Key Takeaways

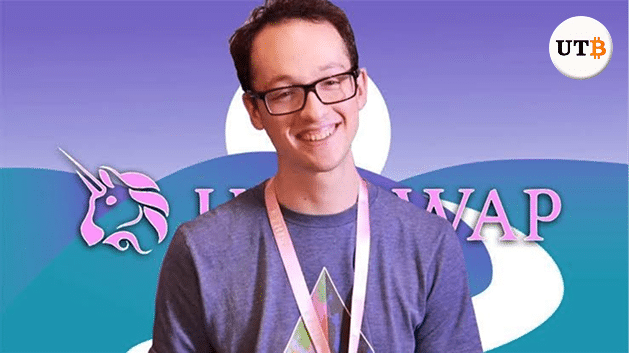

- Hayden Adams was a key influence in the creation of Uniswap, one of the biggest DeFi booms in crypto in 2021, through his programming skills.

- Uniswap, over the past few years, has contributed to the DeFi industry, allowing developers and builders to replicate its models in lending, borrowing, yield farming, and scaling projects on the Ethereum network.

- Adams remains an active contributor to the cryptocurrency industry, creating and helping developers build sustainable, scalable decentralised applications (dApps) on the Ethereum network.

Few would have seen it coming for Hayden Adams, a software engineer who has so much prospect and losing his job after working with reputable companies to creating an unimaginable impact in the blockchain space, particularly after founding Uniswap, a decentralized exchange (DEX) that gained so much hype during the DeFi summer of 2021 on the Ethereum network with every degen trader and investors looking for the next 1000x on Uniswap.

Who is Hayden Adams? Dominating DeFi Space with Uniswap

Hayden Adams has always had a thing for programming despite earning a degree in Mechanical Engineering from Stony Brook University. This passion led him to develop a search engine algorithm for PubMed, demonstrating his experience as a programmer.

Following his graduation, he worked with Siemens as a mechanical engineer, performing simulations on automotive systems and aerospace. Despite his career growth, he was laid off in 2017.

After his layoff, Hayden Adams was introduced to the blockchain with Ethereum, gaining strong interest from his friend Karl Floersch. Building on his experience in programming and a self-taught blockchain language, such as JavaScript and Solidity.

Adams began exploring smart contracts on the Ethereum network for a decentralized exchange as part of his new project, Uniswap. Hayden Adams developed the first stage of the Uniswap model using Vitalik Buterin’s AMM concept.

He received $65,000 as a grant from the Ethereum Foundation, which enabled code audit and migration to Vyper for the Ethereum smart contract.

Uniswap witnessed incredible growth as its native token UNI SURPASSED OVER $1 trillion in trading volume, $3 billion in total value locked, and over $5.8 billion in market cap.

Contributions to the Blockchain Industry

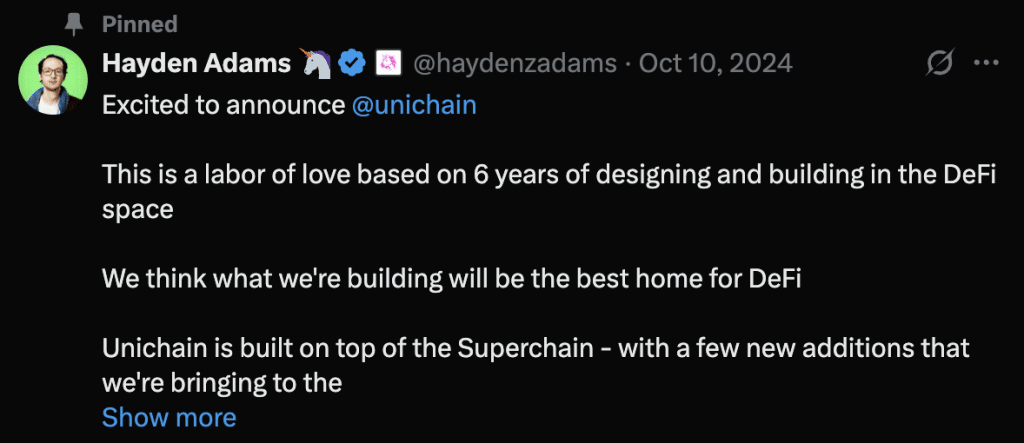

Source – Hayden Adams X Post (formerly Twitter)

The success of creating Uniswap changed the game for decentralized AMM models in the DeFi space, with lending, borrowing, farming, and liquidity provision, creating billions of dollars in trading volume in the market.

This wasn’t the only achievement for Hayden Adams, as he was listed in Forbes’ 30 Under 30 in Finance (2020), highlighting his strong contribution in the blockchain space.

He has consistently spoken about improving scalability in the Ethereum network, leading to the creation of Unichain, a layer-2 blockchain technology that facilitates faster transactions.

Adams has participated in numerous blockchain conferences as a speaker, including Consensus and Deconomy, where he discussed the adoption of DeFi and Ethereum scalability.

Hayden Adams’ Net Worth in 2025

Hayden Adams is estimated to be worth around $150 million to $550 million based on the following:

- Uniswap’s market value is over $1.7 billion, with its equity stake valued at around tens of millions.

- Allocation of UNI token trading above $9 at a market capitalization of $5.8 billion

- Other investments in Unichain, BlockFi, and others.

Conclusion

Hayden Adam continues to explore ways to make the DeFi space fair and open to everyone, including developers looking to build scalable projects on the Ethereum network. His contributions to newer models of Uniswap AMM have gained recognition over time.

Despite his achievements and success, there are no public records of his net worth. However, it is estimated that he could be worth between $150 million and $550 million.

FAQs

What programming languages does Hayden Adams know?

Adams has good knowledge of JavaScript and Solidity, as these two programming languages helped him build Uniswap.

Related Read