Let’s examine the insights shared by our Technical Analyst at UseTheBitcoin as he walks us through his personal trading approach and observations on the crypto market.

Is PNUT Ready To Shine Again?

PNUT was once at the center of attention, reaching a peak of over $2. However, its price quickly plummeted, and at the time of recording, it is now trading at just $0.16. The question now is: Can PNUT reclaim its former glory, or is it destined to remain stagnant?

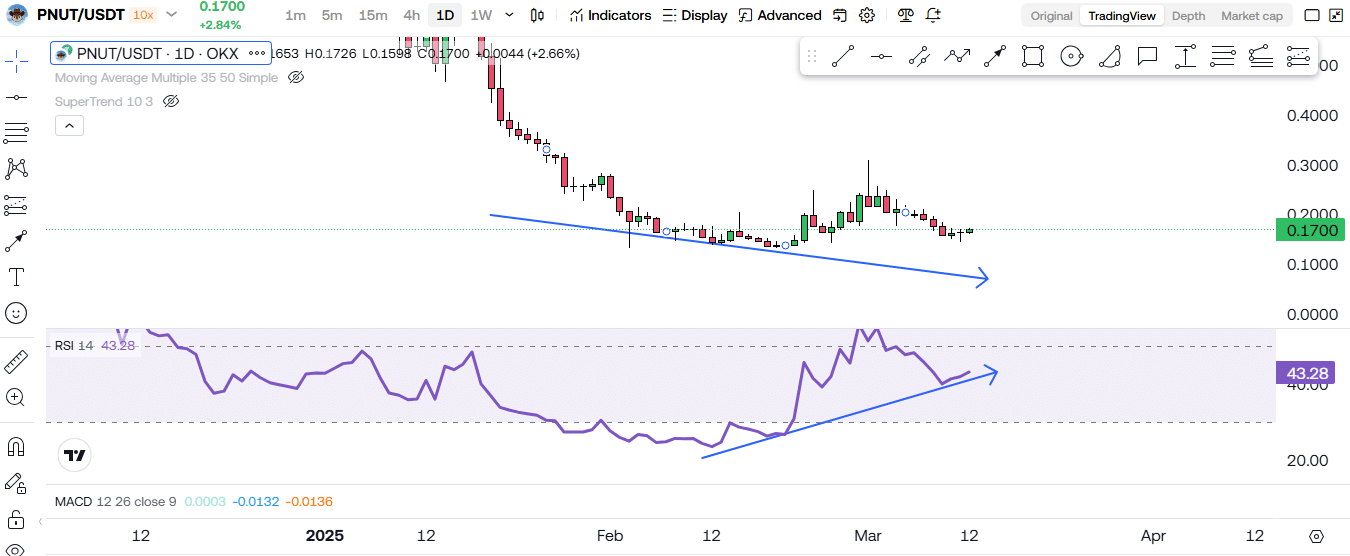

For the past several months, PNUT has been relatively flat, with minimal price movement. But if we take a closer look at its Relative Strength Index (RSI), we can see something interesting happening. The RSI is slowly creeping upwards, hinting at the possibility of a bullish divergence.

A bullish divergence occurs when the price of an asset is going down or moving sideways while the RSI is trending upwards. This suggests that the selling pressure is weakening, and a shift in momentum could be on the horizon. If this pattern plays out, PNUT could potentially transition from its prolonged downtrend into a new uptrend.

But let’s be realistic—bullish divergences don’t always lead to immediate price surges. These patterns take time to develop, and even if PNUT is showing signs of strength, it doesn’t mean that a breakout will happen overnight. It could take days, weeks, or even months before we see a significant movement in price.

Aside from the RSI, there are other technical indicators that suggest PNUT might be setting up for a recovery.

