Let’s examine the insights shared by our Technical Analyst at UseTheBitcoin as he walks us through his personal trading approach and observations on the crypto market.

Bitcoin Explodes To $97K! Next Stop $100K Or BLOODBATH Incoming?

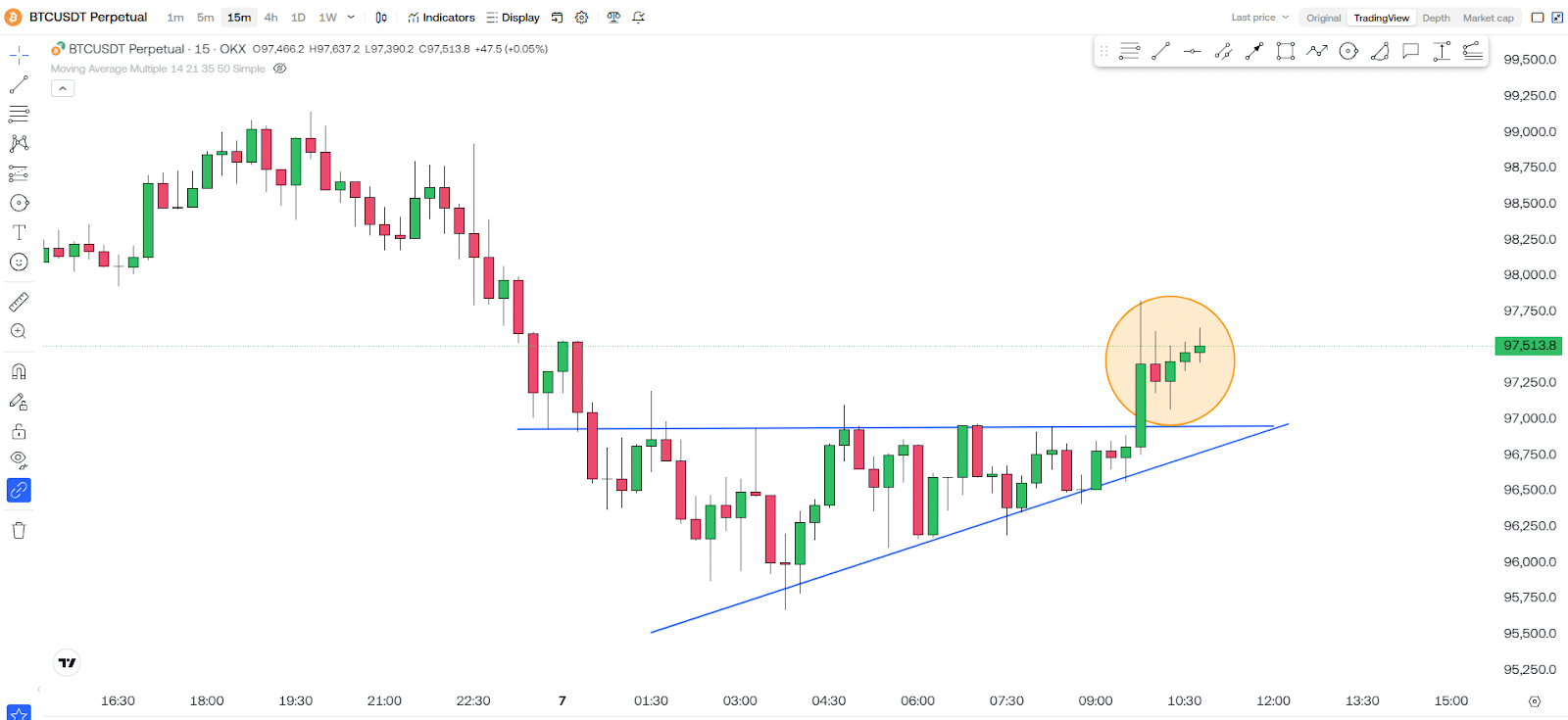

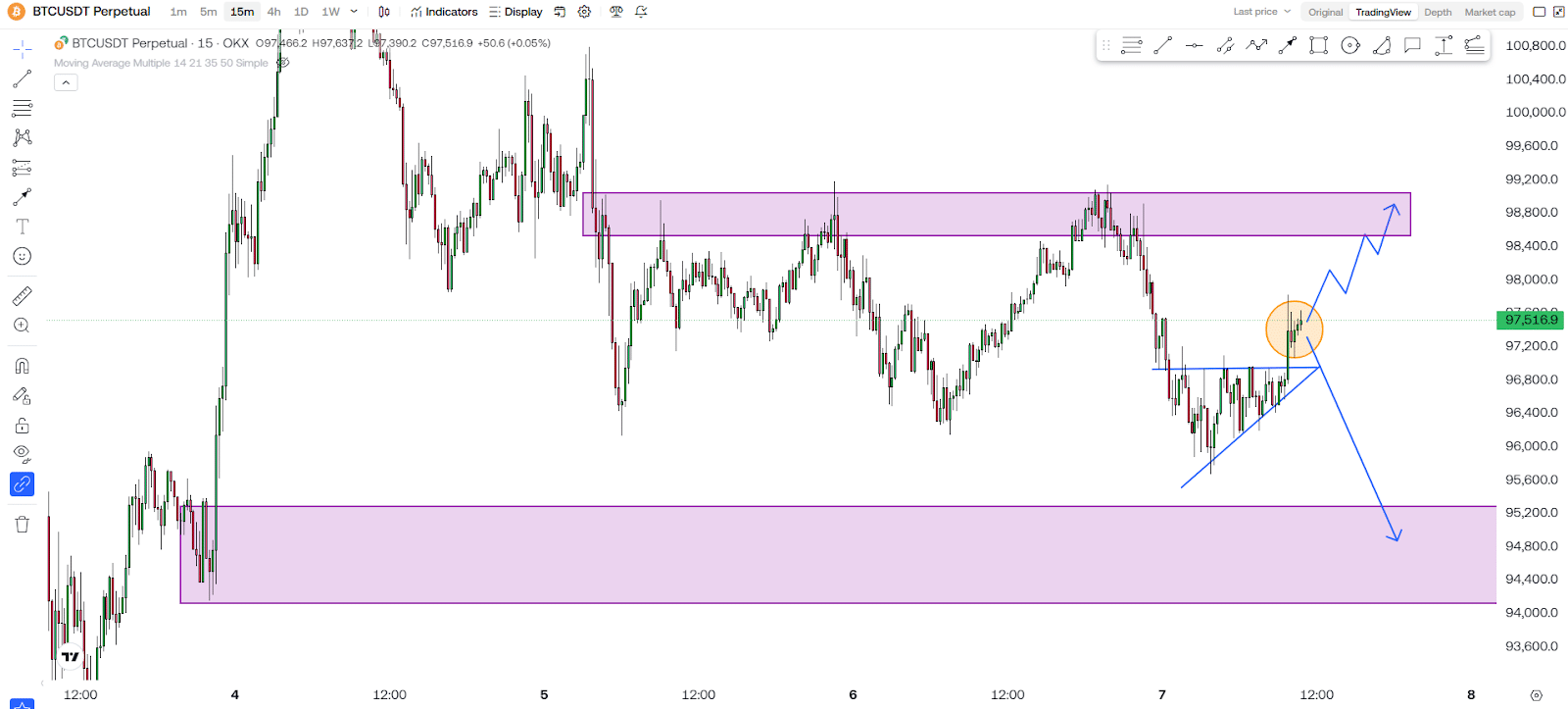

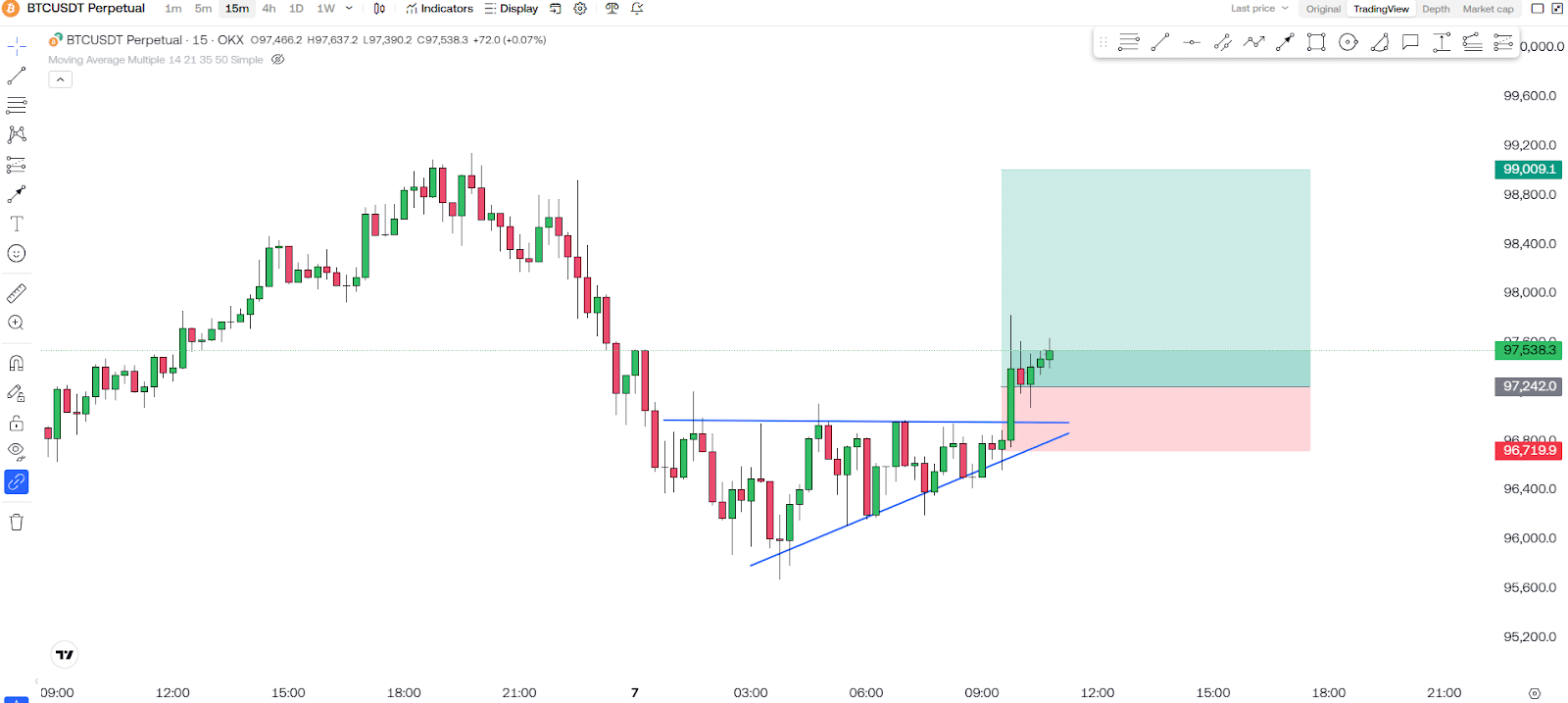

Bitcoin has successfully broken above the rising wedge pattern at the 15-minute timeframe and is currently trading at $97,000. Now, the crucial focus is whether Bitcoin can sustain this momentum for an uptrend move or if it risks turning into a false breakout. Maintaining its position above $96,000 is essential because a drop below this level could trigger a bloodbath in the market.

If Bitcoin continues this bullish momentum, we could see further gains, potentially reaching the 98K levels and beyond. Sustained buying pressure and strong volume confirmation would solidify the breakout, giving confidence to traders and investors. However, any weakness in momentum or lack of follow-through could raise concerns about a possible fake-out.

On the downside, if Bitcoin fails to hold above $96,000, the situation could quickly turn bearish. A drop below this critical level might trigger panic selling, pushing the price down to the next support zones at $95,000 and $94,000. This could result in increased volatility and a sharp decline, leading to significant losses for traders who entered during the breakout.

