India’s crypto market has moved beyond buying and holding digital coins. In the modern landscape, traders are exploring more advanced strategies like crypto derivatives (futures and options) to maximise profits and manage risks effectively in the volatile market.

As crypto adoption grows and innovation unfolds, the Indian crypto market is expected to cross $10 billion in revenue, with 123+ million users by 2026. With this growing demand comes the need for more structured, flexible, and accessible crypto trading platforms. This is where Delta Exchange comes into the picture.

Delta focuses exclusively on crypto derivatives trading and offers a space where you can explore the market and trade futures and options contracts on some of the major cryptocurrencies. In this post, we’ll discuss how Delta Exchange fits into India’s evolving crypto sector, what it brings to the table, and why it’s becoming the preferred choice for those looking beyond the basics.

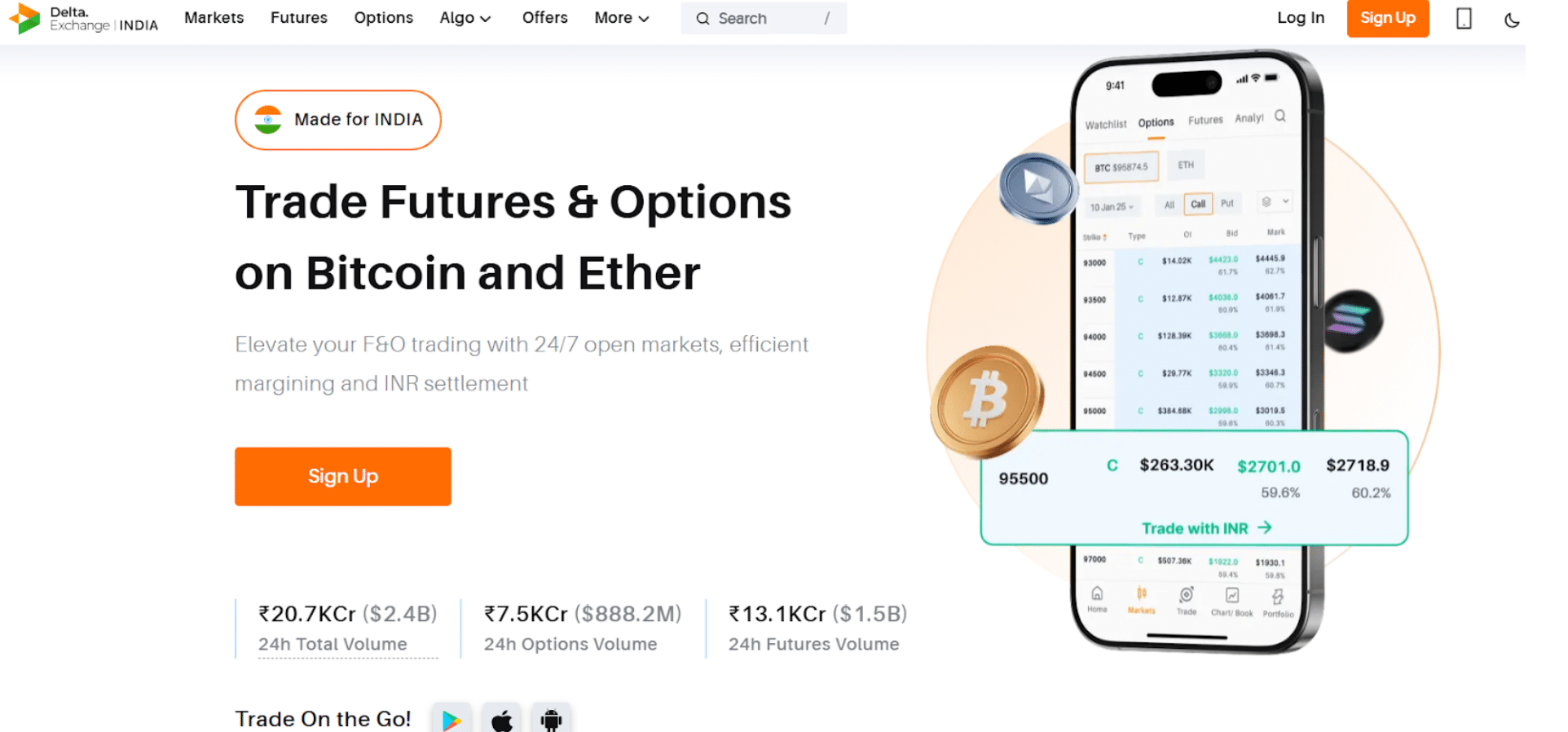

Delta Exchange at a Glance

Delta Exchange has positioned itself as one of the best crypto derivatives trading platforms for Indian and global users – thanks to its active focus on security, compliance, and a growing suite of product offerings.

Source | Crypto derivatives trading on Delta Exchange

Delta, under the Financial Intelligence Unit (FIU), provides Indian users with some clarity in the crypto derivatives space. With the capability of handling daily trading volumes of over $4 billion, the Delta Exchange app simplifies access and trading, especially for the country’s young, tech-savvy population, which is showing a deep interest in derivatives.

With advanced crypto analysis tools and safe regulations, Delta gives you an edge in a fast-moving market and seems to be scaling right alongside it.

What Makes Delta Exchange Unique for Crypto Derivatives?

Delta Exchange has built a strong user base by offering features that directly serve the needs of crypto derivatives traders.

