PancakeSwap is the leading decentralized exchange (DEX) on the Binance Smart Chain (BSC).

With an impressive Total Value Locked (TVL) and many exclusive features, it is no wonder they are a favorite among crypto enthusiasts.

This article will walk you through the steps of staking $CAKE on PancakeSwap, BSC’s sweetest yield farming platform.

About PancakeSwap DEX

Traders must pay a fee of around 0.25% of each transaction value. The majority of the fee (around 0.17%) goes to liquidity providers, 0.03% to the PancakeSwap treasury, and the rest to buy back and burn $CAKE.

In addition to the automated market maker, Pancakeswap offers other products and services, such as the lottery, prediction pools, and even Initial farming offerings, which give investors early access to new tokens on the DEX.

About $CAKE

$CAKE is PancakeSwap’s native cryptocurrency and a BEP-20 token, meaning it runs on the BSC network.

CAKE has a lot of use cases on PancakeSwap:

- Utility – $CAKE is used to pay transaction fees on the PancakeSwap platform and participate in various platform features such as the lottery, prediction market, and Initial Farm Offerings (IFOs).

- Governance – $CAKE holders participate in the governance of PancakeSwap by voting on proposals to improve the platform.

- Rewards – $CAKE rewards users who provide liquidity to the DEX’s pools or stake their Liquidity Provider (LP) tokens.

How To Earn $CAKE On PancakeSwap?

Here are ways to earn $CAKE on the platform:

- Provide Liquidity – Deposit crypto assets into PancakeSwap’s liquidity pools.

- Stake Liquidity LP Tokens – Stake LP tokens to PancakeSwap’s Syrup Pools.

- Participate in IFOs – Invest in new crypto projects during IFOs through $CAKE tokens.

- Participate in the lottery – Buy lottery tickets with $CAKE tokens for a chance to win a share of the prize pool.

How To Stake $CAKE On PancakeSwap?

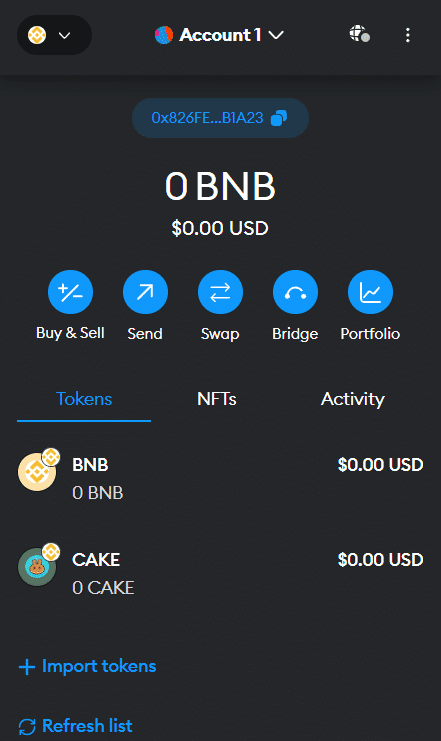

Funding Your Wallet

Set up your wallet and make sure it’s sufficiently funded with $CAKE and $BNB tokens. You need $BNB because $CAKE operates on the BSC network and relies on $BNB to cover transaction fees.

