- Among the main Altcoins, only Ethereum is yet to be crossed upwards.

- XRP moves in another ecosystem and will not pull the market.

- Libra may be positive, not a danger to the market.

It is the middle of summer in the northern hemisphere and the high temperatures warm the seas and generate humid currents that rise and generate perilous storms.

It seems that the cryptocurrencies market is becoming unstable. It is likely that in the coming days, we will see explosive movements among the Altcoins.

The fact that Ethereum is not in the same phase as Litecoin, Ethereum Cash, or EOS concerning Bitcoin, as it is keeping all this upward pressure under control. In the technical section on the ETH/BTC pair, I explain in detail this scenario.

The market is acutely aware of the Facebook project, Libra, but I think it’s not critical for the real Crypto market.

The dynamics of the Crypto market are not going to change, no matter how many problems Libra has with its conception and implementation.

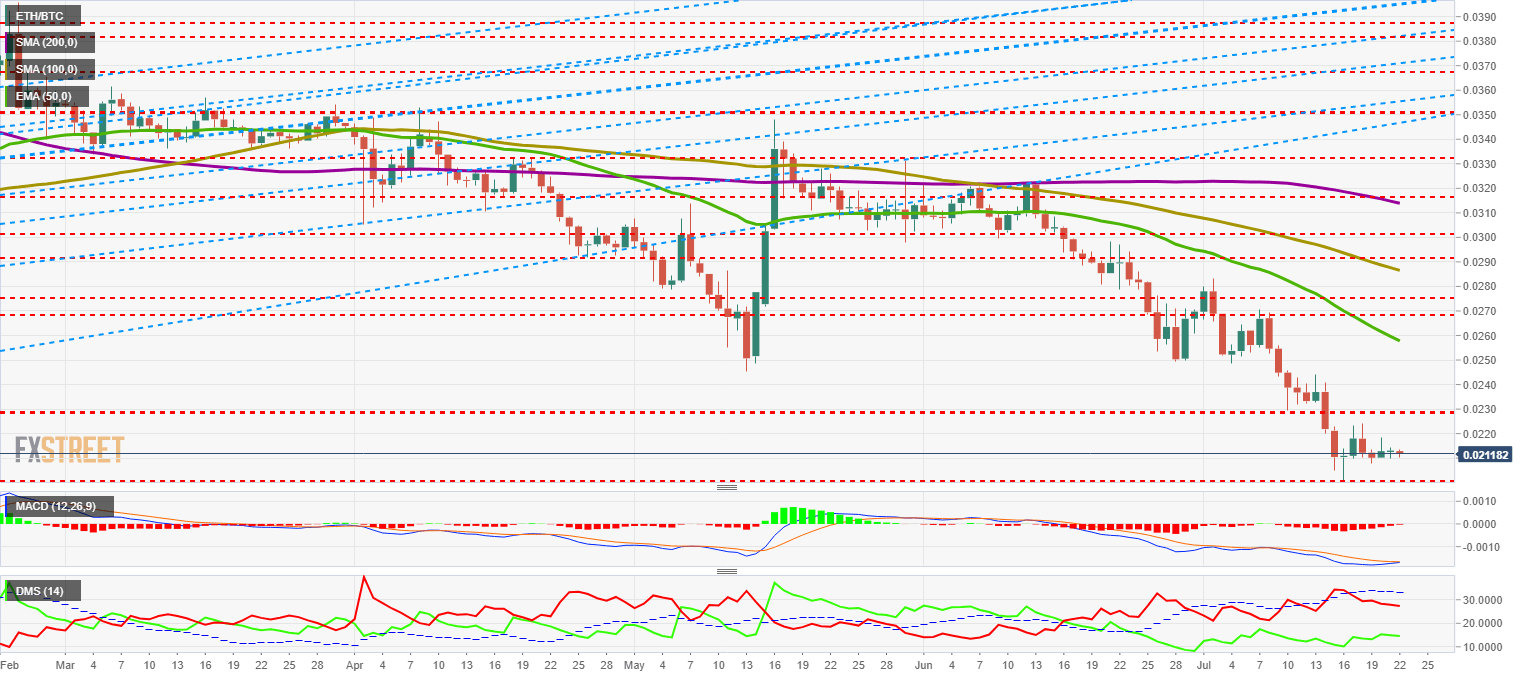

ETH/BTC Daily Chart

The ETH/BTC pair trades at 0.0218, prolonging the uncertainty generated by seeing the price relationship between Ethereum and Bitcoin at such low levels.

