Key Takeaways

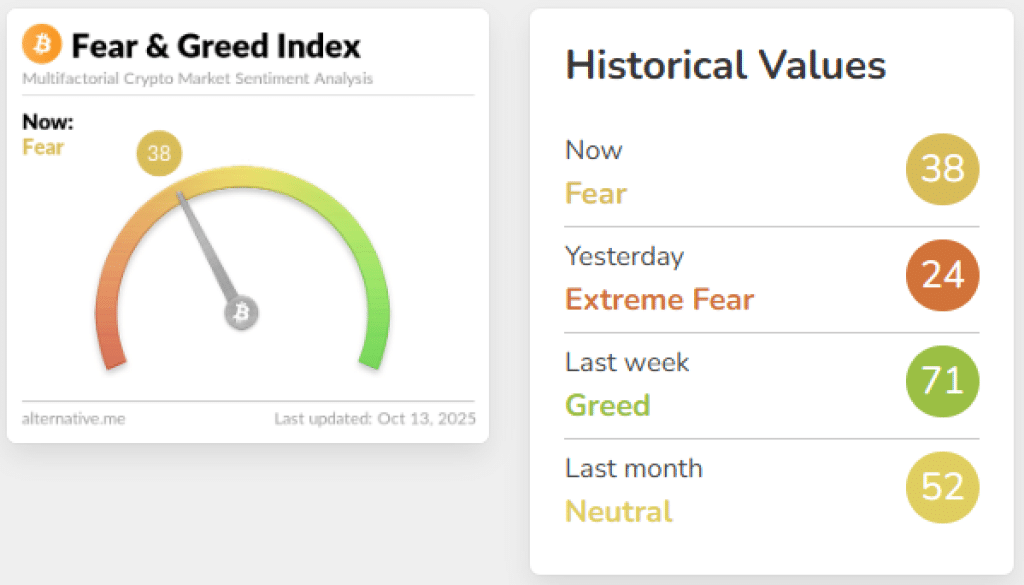

- The mood in the crypto market plunged from “Greed” (64) to “Fear” (24) in a single day, marking the lowest sentiment in nearly six months.

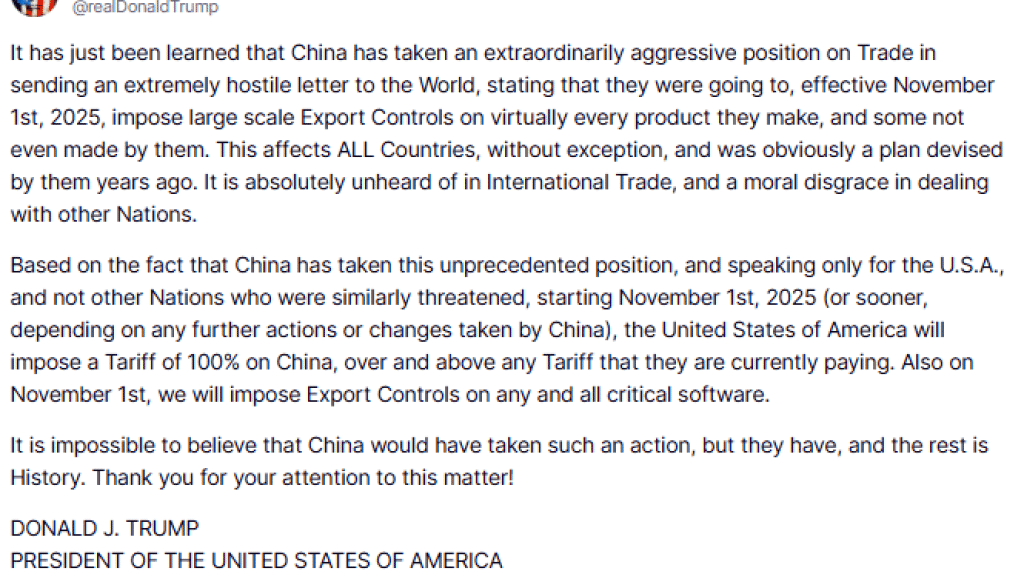

- The sharp drop was directly linked to President Trump’s sudden announcement of a 100% tariff on all Chinese imports, which briefly sent Bitcoin (BTC) spiraling to $102,000.