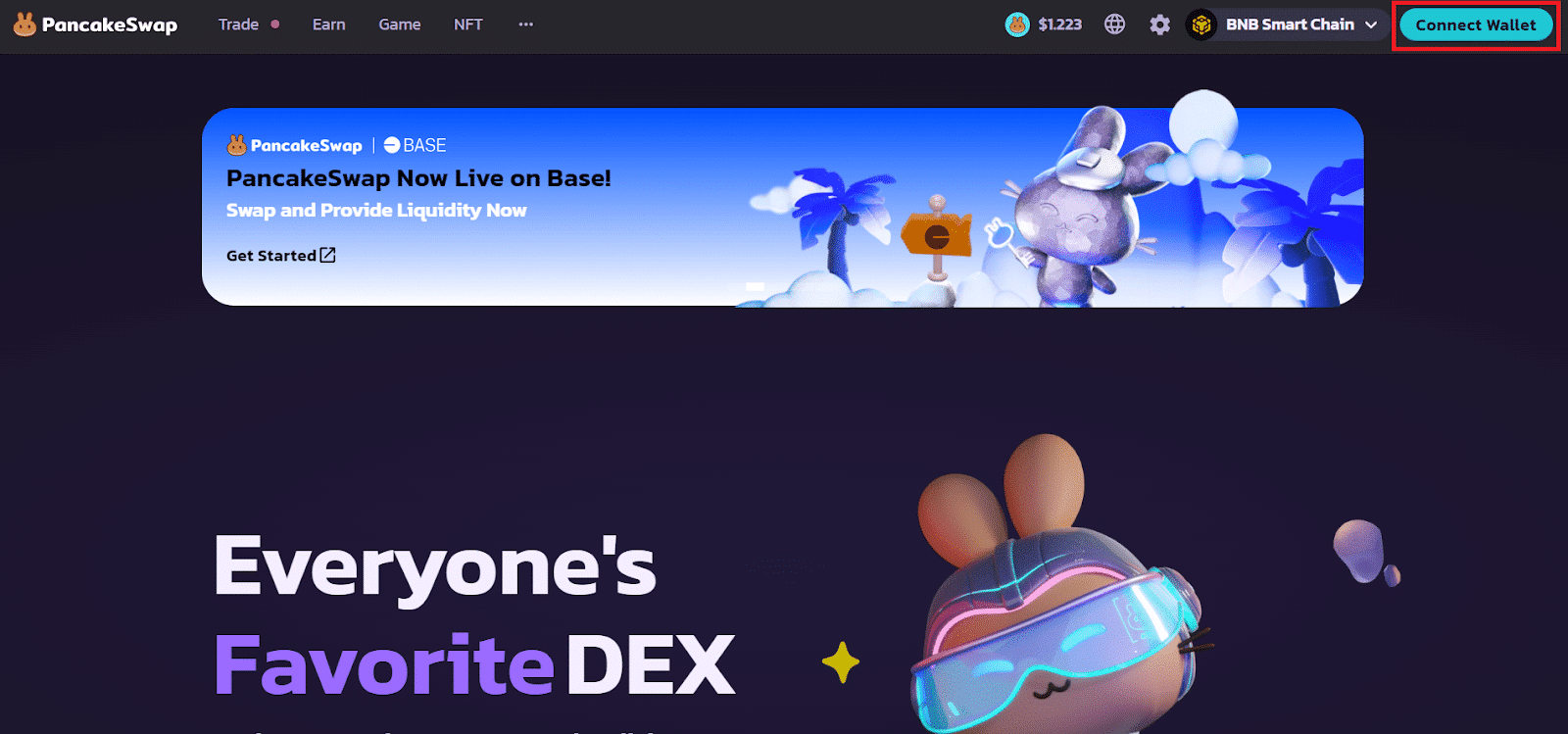

Connecting Your Wallet

Once your wallet is adequately funded, head over to PancakeSwap.finance and connect your wallet. Look for the “Connect Wallet” button in the top-right corner of your screen.

