Key Takeaways

- After a volatile 2022, Bitcoin (BTC) experienced a significant price surge in 2023 and 2024, outperforming traditional stock market indices like the S&P 500.

- This year, growing institutional interest in Bitcoin as a store of value and hedge against inflation contributed to its price increase.

- In addition, positive regulatory developments, such as the approval of Bitcoin spot exchange-traded funds (ETFs), boosted investor confidence and market liquidity.

Have you ever wondered why Bitcoin seems to follow broader market movements?

In May 2024, Bloomberg released a report saying that Bitcoin’s correlation with technology stocks jumped to the highest level since August last year.

Notably, there’s been a decorrelation recently with the S&P 500 hitting all-time highs. But is Bitcoin following traditional stock movements more broadly, or is something else happening here? Stick around until the end to find out!

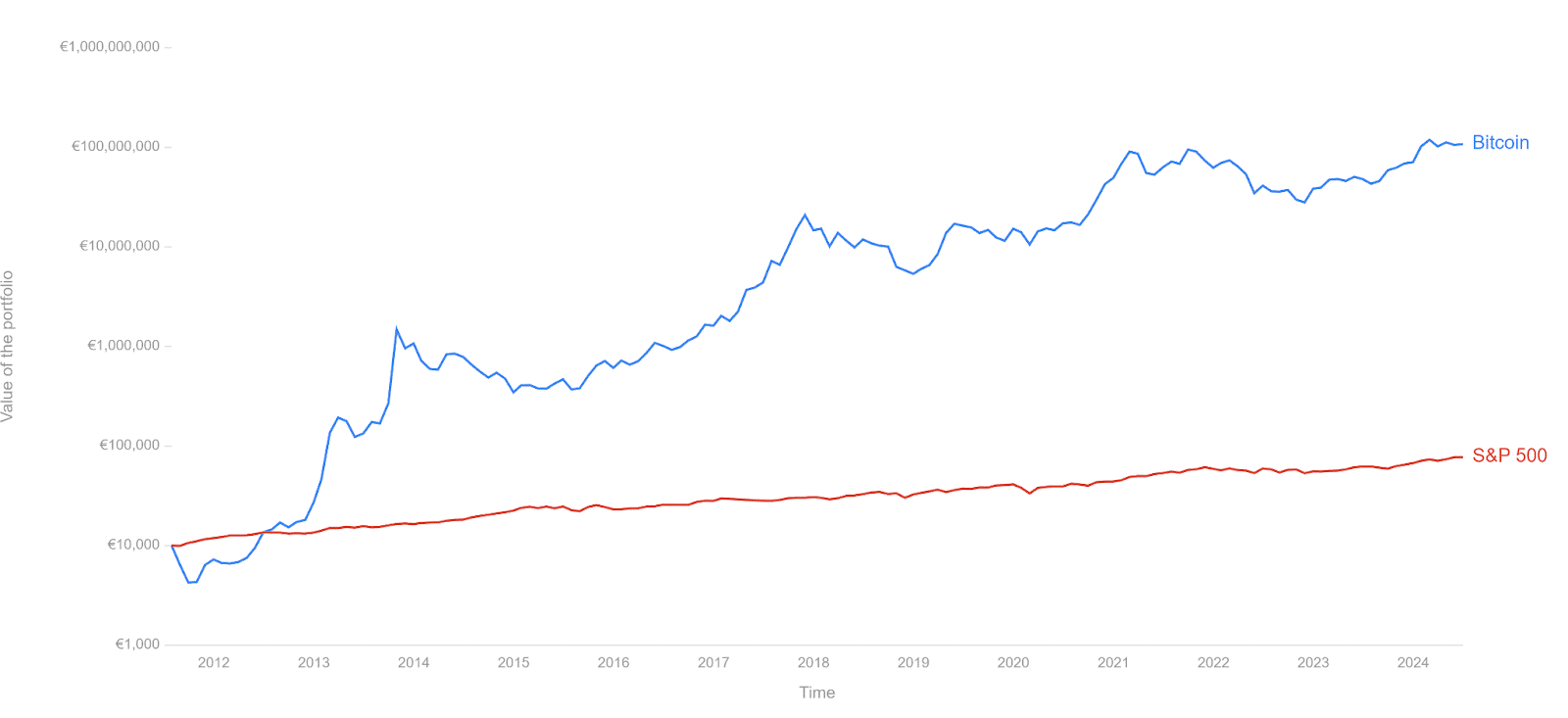

Bitcoin Versus Stocks: Which Gave Better Returns?

Bitcoin has generally outperformed stocks in the past couple of years. However, both asset classes experienced significant volatility at the time.

