Let’s examine the insights shared by our Technical Analyst at UseTheBitcoin as he walks us through his personal trading approach and observations on the crypto market.

Bitcoin (BTC) Market Update

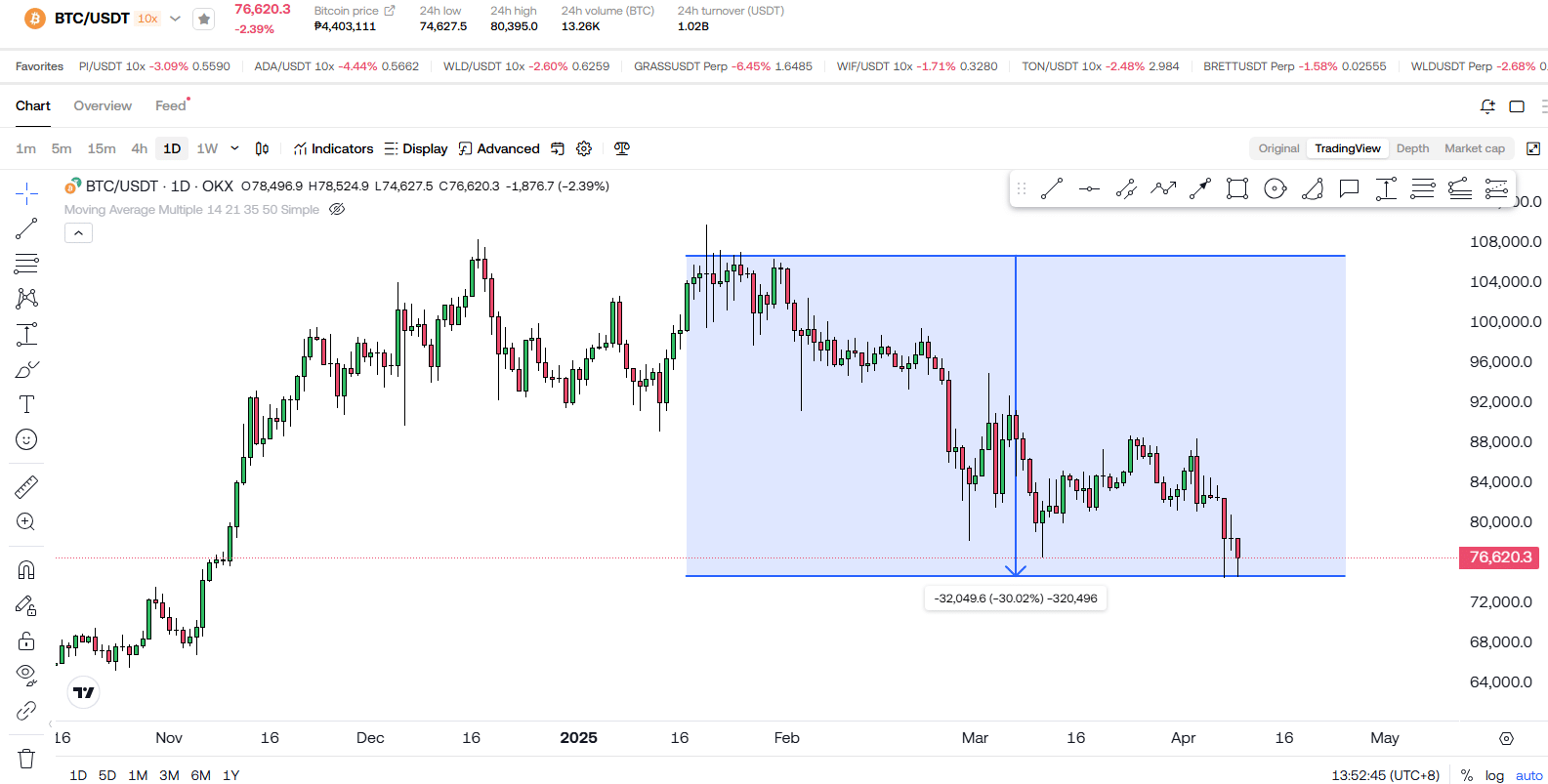

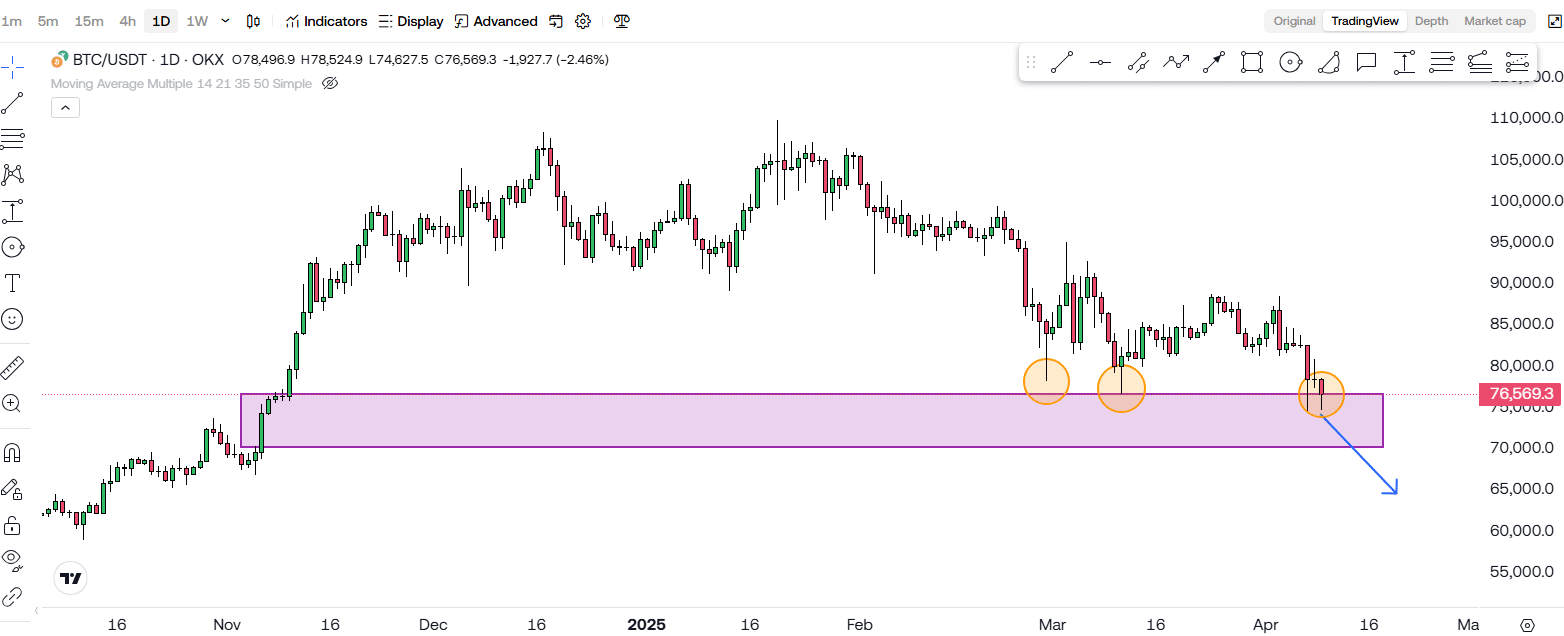

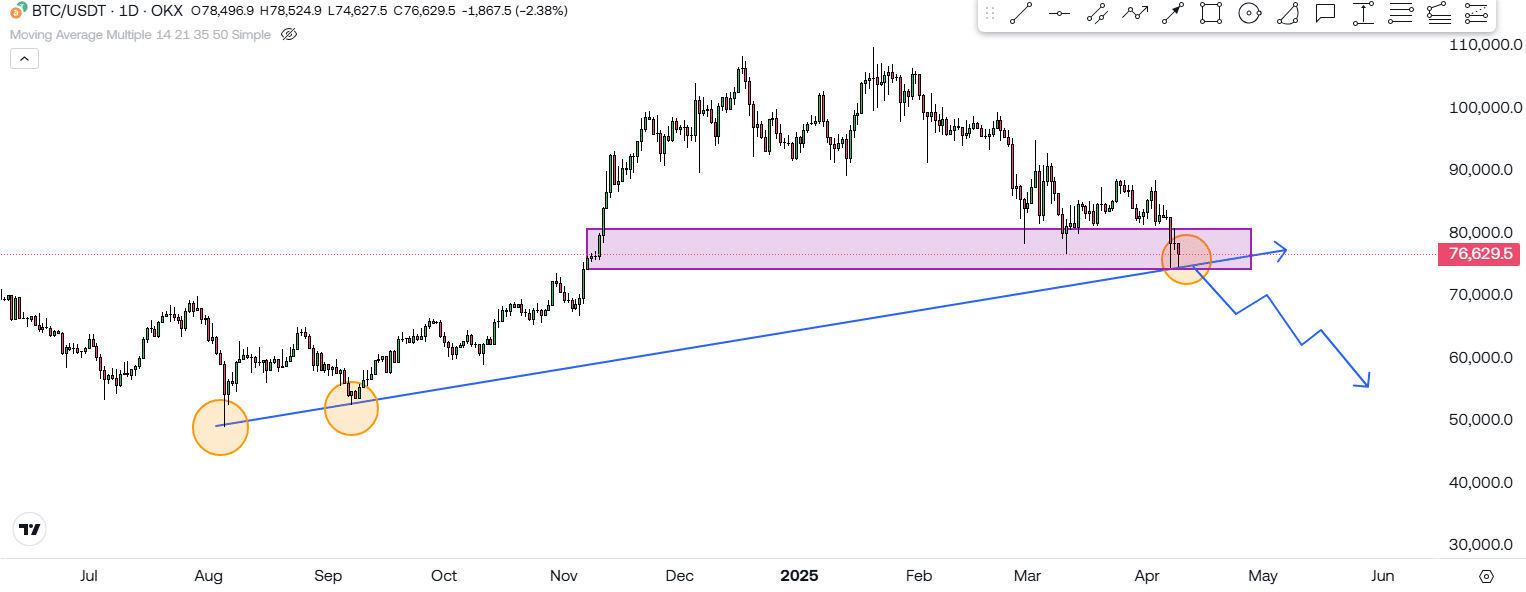

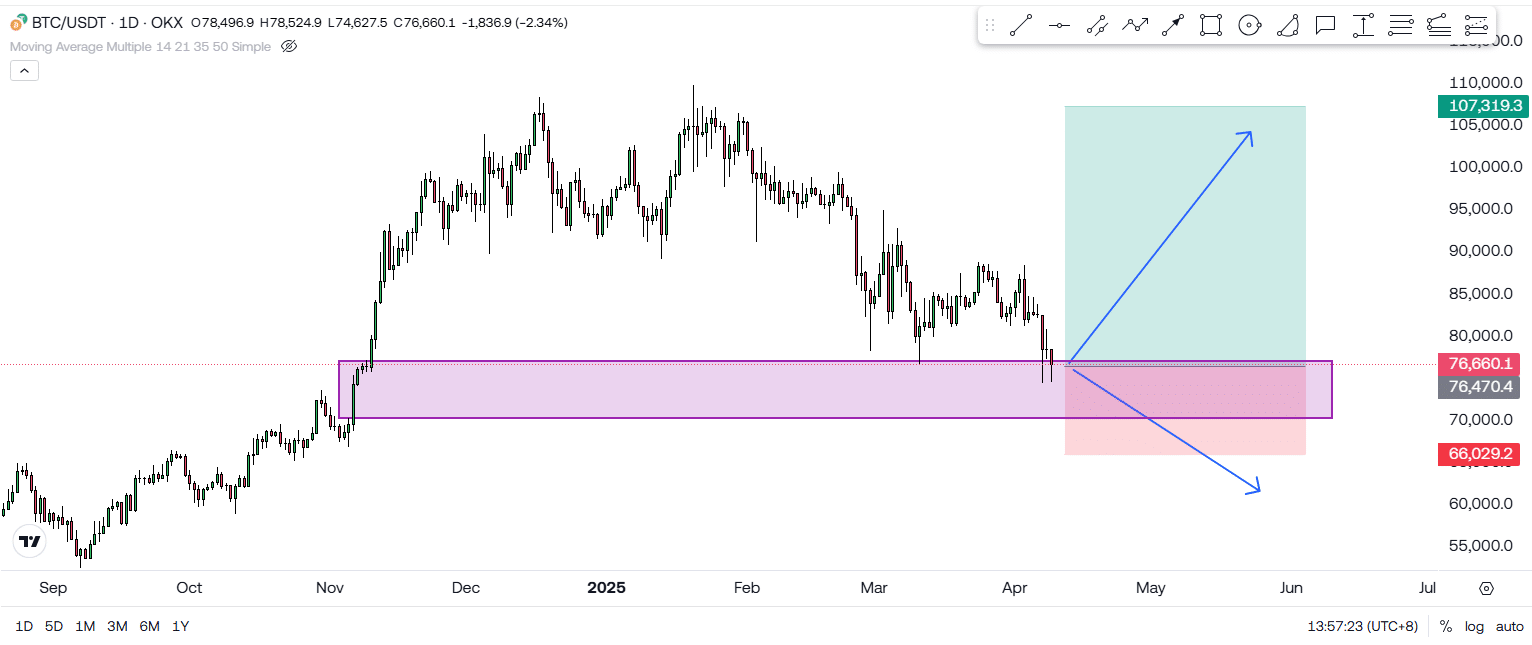

Bitcoin (BTC) is currently trading around $75,000 to $77,000. This marks a significant drop of nearly 30% from its all-time high last January 2025. And now, we are seeing Bitcoin standing right at what could be its last line of defense. If this support level fails, things could get uglier in the short term.

Let me explain why this level is so important.

Currently, Bitcoin is hovering above the $70,000 support zone. This area has been tested multiple times in the past, making it a strong psychological and technical support. However, if Bitcoin breaks below the $70,000 mark, that could be a clear sign that the bulls are losing strength, and the trend might flip into a potential bear market scenario. It doesn’t mean we’ll go straight to $30k or $40k, but it would definitely indicate that the current uptrend is weakening—or possibly over.