Selecting A Liquidity Pool

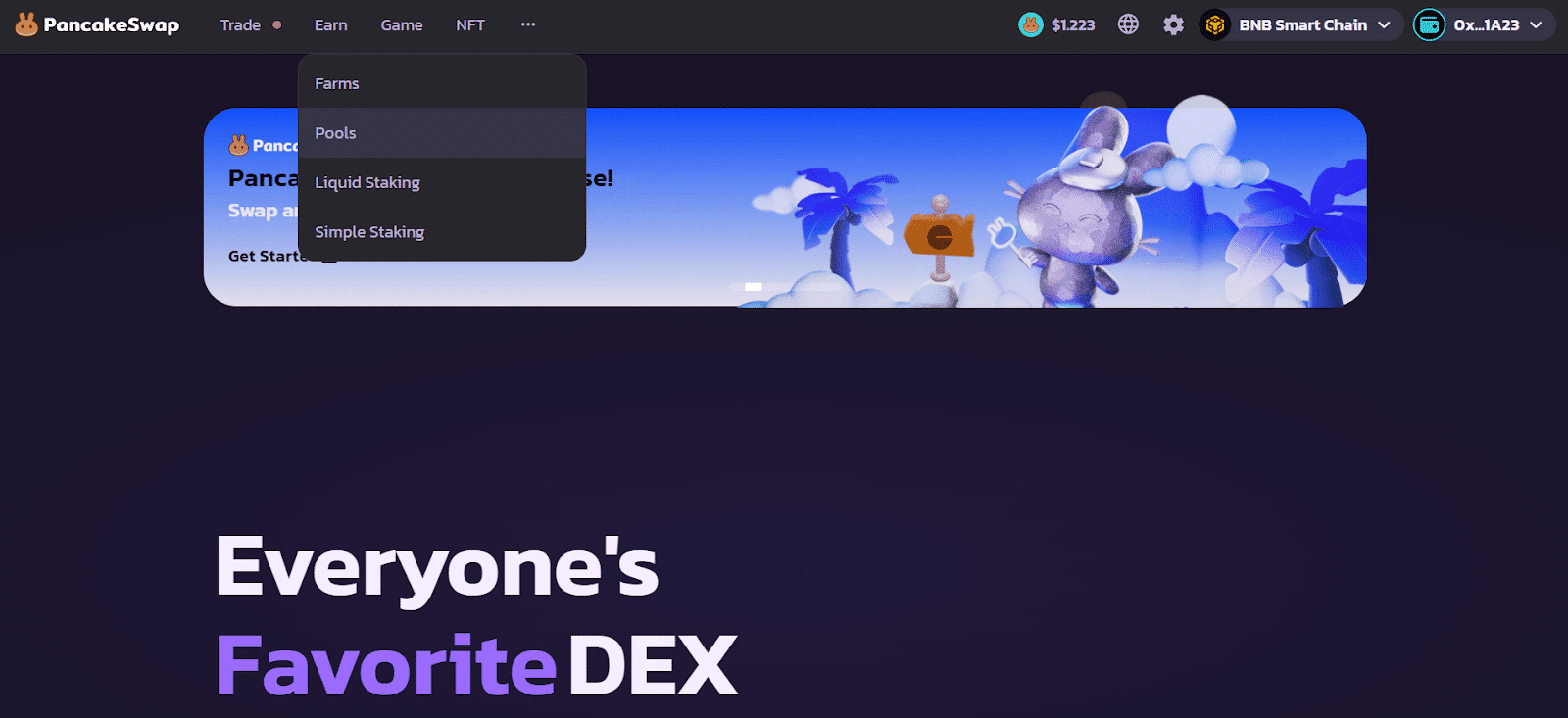

After connecting your wallet, hover over “Earn” in the top menu and click “Pools.”

Here’s a brief overview of the other options available:

- Farms – Involves liquidity farming, where you provide liquidity for trading pairs. You’ll need both tokens in the pair.

- Liquidity Staking – This is similar to farms but is a more low-maintenance strategy as users can stake their assets and continue to use them in DeFi applications without having to unstake and restake them.

- Simple Staking – You stake one token and earn rewards for the same token.

- Pools – Allow you to stake $CAKE to earn other tokens.

For this guide, we will only be focusing on liquidity pools.