Let’s determine the historical performances between Bitcoin and the S&P 500 by looking at some of the important key metrics such as compound annual growth rates (CAGR), standard deviation, Sharpe ratios, and annual returns to provide a comprehensive overview:

Historical Performance

| Index | CAGR | Standard Deviation | Sharpe Ratio |

| Bitcoin | 100.68% | 155.02% | 0.82 |

| S&P 5000 | 14.58% | 14.60% | 0.95 |

The compound annual growth rate (CAGR) is a fundamental indicator of an asset’s long-term performance. According to Curvo, the CAGR stands at 100.68% for Bitcoin, while the S&P 500 has only delivered 14.58%.

Additionally, volatility is further emphasized when analyzing standard deviation, a metric that measures price fluctuations. Bitcoin’s standard deviation is a striking 155.02%, indicating that its price experiences considerable volatility compared to the S&P 500, which only has a standard deviation of 14.60%.

The Sharpe ratio, the metric for assessing risk-adjusted returns, adds another layer to this comparison. Bitcoin’s Sharpe ratio is 0.82, while the S&P 500 has a greater ratio of 0.95. This suggests that, historically, investors have achieved better risk-adjusted returns with traditional equities (the higher a fund’s Sharpe ratio, the better its returns have been relative to the amount of investment risk taken), underscoring the trade-off between the potential for high returns and the risks associated with Bitcoin.

Annual Returns Breakdown

The following table illustrates Bitcoin and the S&P 500’s annual returns from 2012 to 2023:

| Year | Bitcoin (%) | S&P 500 (%) |

| 2023 | 155.68% | 26.29% |

| 2022 | -64.24% | -18.11% |

| 2021 | 59.40% | 28.71% |

| 2020 | 304.45% | 18.40% |

| 2019 | 94.09% | 31.49% |

| 2018 | -73.39% | -4.38% |

| 2017 | 1,336.41% | 21.83% |

| 2016 | 124.26% | 11.96% |

| 2015 | 34.23% | 1.38% |

| 2014 | -56.15% | 13.69% |

| 2013 | 5,428.70% | 32.39% |

| 2012 | 189.08% | 16.00% |

In summary, Bitcoin’s annual returns are marked by extreme volatility, evidenced by its staggering 1,336.41% return in 2017 and a 5,428.70% return in 2013, juxtaposed with significant losses in other years. On the other hand, while the S&P 500 experienced losses in some years, it demonstrated more consistent growth.

Average Annualized Returns

| Index | Last Year | Last 5 Years | Last 10 Years |

| Bitcoin | 121.0% | 45.0% | 60.2% |

| S&P 500 | 22.1% | 15.0% | 13.2% |

Total Returns

| Index | Last Year | Last 5 Years | Last 10 Years |

| Bitcoin | 121.0% | 540.7% | 11,001.0% |

| S&P 500 | 22.1% | 101.1% | 244.0% |

How Did Bitcoin Outperformed The S&P 500 In 2024?

2024 was a pivotal time for the crypto market. According to TipRanks, Bitcoin’s price outperformed the S&P 500 more than threefold this year. Notably, the S&P 500 has only seen a 15.5% rise, while Bitcoin has soared over 57% year-to-date.

This performance was primarily attributed to several factors:

- Institutional Adoption – A growing number of large financial institutions, corporations, and pension funds are adopting Bitcoin as part of their investment portfolios through exchange-traded funds (ETFs), which were recently approved by the Securities and Exchange Commission (SEC) on January 10th, 2024. This increased demand from institutional investors drove up the price of Bitcoin from $38,000 to $73,700 in just three months.

- Regulatory Clarity – Positive developments in terms of regulatory clarity for Bitcoin in the US through Bitcoin ETFs provided a more accessible and regulated way for institutional investors to gain exposure to BTC, further driving demand and price appreciation.

- Macroeconomic Factors – The global economic landscape is a considerable factor that may have contributed to Bitcoin’s price appreciation. These include inflation data, interest rates, and geopolitical events that can influence investor sentiment toward both traditional and crypto assets. Notably, market participants anticipate a shift toward quantitative easing by the US Federal Reserve starting on September 18th, 2024.

In simpler terms, Bitcoin’s price increase was linked to the solid foundation of large financial institutions’ support for the cryptocurrency.

