Key Takeaways

- Building a crypto portfolio means having a mix of established coins (like Bitcoin and Ethereum) for stability and potentially higher-growth altcoins.

- Don’t put all your eggs in one basket! Spread your investment across different cryptocurrencies to reduce risk.

- Beginner portfolios should focus on just Bitcoin and Ethereum.

- Cryptocurrency is a volatile market. Be honest with yourself about how much risk you are comfortable with.

If you were to build a brand new cryptocurrency portfolio knowing what you know after investing in cryptocurrencies for more than five years, how would you do it and why?

However, remember that no one can build a crypto portfolio for you due to the myriad factors involved, including timing, risk tolerance, and project categories. Therefore, you must be an active learner to thrive in this fast-paced market.

In this article, here are four important steps you need to know before constructing the ultimate crypto portfolio:

Stick To Your Plans

The first step to building a successful crypto portfolio is setting clear rules and sticking to them. Without a plan, you’re merely gambling.

Establish specific profit-taking targets and know when to cut losses based on your confidence level and risk tolerance for each project, ranging from 1% to 35% of your portfolio. Lastly, decide whether your investment is for the long term or a quick trade. If it’s the former, commit to holding it for an extended period.

Set Money Aside For Investing

Never invest more than you can afford to lose. Allocate a portion of your income, whether 5%, 10%, or more, exclusively for cryptocurrency investments. This approach eliminates emotional decision-making and cultivates patience, allowing your gains to accrue over time.

Determine Your Risk Tolerance

Before making any investments, decide whether you prefer a low-, medium-, or high-risk portfolio.

A low-risk portfolio might include 50% large caps, 25% medium caps, and 25% low caps.

A medium-risk portfolio could be 35% large caps, 25% medium caps, 25% low caps, and 15% micro caps.

Lastly, a high-risk portfolio might involve allocating 25% to each category.

Taking Profits

Warren Buffett’s advice, “Be fearful when others are greedy, and be greedy when others are fearful,” applies beautifully to the crypto market.

You don’t need complex charts and indicators; instead, focus on identifying greed and fear. Buying opportunities peak when fear prevails, while locking in profits is ideal when the market exudes greed.

Remember that your gains remain unrealized until you hit the sell button, just as losses are not incurred until you do the same.