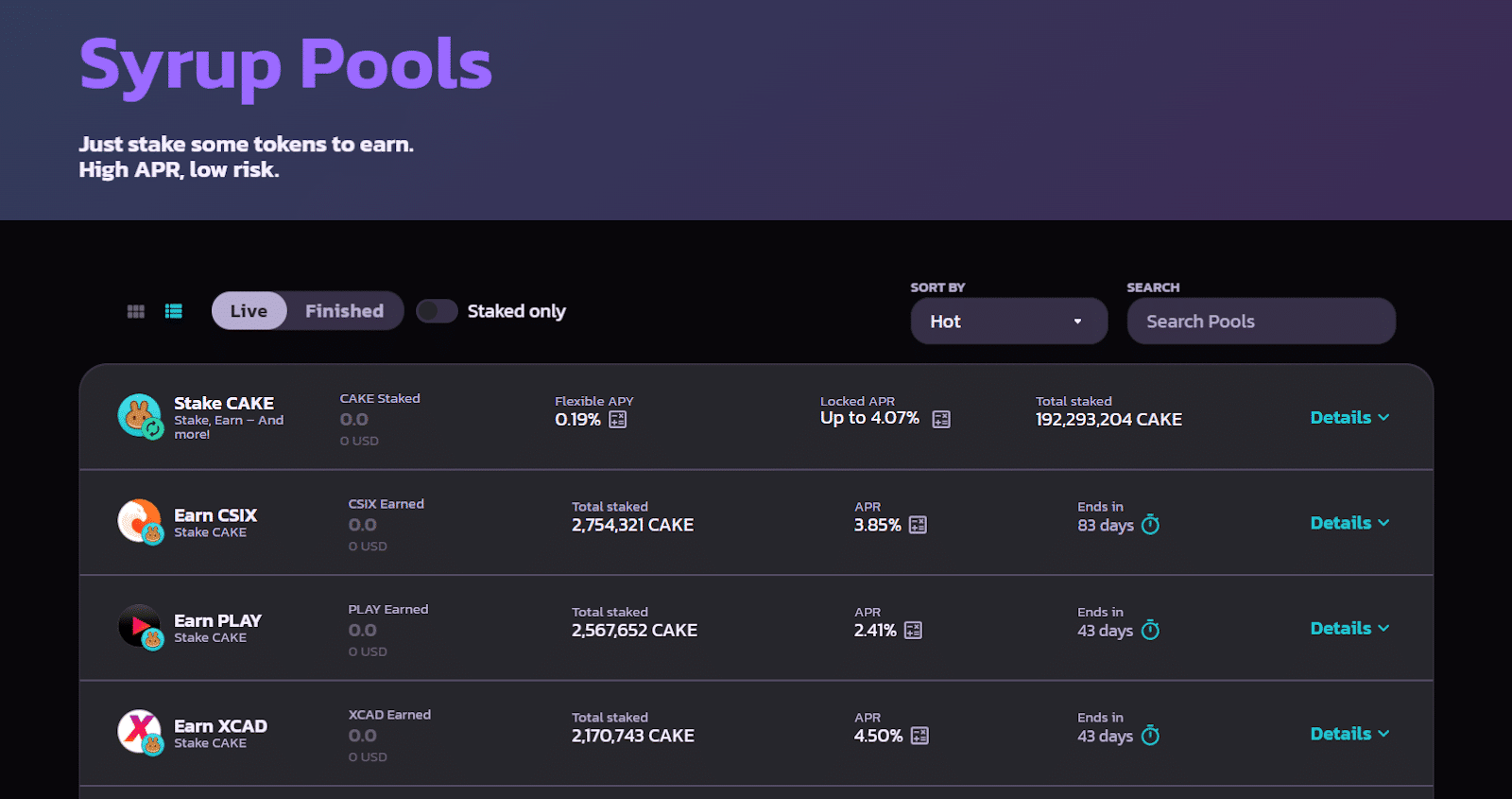

Choosing The Right Staking Pool

Selecting the right staking pool requires careful consideration of several factors:

- Annual Percentage Rates (APRs) – What are the expected returns on your staked assets?

- Terms – Are you comfortable locking your tokens for a specific period, and is it worth the risk?