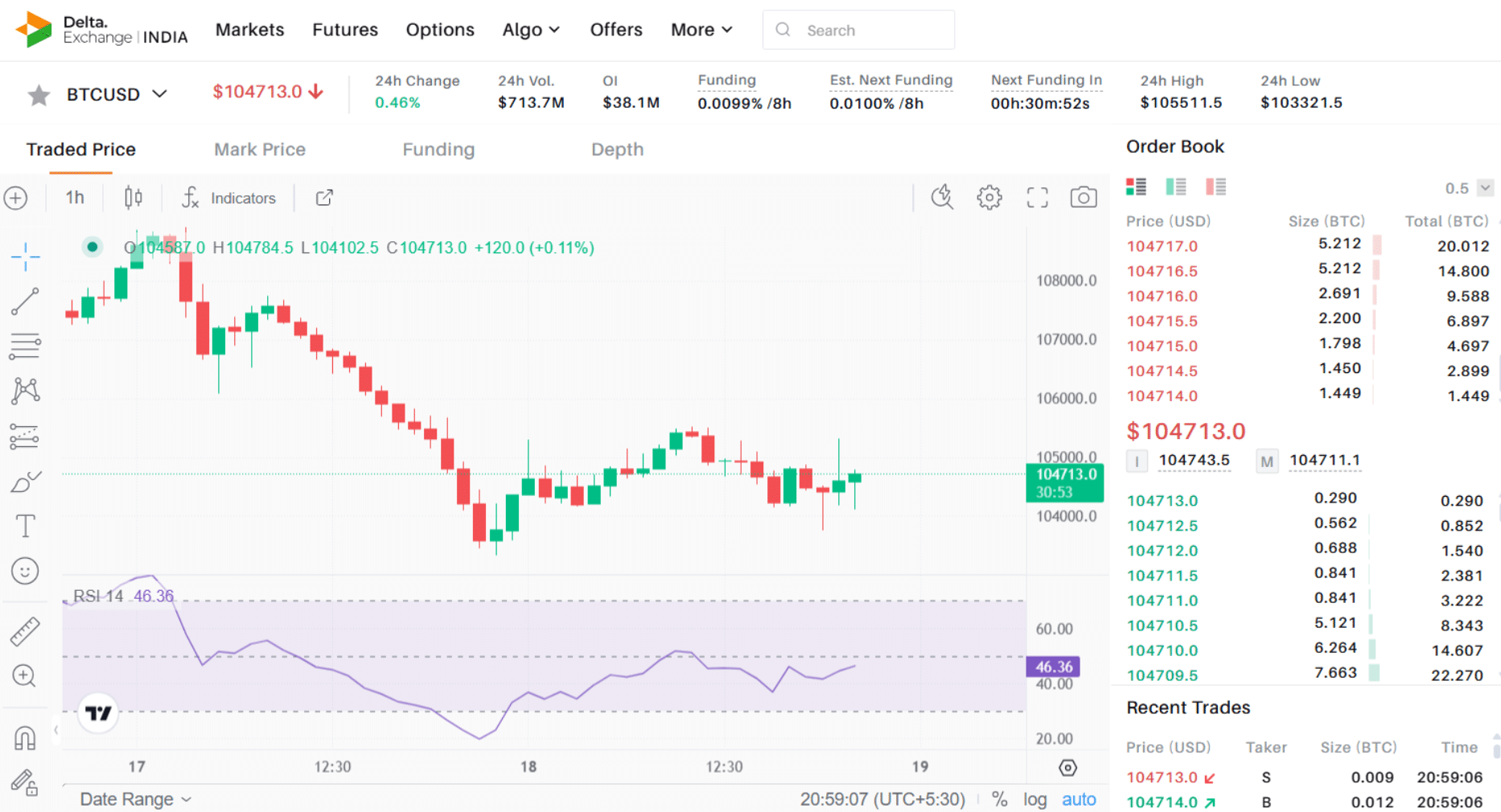

Source | Trade crypto derivatives (futures) on major cryptocurrencies

Here’s what makes it stand out in the crypto derivatives trading space:

- Multi-asset futures and options

You can access multiple contracts, including BTC, ETH, SOL, XRP, and several other altcoins. Whether you’re interested in perpetual futures or options with daily, weekly, or monthly expiries, the platform covers it all. An extra layer of convenience is added by the INR-based trading, which makes entries and exits smoother, without any currency conversions.

- Strategy builder and advanced tools

Delta supports multi-leg setups with a simple strategy builder, helping you create complex trades without overcomplicating the process. Features like basket orders save time on execution, and margin trading gives more flexibility with capital – all within the Delta Exchange app.

- Real-time risk controls

To manage risks better, Delta offers built-in payoff charts, integrated stop-loss settings, and a demo account for testing before investing a real amount. Automated trading bots are also available for those who prefer a rules-based execution approach.

- Strong customer support

Through a ticket-based support system, most issues see quick resolution. If you’re new to crypto derivatives or want to handle a large volume of trades, the platform’s 24/7 customer support is available.

All this makes Delta Exchange a reliable derivatives exchange platform for trading crypto futures and a bitcoin options chain.

Delta Exchange is Designed for All Types of Traders

Delta strikes a balance between simplicity and innovation for both newcomers and experienced traders. If you’re a beginner, you can practice crypto derivatives trading using the demo mode or by placing small-lot trades, with a minimum amount as low as ₹5,000 for BTC and ₹2,500 for ETH.