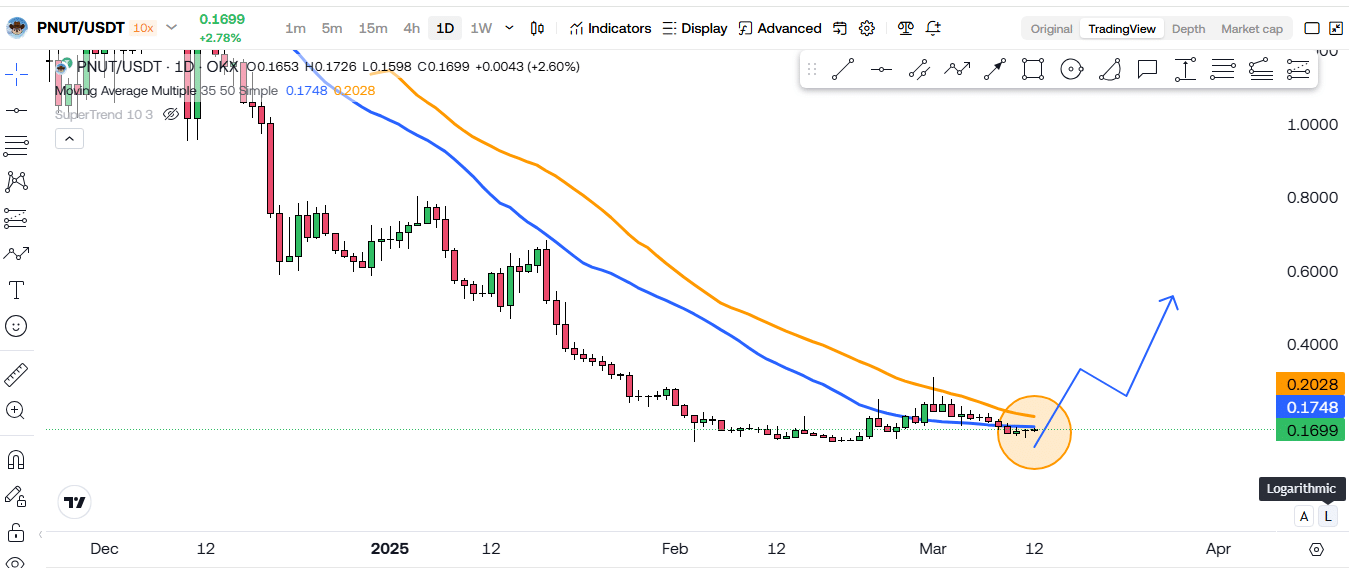

1. Moving Averages (100 & 200-Day)

One of the key levels to watch is the 100-day and 200-day moving averages on the daily timeframe. Right now, PNUT is attempting to break above these moving averages, which is a crucial step for a potential bullish move.

Why is this important? Moving averages act as dynamic support and resistance levels. If the price successfully breaks above the 100 and 200-day moving averages, it could attract more buyers and boost market confidence. This could potentially trigger an upward momentum that brings PNUT back into the spotlight.

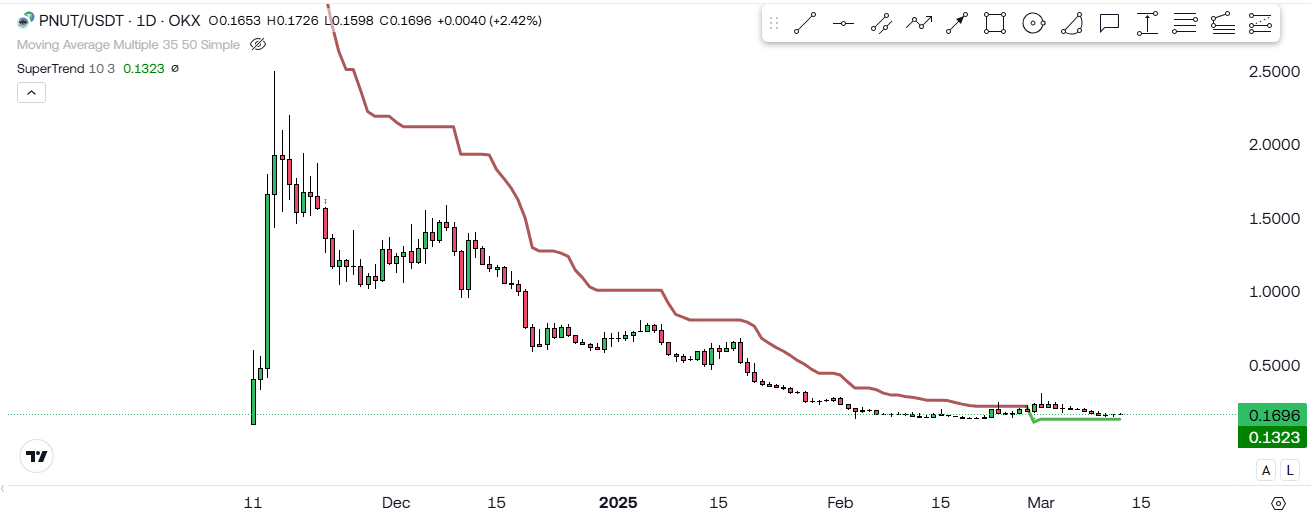

2. Supertrend Indicator

Another useful indicator we can look at is the Supertrend. This indicator helps traders identify whether an asset is in a bullish or bearish phase.

For a long time, PNUT has been stuck in the red zone, signaling bearish conditions. However, it has recently moved above the green zone, indicating a potential buying area. If this trend holds, it could reinforce the possibility of an upward price movement.

Final Thoughts

With multiple indicators aligning—bullish divergence on RSI, moving average breakout attempts, and the Supertrend shifting bullish—PNUT seems to be showing signs of strength. However, this does not guarantee a full recovery. The crypto market remains volatile, and many external factors could still drive prices lower. Before making any investment decisions, it’s always best to do your own research, manage your risk properly, and set realistic expectations.

For more in-depth technical analyses like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!

Additionally, join our Telegram community to discuss the latest market trends, share insights, and get real-time updates from experienced traders. Don’t miss the chance to be part of the conversation!