- Pool Duration – Some pools are indefinite, while others have set timeframes. Ensure the duration aligns with your investment goals.

- Reward Tokens – Can you quickly sell or convert the rewards paid into a token?

Remember that higher expected rewards come with more significant risks. So if you are required to lock your tokens, your risk level rises significantly.

Only the base $CAKE pool is indefinite on PancakeSwap; other pools typically last for three months. Consider whether this duration works for you to at least break even, taking into account the gas fees incurred when sending, allocating, and exchanging tokens.

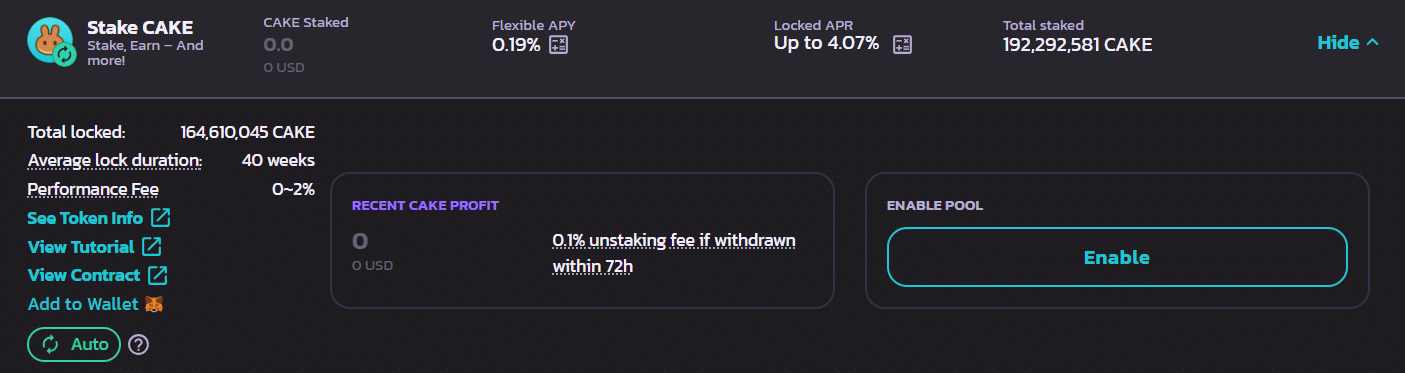

Initiating The Staking Transaction

Once you have chosen the staking pool, click “Enable Pool” within the pool details. This will permit PancakeSwap to manage your tokens through a smart contract.

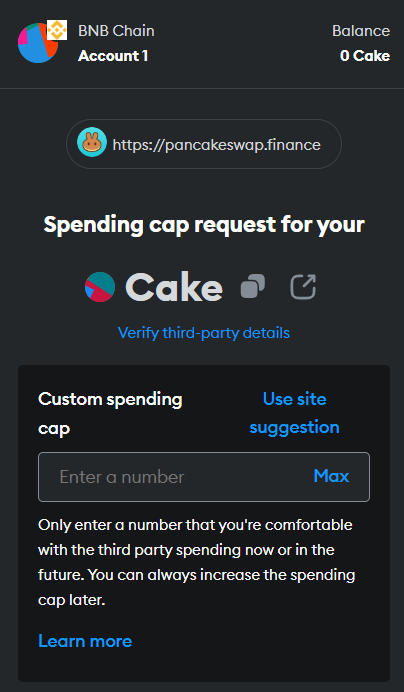

If you are using MetaMask, you can set a spending cap as a security measure in case of an exploit.

Next, choose between flexible or locked staking and specify the lock-in period. Then, enter the amount of $CAKE you want to stake and confirm the transaction in your wallet.

Final Thoughts

PancakeSwap’s ecosystem, utility, and governance have made it a preferred choice for DeFi users. You can sweeten your crypto portfolio and enjoy the delectable rewards it offers. So take the plunge and start staking $CAKE on PancakeSwap to experience the best of Binance Smart Chain’s top DEX!