Key Takeaways

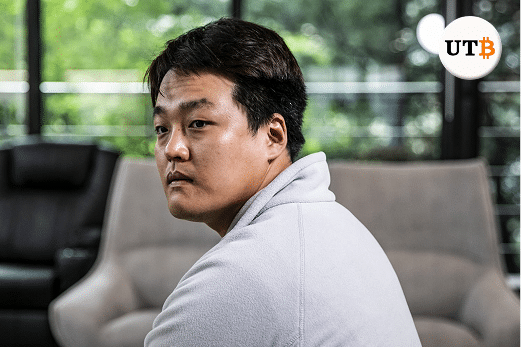

- Do Kwon gained prominence as founder and CEO of Terraform Labs, building a $45 billion Terra ecosystem with LUNA and UST.

- The collapse of TerraLuna resulted in over $40 billion in liquidity being wiped out from the market, leading to numerous projects suffering bankruptcy.

- Kwon faces a potential jail term of over 12 years based on legal cases involving wire fraud, money laundering, and market manipulation.

Do Kwon is a prominent figure whose software engineering journey led him to the blockchain industry, where he built TerraLuna. This DeFi platform mirrors synthetic assets and generates billions of dollars, regarded as one of the most talked-about crypto projects in the industry. However, the project collapsed, leading to his conviction.

Who is Do Kwon? DeFi Billionaire to Prison

Do Kwon earned a degree in computer science from Stanford University and later worked with tech giants such as Apple and Microsoft, gaining hands-on experience in product development.

Following years of work experience, Kwon returned to South Korea, where he founded Anyfi, a peer-to-peer startup communication company making use of mesh network technology, gaining over $600,000 in funding from the government.

However, in 2018, Do Kwon co-founded Terraform Labs in Singapore, focused on using blockchain technologies to address payment solutions for businesses. Building on its success, TerraLuna (LUNA), its native token, was launched.

A DeFi token aimed to decentralize the synthetic asset market platform, allowing users to leverage different yield opportunities with attractive returns. Under the guidance of Kwon, the company launched TerraUSD (UST) pegged to the US dollar as an algorithm stablecoin.

The success enjoyed by Kwon and Terraform Labs led to many other projects being launched, such as Terra blockchain, Mirror, Anchor, Astroport, and Prism. The ecosystem has experienced an astronomical growth of over 40 million users.

While Do Kwon remained active in the crypto space despite being faced with strong criticism regarding the reliability of TerraLuna, defending the argument that this is the change needed for the global market.

In May 2022, TerraLuna suffered a market crash, wiping out over $40 billion in the market and leading to bankruptcy. This collapse led to numerous allegations, including tax evasion in South Korea, money laundering, wire fraud, conspiracy, and defrauding many in the cryptocurrency space. He has pleaded guilty and could face a minimum of 12 years in prison in the U.S.

Contributions to the Blockchain Industry

Source – Do Kwon X Post (formerly Twitter)

Do Kwon last contributed to the crypto space in November 2022 based on his X post following the collapse of TerraLuna, and since then, his account on X has remained dormant following his arrest and imprisonment, as he could face a longer jail term.

Do Kwon’s Net Worth in 2025

At the peak of 2022, when LUNA was trading above $100, Kwon was rumored to be worth over $4 billion from LUNA assets; however, with an over 95% asset crash, it is now hard to estimate his net worth. However, there are suggestions that he still holds over $100 million in Bitcoin for the Luna Foundation. Legal battles and imprisonment could affect his net worth.

Conclusion

Do Kwon’s prominence, from one of the most admired DeFi contributors to a convicted fraudster, highlights the high-risk end of the blockchain space, where innovative ideas and control over billions of dollars can lead to bankruptcy and a potential longer prison sentence.

FAQs

What happened to Kwon Do?

He was extradited from Montenegro to the United States following the crash of TerraLuna.

Who is the founder of Luna?

Kwon was the founder of Luna, which aimed to provide decentralized finance (DeFi) services.

Why did Luna coin crash?

LUNA and TerraUSD (UST) have been designed to work together, meaning that pulling liquidity from UST led to the crash of the LUNA coin.

Related Read