Key Takeaways

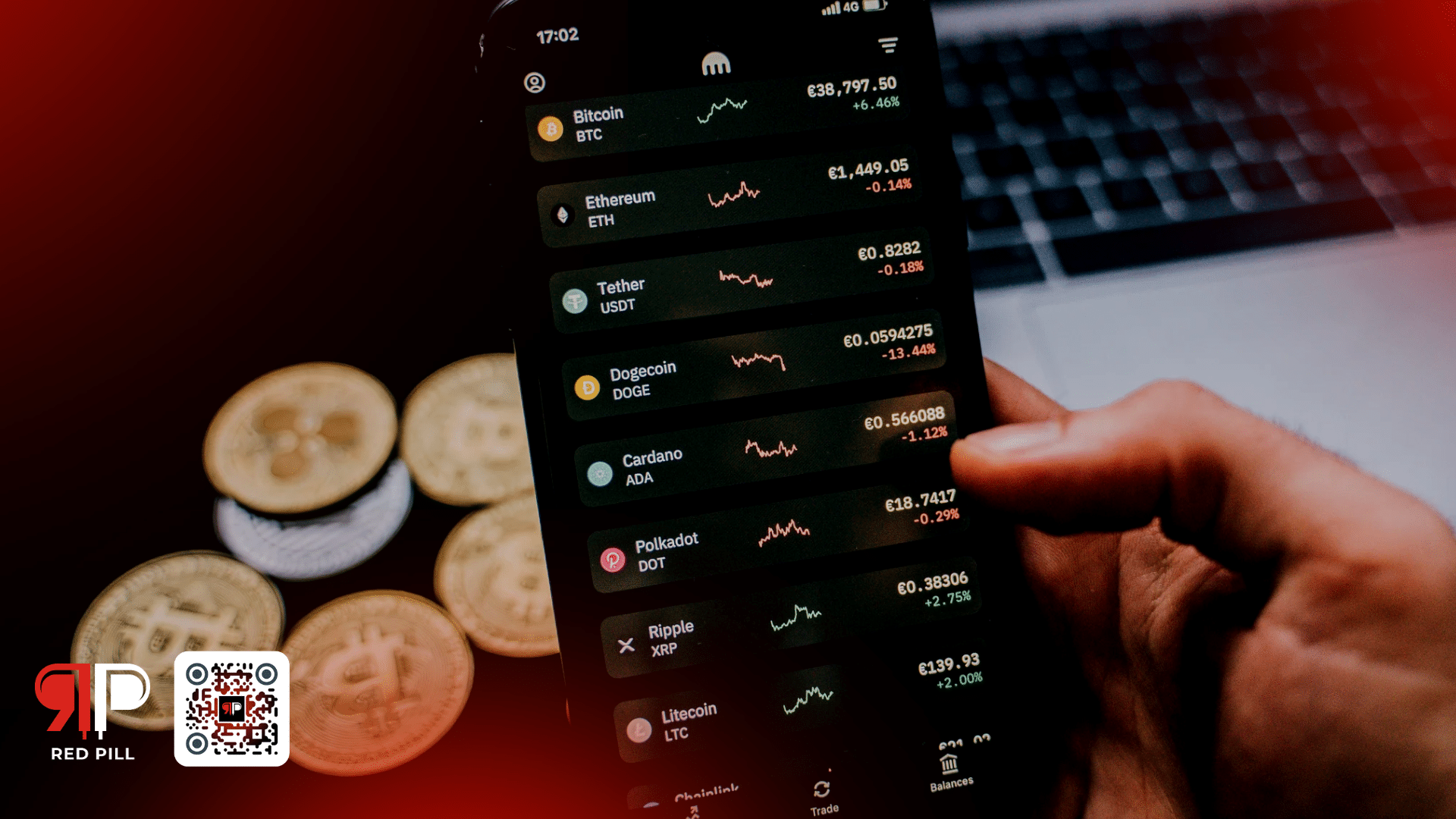

- Whales impact supply and demand. When they buy a lot, Bitcoin becomes limited, driving the price up. However, significant sales increase supply, pushing the price down.

- Special tools analyze the public Bitcoin blockchain to identify whale transactions.

- Dramatic price jumps or plunges could indicate a whale buying or selling a large amount.

What are Bitcoin Whales?

Bitcoin whales are the big money players in the cryptocurrency world. These individuals or organizations hold massive amounts of Bitcoin, giving them the power to swing Bitcoin’s price with their trades significantly. They’re called whales because of their substantial holdings compared to smaller investors.

These whales accumulate Bitcoin through various means, like early mining or smart investments. Their large buys and sells create noticeable price movements, making them a force to be feared in the volatile crypto market.

Why do Bitcoin Whales Influence the Market?

Bitcoin whales are like financial giants in the crypto world. They hold a large amount of Bitcoin, giving them the power to move the price. Here’s why:

- Supply and Demand: When whales buy a lot of Bitcoin, it creates scarcity, driving the price up. But, if they sell a lot, it increases supply, pushing the price down.

- Market Movers: Their large trades are like spotlights in the market. Other investors watch what whales do and follow suit, causing price swings.

- Whale Watching: Some whales are well-known, and their activity is closely tracked. This anticipation of their moves can influence the market even before they buy or sell.

In short, whales have so much Bitcoin that their actions can impact supply and demand, causing major price fluctuations.

Spotting the Bitcoin Whales

While whales try to hide their tracks with tricks, there are ways to spot them:

- Blockchain Analysis: The public nature of Bitcoin’s blockchain allows us to track large transactions. Special tools and deep analysis can reveal whale activity.

- Whale Watching Services: Platforms track known whale addresses, helping investors see when these big players are on the move.

- Sudden Price Swings: When Bitcoin prices jump or plunge dramatically, it could signify a whale buying or selling a large amount.

By combining these methods, investors can get clues about whale activity and make more informed decisions. However, keep in mind that perfectly predicting whale movements is very difficult.

What Trading Strategies Do Bitcoin Whales Use?

Bitcoin whales are like market movers, and their moves cause ripples. Here’s how they play:

- Pump & Dump: This sneaky tactic involves buying a lot of Bitcoin to increase the price (the pump). Then, they sell for a profit, leaving others holding the bag when the price crashes (the dump).

- Stacking Sats: Whales are patient. They strategically buy Bitcoin during dips, slowly building their holdings at potentially lower prices over time.

- Hodling for Gold: Whales believe Bitcoin’s value will rise in the long run, so they hold onto it like digital gold.

- Spreading the Love: Some whales hold diversified portfolios by investing in other cryptos and not putting all their eggs in one basket.

- Playing Both Sides: Whales can be both optimistic and pessimistic. If they think the price will fall, they might short-sell Bitcoin to drive it down further. On the other side, they might strategically buy over time to create buying pressure and push the price up.

- Liquidity targeting: This tactic involves manipulating the price to trigger other traders’ “stop-loss” orders, allowing whales to buy Bitcoin at a discount before the price bounces back.

Final Thoughts

Big Bitcoin holders, called whales, can cause price swings with their trades. You can spot them by tracking the blockchain, following whale watchers, and looking for big price changes.

However, predicting their moves is tough. Do your own research before investing and learn to navigate the market alongside the whales, not just copy them.