Let’s examine the insights shared by our Technical Analyst at UseTheBitcoin as he walks us through his personal trading approach and observations on the crypto market.

Bitcoin (BTC) Market Update

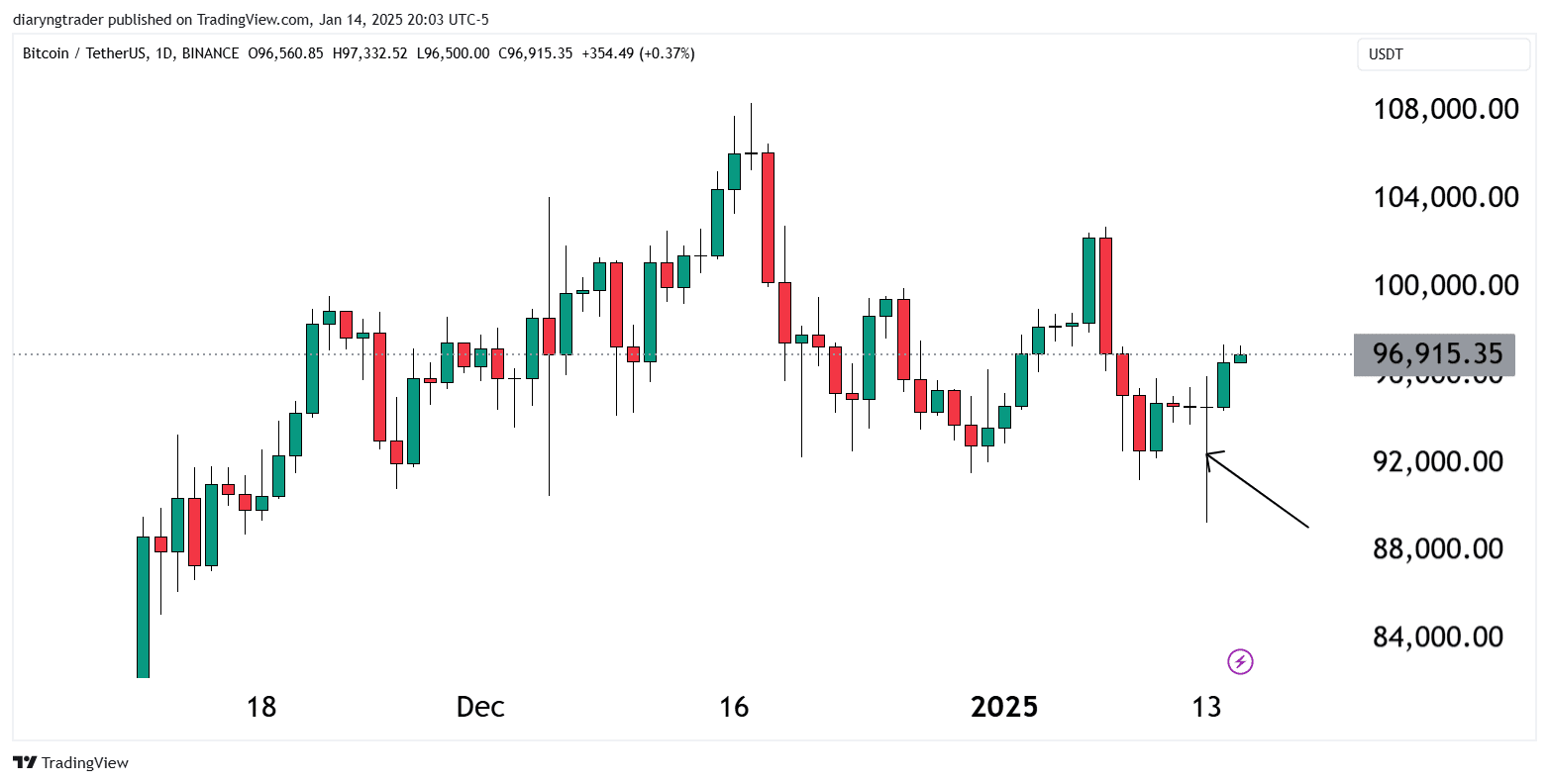

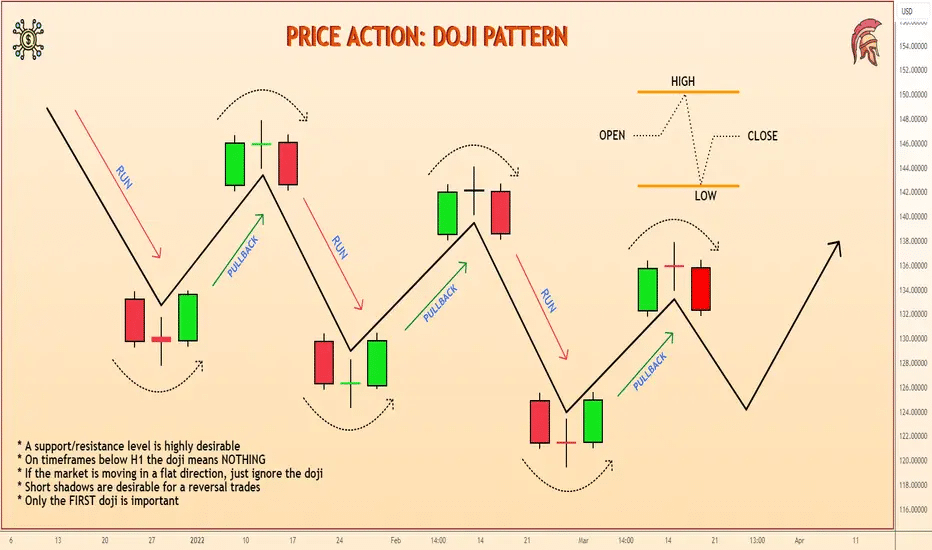

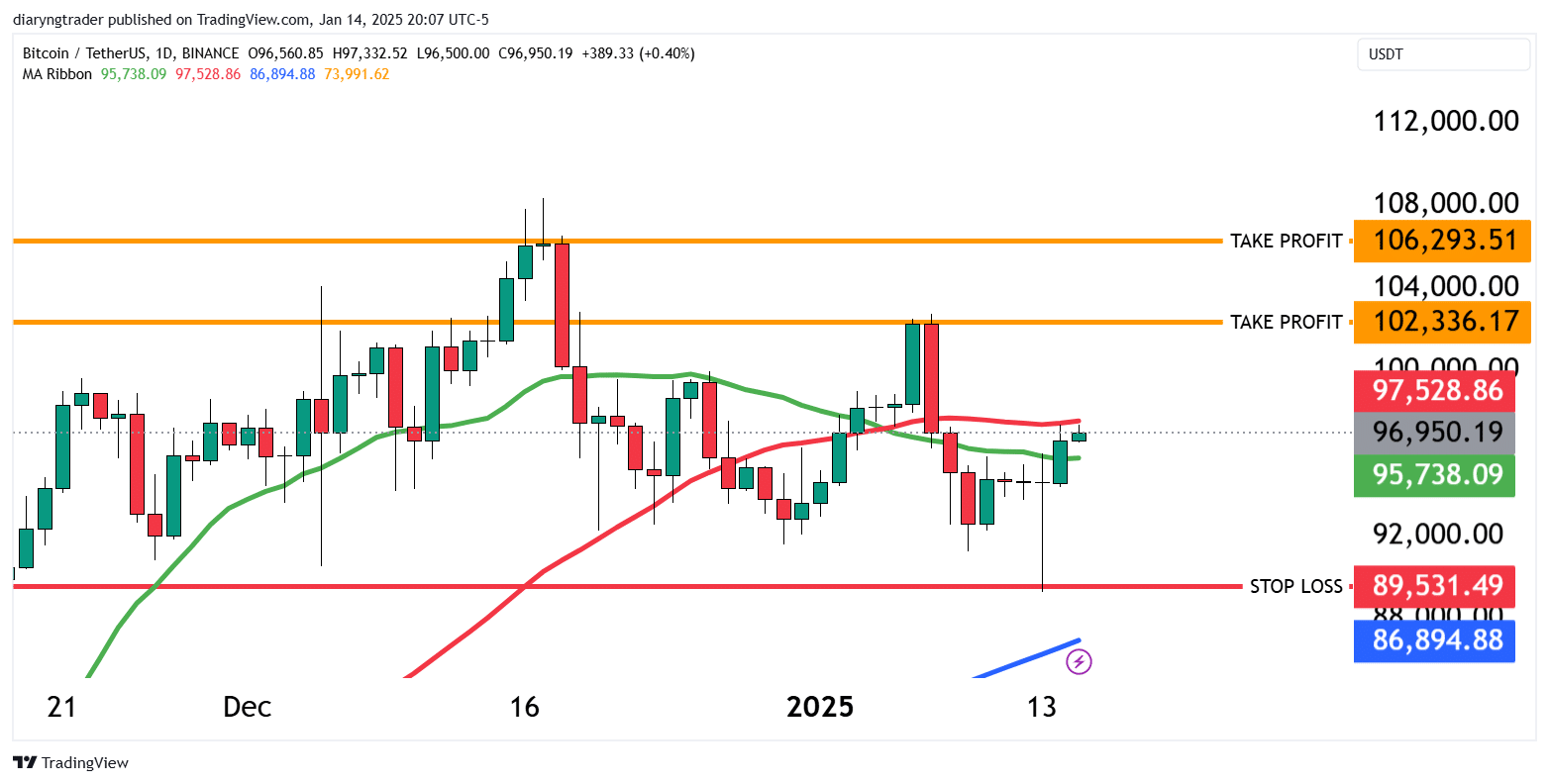

The candle you are observing on the Bitcoin chart is known as a Doji candle. By definition, this type of candle often signifies a potential reversal in market trends. While not a guarantee, it’s widely recognized as an indicator of indecision in the market, where neither buyers nor sellers have a clear advantage.

Over the past few days, Bitcoin has been in a steady downward movement, reflecting bearish momentum. However, the appearance of this Doji candle could signal a potential shift in direction. This candle often serves as a precursor to a trend reversal, and its implications shouldn’t be overlooked.

