Key Takeaways

- HBAR spot ETF and bullish price action boost prices, as bulls aim to push them as high as $0.5 or $1.

- The crypto market and analysts share the same sentiment for HBAR’s strong buy signal, as the price could increase in the coming days.

- Crypto experts and analysts believe HBAR will be approved by the U.S. SEC in 2025 as an exchange-traded fund (ETF).

| Token Name | Hedera (HBAR) |

| Current Price | $0.31 |

| Market Capitalization | $11.78B |

| Total Circulating Supply | 32.82B HBAR |

| Daily Support | $0.29 |

| Weekly Support | $0.27 |

| 1 Year Performance | 252% |

Hedera Hashgraph (HBAR) has gained much attention, following its rally from late October 2024 to early December 2024, which saw a month of over 400% within a short time. Investors and traders look to add HBAR to their portfolio lists as it remains a promising token ahead of the crypto bull market, with a strong community backing this project.

Hedera Hashgraph (HBAR) in 2025 has seen much volume and volatility around its ecosystem as its price has gained much rally by over 13% in the last two weeks indicating its price could be gearing to rally more in the coming weeks or months as crypto analyst share same sentiment surrounding its price.

Let us discuss the HBAR technical analysis that has caught the attention of many traders and investors following a double breakout bullish continuation as the price of HBAR could rally to a high of $0.5, following suit in the rally of Cardano.

HBAR ETF Speculations

Canary Capital submitted an S-1 registration to the U.S. SEC (Security and Exchange Commission) to file for the approval of HBAR spot Exchange-traded fund (ETF), which will give investors in the U.S. exposure to trade this digital currency.

Canary Capital has developed a keen interest in HBAR, and its approval by the U.S. SEC would mean more bullish potential for HBAR and its ecosystem as this could have a more positive impact on its price, similar to what happened to Bitcoin.

Will HBAR be approved to be traded by investors as an HBAR spot ETF? It is still unknown. However, traders and crypto experts believe many crypto assets could get approval in 2025. Considering its use case and unique blockchain technology, HBAR would most likely be part of those assets.

HBAR Price Prediction 2025 – How Much Will Hedera Be Worth In 2025?

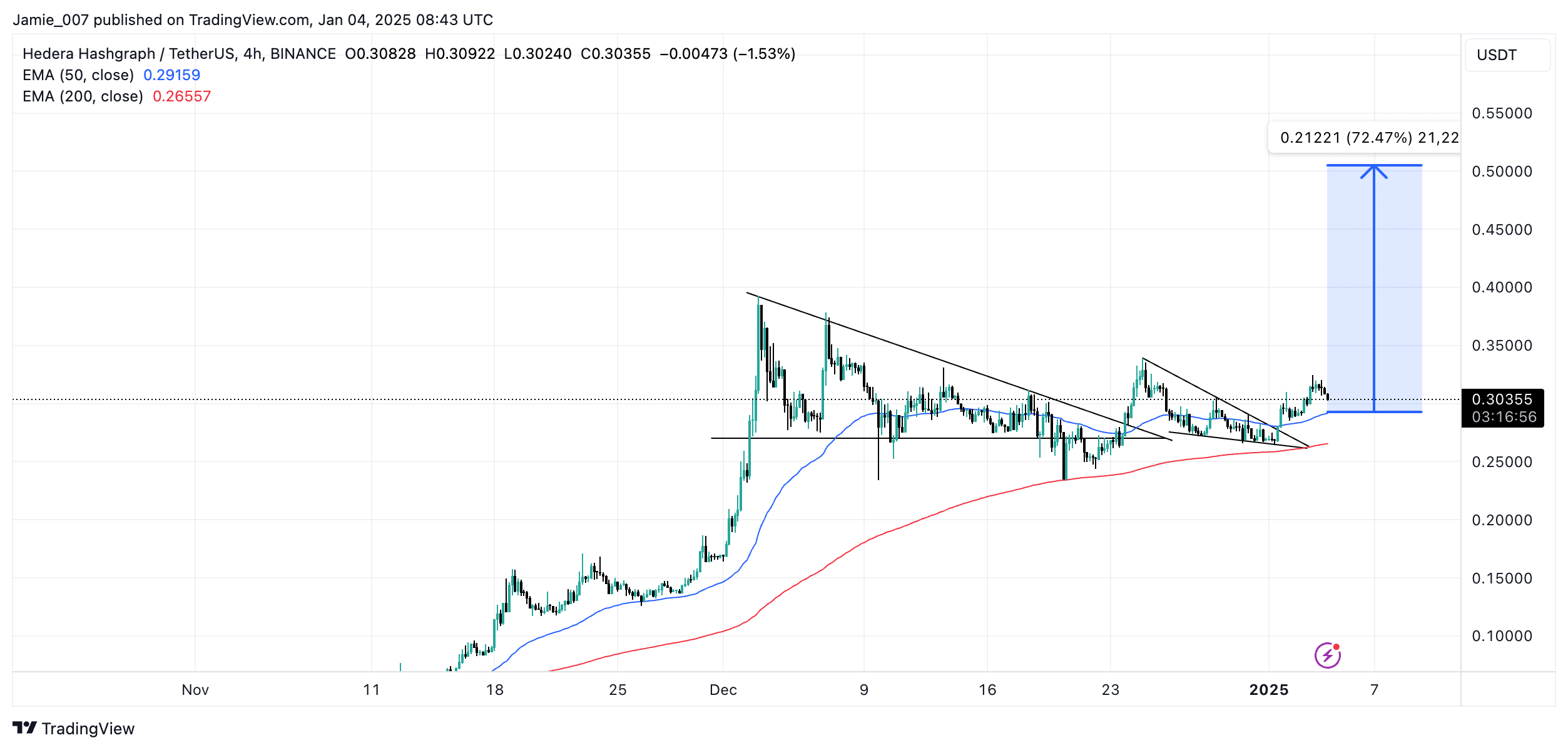

Source – HBAR Double Breakout Price Chart From TradingView

HBAR’s price action in November to December 2024 was a spectacle as the price of Hedera (HBAR) gave investors a run for their money, rallying over 500% within a few weeks from a region of $0.03 to a high of $0.35 before its price faced resistance from trending higher as the price of HBAR dropped to a region of $0.25.

Hedera’s price retracement to $0.25 was immediately bought up by whales and investors, as this undervalued crypto asset has demonstrated the strength of continuing an upward price trend in the coming months.

The price of HBAR has remained in a range for the past couple of weeks after it attempted to break out of its bullish ascending triangle but was faced with low volume to trend higher after a successful breakout. HBAR maintains its bullish structure, trading above its 50-day and 200-day EMAs.

HBAR faces minor resistance of $0.35, around its previous yearly high. A break and close above this resistance could see HBAR rally higher to a region of $0.5, as many crypto experts believe the price could aim for $1 before the end of 2025 and could move faster if the HBAR spot ETF gains approval.