Key Takeaways

- BTC has seen a market crash of over 12% since May 22, as the price eyes a potential key support zone of $96,000 to $95,000.

- Bitcoin’s price crash below $100,000 sparks market uncertainty for altcoins.

- Crypto experts and analysts share worrying concerns in the Bitcoin bull market as demand fails to correlate with price.

Bitcoin’s (BTC) price crashed below $100,000 for the first time in 44 days after seeing its price rally in previous weeks from a low of $74,000 as its price rallied towards a new all-time high of $111,800.

Following such a strong price rally, the price of BTC has traded within a price range for the large part of June, raising many price uncertainties for altcoins and prompting traders to question the abnormalities associated with the current price rally for BTC, which has left altcoins struggling to catch up.

Another key influence on the recent BTC price crash has been the Israeli-Iranian conflict, which has sparked considerable tension in recent weeks. The U.S. involvement in the mix has raised concerns for the financial market in the coming days.

These uncertainties, coupled with prices struggling over the last few weeks, have sparked some price speculation about a potential price crash to $96,000 or lower. Let’s discuss what the market could do in the coming days.

Bitcoin Demand and Volume Abnormalities

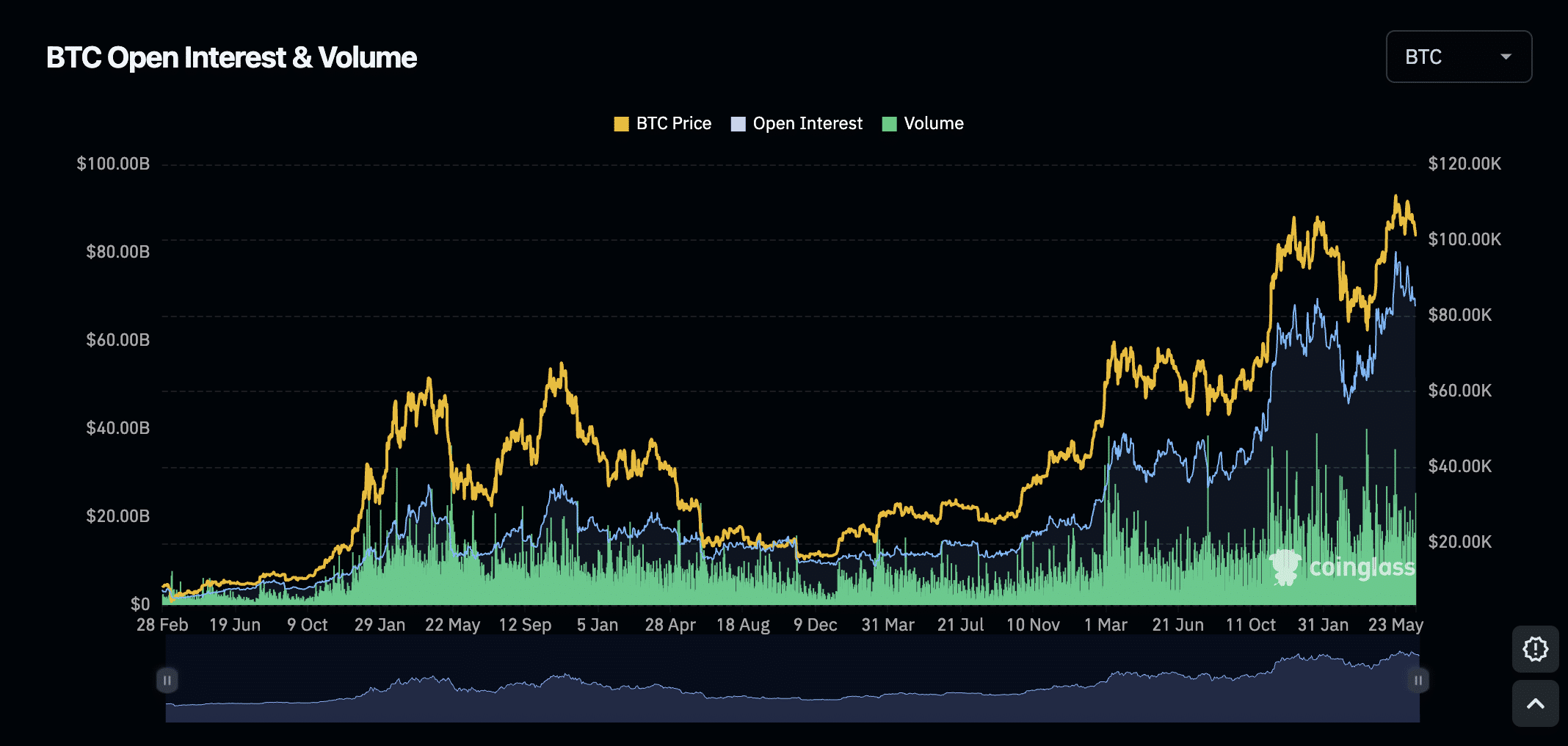

Source – BTC Volume and Open Interest From Coinglass

According to Coinglass data, while Bitcoin’s Open Interest and volume experienced a significant rally towards the end of 2024, on-chain data indicates a notable decline across its price, open interest, and volume between January and May, with few fluctuations. Still, volume has dipped in the last few weeks, leading to a price crash following its all-time highs.

While this abnormality has persisted, the price of Bitcoin has remained strong, trading above $100,000, as crypto experts and analysts raised concerns that these patterns do not align with previous bull cycles from historical data.

Additionally, crypto experts at KongBTC have also noted that demand for BTC has decreased over the past few months, resulting in different price actions. This is because institutional investors are not buying into Bitcoin, as demand in past bull cycles was typically accompanied by a strong bullish rally, but this is missing in recent times.

Bitcoin’s struggles in price continue, but the psychological support of $100,000 has held the price from crashing to a lower price point as bulls remain determined to protect this zone. Crypto experts share their predictions on where the price could be headed in the coming days or weeks.

BTC Price Analysis Ahead of the Week

BTC’s price has defended its position strongly, remaining above $100,000 for the last 44 days, forming a strong bottom around $74,000. The price has demonstrated strong momentum towards new all-time highs.

Despite such a price rally, BTC has failed to meet market expectations over the last couple of weeks, trading within a range. Although the market sentiment remains bullish, the price has struggled to create new highs following a recent price crash below $100,000.

Following the price breaking below its key support, the price of BTC could potentially decline towards $96,000, where smart money liquidity is waiting to fill up long positions before a potential price rally to the upside.

Investors and traders would wait patiently for the BTC price to determine the exact direction before making an investment decision.