Let’s examine the insights shared by our Technical Analyst at UseTheBitcoin as he walks us through his personal trading approach and observations on the crypto market.

Bitcoin Buying Opportunity?

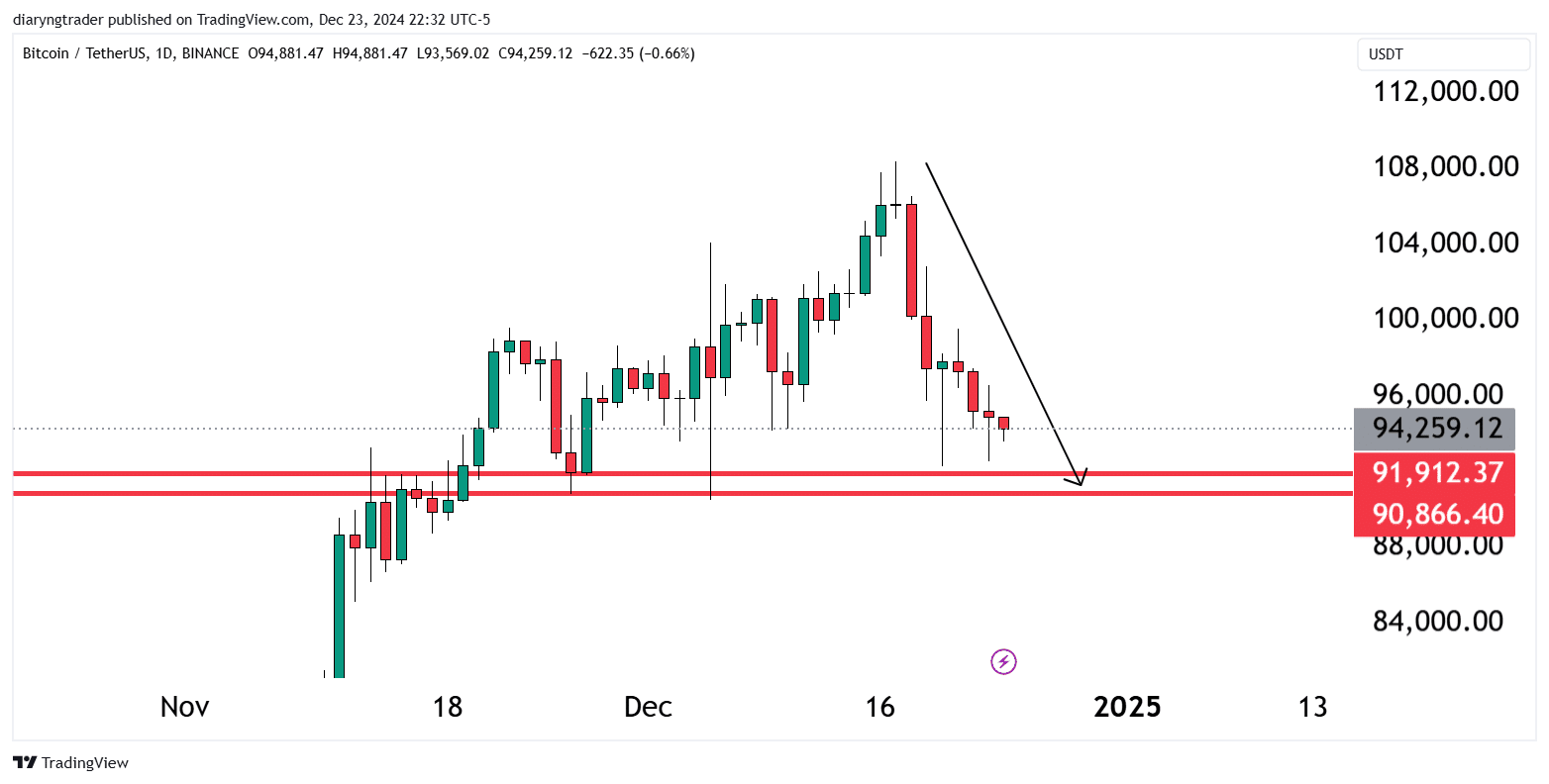

Prepare your cash, as Bitcoin shows the possibility of a retracement to the $91,000 to $90,000 range. Bitcoin’s price action remains sluggish, and there are still no signs of recovery. The market momentum continues to be slow, and we aren’t hearing any fundamental news or developments that could increase the price. This leaves many traders cautious about making any aggressive moves. With that said, the best course of action now is to prepare your cash for deeper corrections and position yourself for potential buying opportunities.

Bitcoin RSI Warns of Weak Market Drive

If you’re monitoring Bitcoin’s technical indicators, you’ll notice that its Relative Strength Index (RSI) is still below the median line. This indicates a weaker market drive and slow momentum, which aligns with the current lack of bullish sentiment. RSI is a critical tool for understanding the strength or weakness of a market, and its current levels suggest that Bitcoin is still in a consolidation phase. While this isn’t necessarily bad, it does mean that patience is essential for traders and investors alike.

Looking at Bitcoin’s moving averages, the price is currently sitting near the 50-day Moving Average (50MA). However, the market hasn’t yet shown any strong signs of support at this level. Typically, a green candle closing above the 50MA would signal buyers stepping in, creating a support zone and potentially reversing the trend. Without this confirmation, the market remains in a waiting zone, and it’s better to avoid entering until we see stronger evidence of support or a breakout.

This period might feel stagnant or frustrating for those actively watching the market. However, it’s important to remember that the best opportunities often come to those who wait. Rather than rushing into trades during uncertain times, use this period to prepare and strategize. Focus on learning new trading techniques, studying the market, or improving technical analysis skills. The more knowledge and preparation you have, the better positioned you’ll be to act when the market finally moves.

This is also an excellent time to reflect on your overall trading approach. Are you sticking to your trading plan? Do you have proper risk management strategies in place? These are essential questions to ask yourself during quiet periods in the market. A solid plan ensures you don’t get caught off guard when volatility reoccurs.

On a more personal note, the holidays are here, and this might be the perfect time to step back from the charts and enjoy some quality time with your loved ones. Trading can be intense, and taking a break during periods of low activity can help you recharge and return with a fresh perspective. The crypto market will always be here, but moments with family and friends are priceless.

Final Thoughts

As we wait for more precise signals from Bitcoin, we must remain disciplined and prepared. Keep an eye on the $91,000 to $90,000 range; it could present a valuable buying opportunity. Ensure your cash reserves are ready, but don’t forget to take care of yourself during this time. Enjoy the holidays, learn, and prepare for the exciting opportunities 2024 may bring. Merry Christmas, and here’s to a prosperous year for all crypto enthusiasts!

For more in-depth technical analysis like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!