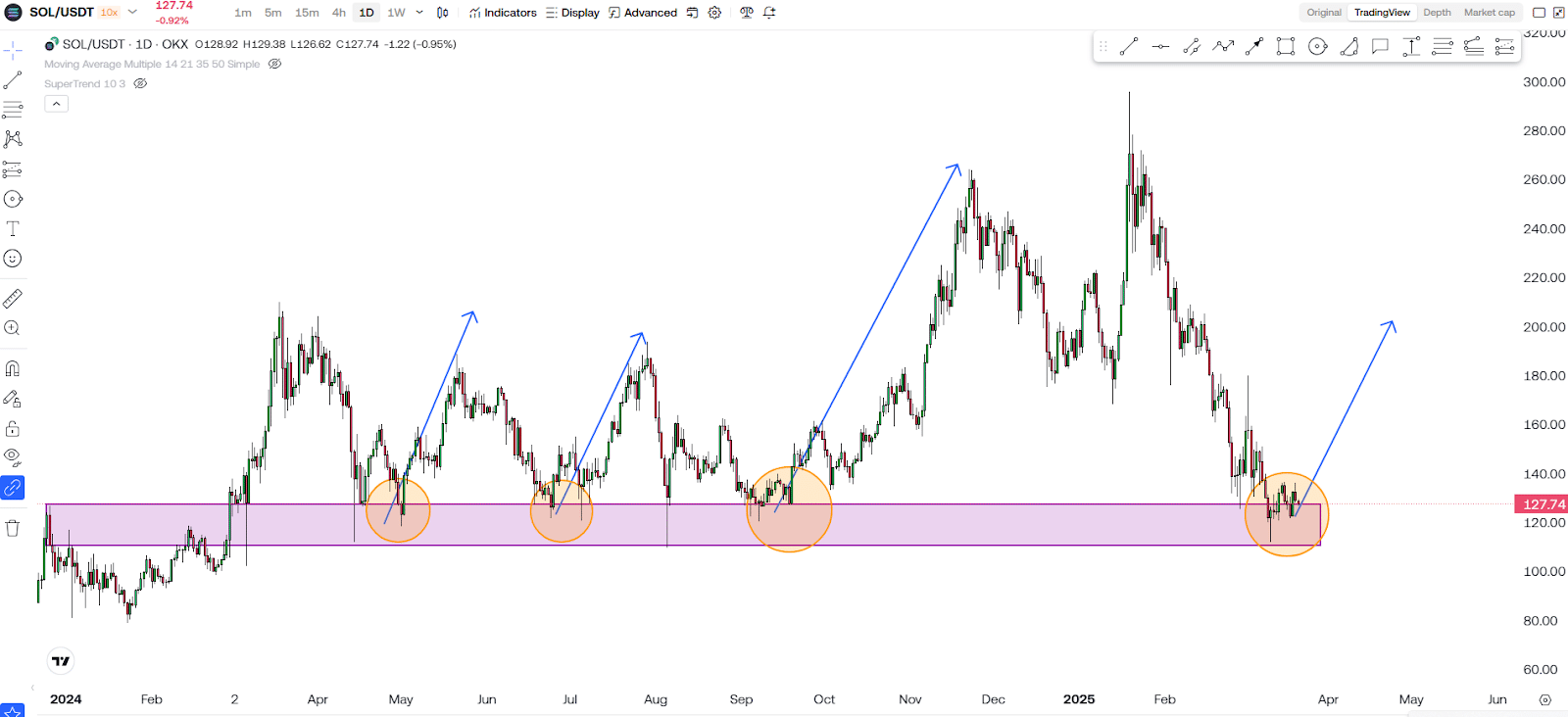

Solana is currently trading within a crucial support range of $110 to $125, a price zone that has historically played a significant role in its price action. Every time Solana’s price has touched this level, it has consistently bounced back. Looking at past price movements, we can see multiple instances where this support range held firm, leading to upward price surges.

Now that Solana has once again reached this critical support level, there is a strong possibility that history could repeat itself, resulting in another price rebound. However, while historical patterns are useful, it’s essential to consider other technical indicators for confirmation.