Now let’s zoom out a bit and look at the bigger picture. If we draw a trendline from previous lows, you’ll notice that Bitcoin has been forming higher lows consistently over the past few months. This tells us that, in the macro perspective, we are still technically in an uptrend. Despite the dip, the market structure is intact—for now.

But if that $70k level breaks, it’s a different story. That would mark a break of the uptrend structure, and we could start forming lower highs and lower lows, which is a classic sign of a downtrend or early bear market formation.

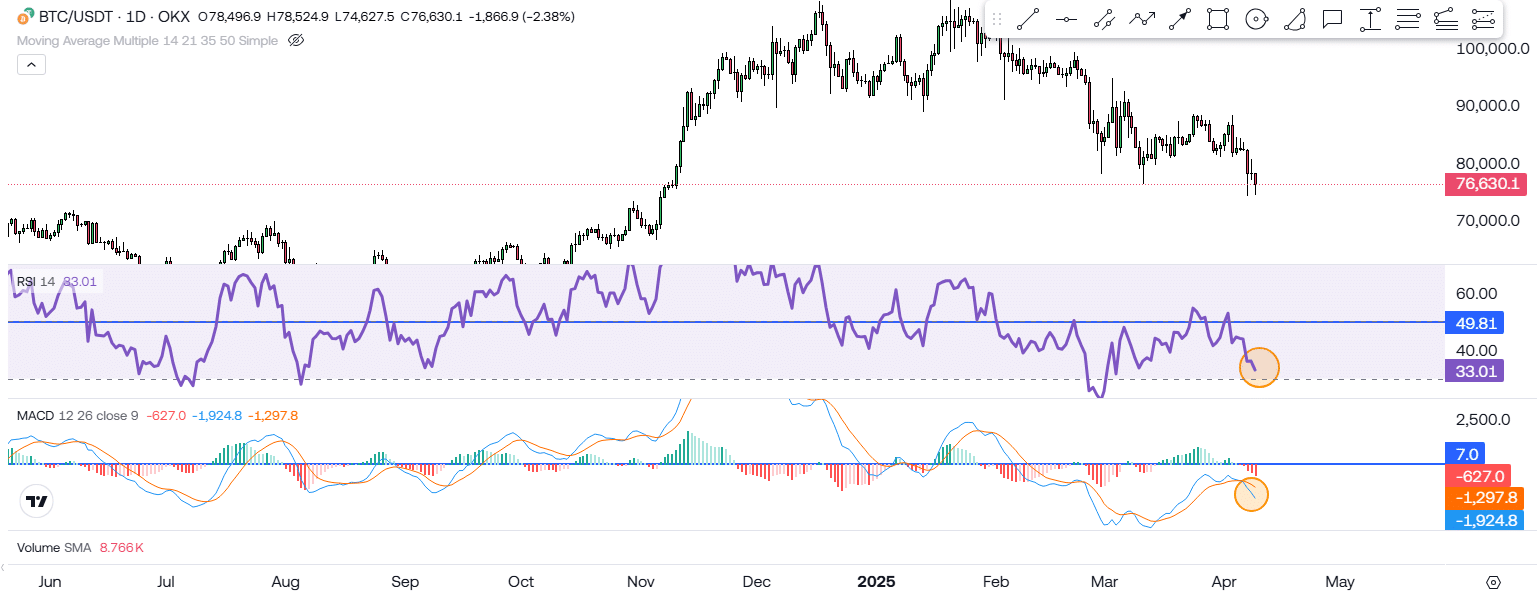

From a technical standpoint, things aren’t looking too bullish at the moment. Most indicators are still pointing downward. The Relative Strength Index (RSI) is below the median line, which suggests weak momentum. The histogram is showing red bars, confirming that bearish pressure is still in play. And on top of that, there’s no major positive news or catalysts in the crypto space right now that could potentially drive prices up.

So what should you do?

If you are planning to invest in Bitcoin, this might actually be a good opportunity to accumulate slowly, especially if you believe in Bitcoin long-term. The $76,000 level is already considered a reasonable price, especially if you plan to hold for several months or years. But if you’re a short-term trader or not comfortable with the current volatility, then it might be better to stay on the sidelines for now and wait for more clarity.

Remember, not trading is also a strategy. Sometimes, waiting is the smartest move, especially when the market is uncertain and momentum is weak. Don’t feel pressured to always be in a trade. Timing is everything.

Final Thoughts

For now, all eyes are on that crucial $70,000 level. If Bitcoin can bounce from here, we might see a relief rally. But if it breaks below it, then brace yourselves—a deeper correction might be on the way.

For more in-depth technical analyses like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!

Additionally, join our Telegram community to discuss the latest market trends, share insights, and get real-time updates from experienced traders. Don’t miss the chance to be part of the conversation!