- Despite the market-wide panic, some analysts, like those at Bitwise, saw the extreme fear as a “strong contrarian buying signal,” suggesting the market is now deeply oversold.

The widely-watched Crypto Fear & Greed Index suffered a staggering drop, collapsing from a healthy 64 down to a shocking 24 in just 24 hours. This wasn’t just a slight dip; it was the most dramatic single-day collapse in market mood we’ve seen in almost six months, proving just how quickly traders react to global shocks.

The lightning-strike catalyst? A sudden geopolitical grenade: US President Donald Trump declared a 100% tariff on all Chinese imports. This unexpected trade escalation, which was framed as a countermeasure to China’s restrictions on rare earth minerals, sent a jolt of panic through global markets. Bitcoin briefly capitulated, seeing its price touch a low of around $102,000 on the perpetual futures market.

When fear hits that hard, money gets wiped out fast. The sell-off triggered a staggering $19.27 billion in liquidations, a mix of long and short positions getting wiped out, making it one of the most destructive single-day events in recent crypto memory.

The Contrarian’s Perspective: A Rare Buying Signal

But in the world of crypto, one person’s panic is often another’s opportunity. Amidst the widespread fear, some smart money analysts are preaching calm and a contrarian view. Andre Dragosch, head of research for Bitwise in Europe, pointed out that their intraday crypto asset Sentiment Index had “generated a strong contrarian buying signal.”

What does that mean? Dragosch noted that the index had plunged to an intraday low of −2.8 standard deviations. That’s an extremely rare level of market distress, one that hasn’t been seen since a major market unwind that occurred in mid-2024.

Historically, when sentiment gets this deeply negative, it often means the market has reached a bottom and is poised for a significant rebound. The belief here is that the current drop is fueled by emotion and panic, creating a fantastic deep selling opportunity for patient investors, not the beginning of a long-term decline.

The Curious Case of the Muted High

Ironically, the market’s extreme reaction to the bad news is contrasted by its relatively muted reaction to the good news that preceded it.

Just days before the tariff crash, Bitcoin had hit a fresh all-time high of $125,100. Yet, as analyst Brian Quinlivan of Santiment observed, this peak didn’t generate the typical, chest-thumping euphoria on social media that past bull runs had. Quinlivan called the reaction a “modest, run-of-the-mill reaction from the crypto audience.”

This paradox is actually a bullish sign. It suggests that this latest crypto rally may have been built on a less over-leveraged and more cautious retail base than previous cycles. People were quick to panic, but they weren’t necessarily overly invested in the first place. That foundation could allow for a quicker price recovery once the geopolitical smoke clears and the fear subsides.

Final Thoughts

The swift descent of the Crypto Fear & Greed Index into the “Fear” zone is a clear reflection of the market’s sensitivity to global economic friction. While the tariff announcement caused a painful liquidation cascade and a sharp price drop, the severity of the sentiment crash is being interpreted by some analysts as a strong contrarian signal, suggesting the panic may have created a rare buying opportunity for patient investors.

Frequently Asked Questions

What is the Crypto Fear & Greed Index?

It is a measure that tracks overall crypto market sentiment, ranging from 0 (Extreme Fear) to 100 (Extreme Greed).

How low did Bitcoin briefly fall?

Following the tariff announcement, Bitcoin briefly dipped to a low of approximately $102,000 on the perpetual futures market.

What is a “contrarian buying signal”?

It is an indicator, often generated by a deeply negative market sentiment, suggesting that an asset is oversold and may be poised for a significant upward correction.