Creating A Beginner Crypto Portfolio

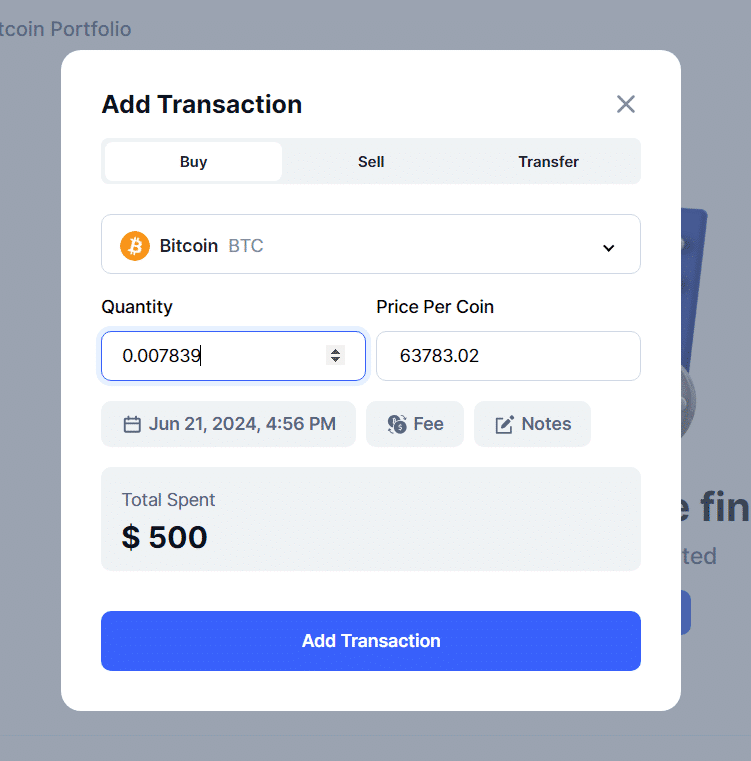

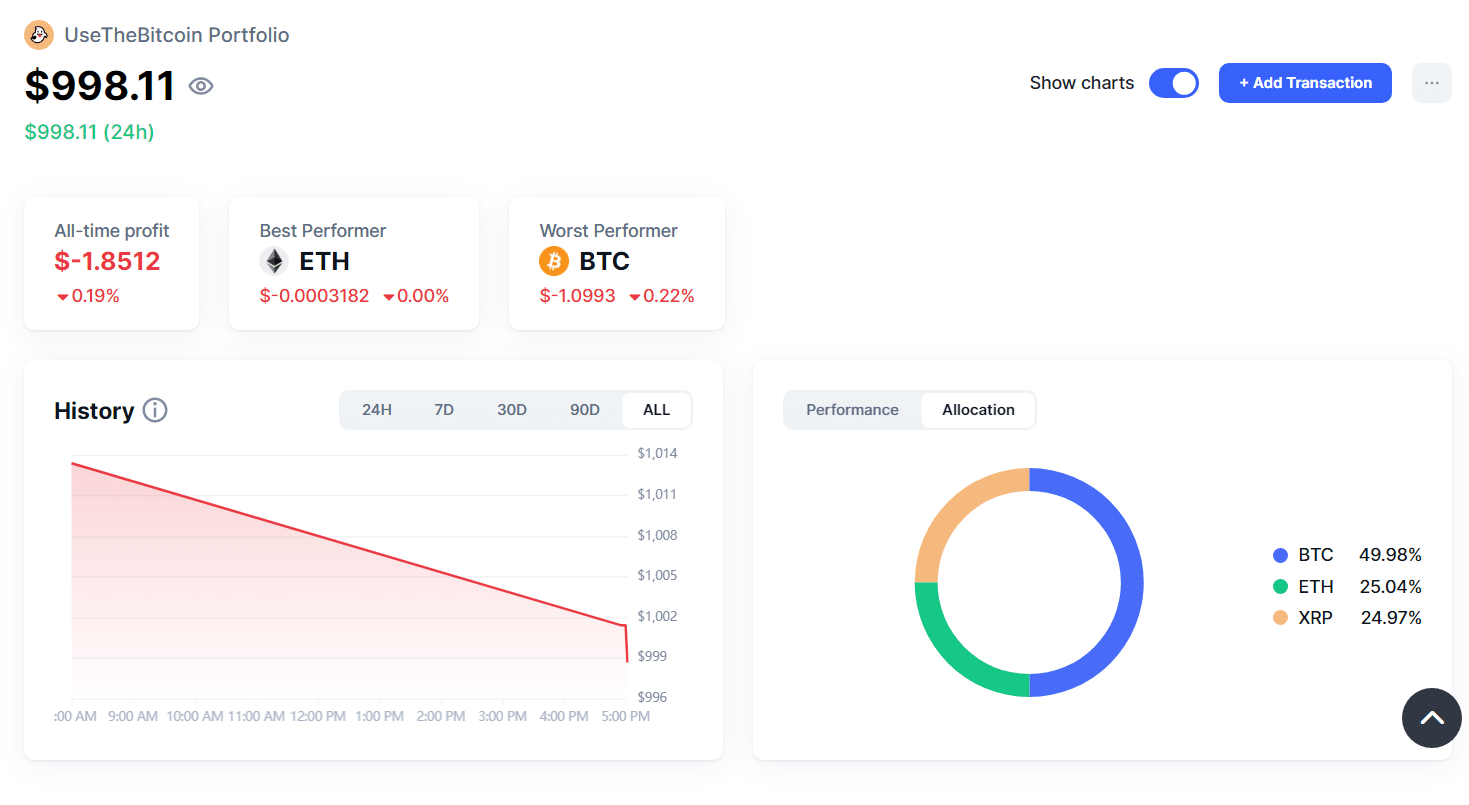

For those new to cryptocurrency and seeking a low-risk portfolio, consider the 50-25-25 strategy. In this case, with a $1,000 USD capital, let’s allocate 50% to Bitcoin (BTC), 25% to Ethereum (ETH), and 25% to XRP (XRP). These coins are among the least risky in the market and consistently rank among the top 10 cryptocurrencies by market capitalization.