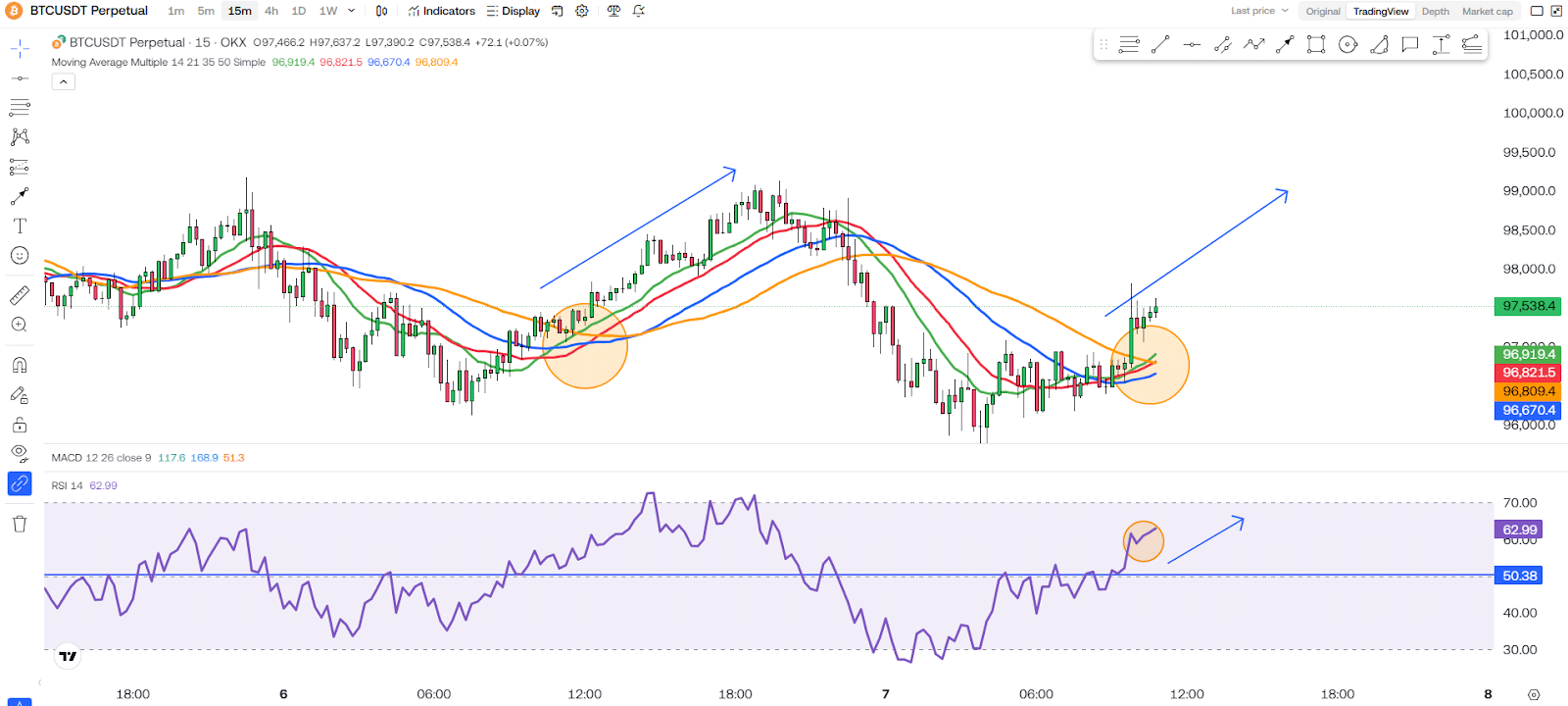

Looking at the moving averages, we can see they are still curling upwards, which suggests that the current uptrend could have more strength. The RSI is also moving above the median line, indicating that Bitcoin remains in buying momentum. These indicators provide a bullish outlook, but the market needs to confirm the breakout with sustained strength.

Despite the current bullish structure, traders should remain cautious. A single piece of negative news or an external catalyst could cause Bitcoin to retrace sharply. While technical indicators suggest an upward move, external factors such as macroeconomic events, regulatory updates, and institutional activities can heavily influence the market.

Risk management remains critical in this scenario. If you are considering entering a position in Bitcoin, setting a stop-loss below $96,000 is advisable to protect against potential downside risks. Proper risk management ensures that you minimize potential losses while still allowing room for potential gains.

Additionally, trading volume plays a vital role in confirming the breakout. If Bitcoin continues to climb with strong volume, it will reinforce the bullish trend. However, if the breakout lacks volume support, there is a higher probability of a false move, which could lead to price rejection and a quick reversal.

As always, broader market sentiment must also be monitored. Institutional involvement, macroeconomic trends, and overall investor sentiment can influence Bitcoin’s trajectory. Favorable news, such as large-scale Bitcoin adoption or bullish regulatory decisions, could propel the price further upward. Conversely, adverse developments could put downward pressure on Bitcoin, negating the breakout.

Final Thoughts

In conclusion, Bitcoin’s ability to hold above $96,000 is the key factor in determining whether this breakout leads to a continued uptrend or turns into a fake-out scenario. If Bitcoin maintains momentum and sustains its breakout with strong volume, we could see further bullish movement. However, if it falls below $96,000, the market could face a severe downturn. Stay cautious, manage your risks, and trade wisely.

For more in-depth technical analysis like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!

Additionally, join our Telegram community to discuss the latest market trends, share insights, and get real-time updates from experienced traders. Don’t miss the chance to be part of the conversation!