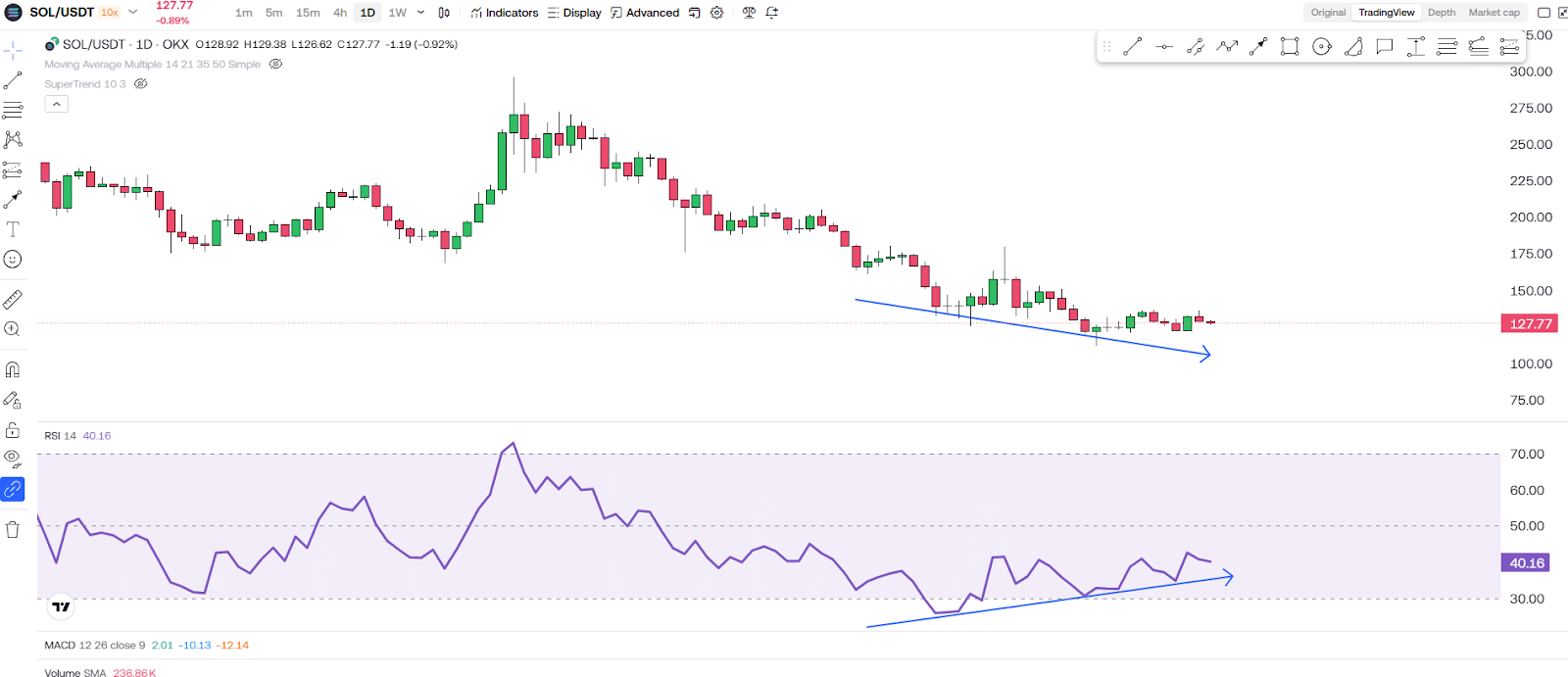

One such indicator is the Relative Strength Index (RSI), which currently shows a pattern known as bullish divergence. Bullish divergence occurs when the price is making lower lows while the RSI is making higher lows. This indicates that even though the price is declining, the underlying momentum is shifting toward a potential bullish reversal. When this pattern appears, it often signals that the bearish momentum is weakening, and a bullish trend may soon emerge.

Another important factor to consider is the overall market sentiment and liquidity. Even though Solana is showing strength at its support levels, broader market trends, such as Bitcoin’s movement, institutional investments, and macroeconomic conditions, can also impact its future price action. A strong Bitcoin rally could further support Solana’s upward movement, while negative market sentiment may put pressure on these support levels.

That being said, it is crucial to remember that no chart pattern or technical indicator can guarantee success. The crypto market remains highly volatile, and various external factors, such as macroeconomic trends, regulatory developments, and overall market sentiment, can influence price movements. For example, news related to Solana’s ecosystem, partnerships, or potential security vulnerabilities can either strengthen or weaken its price action.