At this moment, all technical analysis on the ETH/BTC should be looking at the MACD on the daily chart as we will see now.

Above the current price, the first resistance level is at 0.023 (price congestion resistance), then the second at 0.026 (EMA50) and the third one at 0.027 (double price congestion resistance).

Below the current price, the situation is complicated. The first support level is at 0.0201 (price congestion support) and there is a second at 0.016 (price congestion support). Below this price level, the ETH/BTC chart would enter terrain as unknown as its consequences in the entire Crypto universe.

The MACD on the daily chart is the protagonist of the day and probably of the summer season. It shows a heterodox bullish cross profile, that although you might see some rejection in the cross, will undoubtedly trigger an upward movement in the short and medium-term.

The DMI in the daily chart shows how the bulls have been increasing activity despite the low price levels. This behavior gives clues as to what happens beyond price. Bears have remained very horizontal and do not seem to rely on further declines.

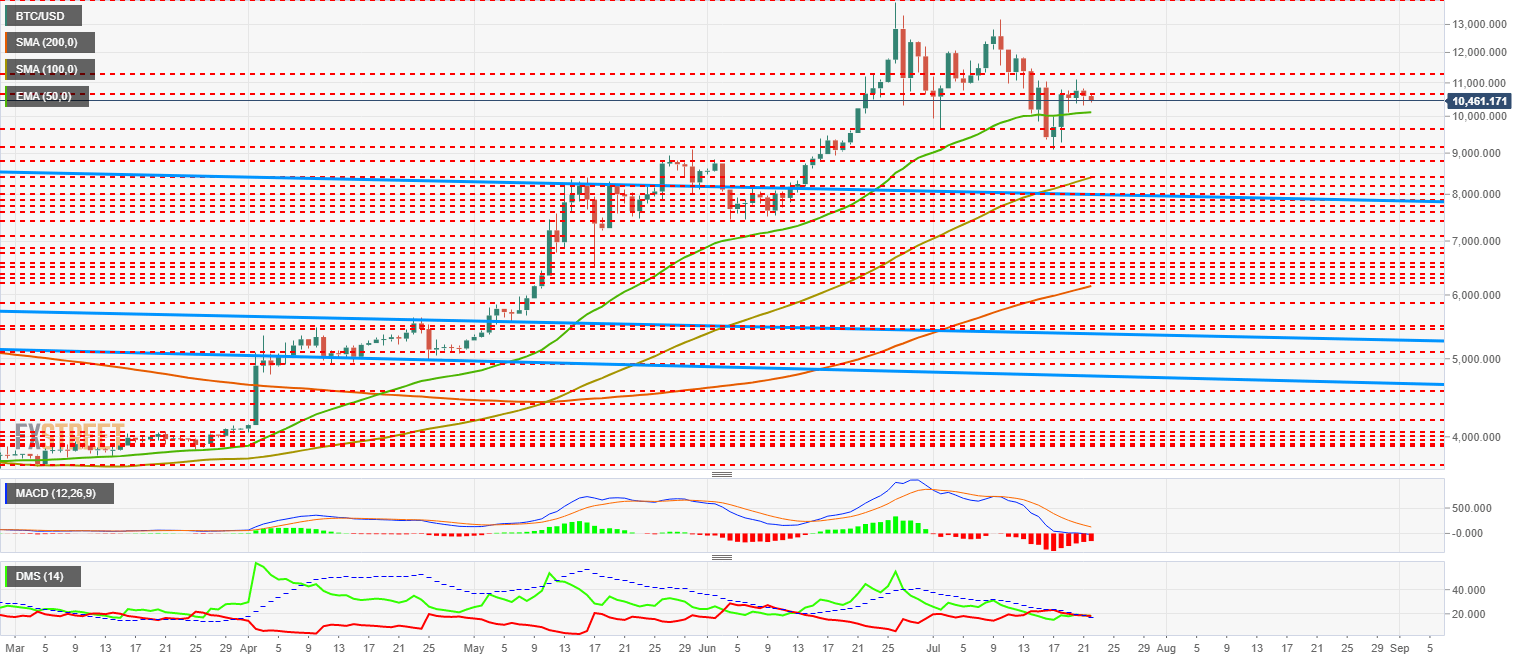

BTC/USD Daily Chart

The BTC/USD pair is trading at $10.461 and has been playing for three days with the price congestion support level at $10.600. The current technical structure is very ambiguous and open to both sides of the market.

The likely behavior is that of bearish continuity, reinforced by the favorable scenario for Altcoins, but there is some secondary scenario in which Bitcoin would move upward with the rest of the market.