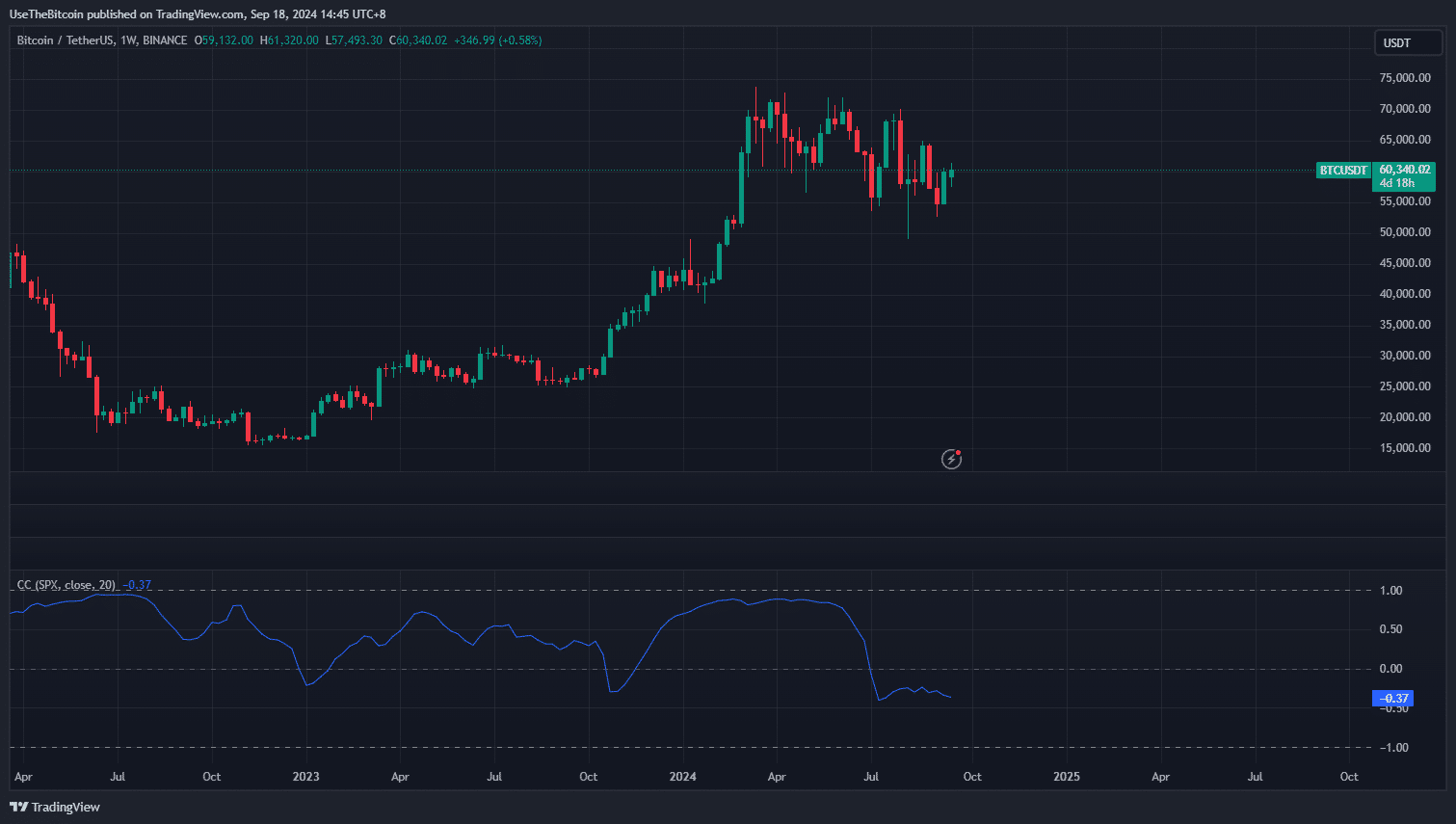

Bitcoin And Its Correlation With The US Stock Market

During the COVID-19 pandemic, the correlation between Bitcoin and traditional assets such as tech stocks becomes even more crucial because it challenges the notion of Bitcoin as a hedge against market turmoil, making it a proxy for tech stocks.

Ideally, if Bitcoin were to act as a true hedge like gold, its price movements would be negatively correlated with those of stocks. This means it would rise when stocks fall, providing a buffer during market downturns. Because of the close correlations, some people even question whether Bitcoin is just another tech stock.

To understand further, let’s take a look at the factors behind it.

