Let’s examine the insights shared by our Technical Analyst at UseTheBitcoin as he walks us through his personal trading approach and observations on Bitcoin (BTC).

Current Market Status

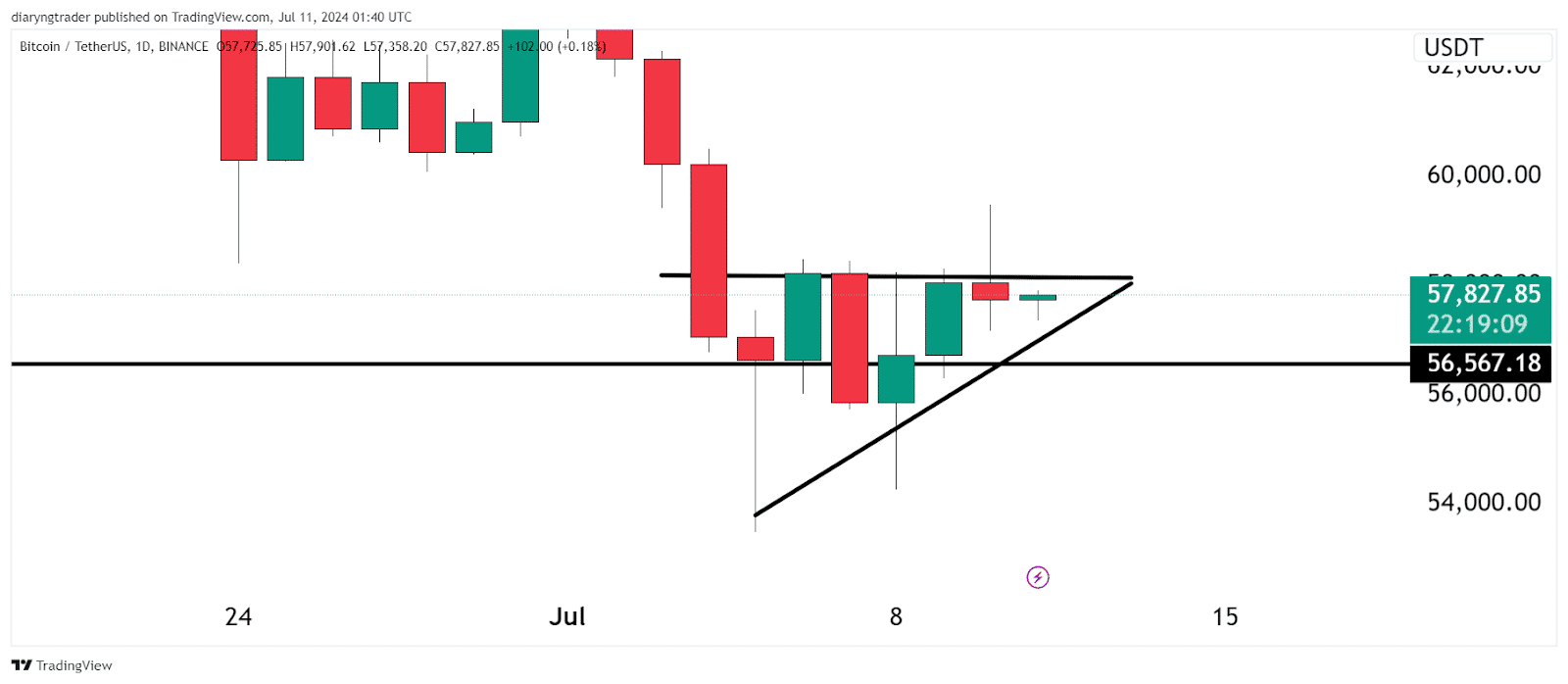

Bitcoin is trading above its support levels, yet the market is uncertain. The cryptocurrency is forming a rising wedge pattern, a bearish indicator suggesting potential downward movement. Recently, Bitcoin attempted to break through resistance levels but was rejected, dropping from $59,000 to $57,000. This rejection indicates strong selling pressure, a concerning sign for bullish investors.