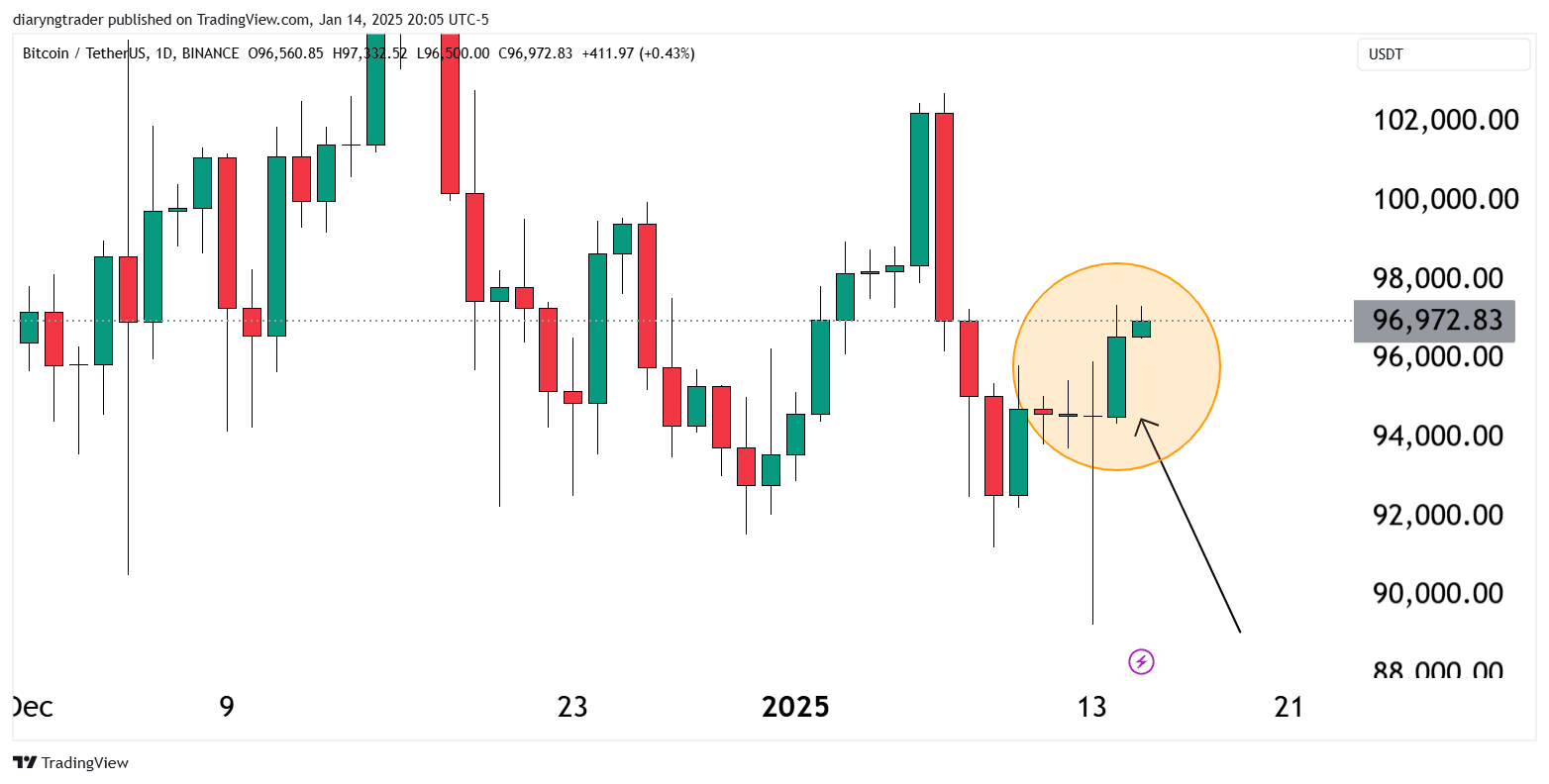

The Importance Of The Next Candle

The trading candle that follows the Doji is absolutely critical, as it serves as the confirmation candle. In this case, the subsequent candle closed with a strong green body, which could confirm the start of an upward trend. The size and direction of this green candle indicate renewed buying pressure, potentially marking a shift in market sentiment. This movement could be influenced by external factors as well, such as recent news events like Trump’s inauguration, which might have impacted market confidence.