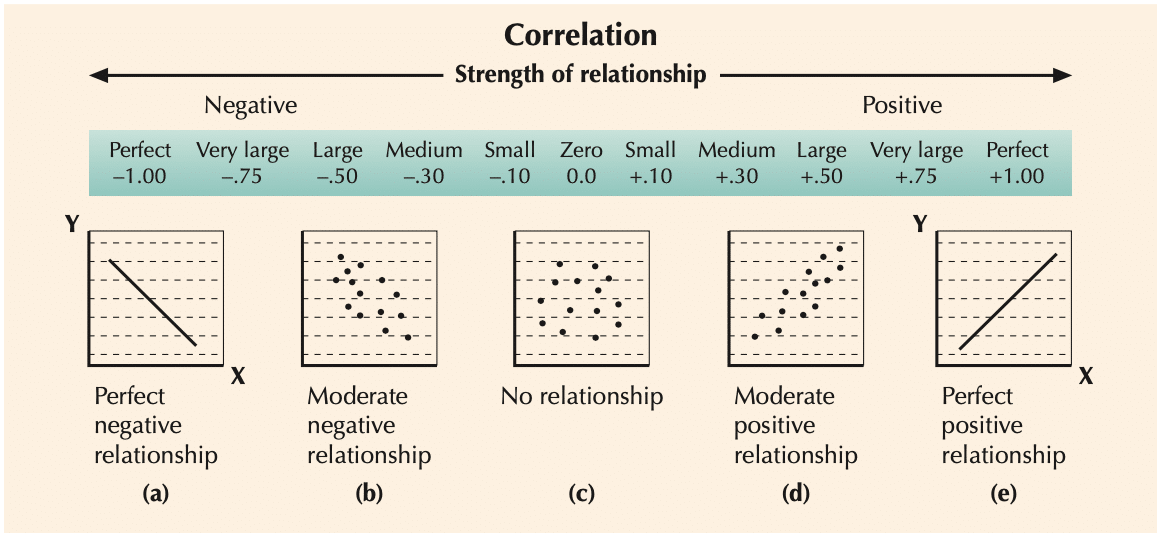

Correlation Coefficient

In a nutshell, the correlation coefficient is a measure that shows how closely two variables are related.

It ranges from -1 to +1, with -1 indicating a perfect negative correlation, 0 indicating no correlation, and +1 indicating a perfect positive positive correlation. Essentially, a value close to +1 means Bitcoin closely follows another asset, like tech stocks, while a negative value suggests it is diverging from that asset.

If you are interested in experimenting with this metric, the indicator is available to use on TradingView.

Economic Conditions

Economic conditions and monetary policies also influence the correlation between stocks and crypto. This is the reason why analysts and investors listen when Federal Reserve chair Jerome Powell speaks.

If inflation is high, the Fed will most likely use all its tools to try to hammer it down. That includes high interest rates, which could lessen the money supply in the market. High rates, of course, make it more expensive to borrow money, slowing businesses down and lessening the amount of capital that can be used to buy investment insurance like stocks and crypto.

If the Fed implements a rate cut, the opposite happens. Lower rates are generally considered bullish for the market.

Geopolitics

Another important factor, of course, is geopolitics. For example, in 2022, the stock market fell due to the Russian invasion of Ukraine, rattling investors. Bitcoin wasn’t immune; it fell 8% after the conflict began.

Notably, one of the most significant differences between traditional stocks and Bitcoin is regulatory changes. Being a younger asset class, Bitcoin has always faced intense regulatory scrutiny. In 2021, the Chinese crypto crackdown sent the market downhill, wiping out over $400 billion quickly. During that period, Bitcoin’s value decreased by 8% in a single day. Meanwhile, the NASDAQ continued to rise.

However, we also saw how the approval of Bitcoin ETFs last January triggered a massive rally, pushing the price up to $74,000 while the stock market remained flat.

What To Expect From Bitcoin And The Stock Market In 2025?

When we analyze all these closely, it becomes clear that there is a correlation between Bitcoin and stocks, especially over longer time frames, but it’s not what most people think.

Bitcoin is not really following the actions of traditional stocks; rather, both are influenced by something bigger. It is more accurate to say that Bitcoin, and to some extent the entire crypto market, are affected by broader factors such as investor sentiment, economic conditions, geopolitics, monetary policies, and regulation.

When we observe deviations in the short term, particularly on the daily time frame, it is often due to specific events—like the FTX collapse, market fears, or the German Bitcoin sell-off. During those situations, the NASDAQ and the S&P 500 were actually doing just fine.

Is Bitcoin Now A Safer Investment Than Stocks?

The short answer is that it really depends. Both Bitcoin and stocks have unique risks and rewards. Determining which is a “safer” investment largely depends on your individual risk tolerance, investment goals, and understanding of both asset classes.

Final Thoughts

We have to remember that the crypto community always knew that Bitcoin (at least most of the time) follows the traditional markets. It follows the risk-on and risk-off attitudes of the broad investment class.

Thus, Bitcoin has always been compared with the S&P 500 and the NASDAQ. Currently, the community has been waiting for Bitcoin’s decoupling. However, there’s growing anticipation for a time when Bitcoin can decouple from these external influences and establish its own independent trajectory.