Influencing Factors

Several external factors are contributing to the current market sentiment:

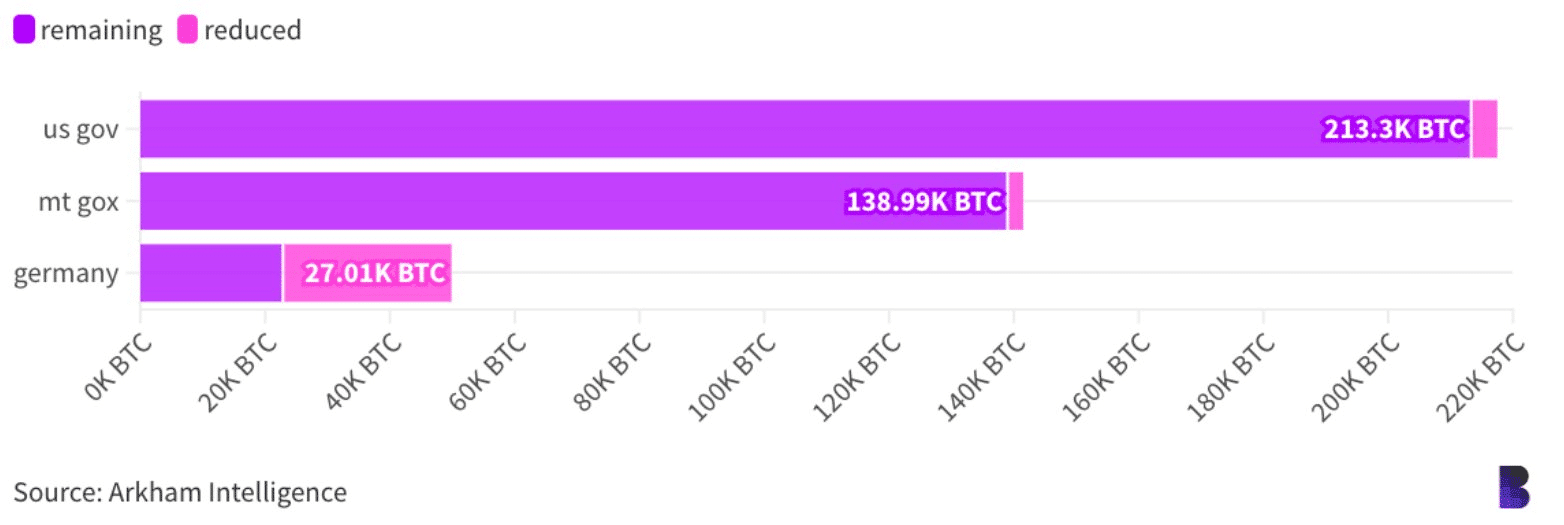

- Germany’s Bitcoin Sales – Germany is halfway through selling its Bitcoin holdings. This large-scale liquidation has already put downward pressure on the market, and continuing these sales could exacerbate this trend.

- Mt. Gox Creditor Distributions – Mt. Gox, a defunct cryptocurrency exchange, still holds a significant amount of Bitcoin, estimated to be five times more than Germany is selling. The distribution of these assets to creditors could flood the market with additional Bitcoin, further driving prices down.

Strategy

In light of these factors, it’s recommended to adopt a cautious approach:

- Observation over action – Consider observing the market closely rather than actively trading. The current conditions suggest volatility and premature trading could lead to significant losses.

- Preparing for a rebound – Keep an eye on the $51,000 to $52,000 range, which might serve as the next significant support level. If the market rebounds from this point, this could present a buying opportunity.

Final Thoughts

While the allure of trading Bitcoin can be strong, especially given its recent volatility, sometimes the best strategy is to refrain from trading until more precise signals emerge. Non-trading is a valid strategy that can protect your capital in uncertain times. Stay informed, be patient, and prepare for potential opportunities at lower support levels.

For more in-depth technical analysis like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!