Key Takeaways

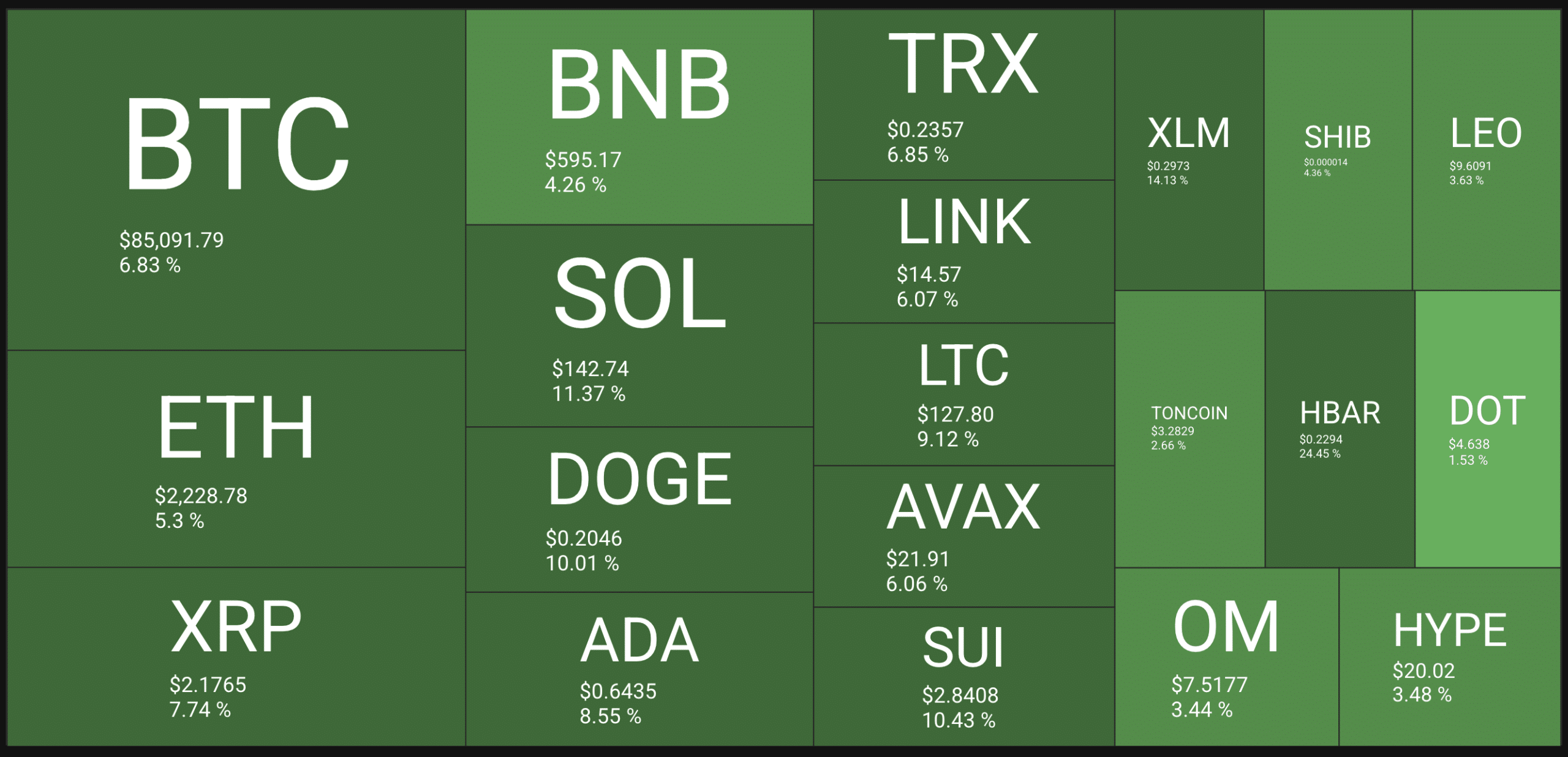

- Bitcoin’s (BTC) price tanks towards $77,000 following Trump’s tariff hikes on US trade partners.

- BTC’s price crash towards $77,000 affected the general crypto market as altcoins struggled to hold above key support zones.

- Weekly and monthly price action for BTC will play a key part in the overall market trend for March 2025.

The past few weeks for Bitcoin (BTC) and altcoins were filled with extreme price volatility to the downside as BTC’s price plummeted from a high of $96,000 to a region of $78,000, creating price uncertainty and fear in the hearts of many investors and traders.

This has resulted in low volume across the crypto space as on-chain data suggests huge outflows of BTC spot ETF, impacting the price of Bitcoin (BTC) and the general crypto market. The current market downturn has affected the market, with many altcoins trading around key support while others remain in a downtrend.

Bitcoin’s monthly and weekly close will play a crucial role in the overall market trend in the coming weeks. Speculation suggests BTC’s price could retrace towards $75,000 to $70,000 before a possible price rally to the upside.

Current Market Update

Source – BTC 1D Market Update

The leading cryptocurrency saw new highs following Trump’s US election win but has faced significant market struggles recently. On several occasions, the price of BTC failed to rally above $100,000, acting as strong resistance for the price, leading to another market crash towards $96,000.

The news of Trump’s policies concerning imposing tariffs on US trade partners has sparked more uncertainty in the past few weeks, leading to a market crash from a high of $96,000 to $77,000 as many crypto altcoins were affected.

The price of BTC closed around $84,000 for the first time in months since October of 2024, as the price continues to look increasingly bearish ahead of a new week. If BTC continues with its price action, there is a high chance of the price hitting $70,000 to $75,000.

Bitcoin Technical Analysis Ahead Of New Week

Source – BTC 1D Chart From TradingView

The price of BTC closed above $84,000 after a crash in earlier weeks. A minor bounce towards $87,000 acted as resistance for the price, which continues to look bearish on the weekly and monthly timeframes.

BTC’s price trading below its daily 50-day and 200-day EMAs (Exponential Moving Averages) worries many traders and investors who are closely watching BTC before making further investment decisions.

With a weekly close for BTC, the price would be looking at trading into a key demand zone of $75,000 before a further price rally to the upside, maintaining its bullish price structure.

Key BTC Support Zone – $75,000 – $70,000

Key BTC resistance Zone – $87,000