Key Takeaways

- MYX Finance surged 371.17% in 24 hours, driven by its revolutionary zero-slippage derivatives architecture and seamless cross-chain UX.

- Its Matching Pool Mechanism (MPM) and gasless execution model make high-volume, low-cost trading a reality across multiple chains.

- The protocol is backed by a community-focused tokenomics model and is live on major L2s and BNB Chain.

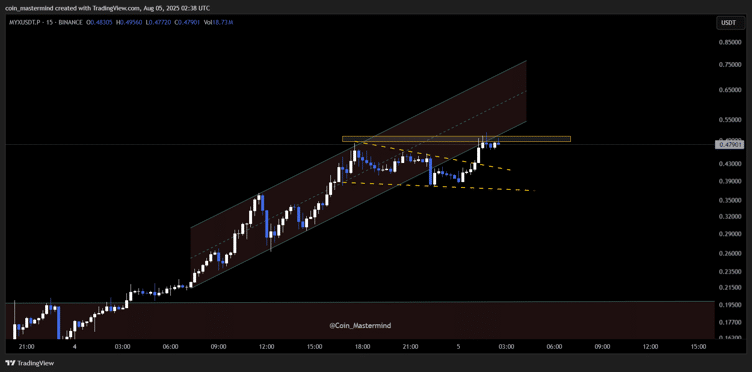

In an explosive 24-hour rally, MYX Finance (MYX) has seen its token price rise 371.17%, hitting $0.979750 with a daily trading volume of over $130 million.

Featured in XT Daily Market Highlights

MYX is reinventing how users engage with decentralized derivatives by offering a zero-slippage, high-performance on-chain perpetual trading experience that rivals centralized exchanges—without giving up custody.

Its recent market traction signals growing demand for next-gen DeFi platforms that marry sophisticated financial infrastructure with intuitive cross-chain usability.

How MYX Redefines On-Chain Derivatives

At the core of MYX Finance is a bold promise: make derivatives as smooth as spot swaps. The platform achieves this through its proprietary Matching Pool Mechanism (MPM), which pools collateral from liquidity providers (LPs) to enable deep, slippage-free markets.

Instead of relying on maker books or traditional AMM curves, MPM net-matches long and short positions and dynamically rebalances exposures—allowing MYX to offer capital efficiency and extremely low fees, sometimes as low as 1 basis point per side.

Chain Abstraction + Lightning UX

MYX also pioneers chain abstraction, letting users deposit collateral from over 20 different chains—including Solana—and trade without bridging or swapping assets. A two-layer account model separates custody from execution, allowing instant order signing through a delegate key, while gas fees are abstracted and netted in settlement tokens, enabling CEX-like speed with full self-custody. Whether you’re trading from BNB Chain, Arbitrum, or Linea, MYX makes the experience feel frictionless and secure.

Market Highlights

MYX Finance currently ranks #297 on CoinMarketCap with a live market cap of $131 million. The token has a circulating supply of 133.75 million out of a 1 billion max supply. Its 24-hour trading volume exceeded $130 million, reflecting a sharp rise in user interest and liquidity. With a staggering 371.17% daily gain, MYX is now one of the fastest-rising DeFi tokens in 2025, gaining momentum across Arbitrum, BNB Chain, and Linea ecosystems.

Final Thoughts

MYX Finance, a decentralized perpetual trading platform, has drawn significant attention. While it presents as a DeFi powerhouse with a user-friendly design, the recent market activity of its native $MYX token suggests a different story. Billions in perpetual volume have been traded with a relatively low spot market cap, fueling speculation that this is not retail-driven.

The token’s rapid surge and millions in liquidations point to sophisticated, algorithmic trading. This has led some to describe the market as an “algorithmic ghost game,” where insiders and exchanges are seen as the true players.

Frequently Asked Questions

What is MYX Finance?

MYX Finance is a non-custodial derivatives exchange that offers zero-slippage trading, chain abstraction, and portfolio margining for perpetual contracts.

Why did MYX token surge 371%?

The token spiked due to its advanced architecture and increasing DeFi user adoption on chains like BNB and Arbitrum. However, there are speculation that trading activity is driven by sophisticated algorithms and insiders rather than retail investors.

How does MYX ensure low slippage and gas costs?

MYX uses a Matching Pool Mechanism to rebalance positions and nets gas fees through a relayer network, delivering instant, low-cost trades even on congested networks.