If you are considering buying Solana at these levels, risk management is key. Here are some important strategies to consider:

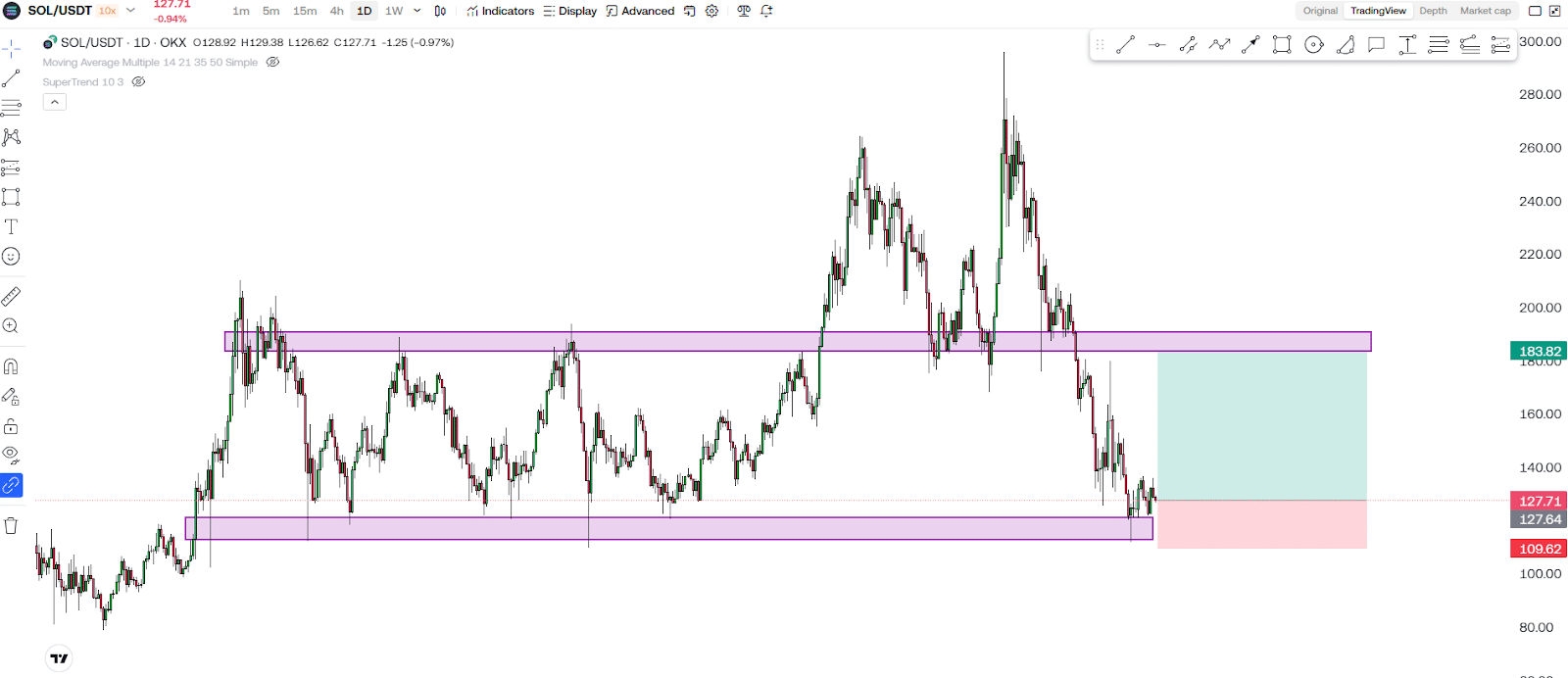

1. Set a Stop-Loss – Place your stop-loss slightly below the $110 support level. If Solana breaks below this range, it could indicate a deeper retracement, potentially leading to further declines.

2. Take-Profit Levels – A reasonable take-profit target would be around $180, as this level has previously acted as a strong resistance zone. If the price reaches this level, it may face selling pressure. You may also consider scaling out your position at different levels, such as $150 or $160, to secure profits while still allowing for potential upside.

3. Monitor Market Conditions – Always keep an eye on market trends, news, and broader crypto movements. Even the best technical setups can be invalidated by external factors. Pay attention to trading volume as well—higher volume near support levels could indicate strong buying interest, reinforcing the likelihood of a price bounce.

4. Consider On-Chain Metrics – Looking at Solana’s network activity, such as transaction volume, total value locked (TVL), and active addresses, can provide insights into the strength of the ecosystem. If on-chain metrics remain strong, it could support the bullish case for Solana’s price recovery.

5. Keep an Eye on Whale Movements – Large transactions and holdings of major investors can influence price direction. Tracking whale activity can help determine whether big players are accumulating or distributing their holdings.

Final Thoughts

In summary, Solana’s current position presents an interesting opportunity for traders. The combination of strong support levels, bullish divergence on the RSI, and overall market trends suggests the potential for a price rebound. However, as always, risk management should be a top priority. Trade smart, set your stop-loss, and plan your exit strategy wisely.

For more in-depth technical analyses like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!

Additionally, join our Telegram community to discuss the latest market trends, share insights, and get real-time updates from experienced traders. Don’t miss the chance to be part of the conversation!