Above the current price, the first resistance level is at $11,250 (price congestion resistance), then the second at $14,000 (price congestion resistance) and the third one at $17,000 (price congestion resistance).

Below the current price, the first level of support is at $10,050 (EMA50), then the second at $9,800 (price congestion support) and the third one at $9,150(price congestion support).

The MACD on the daily chart shows how the indicator has lost all bearishness when it reaches the 0 levels. This data informs us of the keen interest around Bitcoin when there is no patience in waiting for lower prices and buying at neutral levels.

The DMI on the daily chart shows an absolute tie between bulls and bears. To make the situation a little more confusing, both sides of the market move just below level 20, which subtracts all trend strength from the BTC/USD pair. It is a very ambiguous setup and should serve as a warning for what they want to act on the Bitcoin in the short term.

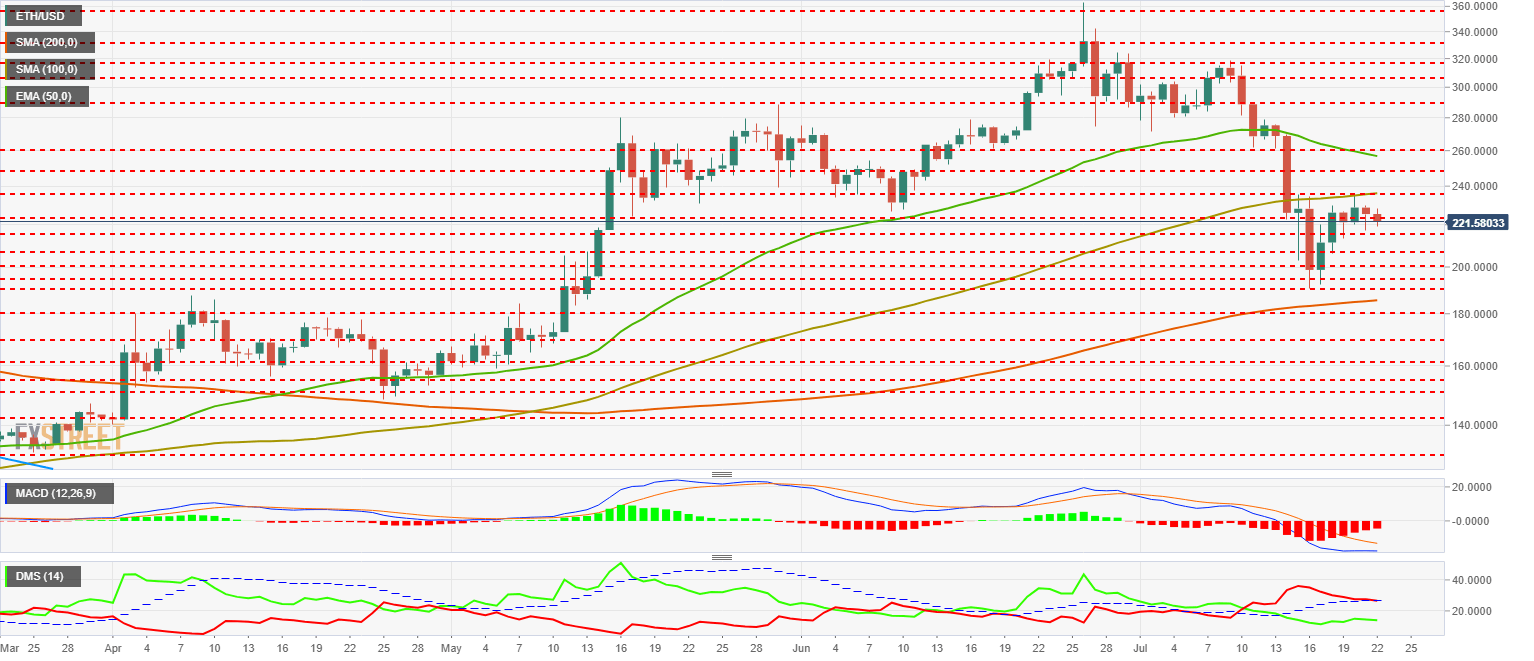

ETH/USD Daily Chart

The ETH/USD is trading at $221.5 and continues to be unable to beat the SMA100, which serves as the ceiling for the current movement. The pair may be favored by probably better relative performance against Bitcoin.

Above the current price, the first resistance level is at $235 (SMA100 and price congestion resistance), then the second at $248 (price congestion resistance) and the third one at $260 (EMA50 and price congestion resistance).