For experienced traders, there’s no shortage of advanced features. You’ll find 100x leverage, margin tools, and a variety of deep ITM and OTM futures and options contracts. The platform allows you to start small, test strategies, and gradually move to high-volume trades, once you’re confident enough.

Trading on the Go with the Delta Exchange App

The Delta Exchange app provides a clean and responsive interface for those who prefer to trade on the go. Available for both Android and iOS, it brings key features of the desktop platform to mobile – including live price tracking, position management, and smart alerts.

To get started, simply visit the official website, sign up, complete your basic Know Your Customer (KYC) process, and you’re ready to deposit INR directly. You can explore a wide range of futures and options contracts, track markets in real time, and withdraw INR when needed.

It’s a comprehensive crypto derivatives experience, ideally suited for you if you want to stay connected to the larger crypto market.

Final Thoughts

If you’re looking to go beyond buying and holding, Delta Exchange opens up opportunities to actively manage exposure through tools like futures and options, margin trading, INR-based contracts, and much more.

As more traders look to build intent-led investment portfolios, crypto derivatives trading on platforms like Delta is shaping what the next phase of participation might look like.

Disclaimer: Crypto trading carries inherent risks due to its high volatility. This article is for informational purposes only. Kindly do your own research and consult experts before making any investments in crypto.