A Bloomberg analyst sees a 95% probability of XRP securing an ETF spot in 2025. With legal hurdles receding and institutional interest increasing, XRP may be poised for a robust market presence. Recent inflows into XRP investment products signal growing confidence, and if momentum continues, the token may soon gain wider acceptance in the traditional finance sector.

XRP ETF Approval Likely in 2025, Says Bloomberg Analyst

In a recent X post from TheCryptoSquire, Bloomberg’s James Seyffart predicted a 95% chance of a Spot XRP ETF approval in 2025—a bold signal that XRP could soon join the ranks of Wall Street-traded digital assets. Ripple CEO Brad Garlinghouse added fuel to the excitement, stating that “institutional recognition for XRP has already begun.” With the SEC case nearly behind them, Ripple’s path appears more evident than ever, setting the stage for XRP to gain traction among traditional investors and potentially reshape its role in the broader financial system.

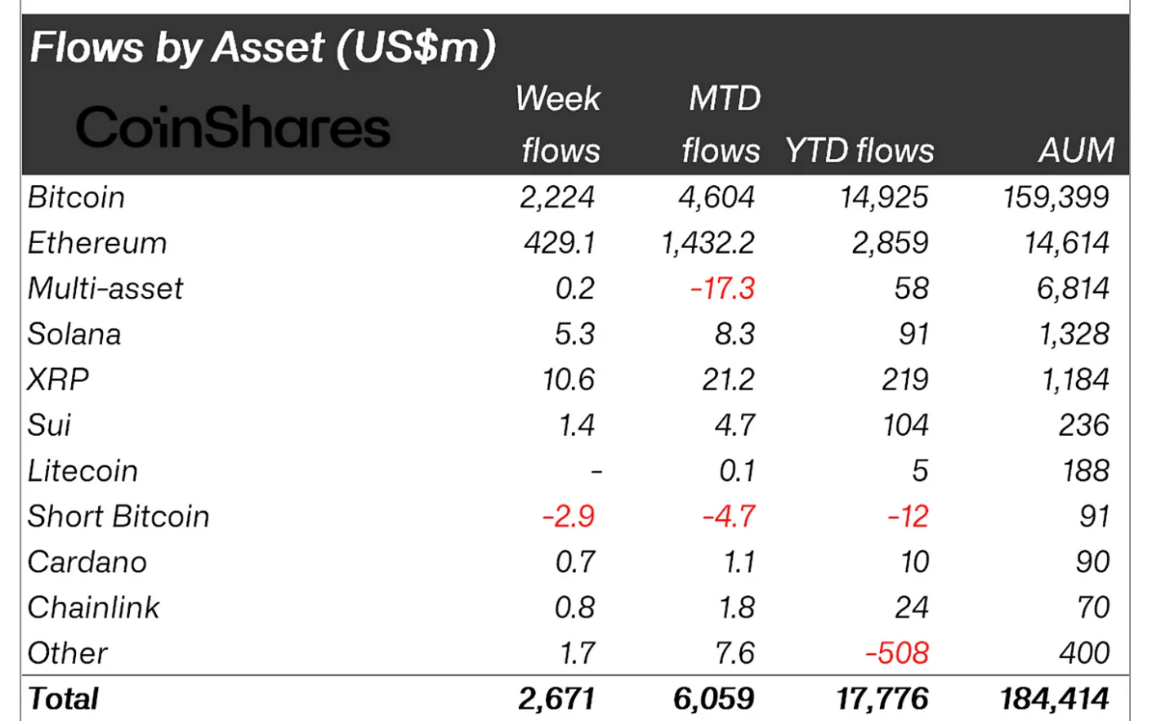

XRP Sees $10.6M Weekly Inflows

CoinShares’ latest Digital Asset Fund Flows report shows that XRP investment products saw $10.6 million in inflows over the past week, with month-to-date (MTD) inflows totaling $21.2 million. So far the cumulative inflows have reached $219 million, pushing XRP’s assets under management to around $1.18 billion.

The report highlights ongoing geopolitical instability and unclear monetary policy signals as key drivers of this consistent investor interest. Even as XRP struggles to break through price resistance, institutional investors appear to remain confident in the token’s long-term potential, as reflected in the sustained capital inflows.

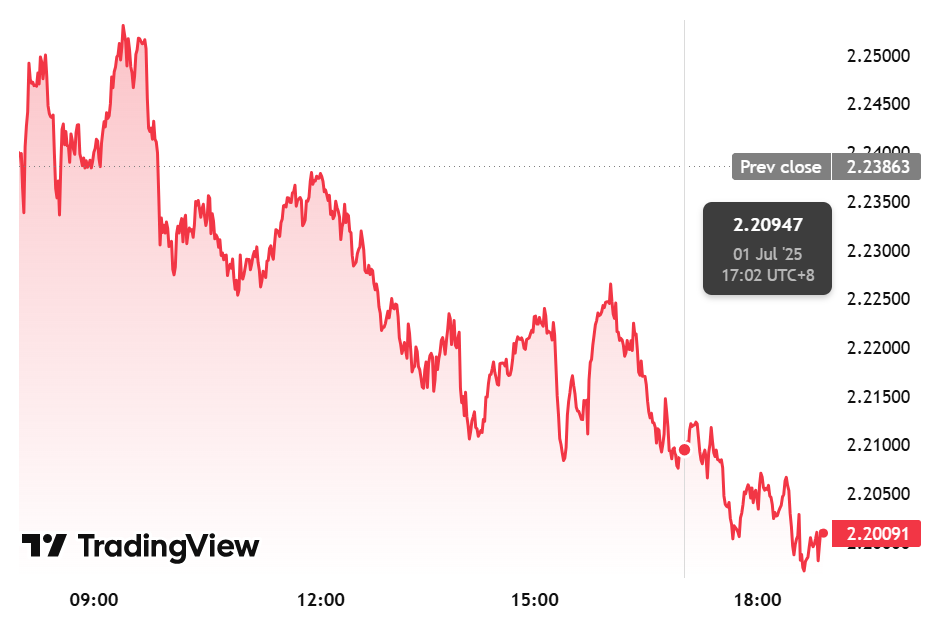

XRP Holds Steady at $2.20

At the time of writing, XRP is trading at $2.20, reflecting steady interest as optimism grows around the potential approval of a Spot XRP ETF in 2025. With Bloomberg’s James Seyffart giving a 95% chance of approval and Ripple’s legal troubles nearly resolved, market sentiment remains strong. Investors are closely monitoring XRP’s price action, anticipating that institutional demand could drive it even higher in the months ahead.

XRP Eyes Recovery After Key Support Test

If XRP dips below the $2.10 mark—its 200-day EMA—it could slide toward earlier support zones like $1.90 from June 22, and $1.80 or $1.61, both revisited in April. However, ongoing buying pressure may help cushion the fall, leading to a stabilization phase before another upward push. Should momentum return, a 7.44% rise from current levels may see XRP testing resistance at $2.33, with the potential to revisit June’s high of $2.65, representing a possible 22% climb.

Final Thoughts

XRP is gaining momentum as investor interest grows and the chance of a Spot ETF approval in 2025 reaches 95%, according to Bloomberg. With the SEC case nearly over and $10.6 million in weekly inflows, confidence in XRP’s long-term potential is rising. While price movement remains cautious at $2.20, strong support and growing institutional demand could propel XRP into a more significant role in mainstream finance.