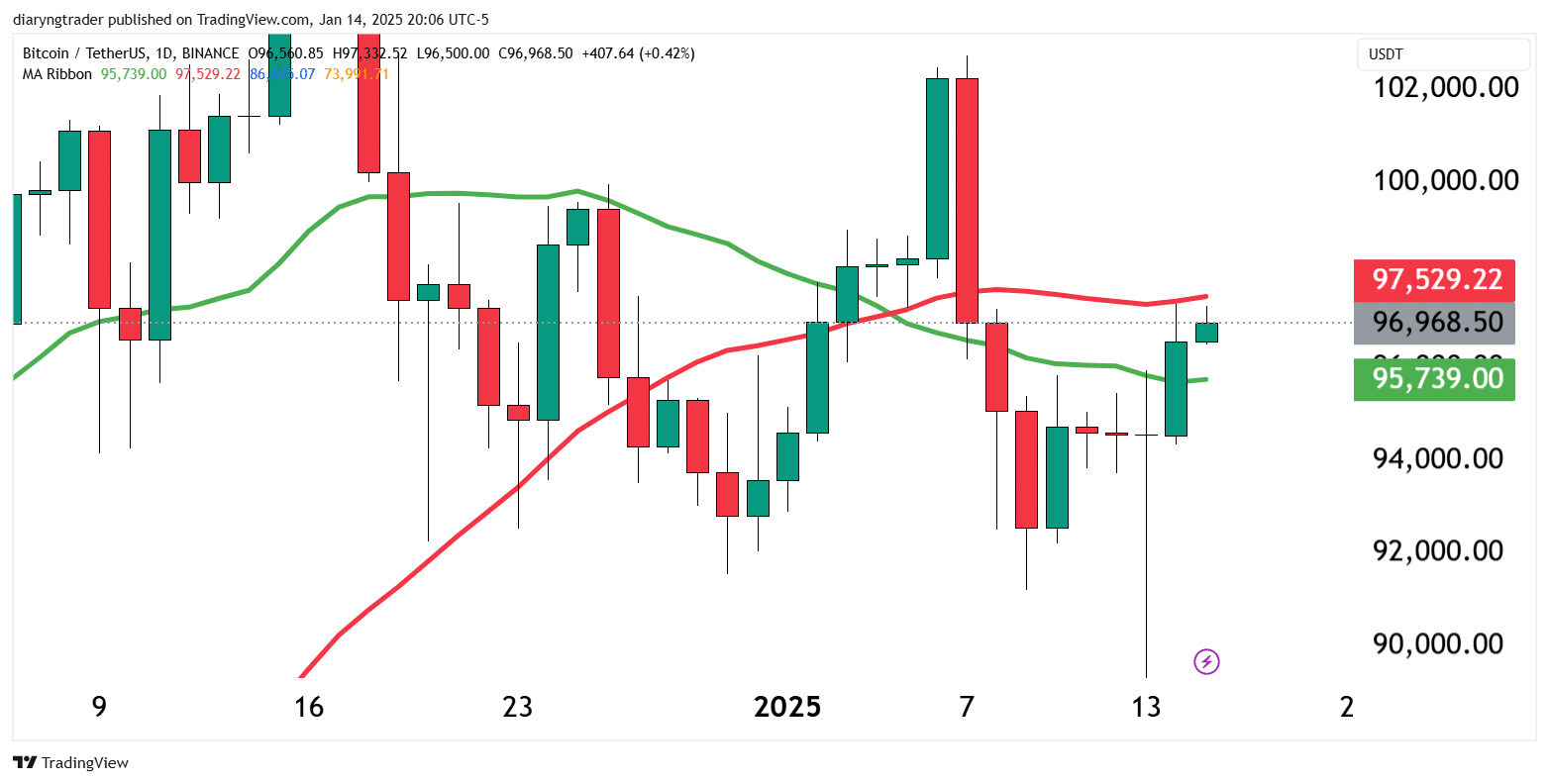

Moving Averages As A Reversal Signal

Another key indicator supporting a potential reversal is the behavior of the moving averages. If you look closely, Bitcoin has managed to break above the 20-day moving average, represented here by the green line. This breakout is significant because moving averages often act as dynamic support and resistance levels. A break above these levels suggests a shift from bearish to bullish momentum. The 20-day moving average, being relatively short-term, is susceptible to recent price action, making this breakout an encouraging sign for bullish traders.

If Bitcoin can sustain its position above this level, it strengthens the case for an uptrend bias. However, a failure to hold above the moving average could invalidate this bullish signal, so it’s important to monitor upcoming candles closely.

