Do you find yourself spending countless hours checking your portfolio because your cryptocurrencies, DeFi assets, and NFTs are scattered across various platforms? Perhaps you have centralized your crypto holdings for tracking but still need to manually input each transaction. If that’s your situation, then this article is for you.

We are going to be diving into the ultimate tools for managing your crypto portfolio this 2024. Whether you’re a seasoned trader/investor or just starting, stay tuned to discover the top portfolio trackers that can help you maximize your gains and make informed investment decisions.

What Are Crypto Portfolio Trackers?

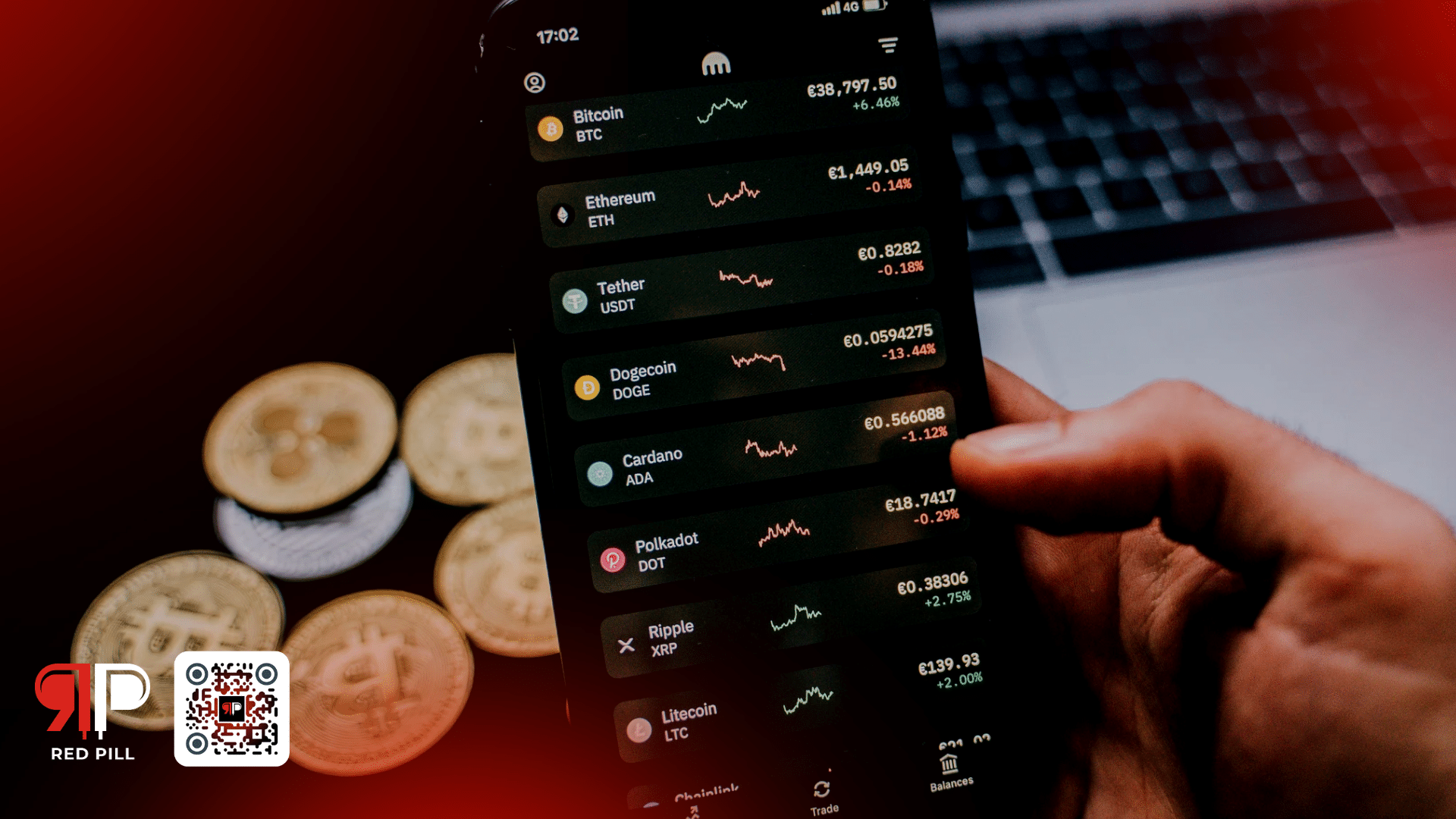

Crypto portfolio trackers are software applications or online platforms that allow you to manage and monitor your cryptocurrency investments in a centralized and organized manner. They provide real-time information on portfolio performance, asset allocation, transaction history, and market trends.

By using a crypto portfolio tracker, you can:

- Track the value of your holdings: See how your overall portfolio value is changing over time, as well as the individual performance of each asset.

- Monitor your performance: Track your gains and losses, and see how your returns compare to the market.

- Stay informed: Get real-time market data and news on your favorite cryptocurrencies.

- Make informed decisions: Use the data and insights provided by the tracker to make informed investment decisions.

The Best Crypto Portfolio Trackers You Can Use This Bull Run

1. CoinMarketCap

CoinMarketCap is among the largest data aggregators in the crypto space, and its portfolio tracker is a free and user-friendly way to manage and monitor your crypto holdings.

CoinMarketCap’s portfolio tracker is a great option for beginners as it offers a comprehensive set of features, real-time data, and a user-friendly interface.

While it might not have all the bells and whistles of paid options, it’s a solid choice for anyone who wants to easily track their crypto holdings and stay informed about the crypto market.

2. CoinGecko

CoinGecko‘s portfolio tracker accommodates both novices in the crypto space and seasoned investors looking for an extensive and adaptable platform. It provides robust tracking and analysis capabilities, and flexible management choices, and fosters a community-driven atmosphere.

While the Free version establishes a solid groundwork, the Pro edition grants access to more profound insights and advanced functionalities, tailored for dedicated cryptocurrency enthusiasts.

3. CoinStats

CoinStats’ portfolio tracker makes it super easy to connect and track all your accounts in just a few clicks. Simply make a CoinStats account and connect your various exchanges and wallets.

The platform lets you track up to five connected portfolios and 1,000 transactions for free. If you’re more of an advanced user, you’ll likely want to go with a premium account. The pro account allows you to track 10 connected portfolios and up to 10,000 transactions. It also provides users with a profit and loss analysis, in-depth portfolio analytics, exclusive coin insights, and order fill notifications.

4. Nansen

If you’re a DeFi enthusiast navigating the world of decentralized finance, then Nansen Portfolio might be your holy grail.

You also do not need to worry about subscriptions or app downloads as the platform offers its core features completely free! Simply connect your wallet address or (Ethereum Name Service) ENS domain and get instant access to your personalized dashboard.

If you’re a serious DeFi investor seeking powerful tools and insights, then Nansen is worth exploring. However, if you’re a beginner or prefer a simpler interface, other portfolio trackers might be more suitable.

Final Thoughts

If you manually note your crypto assets or maybe rely on your memory, then you have to start making use of these portfolio trackers. These platforms provide a convenient, centralized view of all your on-chain assets across different decentralized applications (dApps) and networks, which comes in super handy if you have parked funds in various pockets of the crypto and Web3 space.