Go To CoinMarketCap And Click “Create Your Portfolio”

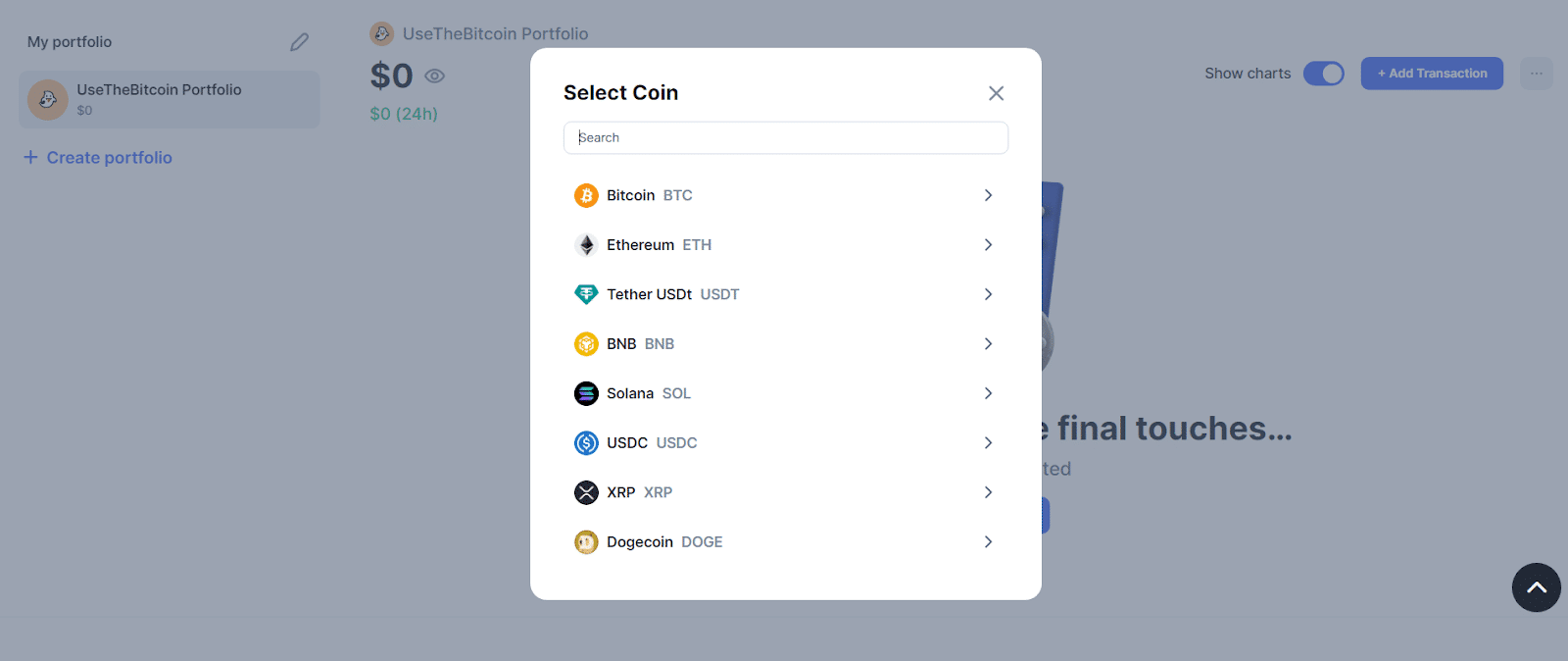

Click “Add Transactions” And Select BTC, ETH, And XRP

Allocate Your Capital Into BTC, ETH, And XRP

And You’re Done!

Final Thoughts

While this portfolio offers lower potential risk, it also presents significant upside potential in the crypto market. Your investment in cryptocurrencies aims to achieve substantial returns beyond what stocks or other financial instruments offer. However, also acknowledge that the crypto space still carries inherent risks, which you must be prepared to accept in pursuit of its greater upside.