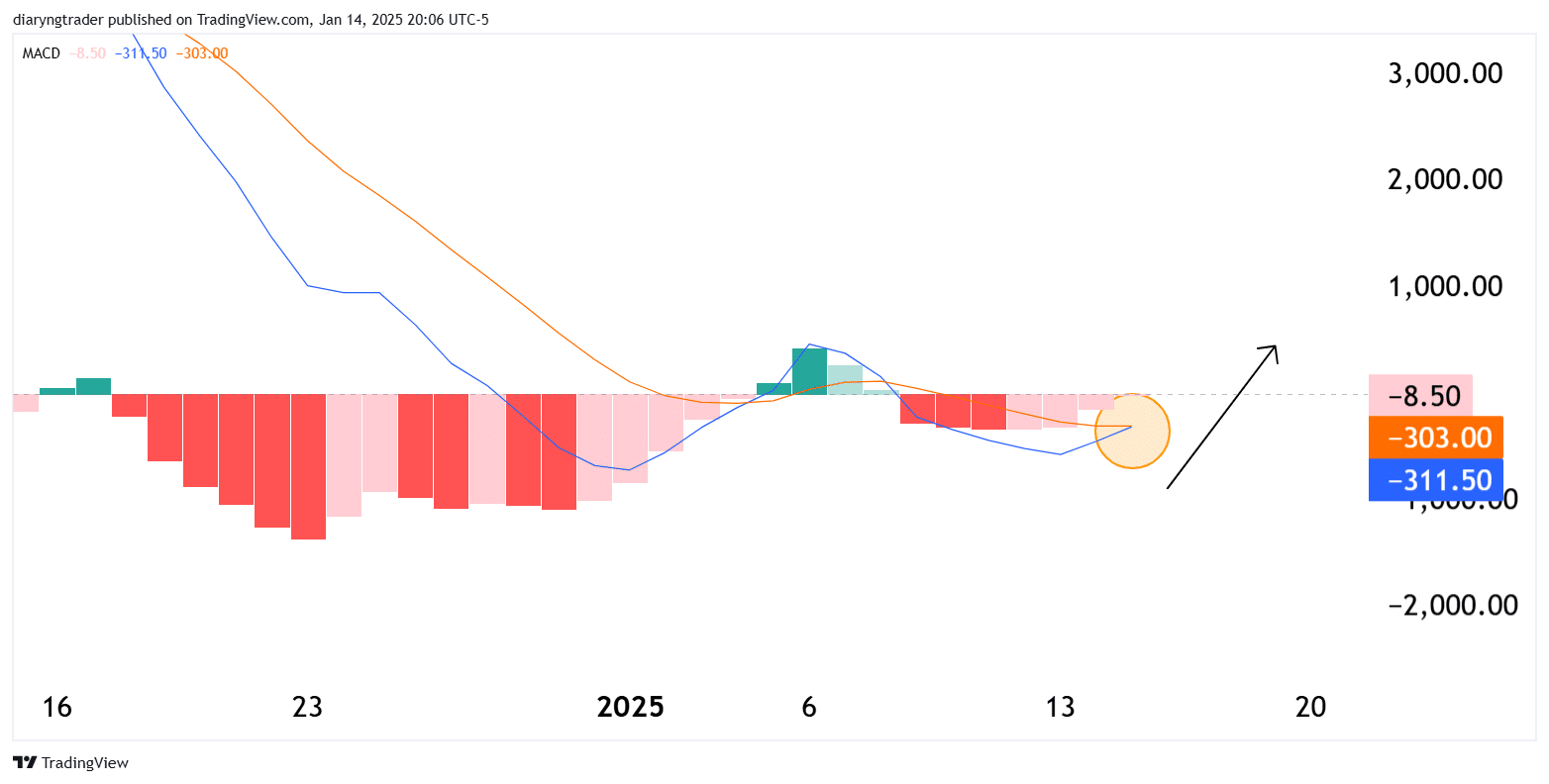

MACD Indicator: Momentum Shifting?

Another powerful tool in our analysis is the MACD (Moving Average Convergence Divergence). At present, the MACD histogram remains in the red zone, indicating negative momentum. However, closer inspection reveals a potential crossover forming between the blue line (MACD line) and orange lines (signal lines). If the blue line crosses above the orange, it would be a bullish signal, suggesting that momentum is beginning to shift in favor of buyers.

In addition, if the MACD lines continue to rise, they could eventually enter the positive momentum zone. This transition from negative to positive momentum further validates the potential for an uptrend. However, traders should exercise caution until the crossover is fully confirmed, as premature assumptions can lead to false signals.

Balancing Optimism With Risk Management

While the Doji candle, moving averages, and MACD crossover point toward a possible upward trend, it’s essential to remember that no technical indicator or pattern offers a 100% guarantee of future price movements. Countless factors, including economic events, regulatory news, and shifts in trader sentiment, influence the market.

For this reason, risk management should always be your top priority. Never trade with more capital than you are willing to lose, and always use a stop-loss to protect your investment from unexpected market reversals. A stop-loss can help minimize losses if the market moves against your position, ensuring you live to trade another day.

Final Thoughts

In summary, the Doji candle, the breakout above the 20-day moving average, and the potential MACD crossover are all compelling signals of a possible bullish reversal in Bitcoin’s price. However, the subsequent few trading sessions will be crucial in confirming this bias. As always, approach the market cautiously, trade responsibly, and stay informed.

For more in-depth technical analysis like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!

Additionally, join our Telegram community to discuss the latest market trends, share insights, and get real-time updates from experienced traders. Don’t miss the chance to be part of the conversation!