Below the current price, the first level of support is at $220 (price congestion support), then the second at $215 (price congestion support) and the third one at $205 (price congestion support).

The MACD on the daily chart shows how the indicator has lost the bearish bias.

The DMI on the daily chart shows bulls increasing activity despite doubts, while bears lose strength and are set to cross down the ADX line.

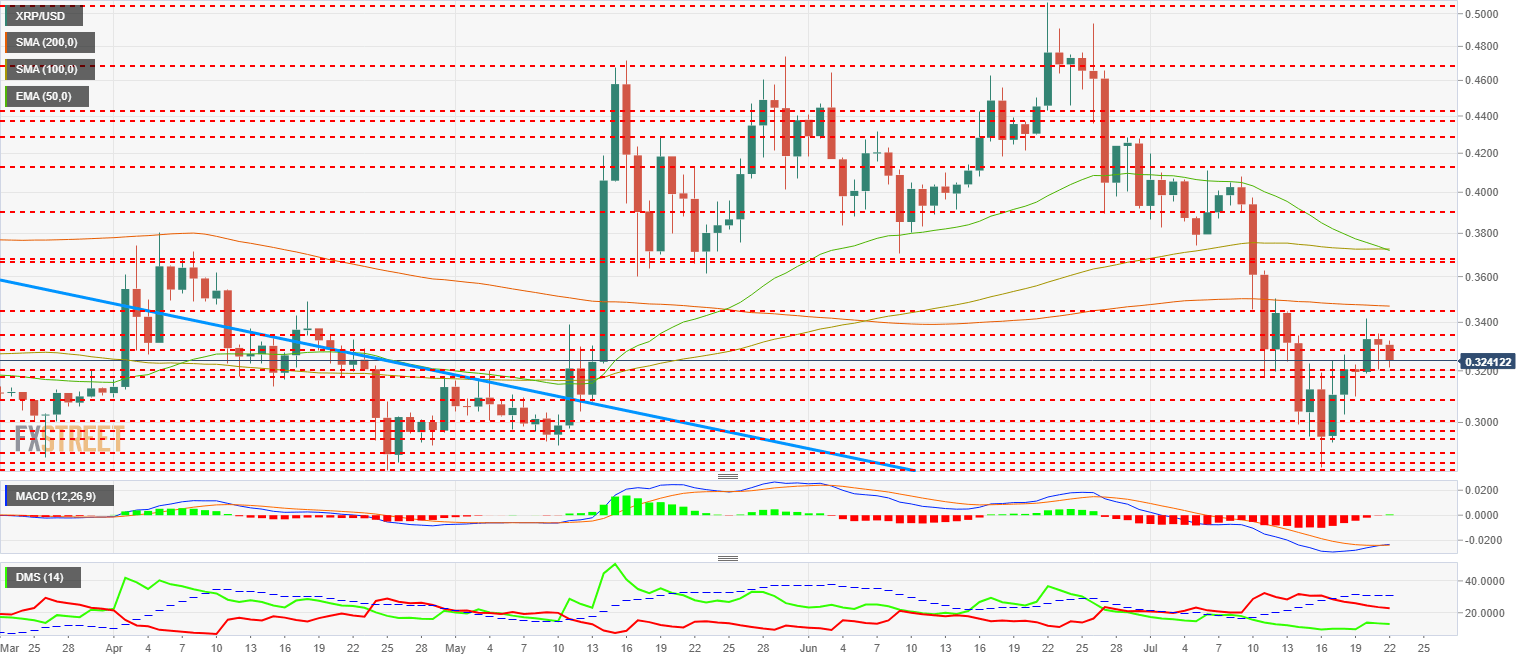

XRP/USD Daily Chart

The XRP/USD is currently trading at the $0.3241 price level and loses support for price congestion at $0.33.

Above the current price, the first resistance level is at $0.334 (price congestion resistance), then the second at $0.345 (SMA200 and price congestion resistance) and the third one at $0.367 (EMA50, SMA100, and double price congestion resistance). A really colossal resistance level.

Below the current price, the first support level is $0.32 (double price congestion support), then the second at $0.308 (price congestion support) and the third one at $0.30 (price congestion support).

The MACD on the daily chart shows a bullish cross in process, although at the moment it is difficult to predict the speed at which the scenario will develop.

The DMI in the daily chart shows us how in the XRP bulls are also increasing the level of activity in recent days, while bears move well below the ADX line. We likely see a bearish movement of support testing that would take the D- line to impact with the ADX on the lower side, and then descend again.